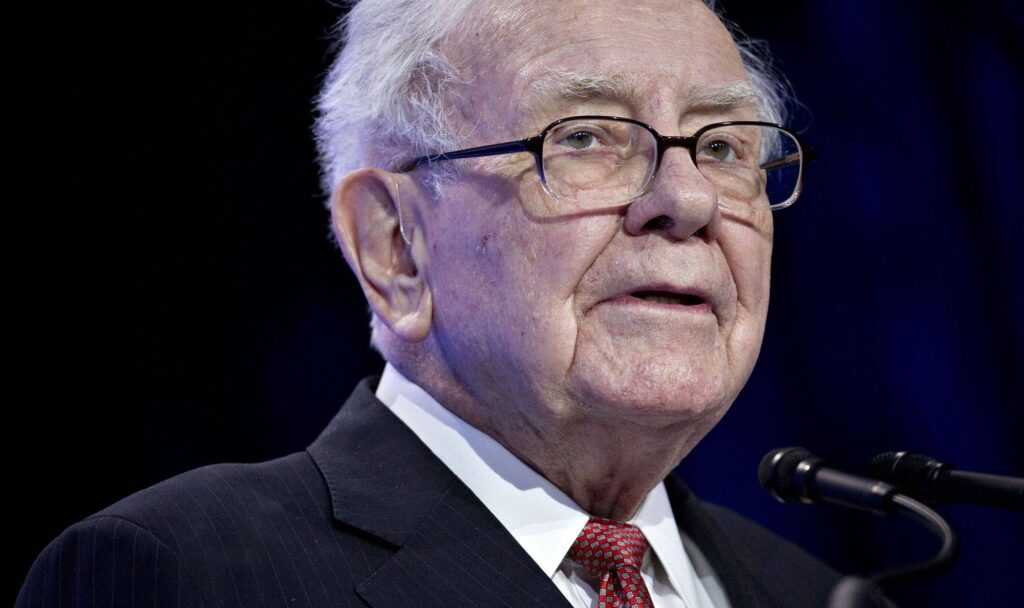

Warren Buffett’s Berkshire Hathaway Inc. on Tuesday announced two major new investments, revealing an $8.6 billion stake in the phone company Verizon Communications Inc. and a $4.1 billion stake in oil company Chevron Corp.

The investments were disclosed in a regulatory filing detailing Berkshire’s U.S.-listed stock holdings as of Dec. 31.

Berkshire also disclosed a new $499 million stake in the professional services company Marsh & McLennan Cos.

To make room, Berkshire reduced its investments in several companies including Apple Inc., though at approximately $121 billion the iPhone maker remains by far its largest common stock holding.

Verizon shares rose 3.0%, Chevron rose 2.2% and Marsh was unchanged in after-hours trading following Berkshire’s filing.

Tuesday’s filing signals where Buffett and his portfolio managers Todd Combs and Ted Weschler see value, without saying who bought what. Buffett normally handles larger investments such as Verizon and Chevron.

“They are Buffett-esque investments,” said Steven Check, who invests $1.3 billion at Check Capital Management Inc in Costa Mesa, California, including $300 million in Berkshire. “Verizon has a low price-earnings ratio, and while oil prices are recovering the stocks still have a long way to go.”

The filing also shows Berkshire deploying some of its cash hoard, which totaled $145.7 billion as of Sept. 30.

Berkshire owns more than 90 businesses including Geico car insurance, the BNSF railroad and Dairy Queen ice cream, but has gone five years since its last big acquisition.

The Omaha, Nebraska-based conglomerate had begun investing in Verizon, Chevron and Marsh by last year’s third quarter.

As it had several times before, Berkshire won permission from the U.S. Securities and Exchange Commission to delay revealing the stakes, to avoid having investors piggyback on its wagers before it was done buying.

Tuesday’s filing showed Berkshire, a major investor in Bank of America Corp., cutting back on other banks, reducing its stake in Wells Fargo & Co. and shedding JPMorgan Chase & Co., M&T Bank Corp. and PNC Financial Services Group Inc.

Berkshire also invested more in drugmakers Abbvie Inc., Bristol-Myers Squibb Co. and Merck & Co. while selling a small stake in COVID-19 vaccine maker Pfizer Inc. It also shed mining company Barrick Gold Corp.

Doug Kass, managing partner of Seabreeze Capital Investment Inc in Palm Beach, Florida, said the Verizon investment “makes sense” reflecting the company’s dividend payout and wireless revenue growth prospects.

He said the lowered bank stakes may reflect Buffett’s concern about persistent low interest rates, and loan losses related to the coronavirus.

Berkshire is expected to release year-end results and Buffett’s annual shareholder letter on Feb. 27.

Source: Insurance Journal

Share this article:

Share on linkedin

Share on facebook

Share on twitter