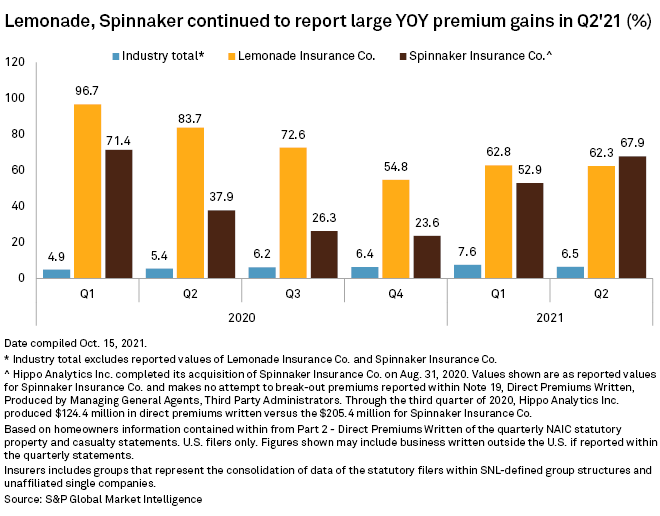

Direct homeowners premiums written were relatively small for the underwriting subsidiaries for Lemonade Inc. and Hippo Holdings Inc. compared to its traditional insurer peers, but year-over-year growth was the highest in the industry for companies with at least $50 million in quarterly premiums.

Hippo’s Spinnaker Insurance Co. saw homeowners direct premiums grow to $121.8 million in the second quarter, up 67.9% year over year. Prior to Hippo’s acquisition of Spinnaker on Aug. 31, 2020, the two companies maintained a relationship through a managing general agency agreement that continues to this day.

Spinnaker maintains several managing general agent agreements, and this analysis is not specific to just Hippo. Based on disclosures in Note 19 of the quarterly statutory filings, Hippo Analytics Inc. wrote roughly $88 million in total direct premiums during the second quarter, compared to $46.1 million in the prior-year period.

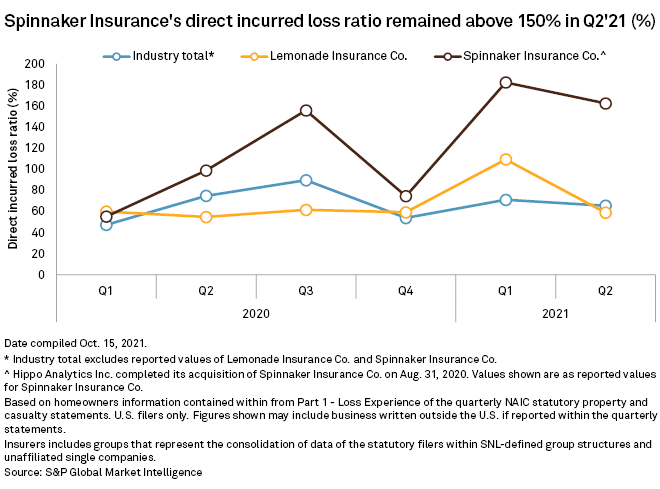

While the growth has been remarkable, Spinnaker has struggled with direct underwriting losses. The insurer’s direct incurred loss ratio was 162.6% at the end of the second quarter, considerably higher than the roughly 66% ratio the industry recorded in homeowners. Those losses, however, are not borne by Spinnaker itself as it cedes the bulk of its business to reinsurance companies.

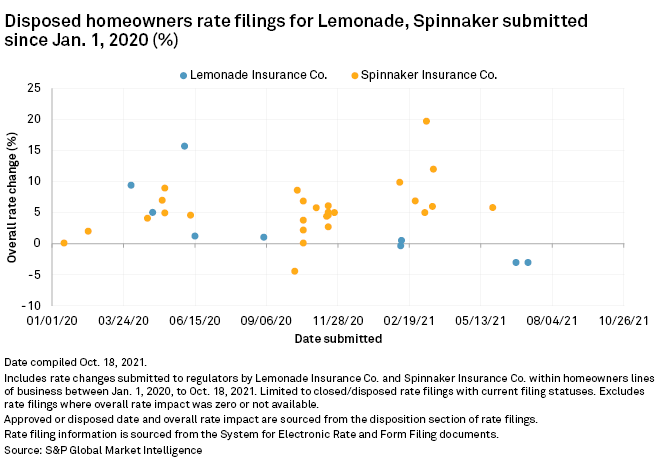

Spinnaker has sought to stem the tide of direct underwriting losses by boosting rates, according to review of rate filings collected by S&P Global Market Intelligence. Through the first 10 months of 2021, the insurer has submitted and received approval for seven rate increases. The most impactful increase in terms of additional premiums occurred in Georgia, where the company raised rates by 9.9%, which could translate to an additional $546,000 in premiums.

Lemonade Insurance Co.’s homeowners direct premiums written soared 62.3% in the second quarter. The $75.5 million total for the period was the largest amount of homeowners premiums Lemonade has written in a single quarter. The previous high, $65.6 million, occurred in the third quarter of 2020. Lemonade’s direct loss ratio fell to 59% during the second quarter after spiking over 100% a quarter earlier.

The most recent filings submitted and disposed by regulators for Lemonade occurred in Illinois. The filing estimates a premium reduction of almost $324,000 due to a bundle credit of 10% if customers sign up for auto coverage. Illinois is the first state in which the insurer launched private auto coverage. It plans to roll out auto policies nationally.