In today’s tangible goods markets, the pandemic produced some unintended supply chain volatility. GM, for example, is currently sitting on thousands of mostly-built pickup trucks that are awaiting semiconductor chips for final assembly. Auto manufacturers are poised to lose billions of dollars due to supply chain disruption. Or just look at the recent disruption in gas supply on the East Coast due to the cyber-attack on a major pipeline.

Many businesses today are challenged by their own supply chain design. Today’s “just-in-time” delivery systems were designed to cut costs in purchasing and warehousing, reduce the potential for waste and improve cash flow and profitability. They weren’t designed to be resilient in the face of supply chain disruption. And every portion of a just-in-time supply chain might be affected by disruption within other supply lines. For example, when the cargo ship, the Ever Given, was stuck in the Suez Canal for one week back in March of 2021, its cargo affected the timetables and routes of many other cargoes as well as the manufacturing and supply of many industries. A short disruption of one week could lead to supply chain issues lasting for months.

Like these companies, insurers are susceptible to supply chain challenges which they have created themselves. They have often “improved” insurance products by introducing additional complexity and better risk analysis without applying the resiliency of digital technologies and cloud-based platforms. COVID tested and disrupted insurance supply chains and found some of them to be wanting.

Participate in the 2021 Insurtech Executive Salaries Survey here! The aim is to provide a report for our young but innovative industry to recognise compensation standards and create benchmarks for executives like yourself, when both hiring and considering positions.

Here is the good news. The digital vision that we uncovered in a recent blog, is leading to API-first, cloud-native, digital experiences that will not only be efficient and resilient, but they will pay for themselves through improved customer and agent engagement and far greater profitability due to smarter risk selection and greater portfolio management. They will open supply chains by improving self-service and access to value-added services that offer choice, and much more. They will keep them open by utilizing “always open” technologies in the cloud, and they will enjoy pricing that matches use, where profitability matches scale

For the past two weeks, we have been looking at Majesco’s latest thought-leadership report, Digital Insurance: The Inflection Point to consider how insurance can match and beat customer expectations. Last week, we determined that insurers need to pursue a digital vision that uses a 360 view of customers—both individuals and businesses—to fulfill the market’s desire for engaging experiences of real value. We introduced the idea of a 360 View across three priority areas of insurance for value-driven digital impact:

- Customer self-service

- Agent or employee benefit portals

- Underwriting

The priority areas noted above are great examples for creating a new 360 View—something radically different from the siloed portals or older underwriting workbench solutions of the past. Not only are the user experience designs different from a digital, 360 View perspective, they also use newer technologies that can innovate in exciting new ways. These include digital platforms, data and analytics, and they incorporate other ecosystem partner solutions and services.

Customer Self-Service—360 View

Hallmarks of a great digital customer experience include choice, speed, and convenience. A truly great digital experience is rich with value-added capabilities that increase customer engagement, which, in turn, could increase loyalty and retention.

So, what is a 360 View?

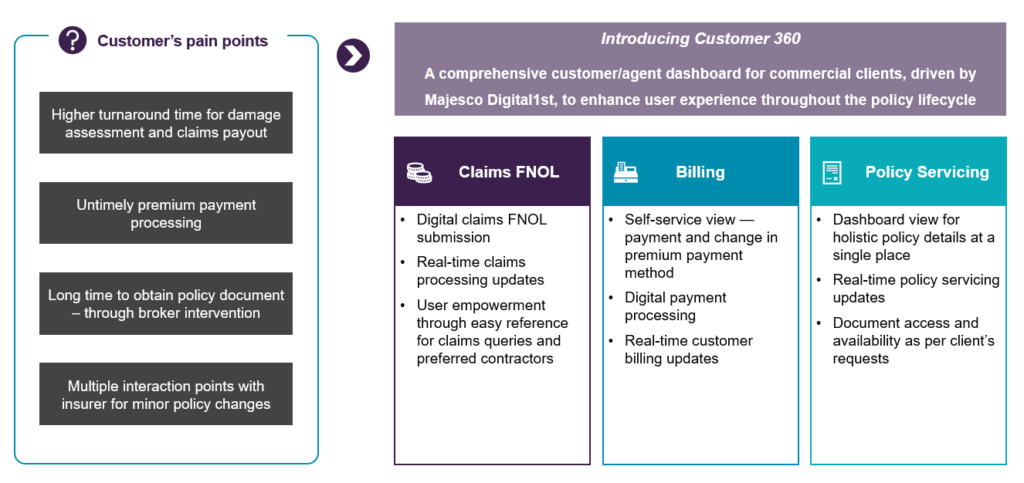

A 360 View is an approach that allows customers to do everything they need via one solution or app that is personalized and provides an experience that goes well beyond just a single transaction. Rather than siloed apps or transactional portals for policy service, billing, payments and claims (as represented in the customer pain points in Figure 1), a 360 View provides a single customer engagement platform across a broad array of areas. The 360 View connects, via APIs, with backend systems including policy, billing and claims as well as partner solutions such as repair shops and car rentals to create a holistic, and optimal customer-facing experience such as one might find with Amazon.

Figure 1: Customer 360—customer engagement through a single platform

A 360 View provides access to every interaction with your brand. The Customer 360 View moves insurers beyond incremental customer service to transforming the engagement to an experience with embedded empathy—a significant mind-set change and strategy that creates a truly customer-centric solution.

The Unintended Consequence of a 360 Customer Experience—Two-Way Benefits

Of course, every insurer would like to provide an improved customer experience that keeps customers happy and engaged as they self-manage many of their important tasks with ease. But that is still “portal thinking,” until we connect customer usage to new data and knowledge for the full value chain. Can what we learn from customer service apps lend itself to agent engagement? Can the data we derive from a customer portal also enhance our understanding of risk as we improve our understanding of insurance usage?

For example, In Majesco’s customer survey, we found that between 50 to 68 percent of individuals would like the ability to turn their insurance off or on with a mobile app. If this were currently possible within carrier apps, consider how much data that actuaries and analysts would receive pertaining to actual usage and actual risk. This kind of information would dramatically improve an understanding of portfolio risk at any one place in time.

This is an equation for improved profitability. Customers stick because the insurer has a winning experience that is integrated and seamless as demonstrated in the webinar, Customer360—Creating an Enriched Digital Customer Experience. Profits rise because customer data feeds portfolio and risk management systems, among other relevant systems such as claims and marketing.

Agent Portal—360 View

Similar to historic customer portals, agent portals have followed the same path. However, with increased competition on where agents will place business, insurers must place a very high priority on being “easy to do business with.” As insurers digitally enhance front-end capabilities to elevate the agent experience, the demand to look at this holistically across different touchpoints and agent journeys is extremely important to create “ease of doing business” solutions.

In particular, the Agent 360 View should include capabilities that support digital licensing and onboarding, quote and bind, viewing of compensation and incentives status, reporting and dashboards, as well as access to digital marketing assets, as represented in Figure 2.

Figure 2: Agent 360—agent engagement through a single platform

In the 2020 Forrester Wave Report, one of the key criteria includes robust capabilities across the front, middle, and back office, represented in a next-generation Agent 360 View that goes well beyond the traditional agent portals of the last ten years.

The world of the agent is dramatically changing. New competition is emerging. Insurers’ ability to engage top distributors—both existing as well as a new digital generation—drives the demand to rethink how we engage agents differently and holistically. It requires a next-generation approach with digital platform technology.

P&C Underwriting—360 View

The continued growth in commercial and specialty insurance, growth in data sources and the need to look at underwriting from a policy and portfolio basis to assess risk appetite has intensified the need to rethink underwriting in the digital age. The small commercial market has shifted to a new digital business model, including straight-through processing and direct to SMB’s by insurers like Homesite or Next and through partnerships with companies like Bold Penguin.

In contrast, the mid to large/complex commercial and specialty market is next for digital transformation, for which next-generation underwriting is key. Furthermore, this segment is seeing the emergence of new risks and customer needs that are fueling the development of new products and services, often requiring rethinking of the traditional underwriting process.

All of this has combined to make P&C one of the most volatile and least-consistent industries, with loss ratios that, according to McKinsey, “vary by up to 28 points, whereas expenses vary by just 2 to 4 points.” Yet, P&C underwriting has the potential for much greater consistency. McKinsey has identified five building blocks for successful P&C underwriting. These include:

- Portfolio steering

- Pricing adequacy

- Risk selection

- Capacity optimization

- Coverage design

Four of these five (all except Coverage design) can be improved by using digital technologies that will bring greater consistency to underwriting at the same time that they lower risk. Reimagining underwriting by using new digital technologies, new sources of data and advanced AI/ML analytics will redefine the next generation of market leaders.

Today, most insurers are dependent on policy systems and data that flows in with the application or is accessed for further assessment—with a policy and internal operational workflow mindset. Next-gen leaders are not just leapfrogging their competition, they are redefining the whole underwriting approach to a holistic 360 View between the underwriter, customer, broker and the broader risk portfolio.

Key areas that redefine a 360 View for underwriting include:

- Data flows in real-time and used by advanced AI/ML to provide intelligent insights.

- Underwriter, broker and customer all see the same information and can collaborate together in real-time.

- Underwriters focus on the knowledge and value they provide to the process rather than on the administration of the process.

- Both structured and unstructured data sources are accessible, integrated and used with advanced analytics.

- There is real-time access to premium and loss data, including audit and all other transactions at all levels of the portfolio.

- There is full transparency and speed for the broker and customer.

Instead of the old terminology of an underwriting workbench—which is singular and role-focused, an Underwriter 360 View provides an intuitive, intelligent dashboard. The dashboard contains a large array of components that provide a transparent and complete view that meets the needs and expectations of everyone—underwriter, broker and customer.

Figure 3: Underwriter 360—complete set of capabilities on a single platform

360 is Only the Beginning

Looking at a 360 View is somewhat like saying, “We’ll improve our experience while we improve our understanding.” This is certainly true. The benefits of working toward the 360 View approach will give insurers so many more benefits, however, that they will wonder why they hadn’t employed it sooner. This shift goes to the core of what it means to be digital. Insurers will find themselves asking much greater questions regarding the value of digital, such as:

- Can we also remove or sunset existing systems and reduce our tech debt?

- Will this allow us to introduce real-time products?

- Can we start to innovate around modern channels, such as personal assistants like Siri and Alexa?

- What parts of our business are truly profitable?

- What networks and ecosystems are we now able to access?

Digital proficiency and a digital framework will naturally uncover additional areas for streamlining processes and optimizing resources within the insurance organization. This is where new business models begin, with an understanding of how new methods can create business impact.

Source: Insurance Innovationer Reporter