According to new research across 36 sub-segments of 12 industrial sectors, the increasing commercial attractiveness of embedded insurance for a larger and more diverse set of non-insurance organisations across Europe.

The forecast suggests over €1.5 trillion of insurance premiums is sharable with non-insurance brands over the next decade, making deeper insurer/non-insurer collaboration a much more important growth opportunity for the sector than previously recognised.

Embedded Insurance also has the potential to address large levels of ‘non-consumption’ of insurance. European ‘protection gaps’ across the four key categories of cyber, healthcare, pensions and natural catastrophe stand at €350 billion. Data suggests creative embedded solutions could also unlock market.

The report highlights key trends in insurance distribution that are enabling a new generation of Embedded Insurance innovation. They include:

- The attitudes of digitally-native Millennials and Gen Z who will soon make up the majority of the workforce. They trust digital brands and are open to accessing insurance from them.

- The digitisation of insurance components – data, underwriting and pricing models, policy admin, claims, capacity provision, regulatory compliance – which are increasingly abstractable into software and configurable in new ways by 3rd party enterprise developers.

- Ever expanding volumes of data and their exploitation by AI to enable new forms of innovation.

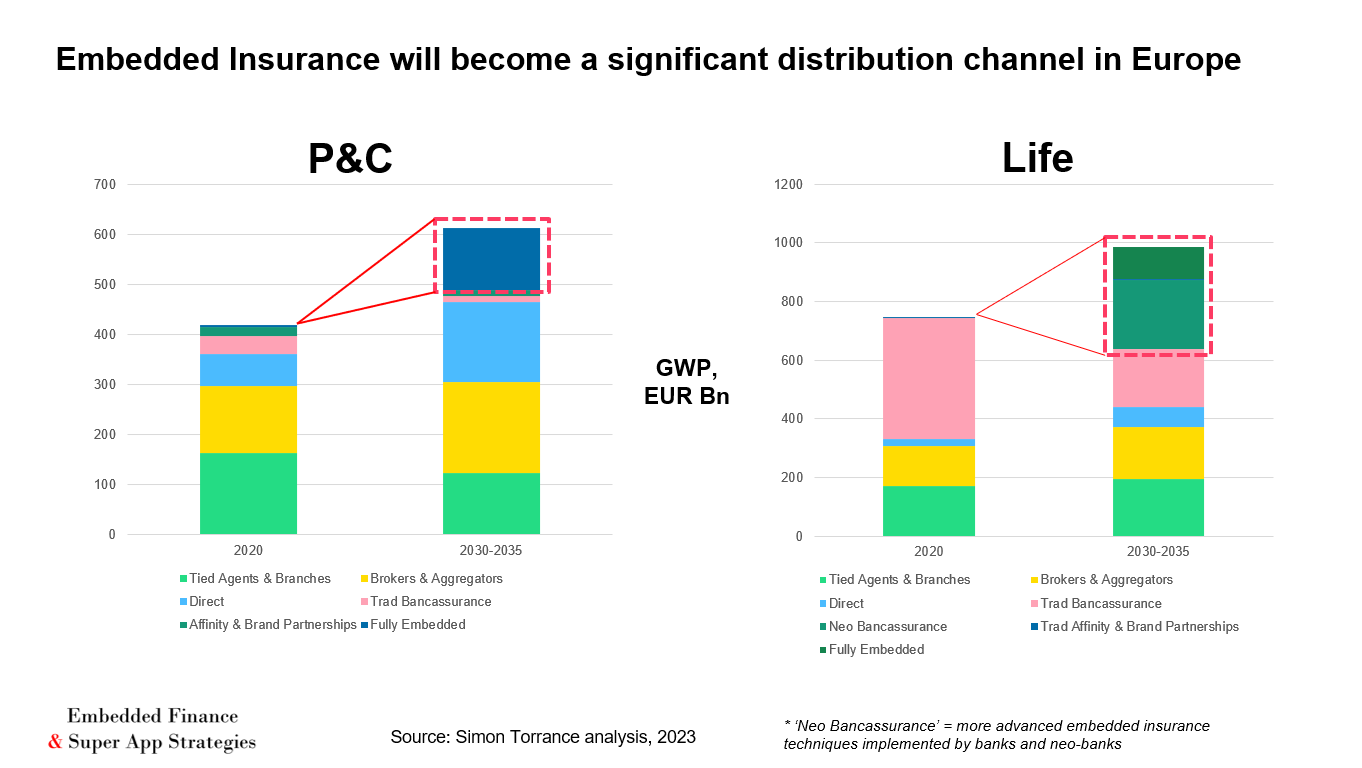

As a result, the report suggests that insurance distribution that is ‘Fully Embedded’ – ie. digitally integrated into third party processes – should grow its share of the insurance distribution market significantly, in both P&C and Life.

However, to realise this potential, the report highlights the need for brands, insurers, brokers, and insurtechs to make a step-change in their technology capabilities.

The industry will need to adopt new forms of digital ‘operating systems’ to enable fully scalable embedded insurance programmes.

‘Operating Systems’ automate more sophisticated interactions and transactions between the supply side (insurance and protection product, service and component providers) and the demand side (non-insurance organisations wanting to create innovative insurance programmes).

They enable richer embedded insurance programmes by:

- Providing a single platform for orchestrating insurance programs of increasing sophistication – to overcome complex integration across technical silos.

- Enabling commercial teams at non-insurance brand to easily configure the right solutions for their customers from multiple suppliers

- Enabling insurers, insurtechs and other protection providers to efficiently distribute their capabilities through any channel

- Using API’s to integrate the components of all parties into the ‘system’

- Leveraging ‘multi-tenant cloud infrastructure’ to support the international and local activity of different entities

- Combining data from the demand side with AI tools to facilitate effective matchmaking with supply side innovation

- Helping to create standards, datasets and data models to increase the efficiency of an insurance program comprised of many different parties.

Access the full report here