There are a few things we may never see again thanks to COVID-19. Free samples at the grocery store, infrequent cleaning of subway cars, cramped conference rooms, packed elevators, communal office pies and cakes, stigma around sick days and working from home, plastic ball pits for toddlers, buffet restaurants, paper menus, shaking (too many) hands and unpackaged dinner mints (okay, maybe those aren’t a thing any more), to name a few. These probably were not great ideas in the first place, at least not during flu season.

There would seem to be equivalents in insurance regulation – wet signatures, certain paper consumer notices, hard-copy regulatory filings, notarization and in-person continuing education, examinations and office requirements. Insurance regulators across the country have temporarily waived, on an emergency basis, certain of these requirements to varying degrees during the pandemic, to allow licensees and regulators to continue to serve consumers consistent with public health concerns.

Various states have also waived certain legal and regulatory impediments to real-time insurance transactions. For example, states have permitted temporary termination and limited extensions of coverage and mid-term retroactive refunds and other premium adjustments that more accurately reflected underwriting risk during certain stages of the pandemic.

Recognizing some of these measures could be extended post-COVID without any material impact on state regulatory oversight, the NAIC Innovation and Technology (EX) Task Force and the Innovation and Technology State Contacts recently requested comments to support making permanent various “regulatory relief” and “regulatory accommodations” related to innovation and technology. Read comments from this author and other stakeholders.

This request for comments is part of a larger effort by the NAIC and individual state insurance regulators to modernize various legal requirements and to encourage and facilitate innovation. Among other areas of focus, we’ve seen it in amendments to the NAIC Unfair Trade Practices Model Act concerning rebating and inducements. These changes, once adopted in the various states, will expressly permit licensees to provide certain loss prevention/mitigation and other value-added services to consumers at no charge or at a discount, without violating the anti-rebating and anti-inducement prohibitions.

(California, Illinois and New York already permit these practices.) The NAIC’s commitment to facilitating innovation seems genuine and reliable, having completed this work over the past several months despite the pandemic. But the NAIC also needs continuing and consistent support from its individual state insurance commissioner members and their respective staff. And any meaningful and lasting innovation cannot be accomplished without cooperation and equal participation and commitment from the National Council of Insurance Legislators and its legislator members.

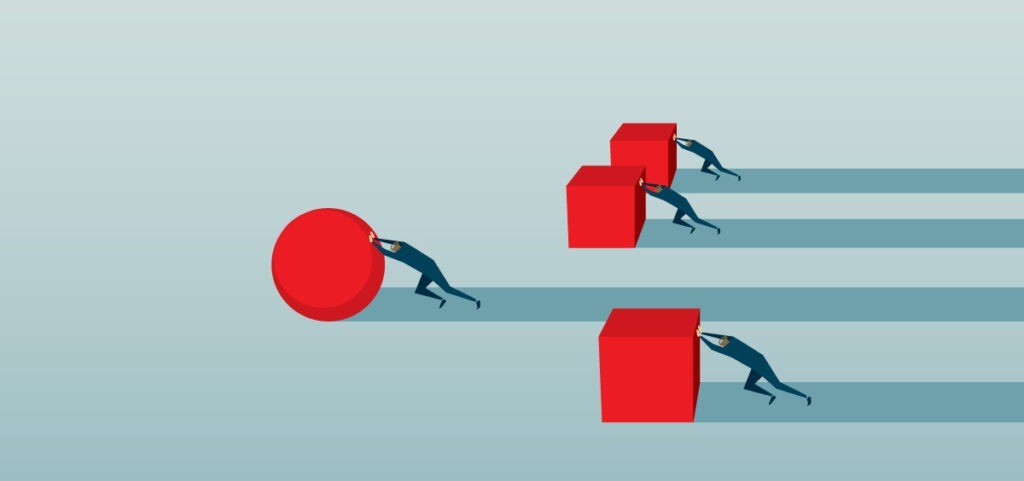

These waivers, accommodations and other relief measures are most welcome. By default, 2020 has served as a pilot program of sorts in which such additional regulatory flexibility was tested in many states. The country appears to have passed the test with flying colors—there has been no discernible negative effect on either of the two pillars of state insurance regulation – solvency regulation and consumer protection.

Can we build back better? In addition to removing unnecessary regulatory requirements and processes, state insurance regulators can facilitate innovation by expediting rate and form filings and expanding file and use and filing exemptions and access to the excess and surplus lines market. These extra steps will more adequately and efficiently address consumer demand for products tailored to their coverage needs in something closer to real time. Recognizing state insurance regulatory resources are already thin, and regulators are already overworked and underpaid, it should not be controversial to suggest industry would provide the financial support necessary for state insurance departments to obtain additional resources, including much-needed expertise around the use of technology and big data in rating and underwriting.

Any requirement, process, delay or extra regulatory cost that does not arguably serve either insurer solvency or consumer protection should be on the table for permanent retirement. It’s time. Before the next pandemic (or extension of this one) and the crisis after that.

Source: Insurance Thought Leadership

Share this article:

Share on facebook

Share on twitter

Share on linkedin