Home » Industry insights » The New Business App

According to the observations on the portfolio powered by Swiss Re’s Coloride telematics solution, there is strong value in creating digital and fair products for customers. However, the experience matured across more than 25 countries worldwide is astonishingly unanimous: usage-based products need to be enhanced with value-added services to attract consumers and keep them engaged.

Data generated through connected vehicles must be leveraged across the insurance value chain, from underwriting and risk selection, to customer engagement and claims management. Long-standing insurance expertise is key to translate data into actionable insights to promote growth and improved portfolio performance.

In a time of many changes and uncertainty, one fact becomes pretty clear: The future is digital! Companies should not hesitate to invest in modern technology, no matter where this crisis is leading us.

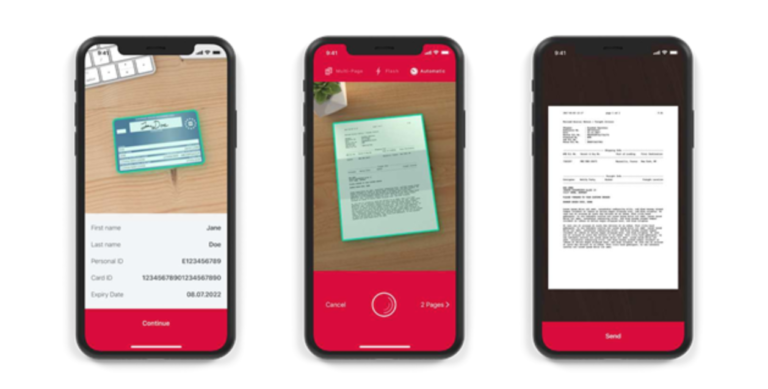

Focusing on offline options is the easiest way to ensure privacy regarding your mobile apps. Protect both you and your customers from attacks and make them benefit from convenient functionality all in one!

Editor and Marketing Manager

doo GmbH / Scanbot

Share this article:

With world’s largest forum for insurance professionals, Insurtech Insights provides an invaluable platform for networking, new insights and exposure for thought leaders. We are always looking for new partners, content creators, and contributors to create value and deliver exceptional support to Insurtech Insights.

To share your knowledge, simply fill out the form.

Insurtech Insights is the world’s largest insurtech community, connecting industry executives, entrepreneurs and investors.