Nearly every time you turn on a light switch today, you are witnessing the power of trends upon shifting markets. Though lighting isn’t going away, the types of bulbs we use and their supply chain has been in flux for the past two decades.

On May 27, 2020, General Electric stopped making light bulbs entirely (after 130 years), selling its lighting division to smart home company, Savant Systems.[i] All of the other major lighting players have also been negotiating a market and industry in the midst of change. Government mandates for lower energy bulbs have removed most incandescent bulb manufacturing operations from the market. LED bulbs not only use much less energy, but the bulbs last far longer—so the sales of bulbs will drop over time.

Philips Lighting, another stalwart industry player (125 years old), decided that instead of leaving the business, it would develop Philips Hue, a connected lighting solution. Smart homes have now given rise to smart lighting, including smart bulbs—digitally-driven bulbs that can adapt themselves to the experience that a customer wants. Many of them can be controlled via home networks and mobile phone apps. Philips also chose to spin off a whole new brand, Signify, that would embrace sustainability and energy-efficient lighting.

Auto insurers are going to have choices like this to make. Auto insurance, coincidentally, is also a 120-year-old “established” industry, based around a policy transaction. Will insurers continue to provide traditional insurance in traditional ways until they are forced down a dead-end path or will they embrace new trends, new technologies, new services and perhaps a new mobility ecosystem approach? Will they reinvent themselves to become next-gen mobility customer experience providers?

In Majesco’s recent thought leadership report, “Rethinking Auto Insurance: From a Transactional Relationship to a Mobility Customer Experience,” we use new customer primary research and recent trend data from other sources to answer two pertinent questions:

- What are the trends pushing auto insurers to adapt their business models?

- Why should auto insurers begin creating mobility ecosystems and customer experiences that will transform their purpose and their profits?

We consider five trending points that are driving change, including:

- The Auto Insurance Buyer—A Shifting Demographic

- Vehicle Technologies

- New Data Sources

- Ownership vs. On-Demand Mobility

- New Auto Insurance Sources and Providers

Let’s briefly consider these trends and how they may impact auto insurers.

Trend 1: The Auto Insurance Buyer

For purposes of simplifying analysis within the Mobility Survey, we created two generational “super segments” by combining two different age groups, Gen Z and Millennials and Gen X and Boomers. As expected, the Gen X and Boomer segment is currently more active than their younger peers in buying or influencing purchases of household services, insurance, and financial products. Three exceptions were in individual life insurance and voluntary benefits, where the segments purchased at equal rates, and Amazon account usage, where Gen Z and Millennials have a slight lead.

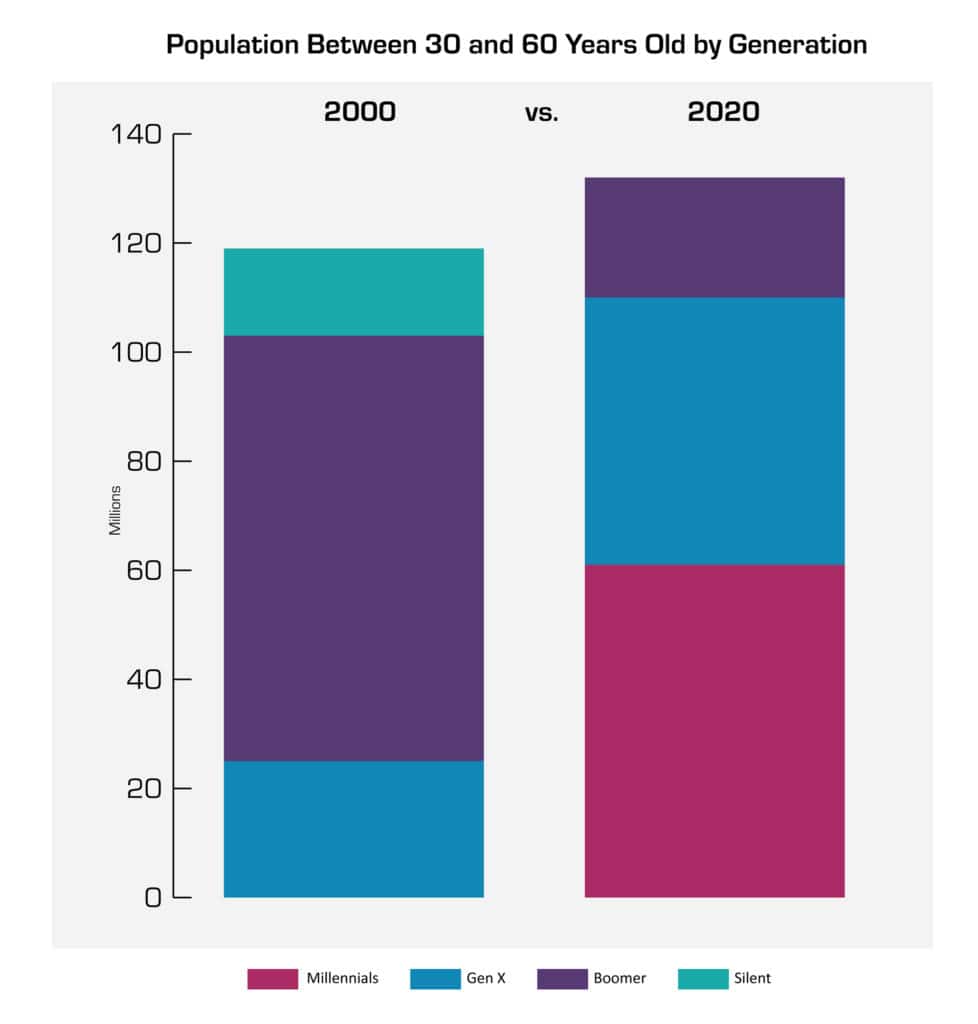

The older super segment has sizable leads in personal lines P&C insurance (auto and home/renters), employee benefit health insurance, investments and annuities. All of these products are good fits for the 30-60 year-old “sweet spot” for insurance and financial products, given they are at a life stage with the greatest insurance and financial planning needs as they establish households and families and accumulate wealth and possessions that need protection.

In 2021 Millennials, all by themselves, will meet and begin to surpass the older super segment. The young super segment’s dominance will accelerate four years later when the first members of the Gen Z generation also turn 30, vaulting this new generation to buying dominance. Providers of household services, insurance and financial products that have not adjusted their business models, products and customer engagement experiences to meet the needs of this new “sweet spot” buyer market will find themselves challenged and left behind.

The insurance industry will need to adapt to this new super segment of new customers.

Figure 1: Insurance buyer “Sweet Spot” populations by generation in 2000 vs. 2020

Trend 2: Advanced Technologies for Vehicle Safety

Nearly 60 percent of Gen Z and Millennials and half of Gen X and Boomers who own or lease a car have at least one type of newer safety or convenience technology in their vehicle. Navigation systems and blind spot detection are the most popular among both segments. The Gen Z and Millennial vehicles have higher rates of collision avoidance systems, surround view systems, automatic braking and automatic parking.

These technologies were expected to put downward pressure on auto insurance premiums thanks to fewer accidents. However, insurers’ experience to date has not matched this expectation. The cost of repairing or replacing these more sophisticated vehicles with advanced technologies is greater than the savings derived from lower frequency. Some of these technologies have indeed shown benefits, but the translation to lower premiums has been minimal. For example, NAMIC found that electronic stability control saves a customer an average of only $8 on their annual premium. And, “Those who pay for blind spot warning, driver alertness monitoring, lane departure warning, night vision, or parking assistance systems save nothing at all.”[ii]

Is it possible that eventually the impact of these technologies will overtake the cost of maintenance and repair? In theory, yes. The greater number of high-tech vehicles that are on the road, including the autonomous vehicles of the future, the greater the chance that vehicular accidents will drop. There is, of course, an unknown set of circumstances related to COVID-19 and auto use. Will a significant percentage of the workforce stop commuting? Will public transit commuters begin to use their vehicles to avoid exposure? Or, will vehicle technologies, such as driverless vehicles or flying taxis create an entirely new commuting scenario? Lilium, a German aviation startup “unicorn” has plans for bringing flying taxis to the skies by 2025, which will further change the mobility options. [iii] The answers may lie in the rise of mobility ecosystems, which we’ll examine in another post.

Trend 3: New Data Sources

Connected devices (and other data sources) are enabling underwriting and pricing based on mileage, location and driving behavior, which could lower premiums, while also making them potentially less predictable. Surprisingly, there are very similar levels of interest in these new data sources between the two generational super segments.

The COVID-19 shelter-in-place actions dramatically reduced the number of miles driven in early 2020—by an estimated 50 percent between mid-March to mid-April.[iv] This is spurring speculation and debate about the pandemic’s longer-term interest in mileage-based or usage-based insurance.[v] Although streets and roads have fewer vehicles on them, numerous states and cities have reported increases in speeding, reckless driving, and fewer but more severe accidents.[vi] From an insurer perspective, broader usage-based/UBI models would be the preferred approach post-COVID-19 than simply tracking miles driven.

Despite the growing acceptance of new data sources, with the potential for variable premium by the month, the traditional 6-month term with a set premium is preferred by both generational groups. However, Gen Z and Millennials have a higher interest in a usage-based model that is automatically triggered by sensing when the car is parked or being driven.

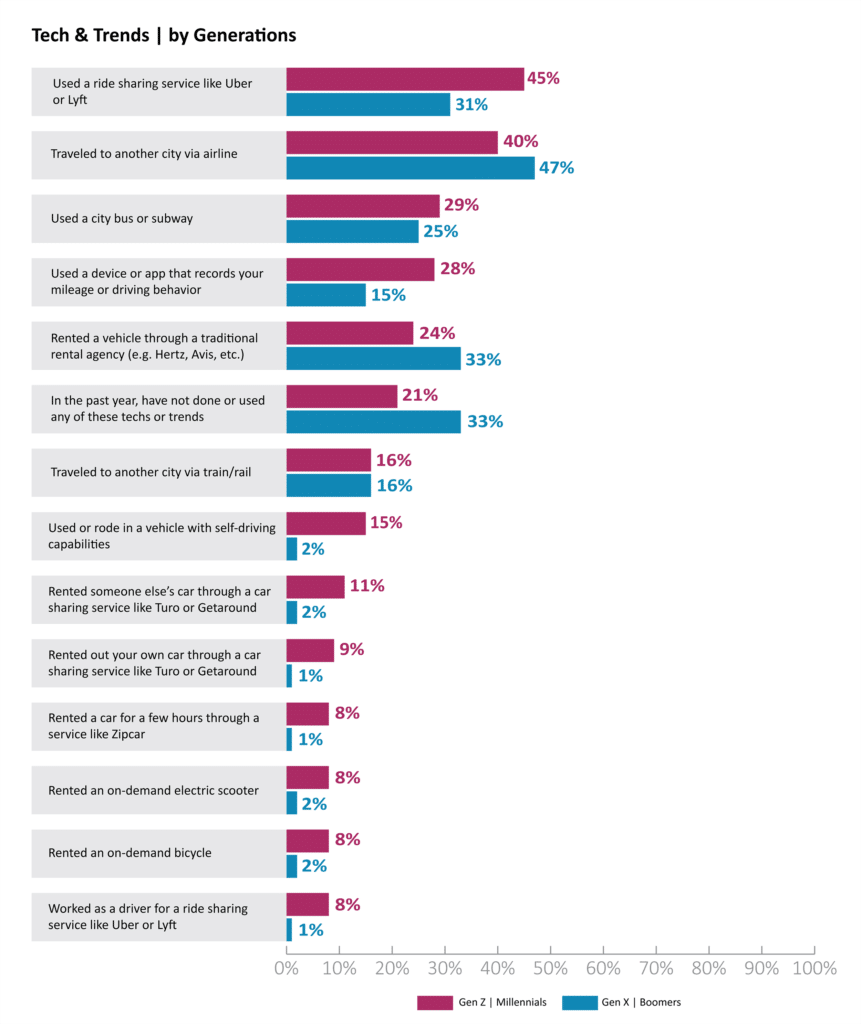

Within the Gen Z and Millennial segment, 28 percent of respondents indicated they have used a device or app to record their mileage or driving behavior as compared to only 15 percent of the older super segment. Both generational super segments showed strong interest in a smartphone app that provides real-time alerts and advice about driving behavior and conditions. Interest is even higher if following the advice leads to discounts on the next insurance bill.

Trend 4: Ownership vs. On-Demand Mobility

There is growing popularity and use of non-owned vehicles and alternative mobility options like rideshare, rentals (traditional and shared economy) and other local or urban rental options like scooters and bicycles. With their increased usage comes the threat of an offsetting level of private vehicle ownership and leasing, leading to a declining need for personal auto insurance. This declining ownership could accelerate if more people work from home, eliminating the need for the traditional “2 car family” and using alternative on-demand mobility.

All-inclusive vehicle subscription services are a relatively new mobility option offered by several auto manufacturers (currently, most are luxury brands) and third-party services. Most allow the customer to switch vehicles on a periodic basis and pay a set monthly fee that covers the vehicle, maintenance and insurance.[vii] A surprisingly high number (30%) of Gen Z and Millennials indicate they are using or have used a service like this—nearly four times higher than the older generation, indicating interest in different access to mobility options as compared to “owning” a vehicle. Some of these users likely correlated these experiences with micro-term car-sharing company’s such as Zipcar.

Nearly 26 percent of Gen Z and Millennials and 20 percent of Gen X and Boomers indicate they would or definitely would consider a vehicle subscription the next time they go to purchase a vehicle. When you add in the “maybes,” these numbers jump to 71 percent and 61 percent, respectively.

Figure 2: Usage of mobility technologies and participation in mobility trends

Gen Z and Millennials use car sharing services more frequently than Gen X and Boomers. Over a third (35%) traveled this way for five or more days in the previous month, compared to only 18 percent of Gen X and Boomers. Clearly, this is an established mobility preference within the younger generation that will fuel a growing market for on-demand rideshare coverage and indicates, once again, the potential decrease in car ownership by this younger generation.

Trend 5: New Auto Insurance Sources and Providers

Most of the consumers we surveyed said they still own or lease one or more vehicles. The traditional purchase methods for auto insurance are still the most preferred channels—agents/brokers or direct via an insurer’s website. This is consistent from the last couple of years from our consumer research.

However, Gen Z and Millennials also indicate strong interest in insurance embedded in the purchase cost of a vehicle, or buying insurance from a vehicle manufacturer’s website, an affinity group, car dealership, or car shopping website—about 25 percent higher than the older generation. Interestingly, this group also showed strong interest in purchasing insurance from three of the “tech giants,” Amazon, Google and Facebook – a wake-up call for both insurers and those selling vehicles. For a better glimpse, see Fig. 3 below.

If we look at all five of these trends in aggregate, auto insurers are facing a light bulb moment. Many of these trends will likely accelerate as we reconsider our work lifestyles moving to the home coming out of COVID-19. If changes are going to occur in demand levels, channel types and service offerings, can auto insurers compensate by bringing the right kind of change to the market? Can they invent their own supply chains of opportunity?

Auto insurers are redefining themselves as mobility companies and in the future will be seeking to own the mobility experience using a vast mobility ecosystem, ideally building those ecosystems around their brands. Those who will lead the mobility shift are the ones who have prepared their business systems and models that will focus on the customer mobility experience and foster non-traditional products and services.

Source: Insurance Innovation Reporter

Share this article:

Share on linkedin

Share on facebook

Share on twitter