The new entity, called CyberAcuView, will compile and analyze cyber-related data to add value and service to policyholders and to help insurers maintain a competitive cyber insurance market.

According to the announcement, CyberAcuView’s activities will be conducted under strict antitrust scrutiny and guidance.

Mark Camillo, most recently Head of Cyber, EMEA at AIG, has been appointed CEO.

CyberAcuView is 100% owned by the seven founding members who are in the top 11 in the market according to AM Best based on the 2019 premium booked directly. The company will invite other cyber insurance directors as associate members, according to its website.

CyberAcuView founding members said they will address cyber risk mitigation as follows:

- Providing industry best practices to improve cyber risk resilience;

- Proactively working with regulators, law enforcement and other security agencies to counter cybercrime and the rapid rise in ransomware;

- Development of solutions for systemic risks and further development of the language of cyber policy in order to improve market efficiency; and

- Analysis of cyber trends to ensure better visibility of cyber attacks and causes of damage, so that insurers can identify critical controls and educate policyholders on strategies for loss prevention.

Camillo includes Monica Lindeen, former Montana Insurance Commissioner who will serve as Director of Regulatory Affairs, and James Schweitzer, a veteran FBI and former Chief Operating Officer of the National Insurance Crime Bureau (NICB), who will join Camillo as Head of the Department Prosecution.

Free Webinar: The must-haves for launching a new insurance product. Sign up here!

“The cyber landscape is evolving, coordinated attacks are becoming more frequent and more disruptive,” said Camillo. “The combination of resources from across the insurance industry will enable us to better understand cyber trends, anticipate and potentially ward off future attacks, and improve overall cyber resilience.”

“Grim” outlook

The announcement of the collective effort comes after a report by AM Best indicated the industry needs to completely rethink its approach to cyber risk.

As the cyber risk environment – ransomware, business interruption and aggregation – deteriorates significantly, “the outlook for the US cyber insurance market is bleak,” the report said.

According to AM Best analysts, insurers “urgently need to reassess all aspects of their cyber risk, including appetite, risk control, modeling, stress testing and pricing, in order to remain a viable long-term partner in dealing with cyber risk.”

The reassessment is needed because cyber insurance, which began as a diversifying, secondary line and further affirmation of policies, is now a “primary component of a company’s risk management and insurance purchase decisions,” notes AM Best in its “Ransomware and Aggregation Issues” report require new approaches to cyber risks. “

Fitch Ratings analysts noted that while U.S. insurers have raised prices and taken underwriting measures in response to spikes in cyber claims, an immediate improvement this year is unlikely and insurers are long-term concerns.

“The cyber market was facing a bill in 2020 as the loss experience worsened, particularly due to the influx of ransomware incidents,” said Fitch managing director James Auden. “While cyber premium rates are rising sharply, concerns remain that underwriters can value this business successfully over the longer term.”

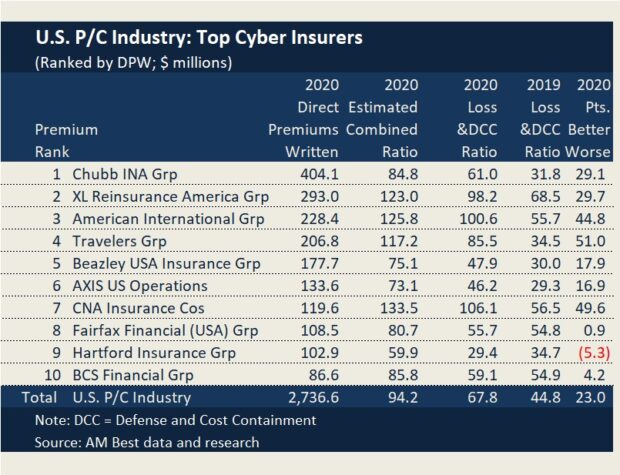

Direct-booked cyber insurance premiums for the property-casualty industry rose 22% last year to over $ 2.7 billion, reflecting growing demand for insurance coverage. The industry-standard rate for statutory direct damage plus defense and cost containment (DCC) for stand-alone cyber insurances rose sharply to 73% in 2020 compared to an average of 42% over the last five years (2015-2019). The average paid loss for a closed stand-alone cyber claim increased from $ 145,000 in 2019 to $ 358,000 in 2020.

According to Fitch, cyber insurance is a growing but relatively small line of business in US cash insurance, accounting for less than 1% of the industry’s direct-booked premiums. The segment’s market share remains relatively concentrated, with the top five authors holding a 50% market share and the top 20 authors holding an 87% market share in 2020. The top three US cyber writers are unchanged from last year: Chubb Limited (15% direct market. Share); AXA XL (11%); and American International Group, Inc. (AIG, 8%).

Losses related to ransomware attacks have grown in importance over the past two years, with a number of incidents already this year. Fitch said cyber coverage prices had “accelerated” upward over the past two years.

Source: Businessservices News