If your Innovations are Unknown, you May be Underrated

Amid the economic turmoil of 2020, we’ve heard a lot about pricing adjustments on existing insurance products and about product innovations aimed at addressing new areas of risk

Home » Thought Leadership » Page 100

We regularly curate the latest insights and reports provided by and in collaboration with our partners and stakeholders to create the largest platform for knowledge-sharing and development within the world’s insurance industry.

Amid the economic turmoil of 2020, we’ve heard a lot about pricing adjustments on existing insurance products and about product innovations aimed at addressing new areas of risk

The Covid-19 pandemic continues to have an impact on every industrial sector as businesses and societies worldwide grapple with an ever-evolving situation. While some industries will be looking to embark on a recovery in the short-term, the Covid-19 impact on the healthcare sector will be long-lasting.

Over time, insurance has evolved from a product that is sold to a product that is bought, according to Christian Bieck, global leader of the insurance practice for the IBM Institute for Business Value, a research organization that provides thought leadership based on primary data and real-life case studies

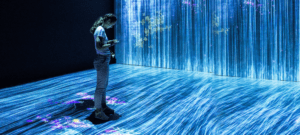

Digitization is the industrial revolution of the 21st century. What does this mean for a data-driven industry like insurance? The answer is simple: Turn everything on its head and reinvent yourself under high pressure- the future of insurance is digital

With the pace of change InsurTech has driven—and which COVID-19 has accelerated—the competitive pressure for insurers to change has grown proportionately more intense

As insurance technology advances, carriers must focus on customer pain points and allow them to drive efforts to find solutions

The race to fifth-generation (5G) wireless technology is on, with governments around the globe scrambling to support it. If they don’t, many industry experts believe, they risk losing out on the futuristic opportunities that 5G could make possible, from self-driving cars to smart cities that can point vehicles to the clearest roads. These advances also promise significant economic incentives: A 2019 study from IHS Markit predicts that by 2035, 5G will create 22 million jobs and generate $3.5 trillion in economic activity globally

Digital transformations that would have taken three to five years are now happening in under six months

The most effective way fleets can control their insurance costs in a hard market is to leverage telematics to drive out risky driving behaviors

Technology promises to free agents to spend more time with clients and prospects, broadening and deepening relationships

Please feel free to send us an email

news@insurtechinsights.com

Insurtech Insights is the world’s largest insurtech community, connecting industry executives, entrepreneurs and investors.