Google Cloud, Allianz Global Corporate and Specialty (AGCS), and Munich Re are pairing up to make cyber insurance more mainstream and embed it into cloud services.

The partnership comes as it becomes increasingly clear that cyber insurance is going to play a role in enterprises of all sizes. Specifically, the trio of companies is launching the Risk Protection Program.

The Risk Protection Program aims to cut cloud security risks and offer cyber insurance designed for Google Cloud customers. What’s notable about the program is that cyber insurance, which is evolving, could become more mainstream should it be resold via technology providers.

Sunil Potti, general manager and vice president of Google Cloud Security, said that the partnership with Allianz and Munich Re has been “in the works for a few years.” Potti added that cyber insurance is an effort to turn the concept of shared responsibility of security into shared fate. “This is the first down payment on that journey,” said Potti.

Should the Google Cloud, Allianz, and Munich Re model be emulated, businesses could procure cyber insurance through enterprise software makers, security companies, web hosting firms, and other providers.

Google Cloud said that the Risk Protection Program aims to address the reality that more sensitive workloads are being housed in the public cloud. That fact also means that risk protection has to be more integrated with services. Customers, who were previously expected to create their own security models, will be able to leverage Google’s Trusted Cloud and layer in cyber insurance protection.

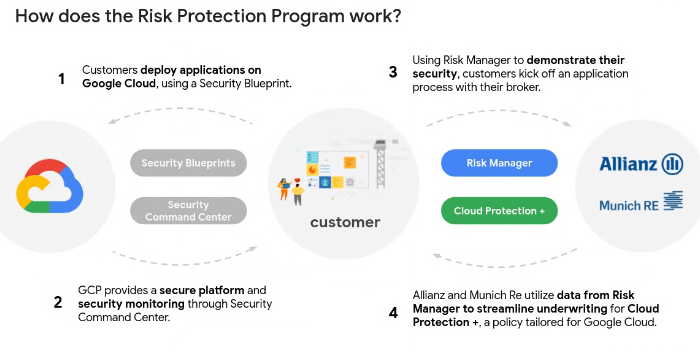

The parts of Risk Protection Program go like this:

- Risk Manager, a diagnostic tool that enables Google Cloud customers to manage and measure risks on the platform get reporting. The Risk Manager tool is available to Google Cloud customers by request and will be prioritized for Security Command Center Premium customers in the US.

- Cloud Protection +, a cyber insurance product that’s offered by AGCS and Munich Re, and designed for Google Cloud customers.

- Customers would run Risk Manager and send to AGCS and Munich Re to obtain a quote for cyber insurance if eligible for Cloud Protection +. The companies’ theory is that cyber insurance procurement will be easier if integrated with Google Cloud.

A Model to Expand Cyber Insurance

AGCS said Cloud Protection + will cover cyber incidents within their own corporate environments as well as on Google Cloud.

For now, the offering is targeted at US Google Cloud users, but “this offering may be offered globally at a later date.”

Bob Parisi, head of cyber solutions at Munich Re, said that the partnership with Google Cloud will streamline applications and underwriting. Parisi added that Risk Manager will connect data to the underwriting process, but Munich Re and Allianz aren’t monitoring corporate networks in real time. “Risk Manager gives us an inside-out look at a company,” said Parisi. “We’re driving underwriting toward a more data-driven approach.”

Thomas Kang, the North American head of cyber, tech, and media at Allianz, said the goal was to make a program that was cloud-first given that’s where workloads are going.

The other moving part is that Risk Manager could gauge security posture of an enterprise over time. As a result, the more frictionless experience may improve underwriting speed as well as discounts over time.

In addition, Google Cloud also gets a bump from cyber insurance via the Allianz and Munich Re partnership. By leveraging cyber insurance partnerships, it can target more regulated industries such as financial services and healthcare. Allianz and Munich Re will share the coverage 50/50.

Bottom line: The Google Cloud alliance with Allianz and Munich Re may provide a blueprint for other cloud and tech services providers to emulate. You can expect similar bundles going forward aimed at enterprises of all sizes.

Source: ZD Net

Share this article:

Share on linkedin

Share on facebook

Share on twitter