Climate change fuelling surge in property insurance: Swiss Re

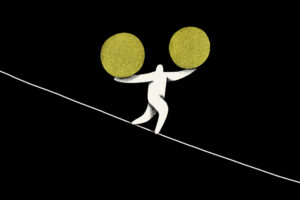

Climate change will help propel a threefold surge in property insurance premiums over the coming two decades, according to a study published on Monday by Swiss Re.

Home » Thought Leadership » Page 52

We regularly curate the latest insights and reports provided by and in collaboration with our partners and stakeholders to create the largest platform for knowledge-sharing and development within the world’s insurance industry.

Climate change will help propel a threefold surge in property insurance premiums over the coming two decades, according to a study published on Monday by Swiss Re.

Technology, machine learning, robotic process automation, data aggregation and analytics – in recent years, the insurance industry (like many other sectors) has been motivated to make use of those tools to improve their operations and enhance their underwriting, pricing, and loss control capabilities.

This Spring, UK regulator, the FCA announced a ban on the unfair practice of ‘price walking’ in the insurance industry.

Technology, machine learning, robotic process automation, data aggregation and analytics – in recent years, the insurance industry (like many other sectors) has been motivated to make use of those tools to improve their operations and enhance their underwriting, pricing, and loss control capabilities.

The COVID-19 pandemic and ensuing lockdowns have changed how we work for good. Offices, once the bustling centre of company life, have for much of the year been home only to empty desks, unground coffee beans and unanswered questions.

To compete for a larger share of a valuable market, insurance companies improve the customer experience by offering tailored products and efficient services while also amplifying their social engagement.

Insurtech could rightly be considered the greatest of the Wild West insurance opportunities, but in terms of opening up new markets, Group and Voluntary Benefits are making their own case for a land of new opportunities.

With technology taking centre stage, industries and sectors are getting disrupted. Insurance is no exception, and its key functions are being reimagined with the power of digital technologies such as artificial intelligence (AI) and machine learning (ML).

Over the last few years, insurers have been heavily focused on finding ways to tap into the younger generation that will be their primary consumers in the future. Here is an interview with insurtech Gigacover’s Mr Amerson Lin to get his take on how to reach that demographic.

Having cyberinsurance should be a requirement for any organization’s security plan, especially for SMBs.

Please feel free to send us an email

news@insurtechinsights.com

Insurtech Insights is the world’s largest insurtech community, connecting industry executives, entrepreneurs and investors.