Scamnetic Raises Funds for AI Scam Detection Solutions

Scamnetic, a startup leveraging advanced AI to protect users against a wide range of digital scams, has successfully closed a $1.35 million pre-seed funding round.

Scamnetic, a startup leveraging advanced AI to protect users against a wide range of digital scams, has successfully closed a $1.35 million pre-seed funding round.

AI can complicate rather than simplify and reinsurers should take a circumspect approach to replacing legacy processes, according to Nicholas Berg and J.C. Brueckner of SCOR

Carrot General Insurance, a leading South Korean insurtech firm, has secured exclusive rights from the General Insurance Association of Korea (GIAK) to implement its Behavioral-Based Insurance (BBI) system for six months.

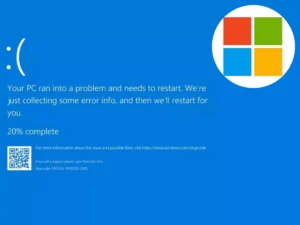

The significant outage linked to IT giant Microsoft has caused widespread disruption, affecting banks, airlines, train companies, and media organisations – with dramatic implications for the global insurance industry as businesses worldwide report significant disruptions.

In our latest series, MEET THE FOUNDER, we speak to former British Army Officer (Intelligence Corp) turned insurtech entrepreneur, Forbes McKenzie, who is a trailblazer in space and intelligence technology for the financial services and insurance industry.

Five Sigma, a leading AI claims management software company, has announced the launch of “Clive™”, the insurance industry’s first AI-powered Insurance Adjustment Agent.

Zyber has announced the launch of its new cyber insurance quoting platform tailored for startups and midsize enterprises. The platform allows users to obtain insurance quotes within minutes through a streamlined digital process.

Charlee.ai, a provider of AI-based predictive analytic solutions, has announced a partnership with SaaS insurtech Duck Creek Technology to enhance the claims management process through advanced predictive analytics.

Aspen Insurance, a prominent provider of insurance and reinsurance solutions, has introduced Aspen Data Labs, a platform designed to enhance digital capabilities and strengthen its focus on data and Analytics.

Limit, the insurtech, has launched LimitAI, which it claims is the first generative AI created exclusively for the Property & Casualty (P&C) sector. LimitAI is designed to analyse extensive insurance documents, quotes, and policies, providing rapid answers to various insurance-related queries.

Please feel free to send us an email

news@insurtechinsights.com

Insurtech Insights is the world’s largest insurtech community, connecting industry executives, entrepreneurs and investors.