Looking at the quarter-on-quarter global InsurTech investment figures, one could be forgiven for thinking that there was, is and continues to be venture and growth capital for many (or even most) InsurTech businesses. Superficially this certainly seems to be the case. Generally speaking, deal count and volume continue to rise consistently on a quarterly basis; however, this is possibly where the good news for the majority of InsurTech businesses ends. If we scratch away at the figures a little more, we can quite clearly see that a significant amount of the capital raised on a quarterly basis is arriving at the doorsteps of the few.

In our previous Quarterly InsurTech Briefing (Q2), we reported that the first half of 2021 oversaw the largest amount of global InsurTech funding in a six-month period on record, with a staggering US$7.4 billion raised in 183 days. To put this into perspective, in H1 2021, if we were to spread the investment total equally over the number of days in this time period, on average $40 million was invested into InsurTechs (globally) per day. This would represent a daily investment in the region of approximately $16,000 to $13,000 into each InsurTech on the planet (if we assume there are somewhere in the region of 2,500 to 3,000 businesses that have adopted the term “InsurTech” over the past decade).

On average, since the beginning of 2017, approximately 6.5 times more investment is occurring on a current quarterly basis into InsurTechs across the globe. This might logically and rationally lead the average contemporaneous InsurTech into thinking it has relatively easy access to ready capital. Unfortunately for most this simply is not the case. Before we continue with this narrative it is of course worth noting that not every InsurTech on earth needs or wants to raise money (especially not every quarter). There are those few InsurTechs that generate a profit, or those that are quickly acquired or have limited interest in ceding equity unnecessarily.

While the significant consolidated macro growth of global InsurTech investment trend over a relatively short period of time is in and of itself very noteworthy, a stark pattern has been driving most of this growth that is not good news for most InsurTech businesses: the concentration of the much for the few. The data we presented from the previous quarter’s investment results showed that over two-thirds of the total volume raised went into only 15 InsurTech deals; in other words, approximately 0.5% of the world’s InsurTech businesses shared $3.3 billion between them, while the remaining $1.5 billion was distributed among 147 companies. We know this remaining amount was also largely concentrated into just a few companies (given the number of rounds that were $70 million to $99 million, which fall short of the mega-round status but consume a significant amount of capital). As for the remaining 95% of the world’s InsurTechs, there was zero fundraising activity (in Q2 2021).

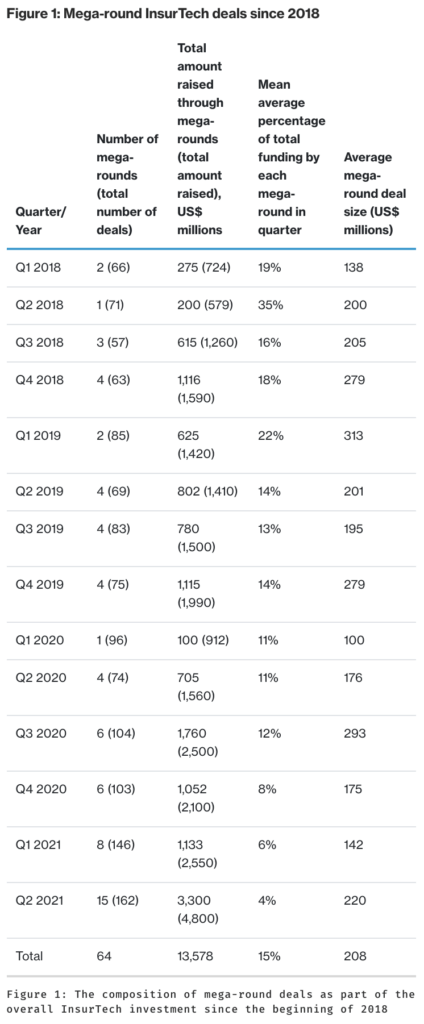

If we look back at the past few quarters, the concentration of significant funds into only a handful of deals on a quarterly basis is certainly not a unique issue to Q2 2021; in fact, Q2 2021’s mega- round deals, on an individual deal basis, represented a historic low percentage of the total amount of capital available (4%) being concentrated in one deal — this compared with Q2 2018 when a single mega-round deal represented 35% of the total amount of capital raised in the entire quarter.

In Q1 2021, eight deals (of 146) were responsible for 44% of total global funding; in Q4 2020, six deals (of 103) were responsible for 50% of the total global funding, and in Q3 2020, six deals (of 104) accounted for 70% of the total volume raised of global funding into InsurTech. We present the data in Figure 1 dating back to the beginning of 2018 to illustrate the effect that mega-rounds (rounds over $100 million) are having on total quarterly funding.

If we look at the average total percentage of mega-round deals per quarter, we can see that approximately 50% of InsurTech investment goes into mega-round deals. What is particularly interesting is that in the past few quarters, each individual megaround does seem to be representing an increasingly small(er) percentage of quarterly raises. This is most likely a reflection of an increased number of mega-rounds being done on a quarterly basis. We know that many InsurTechs before going public wish to embark on a big raise to increase their company value, and with it create unicorn status (i.e., start-up companies in the software or technology industry that are valued at over $1 billion). Four InsurTech unicorns were created in 2018, five in 2019, five in 2020 and eight so far in 2021. Depending on your definition of InsurTech, it could be argued that there are now 24 InsurTech unicorns in existence.

The topic of unicorn creation leads us to ask the same question we asked exactly two years ago (in the Q3 2019 Quarterly InsurTech Briefing): At what point does a “group of unicorns” become an oxymoron? Well, it has come to our attention that there is such a thing as a group of unicorns: A “blessing” of unicorns is the collective noun for such a group. Are the InsurTech unicorns in our midst a blessing? That remains to be seen. In Q3 alone, there have been a couple of new unicorns added to this “blessing.” U.K motor InsurTech Marshmallow joined the blessing club following an impressive $85 million raise, on a $1.25 billion valuation. Similarly, unicorns also publicly unveiled themselves this quarter as well. Just days after Q2 2021 closed, both Hippo (already a unicorn) and Doma went public.

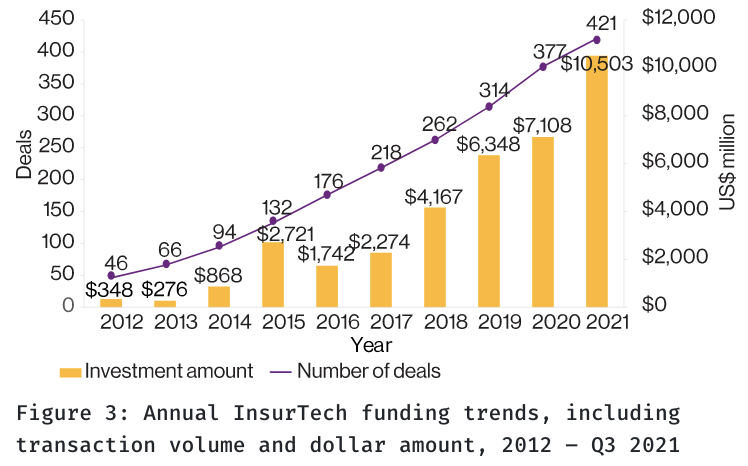

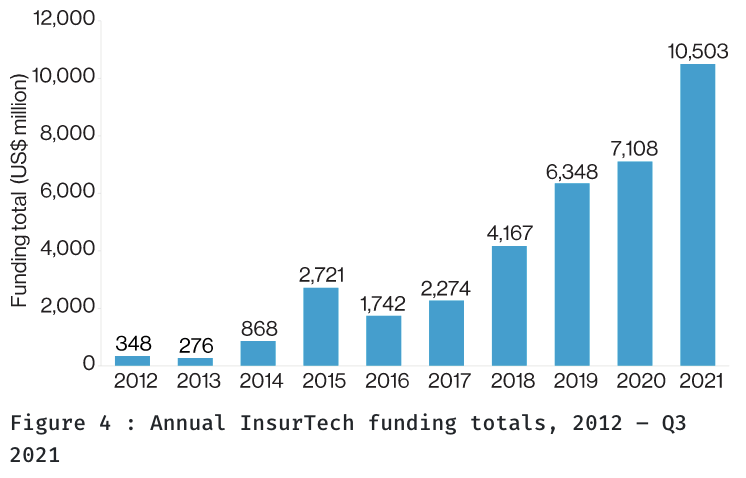

This latest Quarterly InsurTech Briefing is announcing that global InsurTechs continue to see a strong trajectory in Q3. This quarter, global InsurTech funding reached an enormous $3.1 billion. This represents a 23% increase compared with the same period last year and is notably the second-largest funding quarter on record. For the first time in history, we are seeing in excess of $10 billion being invested in a single year into this truly global phenomena. The total number of deals is also now at an all-time high as well, with 421 deals completed this year to date.

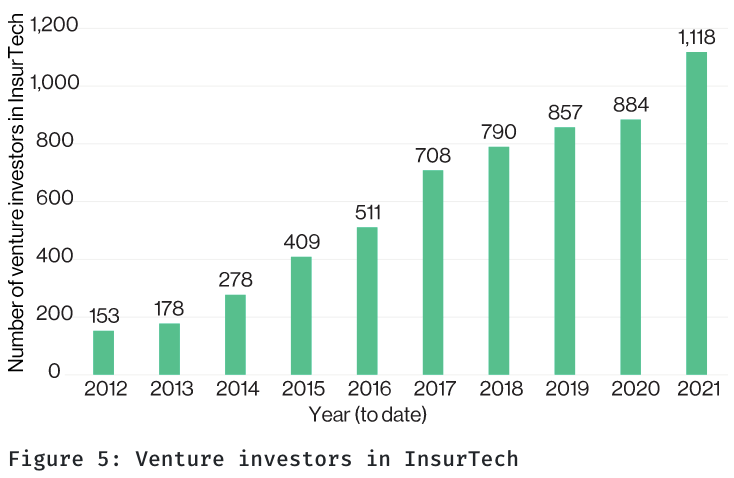

Undoubtedly, one of the biggest drivers of overvalued valuations for businesses in this space is the continued prevalence of venture capital (VC) investors who have turned to InsurTechs to expand their portfolios and make the most of relatively buoyant markets.If we look at the past 10 years, the number of venture investors participating in InsurTech is staggering — especially when considered through the lens of year-on-year new entrant activity. In this instance, we define a “venture investor” to include the following types of investor/capital: VC, corporate venture, super angels and growth equity. (Note, investors may have participated in multiple deals in a given year but will only be counted once in the data we wil present in Figure 5).

In 2012, we estimate that globally 153 venture investors put their capital to work into businesses that self-identified with the label of “InsurTech.” Two years later, in 2014, that number had nearly doubled to 278 venture investors. Two years after that, in 2016, it was on the road to doubling again to 511 venture investors. In 2021 we estimate that, to date, 1,118 venture investors have their attention firmly set on the world of InsurTech – almost 7.5 times the original number we estimate for 2012. These investors are situated across the globe with varying appetites and mandates; some have a very specific InsurTech strategy, and others are making the most of the opportunity as they see it. As Figure 4 shows, there seems to be no slowing down of venture investors wanting to participate in this space, and in the short term at least, this only looks set to continue. It does, however, make the grey matter (in terms of both promising InsurTech business, and market opportunity) and capital balance increasingly out of proportion (and as a result will continue to support [and drive] the sorts of frothy overvaluations we have been seeing for many years now — a financial game of musical chairs, if you will).

In certain cases, the motivations of outside VC providers are relatively short-term focused and therefore greater emphasis is placed on volume and inbound growth versus sustainable loss (and therefore combined) ratios — or at least business models that can be self-sustaining without the assistance of investment capital.This venture investment cycle is self-perpetuating on the way up; venture capitalists are looking to drive valuations up, and this in turn attracts other venture capitalists who are attracted to these new areas of growth. This too is reflected in the steady and significant rise in venture investors participating in InsurTech investments over the years; that is to say, it is not just the prevalence of innovative technology in our industry or “the great untapped” that is luring new venture investors in. Given that there is clearly an increasing venture investor audience participating in the global InsurTech landscape, it is worth considering this every time a significant raise is completed or a new unicorn joins the blessing. It is also worth consistently checking back to the many motivations that a variety of investors have when we evaluate the timeline around the future of the InsurTech valuation peak — and perhaps most important, the types of investment motivations of the capital supporting InsurTech businesses. Bearing this in mind does help to rationalize certain valuations that might otherwise be considered irrational (relative to business performance on traditional [re] insurance metrics).

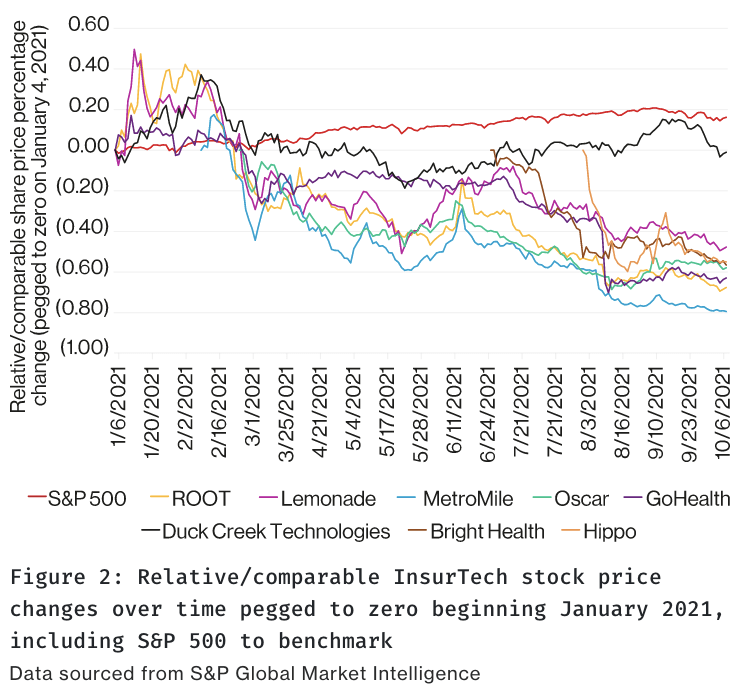

Given that much of the capital coming into InsurTechs is attracted to volume and inbound growth (particularly of gross written premium), many of the most highly valued InsurTech businesses by venture investors are unsurprisingly risk-originating businesses. There are, however, many hundreds of InsurTech businesses that focus on distribution and business-to-business (B2B) software vendor models that might themselves be fantastic businesses but are unlikely to achieve the types of elevated company valuations that their carrier-model InsurTech cousins are commanding (at the moment). One cannot help but think that this current trend of overvalued businesses going public might not actually be a blessing at all. Will some of these underwhelming InsurTechs ultimately jeopardize our overall view of technology as it continues to come into our industry? Will they be the heat that dries up investment funding that should actually be looking for a better home? Only time will tell, but one thing is for sure: The vast majority of InsurTech businesses are unlikely to receive many of the dollars that dominate most InsurTech news stories.

Q3 data highlights

InsurTech funding falls from its previous record high but remains elevated, raising $3.1 billion across 113 deals.

Global InsurTechs continue to see a strong trajectory in Q3. This quarter, global InsurTech funding reached $3.1 billion. While this figure represents a 35% decrease from the prior quarter, it still represents a 23% increase compared with the same period last year and is notably the second-largest funding quarter on record.

After two consecutive quarters of deal growth, InsurTech deal activity fell nearly 30% from Q2 to 113 deals; however, year over year, overall deal activity was up 9% reflecting continued growth.

This quarter, mega-rounds remained elevated at 11; furthermore, outsize deals accounted for roughly 51% of total funding, compared with nearly 70% in Q2.

After reaching the lowest level since Q2 2018 last quarter, the share of U.S.-domiciled companies rebounded to nearly 46%, an increase of roughly seven points from Q2 2021. Countries including Indonesia, Sweden, South Africa, Singapore and the U.A.E. all saw quarter-on-quarter increases in deal activity as InsurTech continues to scale across the globe.

Early-stage average deal sizes grow to nearly $12 million, up 90% compared with Q2 2021

Early-stage start-ups raised a record-breaking $630 million in Q3 despite deals falling by 39% quarter on quarter to 57 deals. Given this dynamic, the average deal size across early-stage deals grew to nearly $12 million, an increase of more than 90% quarter on quarter and nearly 80% year on year.

The mix of early-stage deals also saw a notable shift in Q3. As a share of total deals, Seed/Angel rounds have fallen dramatically, reaching the lowest point since Q2 2020. Seed/Angel deals accounted for just 19% of overall deals — a 23-point decrease quarter on quarter and a 12-point decrease year on year.

Conversely, Series A saw notable growth and accounted for 31% of all deal activity, a 15-point increase quarter on quarter and a six- point increase year on year.

Cyber insurance-focused start-ups represented two of the top three largest deals this quarter, as cyber continues to be a major business challenge

Cybersecurity continues to be a major challenge for corporate executives and small businesses alike as the threat and frequency of cyber attacks continue to grow.

Of the three largest rounds this quarter, two of the start-ups were focused on offering cyber insurance, including Coalition, which raised a $205 million Series E, and At-Bay, which raised a $185 million Series D. We will feature the At-Bay deal in our Transaction Spotlight section.

Companies deploy a variety of models to approach cyber insurance, including tech-enabled managing general agents (MGAs) to underwriting and risk analytics providers. Outside of the top three deals, Envelop Risk, which focuses on cyber underwriting services to (re)insurers, inked a sizeable $130 million Series B, while even earlier in the funnel, BOXX Insurance and Y-Combinator-incubated Telivy each raised funding to grow its solutions further.

If we look specifically at Q3’s mega-round headlines, to reiterate, of the 113 deals done in Q3, 11 were “mega”. In terms of volume of capital committed, these 11 deals accounted for 51% of the total amount of capital invested in the quarter. The table below shows the impact that Q3’s results have had on the overall average trajectory of mega-round funding into InsurTech (between 2018 and now). While it has done little to significantly alter the overall numbers, Q3’s results support the theory that the number of mega-rounds being done per quarter is generally on the rise (this is the second largest quarter ever for mega-rounds recorded). Consequently, each individual mega-round deal represents a steadily decreasing percentage of total mega-round activity, while we observe the continued trend for more than 50% of quarterly funding to be concentrated into just a handful of deals.