At one time, life seemed to be compartmentalized. Work was work. Home was home. You drove your car or commuted to work or business. Your work stayed at work. You slept and ate at home. You might drive back out to a movie or a restaurant on the weekend. With the exception of agricultural jobs, where home and farm were often the same, most of us lived and operated within these compartments. Insurers understood the compartments and they insured them appropriately. But, most importantly, insurers and their agent channels knew how to catch us where we would be most likely to sign up for insurance. They were adept at selling.

Convenience and technology, however, kept creeping into the picture. We had our newspapers and mail delivered to our homes or digitally. We had movies in the mail and now download and stream them. We had pizza delivered and now we can have nearly any restaurant food and groceries delivered via apps. We ordered books online with a click and now we can download them to read on tablets.

This trickle of ease and use of technology gave us a taste of how the desire for convenience could improve our life experiences. Aspects of our compartments were seeping into the other compartments. This made selling a more difficult process. All industries had to rethink their products and services from the standpoint of the customer—their desire for convenience and use of technology. If you couldn’t get people to go to their entertainment, you had to bring it directly to their homes. If you couldn’t get people to walk into your bank, you needed to place your bank on their phones.

And we are now evolving beyond convenience. Life is no longer compartmentalized. It has gotten complicated. Customers want simplification and a holistic view to manage their lives across many different areas. And insurers have to pay attention to the changes. What happens when a large portion of the population begins to drive their cars for work instead of to work or many people shift to work at home instead of working “at work”? What if they want value added services to manage risk—from their homes and autos to their health and more? These are radical shifts that are rewriting the stories of insurance. The nature of home, work, business and family are erasing the conceptual lines that kept insurance “traditional.”

The Gen Z and Millennial Lens

Though Majesco’s Consumer Survey Report covers all age groups, insurers that are concerned about the near future will be most interested in the shifts and interests among Gen Z and Millennials. They are now the dominant buyers for both life and non-life insurance products with a focus on five specific segments: life/health/accident, employee/voluntary benefits, auto, mobility, and homeowners/renter’s insurance.

Millennial and Gen Z life journeys have not followed the traditional path set by older generations, with high percentages remaining single and not married but with partners. They have made other significant lifestyle shifts from older generations that result in different risk needs that require different insurance needs.

Over the next three years Gen Z and Millennials plan to accelerate their life journeys through rapid change, outpacing the older generation in all aspects, including twice the average rate of changes in the home, work, and mobility aspects of their lives.

These shifts align with a shift in expectations regarding the types of insurance products they need, the necessity for value added services and the demand for personalized underwriting. This will place pressure on insurers to accelerate and improve IoT and data strategies.

The Millennial and Gen Z populations desire a holistic customer experience—where digital offerings bring together other products and services to help the customer manage their lives. This necessitates a full view for customers across their insurance products, value added services and non-insurance products. When insurers can’t deliver that view, a gap arises between customer expectations and what insurers are delivering. This gap opens the door for new competitors to meet that expectation—either directly or through partnerships with insurers. Just consider what companies like Toyota, Sofi, Ford, Petco, Outdoorsy are doing by offering insurance products through embedding or partnering on channel options with various insurers. This year’s research adds clarity to the market areas where insurers are currently missing opportunities.

CAUTION: Opportunities Ahead

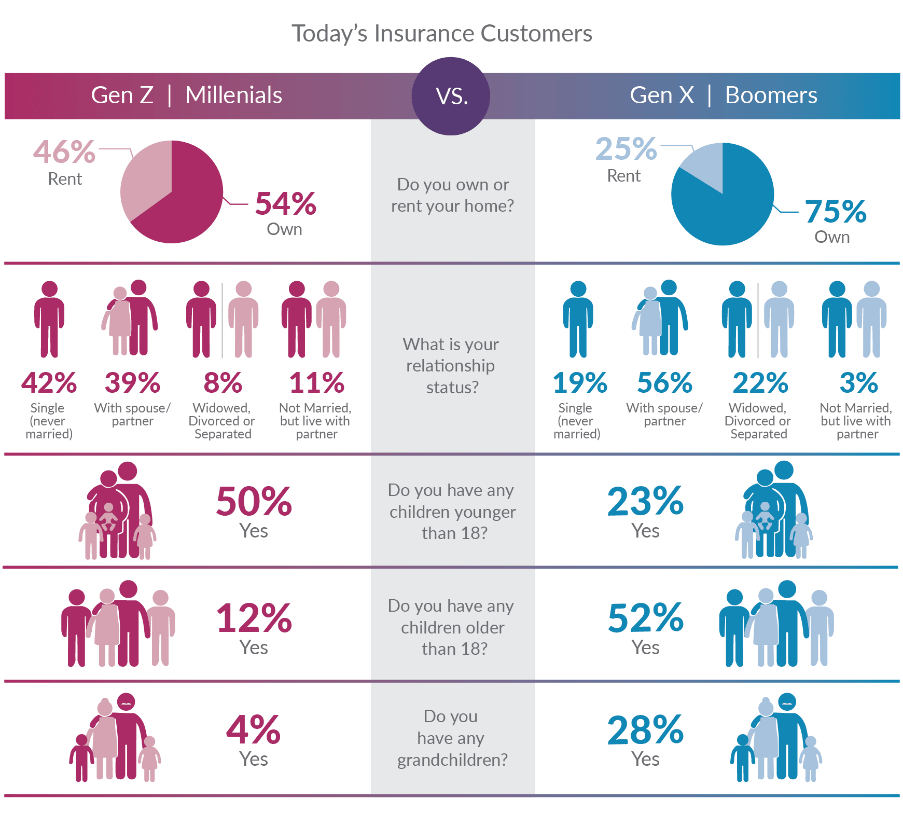

Millennials’ life journeys have not followed a traditional path, largely due to the severe economic stress of the 2007-2009 Great Recession as they entered the workforce. Since then, many have achieved a firm foothold in their life stage journeys, with a growing majority owning their homes and having children. Yet, high percentages of Gen Z & Millennials are single (42%) and not married but with partner (11%), reflecting a significant lifestyle shift from older generations, which likewise reflects different insurance needs as seen in Figure 1.

Figure 1: Life stage characteristics of today’s insurance customers.

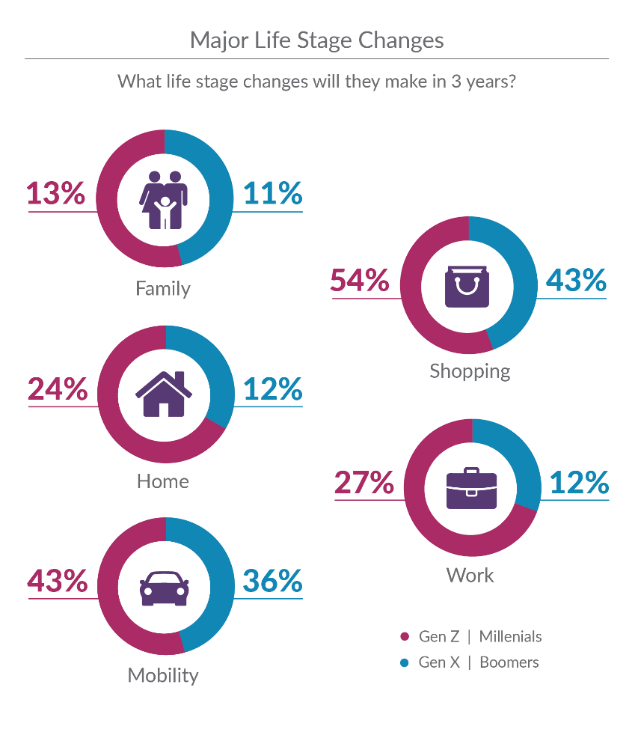

Over the next three years Gen Z & Millennials will outpace Gen X & Boomers in lifestyle changes in all aspects, including twice the average rate in Home and Work categories, as seen in Figure 2. Each of these aspects are further assessed in detail in the report over the 7-year window.

Figure 2: Expected life stage changes in the next 3 years

Every area that directly impacts the need for and use of insurance is prime for growth. The only question is whether or not insurers are prepared to capitalize on that growth. In many cases, the growth won’t be through traditional methods of selling or even through traditional products. Digital plays a HUGE role in their expectations. And holistic lifestyles and the desire for convenience will push insurers to digitize and innovate their channel and ecosystem partners in order to place their products at the point of life events and important larger purchases.

COVID-19 Hastens Market Shifts by Making Insurance Top-of-Mind

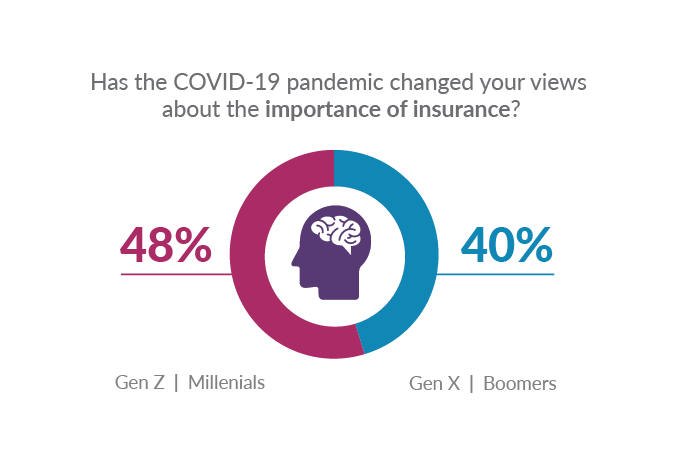

A connected facet of insurance’s potential growth and change is a new protective mindset. A crucial factor influencing all generations is COVID-19 and customers’ views on insurance. Nearly half of Gen Z & Millennials and 40 percent of Gen X & Boomers in this year’s research felt that insurance has become more important due to the pandemic. (See Figure 3.)

Figure 3: COVID’s impact on the importance of insurance.

Is “the COVID Effect” a fad? Possibly, but unlikely. Even if COVID were to evaporate overnight, general uncertainty over new weather patterns, social and political unrest and property investments mean that insurers need to respond quickly with new or modified products, value-added services and customer experiences that meet rapidly changing customer needs and expectations. The work and home trends that were accelerated by COVID have been around long enough to have made a lasting impression on both the economy and consumer sentiment.

Opportunities in the Widening World of Work

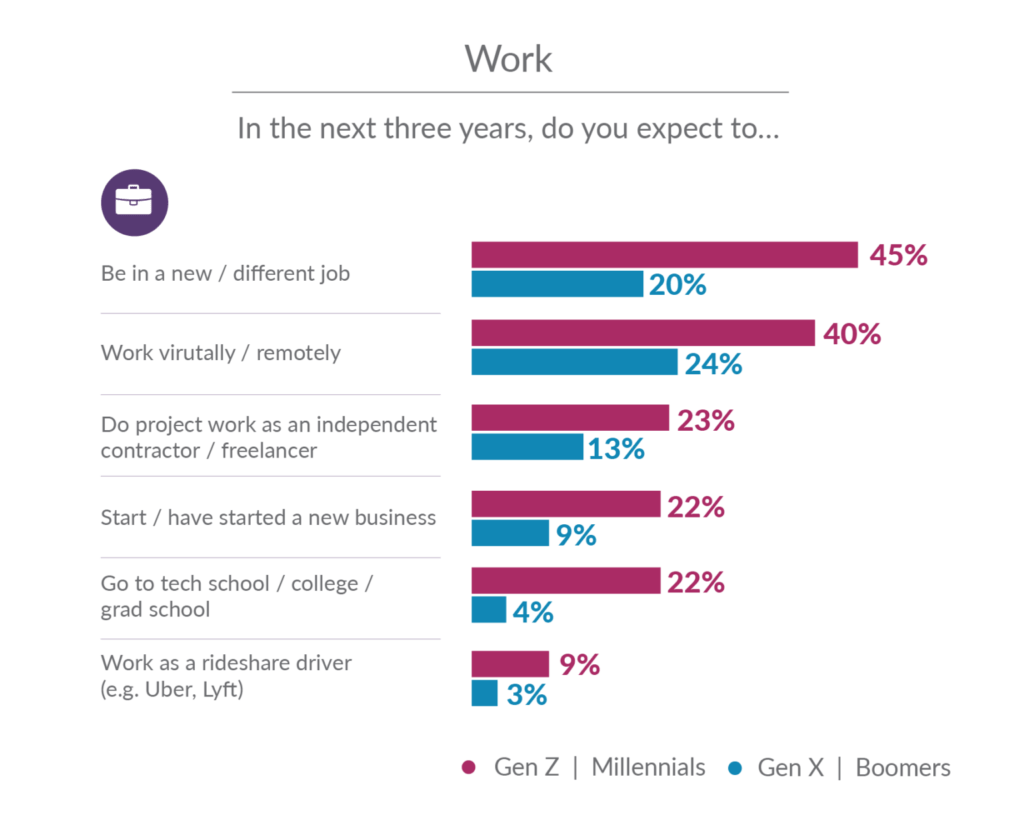

During 2020, 42 percent of Americans worked from home, nearly double the rate from 2019. Gen Z & Millennials reflected higher rates of gig work as both independent contractors and rideshare drivers in 2021, likely reflecting job losses, resignations from jobs and seeking new job options. (See Figure 4.) This means that geographic distribution of “the workplace” is now wider than ever before. This segment anticipates a steady continuation of independent contractor work, but a decrease in rideshare work back to pre- and early-COVID levels as their employment and personal financial situations stabilize.

Figure 4: Gig Economy work trends.

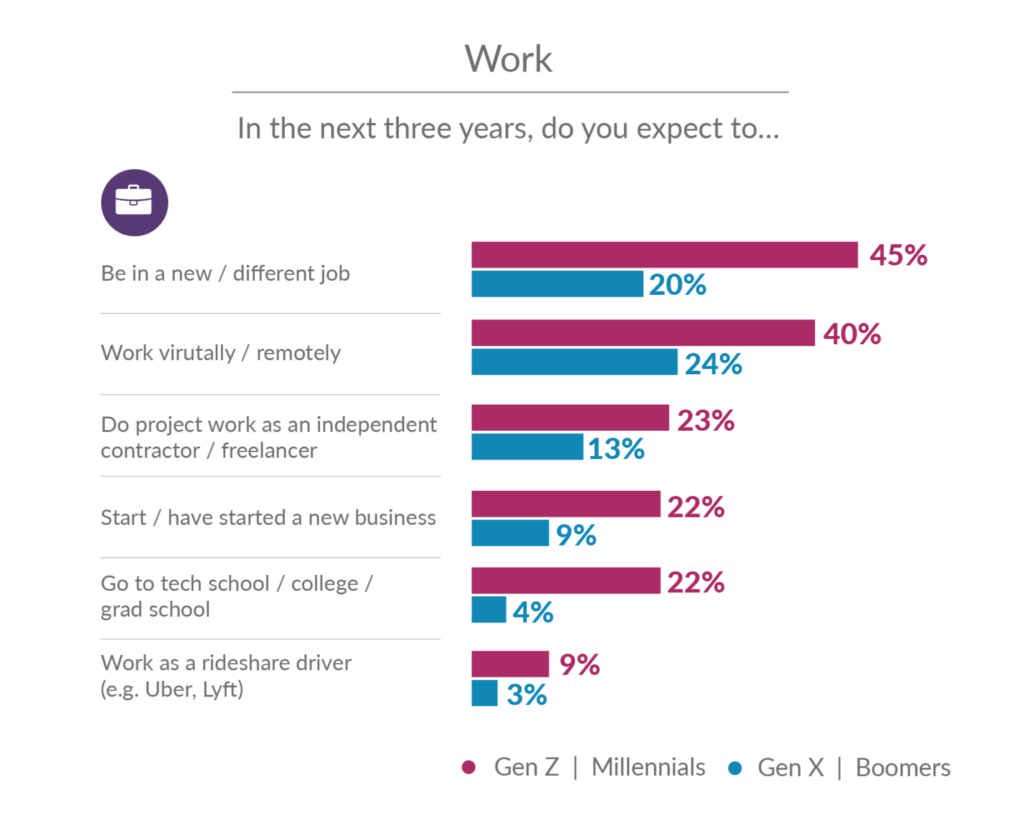

True to this generation, Gen Z & Millennials expect to be in different jobs (45%) and working remotely (40%), continuing the transient aspects of this generation that will put new demands on employee benefits to be flexible and portable. Nearly 25 percent indicate they will start a new business, highlighting an opportunity for insurers to develop relationships with employees directly to keep them as customers as their lifestyle changes.

These changes reflect growing opportunities for insurers to cover the shifting worker and employer needs. From on-demand benefits for gig/independent contractor work to work from home setups—employee and employer needs are dramatically changing. Innovative options like Nationwide’s Work From Home Insurance, which bundles home/renters, usage-based auto, and identify theft insurance is an example at the forefront of this change.

Figure 5: Expected changes in work in the next 3 years.

Opportunities in the Financial Sphere

Gen Z & Millennials have consistently trailed the older generation in banking and investing by an average of 10 percent to 15 percent. This offers an excellent opportunity to engage them now to address a broader financial well-being approach by developing a partner ecosystem that brings together other financial offerings and value-added services. Insurers can take advantage of Gen Z & Millennials’ high levels of interest for both planning (money management, financial planning, debt management) and financial loss prevention and recovery services (identity theft insurance, credit monitoring) as first areas of focus for partnerships (Figure 6).

While Gen X & Boomers don’t feel the same need for planning tools or services, they are still interested in financial loss prevention and recovery services to protect their financial assets as they enter or are in retirement.

Figure 6: Interest in financial wellness value-added services.

Product Placement: An Opportunity for Ecosystem and Partnership Development

For every opportunity, however, insurers will need to ascertain the best route into the market. Majesco’s research into digital shopping trends highlights the need to not just be online, but to think innovatively around online positioning with partnerships in areas where people are already shopping.

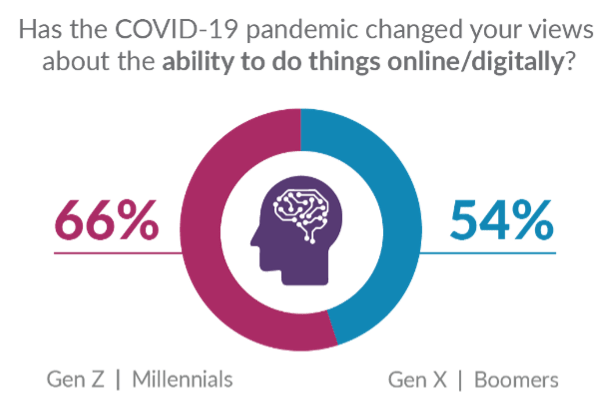

The last year has accelerated the use of digital and online options across all industries. The level of impact is substantial with 66 percent of Gen Z & Millennials and 54 percent of Gen X and Boomers changing their views of the importance of digital and online capabilities due to COVID as seen in Figure 7. McKinsey research found that online purchases increased 30 percent since the beginning of COVID and have remained at this level.

Figure 7: COVID’s impact on the importance of digital capabilities

And expectations continue to rise for digital and online. Both generational groups expect to do more shopping and buying online, outpacing in-store or in-person shopping by 10 percent. Once again, positioning is best where life happens. Carvana, for example, offers both gap insurance and mechanical protection “at the point of sale” for any car in its inventory. Are insurers prepared with the technologies and digital connectivity that will help them fill the growing gaps in online placement?

Mining the market

Just as Bitcoin was an industry to be “mined,” consumer and business trends are also filled with value for those who read the research. The viability of the insurance industry is vitally connected to demographic trends, market trends, customer expectations and adoption of new technologies. If we lose touch with our customers, both current and future, we lose business.