So, since they aren’t going anywhere, it’s natural to ask: how can carriers and agents better collaborate to serve customers and drive growth?

Carriers have been making substantial investments in digital sales and service capabilities, cloud, CRM systems and artificial intelligence-driven chat to drive cost out in claims and service. But I believe there is still substantial room for improvement in using technology to improve agent capabilities to drive sales growth and deliver a better customer experience. Ignoring this can not only miss opportunities but also create risks.

For example, we have seen carriers launch initiatives to route all customer service calls through central service centers. Agents still sell the policies, but when the customer needs assistance afterward they are directed away from the agent and toward an automated service system instead of connecting with the agent or agency staff they already know and trust.

Programs like this both take away one of the agent’s biggest strengths and risk alienating customers who would prefer to talk to their local agent. Successful agents use service opportunities to strengthen relationships and drive cross-sales. Approaches that disintermediate the agent have the potential to negatively impact both sales and retention.

This is not to say that call centers, digital self-service or chat technology should not be used, but rather that customers should have the choice of how they wish to engage.

Catalysing collaboration through technology

I see three distinct areas where carriers can leverage technology to partner with agents to improve agent performance, the carrier’s bottom line and the carrier value proposition to the agent.

1. Marketing

Most agents do not have the scale to consistently and successfully use technologies such as artificial intelligence or web crawlers in their marketing efforts. But carriers do! Carriers also have access to tremendous amounts of data, both internal and external, that they can mine for actionable insights.

For example, is a current customer shopping for baby carriages? This could be an opportunity for a life insurance discussion. Are they looking at real estate postings or mortgage rates? They are likely either refinancing their home or looking for a new one. Conversational ads on social media can be used to generate leads when a prospect is actively looking and therefore most likely to purchase insurance. Notifying an agent in real-time when events like these happen will create win-wins scenarios for agents, carriers, and customers.

2. Sales

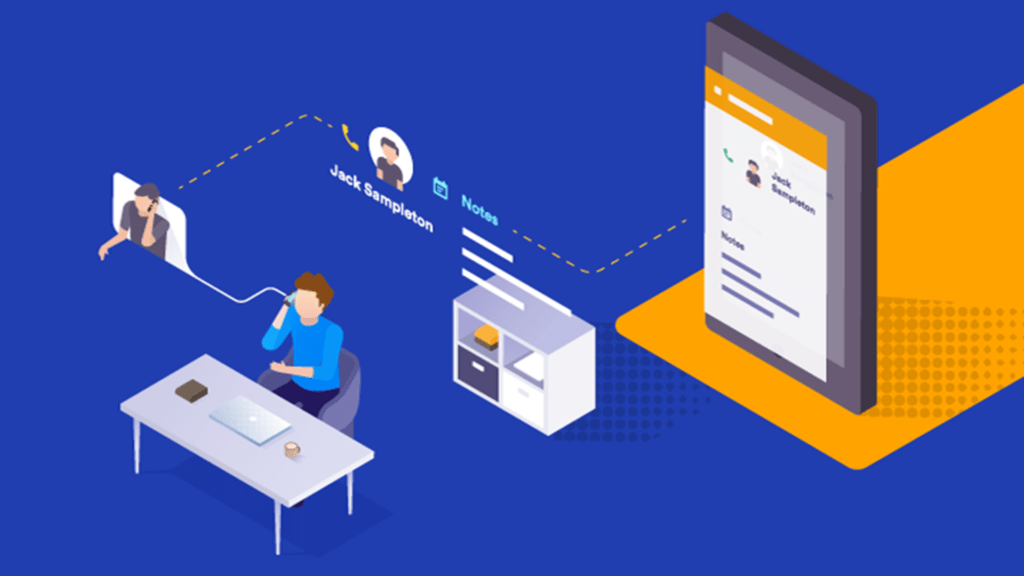

Using artificial intelligence and speech recognition, carriers can leverage the skill sets of their best sales agents and provide scripts, objection responses and next-best offers to all agents – on their computer screens – as they are having sales conversations.

3. Service

There are many opportunities for collaboration here. Examples include technologies that allow a customer to have a chat or call options from a robust agent website; integrating self-service and quoting capabilities from an agent website with notifications sent to an agent for follow up after a customer-initiated action; and options to schedule an appointment with agent or agent staff digitally. These capabilities should be available on both the agent website as well as the carrier website. Carriers should embed an agent somewhere in every customer service loop, as consumer preferences vary from transaction to transaction.