Virtually across the board — but most noticeably in pricing, underwriting and claims — insurers reported that their use of and plans for advanced analytics have been reignited over the past two years, This, according to Willis Towers Watson’s 2021 P&C Insurance Advanced Analytics Survey.

“Outside a small set of respondents who express doubts about the business case for advanced analytics, either due to concerns about cost or the ability to explain outputs to either management or customers, the North American P&C market still looks set on a course for increased use of advanced analytics,” said Lisa Sukow, director, North America P&C practice, Insurance Consulting and Technology, Willis Towers Watson. “There is continuing optimism from the companies surveyed about the impact that advanced analytics has had on both top- and bottom-line performance.”

Time is the biggest enemy, according to half of the respondents, but data management, handling and warehousing are also key factors mentioned in slowing or delaying progress. While dealing with the effects of the COVID-19 pandemic has clearly played its part in limiting the time and resources available to work on advanced analytics projects since early 2020, it seems to have had only a marginal impact on these plans.

“The pandemic has certainly increased time pressures to do other things and delayed some investments in support of advanced analytics; however, it hasn’t affected plans to any great degree,” said Nathalie Bégin, director, North America P&C practice, Insurance Consulting and Technology, Willis Towers Watson. “Other reasons for some of the struggles that insurers have faced in keeping their ambitions on track lie closer to home. These include IT infrastructure, the dexterity with which they handle data and corporate cultural barriers.”

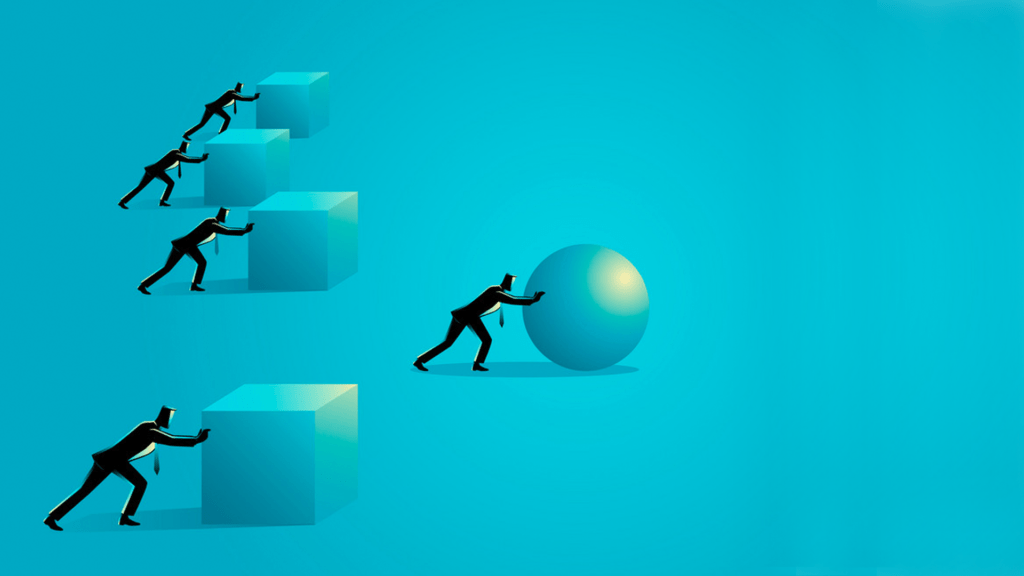

Nevertheless, advanced analytics is becoming firmly established as a key source of potential competitive advantage among insurers. Despite most companies facing issues around prioritization or resource constraints, strong pockets of progress have occurred in the two years since Willis Towers Watson’s last survey.

While companies recognize there is room to increase the use of advanced analytics in rating/pricing, bigger leaps are anticipated in the underwriting process, including automation levels and decision support employed. Moreover, uses of advanced analytics in claims have accelerated at a faster rate, partially because there are more gaps to fill in capabilities.

Over half of respondents describe themselves as having active working relationships with the InsurTech community, and 10% are fully commercialized.

The survey shows the use of telematics data has stayed the same or slightly declined since 2019. This may be because companies that went in early and strongly on telematics usage and propositions have taken off some of the sheen and attractiveness of the potential opportunities in certain markets for companies that didn’t. Equally, companies may feel there are less complex advanced analytics targets and benefits for them to pursue.

“There are actions insurers can take to restore or build momentum behind targeted applications of advanced analytics,” said Sukow. “Insurers can reduce costs and increase time available by investing in data analytics expertise, leveraging InsurTech and having flexible IT capacity. More analytics means more data, which exacerbates problems with IT bottlenecks and/or connectivity between systems. The survey shows more companies taking advantage of the cloud and upgrading analytics tools, but these have largely scratched the surface of what can be achieved with the likes of on-demand capacity and API-enabled software.”

Sukow also noted that insurers can maximize harvesting of their internal data. “Many companies still hold huge amounts of useful but unexploited internal data. With the right technology, data available from sources such as images, unstructured claims, underwriting and customer information, and text mining increasingly have the power to transform product propositions and profitability.”