Insurtech startup Digit Insurance has consistently seen its employees putting in their own money every time it has raised funding — a sign of the great confidence each person who works there has in the future of the business.

Founded by Kamesh Goyal, Bengaluru-based Digit Insurance has crossed Rs 5,000 crore in gross written premium in a span of less than five years. In 2021, the startup not only became the first Indian unicorn of the year but also the first insurtech company to achieve the coveted billion-dollar valuation.

And it certainly seems like Digit Insurance has been ticking all the right boxes in terms of insurance premium income it generates on its platform, its range of products, and the volume of business.

Registered in December 2016, the startup sold its first policy in late-2017, and there has been no looking back since, even amid the lows of the COVID-19 pandemic.

Exponential growth

The insurance industry in India is estimated to be worth $280 billion, reveals India Brand Equity Foundation (IBEF). However, the penetration levels of insurance across the country remain below five percent.

According to the Insurance Regulatory Authority of India (IRDA), the overall insurance penetration level for FY21 stood at 4.20 percent of which life segment was 3.2 percent and non-life at just one percent.

Additionally, premium volumes generated by the Indian insurance sector in 2020 stood at $107.99 billion of which $81.25 billion came from life insurance and non-life was $26.74 billion.

Kamesh believes the overall situation — from an economy perspective — is turning out to be better with the general insurance segment recording around 11-12 percent growth.

However, he adds that in the short term, competition is going to be intense with numerous players requiring fresh capital as their P&L would be under pressure, largely due to the outbreak of the COVID-19 pandemic. Other startups in this sector include ACKO Insurance, Coverfox Insurance, and PolicyBazaar, among others.

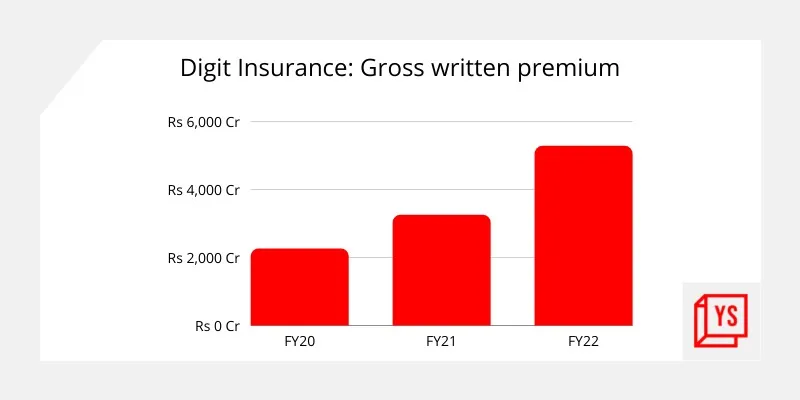

In FY 2021, Digit Insurance had registered a gross written premium of Rs 3,243 crore as compared to Rs 2,252 crore in FY20, which was a growth of 44 percent. For FY22, the insurtech unicorn registered a gross written premium of Rs 5,268 crore, which was a 62 percent growth when compared to FY21.

Although the founder claims he was apprehensive about the startup’s growth prospects, especially during the deadly second wave of COVID-19 in April 2021.

“We have been able to achieve break-even under IFRS standards in the third full year of the business and our team has been able to do this without burning a huge amount of cash,” says Kamesh.

Key to success

Kamesh takes a lot of pride in how Digit Insurance has grown over the years and cites two important parameters: the positive rating from customers on social media platforms (always around 4.9/5) and products attuned to their needs.

Added to this, at the height of the second wave of COVID-19, the startup launched specific health insurance policies as a cover against coronavirus even as most others stopped selling such a policy.

“We have always been a customer-centric company and the focus is on improving our service levels,” says Kamesh.

This philosophy has led to Digit Insurance extending its reach across the country while most insurtech startups tend to focus largely on metros or Tier-I cities. In fact, Digit generates 10 percent of its business from Tier-IV+, in what could be termed as rural areas.

The founder says, “Except for three pincodes in the country, we have either sold a policy or processed one in all the other postal codes.”

Digit Insurance, over the years, took these steps because the startup believes in providing choices to its customers without any compulsion to favour a particular product or a distribution channel.

As an online platform, Digit Insurance helps people buy all kinds of non-life insurance policies. There are also different buying channels — the app, web portal, or through a distribution partner.

“We have different ways to interact with the customers, and without this freedom of choice, you will be attractive only to a certain set of customers,” warns Kamesh.

Added to this, Digit Insurance also enables conversations in native languages, which further adds to the comfort factor, leading to higher customer satisfaction and sales.

Since its inception, Digit Insurance has cumulatively raised Rs 2,806 crore in funding, from key investors including Canadian billionaire Prem Watsa-led Fairfax, Faering Capital, Sequoia, IIFL, among others. It was last valued at Rs 26,973 crore or $3.5 billion.

A robust tech platform

Driving this multi-prong, customer-friendly, flexible approach is the technology platform Digit Insurance has developed over the years. The founder firmly believes the best results are only obtained when human intelligence and machines go hand in hand.

Elaborating, Kamesh cites the example of how during the height of the COVID-19 pandemic, Digit Insurance was able to conceive a suitable insurance product, put it onto their system, sell it, and successfully service claims even on a completely remote operation.

“If somebody had told me — four years ago — that something like this was possible, I would not have believed them but technology has now made it possible,” says Kamesh.

However, he also strongly believes that the classical skills of the insurance industry, like risk selection and pricing, can be best done by skilled professionals, i.e. insurance agents, and there is no algorithm that can replace them.

The biggest advantage of technology in the insurance industry, according to Kamlesh, is the degree of customisation of products it allows based on the market requirement.

For example, one need not buy insurance cover for their entire mobile phone and instead just narrow it down to the screen cover. Or in the case of vehicle insurance, the majority of the inspection can be done through technology without human intervention.

Growth segments

The non-life insurance industry is unbelievably competitive in India and is likely to remain so in the foreseeable future, says Kamesh, adding that there is an ongoing stress test in the industry with some players doing well while others are struggling.

Today, key growth segments for Digit Insurance include travel, vehicles, employee benefits, health, fire, and property. In fact, the travel insurance segment is also emerging as a major contributor after being in lull mode for almost two years due to the pandemic.

To this end, the startup has already formed partnerships with all the major travel aggregators in the country.

“Travel insurance will become a big portfolio for us and we are now selling policies above three digit numbers on a daily basis,” says Kamesh.

As part of its future plans, Digit Insurance is looking to participate in various government insurance schemes and also expand its reach from the present 125 locations, which would mean going deeper into non-metro areas to reach more customers from Tier-III+ areas.

Along with this, the continuous goal will be to ensure further transparency and product simplification.

Given the kind of impact that COVID-19 has had, Kamesh remarks, “We cannot bind ourselves to some plan and the last two years showed us that, which can also make us lose our agility.”

Source: Your Story