As Accenture forecasted, life insurers that modernized their core new business and policy administration systems accelerated their digital transformations. Their new digital capabilities, including the cloud, analytics, automation, and ecosystems, enabled these insurers to drive profitable new business.

An April 2020 LIMRA survey showed that 24 percent of U.S. companies that accept online/mobile applications experienced an increase and more than a quarter have expanded their automated underwriting practices. Similarly, the November MIB Life Index shows life application activity overall grew 4.1 percent (YTD November 2020) versus 0.7 percent in 2019 (annual)—an upward trend that started after the pandemic and was largely driven by younger applicants under the age of 45.

Even with the economic fallout from COVID-19, these insurers were better equipped to adopt a completely digital insurance buying experience, which proved a huge benefit to customers restricted to their homes during the pandemic. They were also better positioned to grow their businesses beyond the pandemic, since online purchasing is likely to remain a fact of life — and life insurance — for the foreseeable future.

For 2021, Accenture’s underwriting predictions focused on accelerating digital insurance. They assume continued low U.S. interest rates and an expected contraction in premiums that will lead to added margin pressure. Insurers who haven’t already modernized their core systems must do so quickly and must reinvest their legacy maintenance savings into digital underwriting technologies. Companies that do so will be nicely positioned to capture new opportunities. For example:

1. Technology investments that transform the cost curve will enable insurers to invest in underwriting innovation and unlock greater value

Operating efficiency will dominate in the short term. In the long term, however, insurance leaders are preparing for the post-pandemic world, leveraging cloud, automation, and AI to streamline the underwriting function to enable faster, more accurate underwriting decisions.

More than 25 percent of U.S. life insurers have expanded automated underwriting, according to the LIMRA study, “How Covid-19 Is Affecting Life Insurance in the U.S. and Canada” (April 2020). COVID-19 taught us an important lesson in the importance of contactless transactions, and underwriting was no exception. Where possible, insurers adapted their risk models to include alternative evidence sources to reduce or eliminate fluids and/or paramedical exams and their associated costs. Expect expanded use of contactless underwriting in the near future and beyond as additional alternative evidence sources, such as health and wellness data, become increasingly available.

2. End-to-end digital customer experiences will dominate the life insurance buying process and drive underwriting innovation

Insurers can differentiate themselves by the experiences they offer to their customers, and underwriting can be a powerful differentiator. Technologies such as AI, analytics, and alternate risk engines, connected through well-developed APIs, can provide consumers with seamless, completely digital experiences that render quick and accurate underwriting decisions while communicating the status of applications throughout the process.

These same technologies will help insurers provide the right products, competitively priced and offered through optimized distribution channels, to reach the more than 60 million uninsured and underinsured consumers that LIMRA estimates live in the United States.

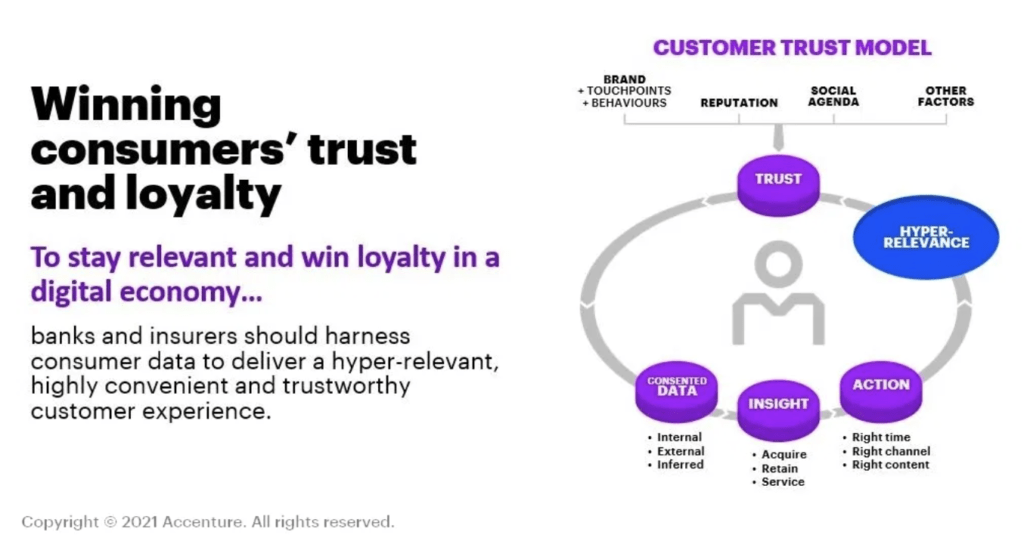

Accenture research found that more than three-quarters of consumers surveyed are willing to share personal data for benefits, such as personalized offers, more efficient and intuitive services, and more competitive pricing. The concept of “pay as you live” is becoming more relevant to insurers as consumers increasingly conduct their important life transactions online and on mobile devices.

3. Increasingly fierce competition will elevate the importance of brand loyalty and trust.

Brand loyalty and trust will become even more important to attract and retain policyholders. New technologies will help insurers focus their organizations on the customer and empower their people to innovate products and processes that attract and cultivate customer loyalty.

Underwriting plays a role here. It’s not just about instilling trust in the solvency of the carrier. It’s about underwriting that supports personalized and relevant experiences—a living system—to provide new products and services, driven by real-time data, predictive models, and ongoing risk assessment.

Underwriting will break out from a back-office function to a strategic role one that influences front-office functions, such as marketing, sales, and distribution. Insurers will be able to anticipate customers’ needs with bespoke products for which the consumer is already prequalified and ready to purchase. This will be the end-result of intelligently prepared data and insights that empower underwriters to make consistent, accurate decisions.

The insurance industry has shifted to a digital business model for the immediate future. Beyond the COVID-19 pandemic, however, living businesses that integrate physical and digital worlds will emerge.

Insurers can prepare for that future now by implementing a flexible core insurance technology platform. This will enable them to innovate and grow sustainably, by leveraging underwriting as the underpinning of a digital customer experience that will generate profitable revenue.

Source: Accenture

Share this article:

Share on linkedin

Share on facebook

Share on twitter