More than 30% of small businesses were uninsured in 2020, according to AdvisorSmith, despite 75% of business owners reporting having experienced an insurable event that year.

One pivotal reason why is that navigating the traditional market can be challenging for small businesses, which can face long and complicated claims processes, and that’s if they’re able to secure insurance in the first place. Niche companies may struggle to find packages that suit their needs (and budgets), while some of the smallest and most vulnerable (like independent farmers) may not have access to coverage of any kind.

Parametric insurance, which issues payouts triggered by predetermined events (rather than through a claims adjustment process), can help fill in some of these gaps. However, a traditional parametric insurance contract still presents significant costs for providers, who must delve deeply into highly specific and potentially unfamiliar markets while hiring individuals to monitor for the qualifying event, verify that it occurred and authorize the payout. Traditionally, these costs are passed on to policyholders, but developments in blockchain technology are making insurance from specialized providers cheaper, faster and more accessible.

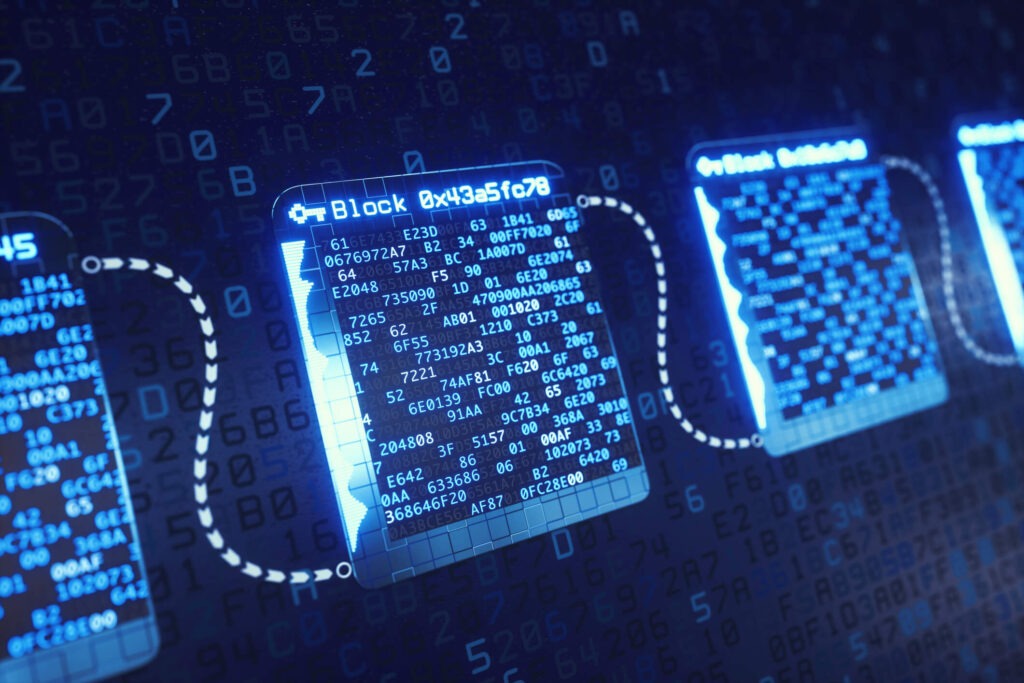

The logic of parametric insurance easily transfers to smart contracts, which are digital agreements on blockchains with conditions attached to their execution (if X occurs, execute action Y). Oracle networks like Chainlink provide the necessary information from outside the blockchain to confirm that conditions for payment have been met and that the insurance company should therefore pay out the claim. Claims are then paid automatically in line with the smart contract’s predefined logic.

The combination of blockchains, smart contracts and oracle networks makes parametric insurance more accessible to small businesses, as specialized providers can lower operating costs and secure the assurance they need to underwrite policies with automatic payouts. Blockchains also keep an immutable record of transactions, providing accountability; smart contracts improve efficiency by automating contracts, and oracle networks, which connect blockchains to real-world data, validate that an event did indeed occur and that the automated payment cannot be manipulated.

Using smart contracts to provide insurance allows participants to bypass the claims process and receive funds more quickly because providers know that claims are paid out based on predetermined, verifiable and objective metrics. Here are four blockchain-based parametric insurance products that small businesses can use to maximize their operational security and minimize risk.

Source: Entrepreneur