While last year’s shelter-in-place restrictions changed consumer preferences and accelerated virtual claims handling, they also affected miles driven, accident frequency and policyholder premiums. Now, after nearly two years, the economy is slowly rebounding, even in spite of the Delta variant. However, COVID-19’s influence on commute patterns, population redistribution and the current price of raw materials promises to have a long-lasting impact on automotive claims and proper, safe vehicle repair.

Rising VMT and Fuel Prices

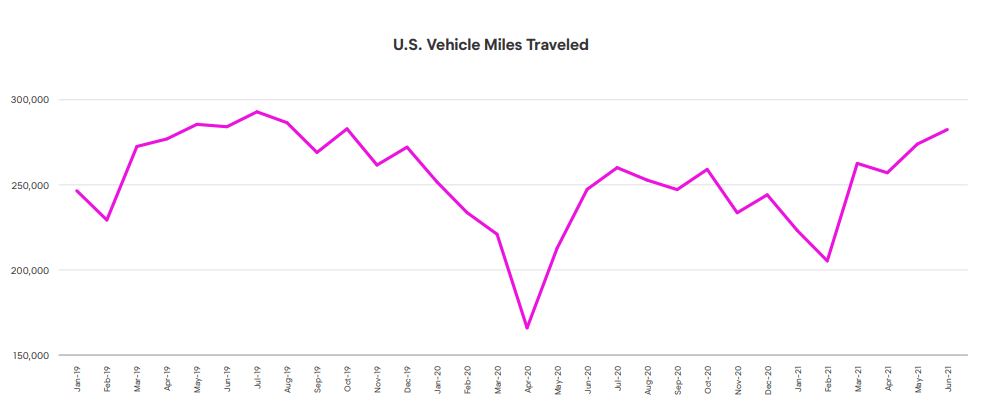

A recent report from the U.S. Department of Transportation showed that vehicle miles traveled (VMT) rose 29% in May 2021 compared with May 2020, and decreased only 4.1% from May 2019 (Figure 1).

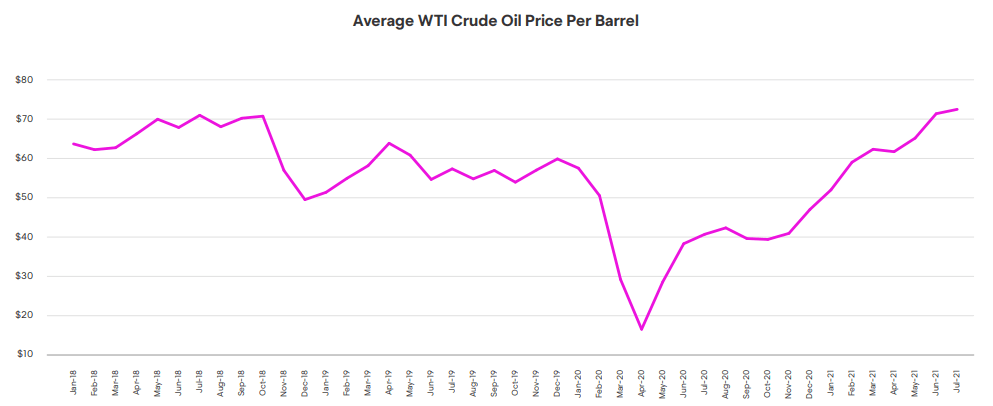

This growth in VMT occurred despite the cost of oil, which has jumped 36% in less than a year and reached a level not seen since the summer of 2018, as reported by the U.S. Energy Information Administration (Figure 2). With the increase in VMT comes an increase in claims volume. In fact, we are already seeing a return to near pre-pandemic levels. For example, there was a 24% jump in the total number of repairable claims in June 2021 compared with June 2020 and only a 2.3% decline compared with June 2019, according to Mitchell data. With some business travel resuming and more companies preparing employees for an eventual return to office work, claims volumes will likely grow, potentially even exceeding pre-pandemic levels by the end of this year.

The Impact of Inflation

Claims cost more today than they did a year ago, with the average repairable severity rising by just over 3% for 2021 year to date compared with the same period in 2020, based on Mitchell’s estimating data. While some of the expense can be attributed to advancements in automotive technology and complexity, inflation may also be to blame—driving higher parts prices as a result of government spending, supply chain imbalances, an increase in the cost of raw materials and other factors.

This is evident in the Consumer Price Index (CPI) data provided by the U.S. Bureau of Labor Statistics. In June 2021, there was a 0.9% increase compared with the previous month and a 5.4% increase compared with June 2020.

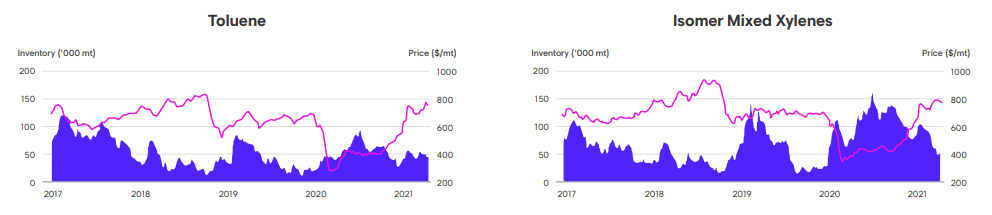

In addition, rising oil prices affect many components of the automotive repair process, especially solvent-based paints and materials as well as replacement parts. An analysis by S&P Global Platts shows a nearly 15% boost in the market price of toluene and isomer mixed xylene, which are primary ingredients in the manufacturing of automotive clear coat (Figure 3). Petroleum is also a critical component of manufacturing steel. The considerable rise in oil prices has resulted in an increase in steel costs—to the tune of 46% in July 2021 compared with July 2019.

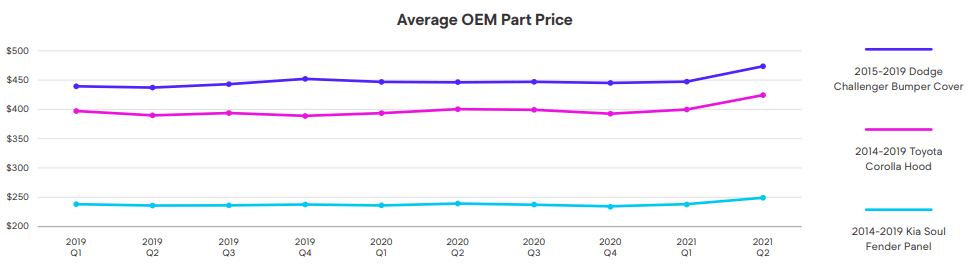

Not surprisingly, when the price of raw materials increases, so does the cost of goods made from those materials (though not immediately). Parts inflation is now affecting the automotive market, especially parts that are petroleum-reliant like those made of steel sheet metal and polyolefin plastic bumper covers. A review of the average OEM parts prices on Mitchell estimates demonstrates a consistent trend of rising prices for several of the most commonly replaced parts over the course of 2021. For example, the price of the 2014-2019 Toyota Corolla hood jumped by 6.9%, the 2015-2019 Dodge Challenger front bumper cover by 7% and the 2014-2019 Kia Soul left fender by 8.5% between July 2019 and July 2021 (Figure 4). Prior to 2021, the prices of all three parts were relatively stable, according to Mitchell data. If commodity prices continue to rise or even remain elevated, we may experience an additional increase in prices throughout the remainder of the year and into 2022.

Population Shifts and Their Effects

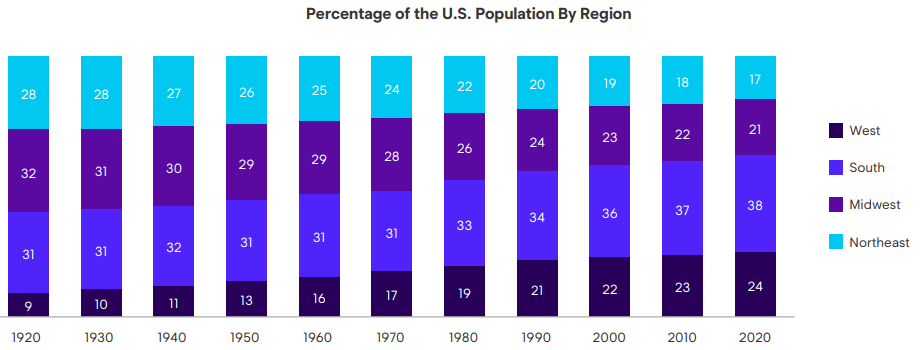

Finally, we are experiencing a redistribution of populations across the U.S. as remote work becomes more common. This “urban exodus” is pushing some people to relocate to suburban areas that can support a hybrid work model from an affordable ZIP code. According to recent U.S. census figures, previously high-demand states for employment like Illinois, California and New York saw population declines in the wake of the pandemic while less-crowded, tax-friendly states—including Texas, Florida and Tennessee—experienced unprecedented population growth. Overall, the West and South are witnessing the greatest influx of residents. At the same time, the Northeast and Midwest continue to shrink as a percentage of the overall population (Figure 5).

This shift in population centers is significant as both insurers and repairers develop strategies to meet customer needs. Certain markets may now be much more attractive for opening a collision repair facility than they previously were. Additionally, more dispersed populations could require carriers to rely even more on virtual claims handling processes, especially if staff or shop coverage is sparse in various regions of the country. For years, the industry has focused on changing vehicle technology and complexity and the impact to auto insurers and collision repairers. While this topic remains a primary concern, today’s economic climate is perhaps equally as distressing. Abnormal levels of inflation, an expected return to normalcy in the transportation sector and a redistribution of the population mean that the industry of the (near) future will look very different from what many of us predicted previously.