The group of insurance businesses, which includes Berkshire Hathaway Reinsurance Group, GEICO and Berkshire Hathaway Primary Group, reported insurance premiums earned had risen in 2020 to $63.4 billion up from $61.1 billion in 2019.

Net underwriting earnings for these businesses rose to $657 million in 2020, up from $325 million in 2019. But this was a huge reduction compared with $1.6 billion earned in 2018.

Across the firm’s insurance group there were vastly different results.

Berkshire Hathaway Reinsurance Group reported a full year loss of $2.7 billion in 2020, representing a greater loss than in 2019 of $1.47 billion.

In contrast, its GEICO business, previously known as the Government Employees Insurance Company, reported pre-tax underwriting earnings of $3.4 billion in 2020, up from $1.5 billion in 2019. And Berkshire Hathaway Primary Group reported earnings of $110 million in 2020, down from $383 million the year before.

The 2020 full year results report said: “In each year, we generated underwriting earnings from primary insurance and underwriting losses from reinsurance. Insurance underwriting results included after-tax losses from significant catastrophe events of approximately $750 million in 2020, $800 million in 2019 and $1.3 billion in 2018. Underwriting results in 2020 also reflected the effects of the pandemic, arising from premium reductions from the GEICO Giveback program, reduced claims frequencies for private passenger automobile insurance and increased loss estimates for certain commercial insurance and property and casualty reinsurance business.”

After-tax earnings from insurance investment income in 2020 declined $491 million (8.9 percent) versus 2019, reflecting lower interest income. This was mainly due to falling interest rates on the firm’s holdings of cash and US Treasury Bills. The report noted that: “After-tax earnings from insurance investment income in 2019 increased 21.4 percent over 2018, attributable to increases in interest and dividend income.”

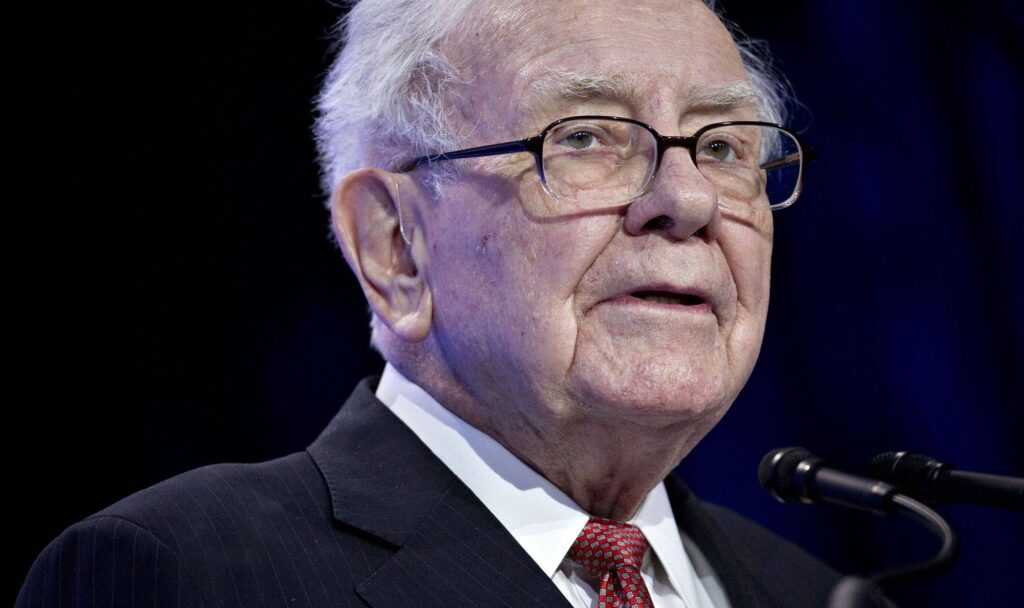

In his letter from the chairman, published with the 2020 full year results, Buffett said most of Berkshire’s value is in four businesses, all of which are “jewels”.

“The largest in value is our property/casualty insurance operation, which for 53 years has been the core of Berkshire. Our family of insurers is unique in the insurance field. So, too, is its manager, Ajit Jain, who joined Berkshire in 1986.

“Overall, the insurance fleet operates with far more capital than is deployed by any of its competitors worldwide. That financial strength, coupled with the huge flow of cash Berkshire annually receives from its non-insurance businesses, allows our insurance companies to safely follow an equity-heavy investment strategy not feasible for the overwhelming majority of insurers.”

Source: Intelligent Insurer

Share this article:

Share on linkedin

Share on facebook

Share on twitter