Hippo Insurance has led the charge in innovative P&C proactive homecare cover and continues to scale, despite the downturn. In charge of steering the company in the right direction, is its CEO and President, Richard McCathron.

We caught up with him to find out how he’s navigating the choppy waters – and what leadership skills and strategies are proving successful.

You have a long career in the insurance space – what attracted you to the industry?

If you really think about it, nothing happens without insurance. We can’t buy homes, we can’t drive cars, we can’t build and sell products, we can’t protect our families when catastrophic events happen.

Insurance is the safety net that helps individuals achieve life’s milestones and explore the world, and helps companies meet consumer needs and innovate. I cannot imagine a more productive way of spending my time while contributing back to our society.

You joined Hippo in 2017. How did that move come about?

I had already been working in the insurance industry for nearly 20 years when I joined Hippo. I was looking for something different and from my first meeting with Hippo co-founder and former CEO Assaf Wand, it was clear the company was building something special.

His vision, using modern technology to offer a new kind of insurance and changing the way we protect our homes, was so different than anything I had come across in my career. Hippo was proactively supporting customers, helping them prevent small things from becoming big issues, rather than only showing up after something had gone wrong.

It was an opportunity I could not pass up, and that vision of what home insurance company should be and how we can best serve our customers still motivates me today.

Hippo is known for doing things differently when it comes to home insurance. Can you expand on that by sharing your differentiators with us?

Hippo has three key differentiators:

- Our people. We are a team of seasoned insurance professionals that combine a deep understanding of risk, gained from decades spent at the world’s most respected carriers, armed with Hippo’s proprietary technology to transform the industry.

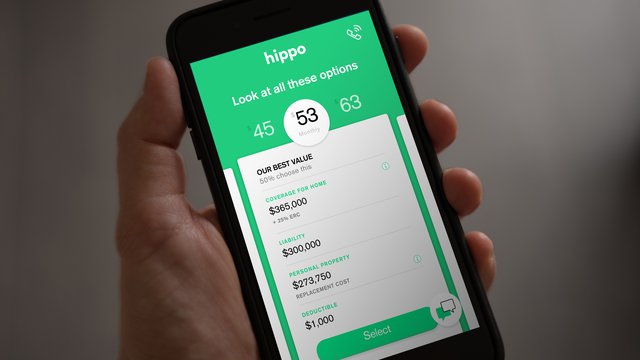

- Hippo Home Care. We are redefining the way we think about home insurance, building a first of its kind home protection platform that helps homeowners prevent small thing from becoming big issues.

- Distribution. We meet customers wherever they are in their home ownership journey through a series of diversified growth channels and an industry-leading portfolio of embedded partnerships.

2022 was a year of rapid progress for Hippo. Can you tell us about that – outlining which key factors resulted in success?

2022 was an important year for Hippo. We were able to grow, while focusing on profitability and announced at our September Investor Day we expect to be EBITDA positive by late 2024.

Our Gross Loss Ratio improved by 62% points from 2021, the result of 64 rate filings, our improved ability to identify and attract our target customer, and further geographic diversification.

We also had multiple key product and service launches in 2022 including:

- Piloting Book-a-Pro in Texas to connect homeowners with our curated network of repair service providers.

- Ramping up the cross-selling of non-Hippo insurance products as a third-party agency.

- And expanding our builder channel with the launch of the Hippo Builder Insurance Agency, allowing us to partner with builders of any size.

It’s a difficult time for the P&C sector now, with interest rates rising etc. What strategies can insurtechs be actioning both to help their customers and to stay buoyant?

In challenging times it’s important to refocus your team on your strategic priorities. At Hippo, we’ve spent the last year organising our business around delivering a differentiated customer experience. It sounds obvious, but without strict prioritization it’s easy to misallocate resources to projects that do not help attract and retain our target customers.

It’s also critical for insurtechs to get their insurance fundamentals down. Sometimes firms over index on the second half of insurtech – but even the most advanced technology will fail if the company is not positioned to deliver an underwriting profit.

Our tech stack was specifically designed to allow us to be agile and respond quickly in a challenging macroeconomic environment, but we rely on our team of experienced industry leaders to wield that tech and ensure our underwriting, actuarial and claims functions are executing at the highest possible levels.

It’s a challenging investment market too – what’s your long view when you look at the current situation? Are we looking at this stretching into 2024?

While I certainly hope things begin to turn around this year, it is possible the challenges we’ve seen over the last few months continue into 2024. If that’s the case investors will correctly expect firms to prioritise profitability and margins over growth.

The insurtech category is no different, which will place a greater emphasis on underwriting results. Privately held insurtechs who lack cash may struggle to raise capital in that environment which could lead to increased M&A activity this year and next.

What leadership skills are essential right now for riding out the storm?

During times like this it’s important to keep your eye on the end result and move towards that in an unwavering way. I remind our team all the time that nothing moves in a straight line – there are ebbs and flows, positives and negatives but it is generally just noise.

Ultimately, we know what our north star is and must keep driving towards that. At the end of the day, great teams can accomplish great things if they are moving at the same speed and direction.

Are there any interesting ‘Hippo’ projects you can tell us about on the horizon – say, happening in the next 12 to 18 months?

We’re excited about what the future holds for Hippo and the next 12-18 months should be very busy. We’re going to focus on our customers – continuing to develop a truly differentiated consumer insurance agency, while investing in our Hippo Home Care business, to launch new products and services.

As a CEO in a growing company, your role must be full of challenges. How do you unwind and maintain your work/life balance?

It’s critical to remember what’s most important – friends, family and those who are on the journey with you need time too. Although difficult, you need time to decompress and recharge. For me, it’s about getting outside in nature and experiencing as much as possible of what the world has to offer. Different geographies and cultures, and building relationships. Balancing that with purposeful professional pursuits, like protecting the joy of homeownership, is what motivates me.

What’s next for Richard McCathron?

It’s pretty simple, continue building a great company, with great people in order to meet ever-changing customer expectations. Simply put, in 10 years I want to look back and be proud of what we have built and how we have changed the way people think about maintaining and protecting their homes.

Interview by Joanna England