As it relates to policy intake, claims management and servicing functions, we often hear the question, “How do we create a flexible, cost/time-efficient, customer-centric process that supports our vision when data is inconsistent and internal processes are so fragmented?” The labyrinth of disparate internal systems and the manual workflows that have been built over decades act as obstacles to growth.

We saw the processes tested in real time as the COVID-19 pandemic sent the insurance world into hyper-drive to “virtualize” insurance sales and operations. A recent Deloitte Center for Financial Services survey found that “75% of insurance executives polled felt their carrier did not have a clear vision or action plan to maintain operational and financial resilience during the pandemic.” The gaps to transact and support business in a virtual world became obvious. Customers and associates need to transact business 24/7 from anywhere, and on any device, but current practices don’t support this.

The multitrillion-dollar protection gap presents a tremendous opportunity for new financial products to narrow the gap and disrupt the industry. The competition will be fierce. Internal and external digitization is imperative to support innovative growth. When claims management and servicing solutions are designed for growth with a customer-first mindset, policyholders and beneficiaries become hot prospects. The path forward doesn’t need complex, multi-year, multimillion-dollar implementations, or extreme staffing changes. It just takes the right solution.

Why has internal claims transformation lagged?

Digitizing the external new business experience has helped carriers remain competitive and attract top agents. But what happens AFTER a policy is issued? Carrier-specific, manual workarounds and disparate databases tether together antiquated processes and lead to longer approval times, higher not-in-good-order (NIGO) rates and multiple customer touchpoints.

Digital claims management and servicing transformation can be costly, complicated and time-intensive. Small interventions can solve specific issues, but until recently a single platform solution wasn’t available.

Traditionally, financial services lag other sectors in their adoption of technology. The 2021 Gartner Roadmap Survey reported that “a lot of value is placed on assisted service and the customer service representatives. While the rep remains a valuable focus of technology investment trends, customer service leaders are also signaling an increasing focus on the value of analytics and self-service technologies that help understand and serve the digital customer.”

Imperative for claims and service transformation

From my discussions and research, I’ve identified the following top four “pain points,” driving carriers’ accelerated need to find flexible solutions and offer self-service options for easy adoption by associates and customers.

- Multiple Legacy Systems and Manual Workarounds

- Changing Claims Workforce

- Changing Customer and Associate Expectations

- Lack of Process for Retention of Beneficiary Assets

Pain points become opportunities

Pain Point #1: Multiple Legacy Systems and Manual Workarounds

Solution: Multiple Systems and Workarounds Become a Single Orchestration Layer

As I’ve said before, carriers can’t expect to offer an Amazon-like customer service experience if their internal systems function more like a 1970s K-Mart. When carriers develop their digital claims and servicing strategy, there are two considerations I recommend:

- Current Optimization

How will digitization affect the current business model and optimize the near term? A carrier may need to take an implementation approach that addresses specific needs vs. implementing a straight-through enterprise transformation.

- Long-Term Transformation

How will the digital strategy support the business transformation necessary to stay competitive in a changing industry landscape?

This requires an investment in developing a strong digital foundation. Consolidation and seamless rules-based configuration build the foundation that carriers can evolve from.

Pain Point #2: Changing Customer and Associate Expectations

Solution: Flexible Cloud-Based Platform and Digital Solutions

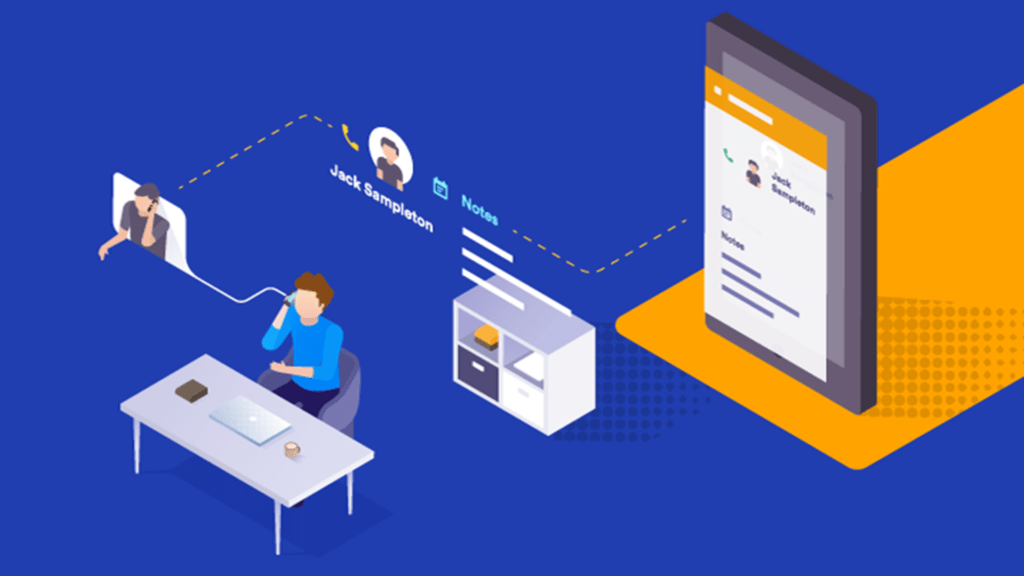

Transformational technologies enable claims and servicing associates to bring the most value to the service function. These could include employees having anytime, anywhere, any-device access to workforce and case management tools, consolidated internal collaboration tools and uniform communications methods to deliver the most value.

The technical transformation decisions need to meet the preferences of the digital customer. These include self-service channels such as online account portals and mobile applications.

Analytics are critical. This includes the collection, analysis and reporting on customer data using digital analytics, sentiment analysis and machine learning to be able to make informed decisions. Interaction assistance tools and “voice of the customer” feedback will help enact an optimum solution for all.

As carriers build on their digital claims and servicing foundation, they need to enable the ability to support third-party providers in internal digital transformation efforts. Additionally, carriers will need a scalable technology solution that supports future growth.

Pain Point #3: Changing Claims Workforce

Solution: Support the Changing Claims Workforce While Supporting Legacy Requirements

End-to-end virtual claims and servicing processes are essential as insurance carriers move to in-office and hybrid work models. Their popularity is accelerating carriers’ need to implement straight-through and single-issue digital solutions. Gartner recently reported that “55% of employees say that whether or not they can work flexibly will impact if they stay with their current employer.”

Additionally, the Insurance Information Institute reports that “82% of insurance claims and policy processing clerks are women. With 1 in 4 considering downsizing their careers or leaving the workforce entirely post-pandemic, carriers need to focus on solutions to retain these valuable workers.”

Something often overlooked is that as technologies are evolving, support for legacy systems is still needed as boomers with skills like COBOL retire. COBOL still runs over 70% of the world’s businesses, and IBM estimates there are over 200 times more transactions processed daily by COBOL business applications than there are Google and YouTube searches every day.

Pain Point #4: Lack of Retention Processes for Beneficiary Assets

Solution: Create a “Customer First” Mindset to Turn Beneficiaries into Clients

Less than 4% of beneficiary assets are retained. A customer-centric, beneficiary claims process can turn beneficiaries into prospects, when done well.

Imagine a world where, through rules-based configuration, assets could be retained at the carrier instead of being disbursed to the beneficiary to be managed somewhere else. Or a rules-based suitability configuration that connects beneficiaries to an agent to discuss suitable financial products offered by the carrier. Such a configuration exists.

Moving forward: the impact of flexible claims and servicing solutions

Carriers that strive for digital strategy that creates a seamless orchestration layer among policyholders, claimants and associates will see near-term digital optimization efficiencies and be well-positioned for long-term transformation.