Insurtechs are important for the development of the industry — but as tools. Incumbents must still get the real transformation done.

Given the nature of insurance, and the possibilities that data analytics and technology offer, there should be little doubt that the industry is moving toward becoming a technology industry. It is therefore only natural that insurers are looking for ways to reinvent themselves as technology companies, running corporate-wide digital transformation projects to ensure adjustment to the changing markets and secure a competitive position in the future. This white paper demonstrates how insurtechs are important for the development of the industry but also underlines that insurtech does not address all challenges faced when creating a future successful insurer – insurtechs are digital instruments to be used in the transformation journey, but it’s still up to the incumbent to get the real transformation done. This paper explores how to use insurtechs to address current incumbent pain points and what to look for before entering a partnership with insurtechs.

The Insurtech Landscape Mid-2020

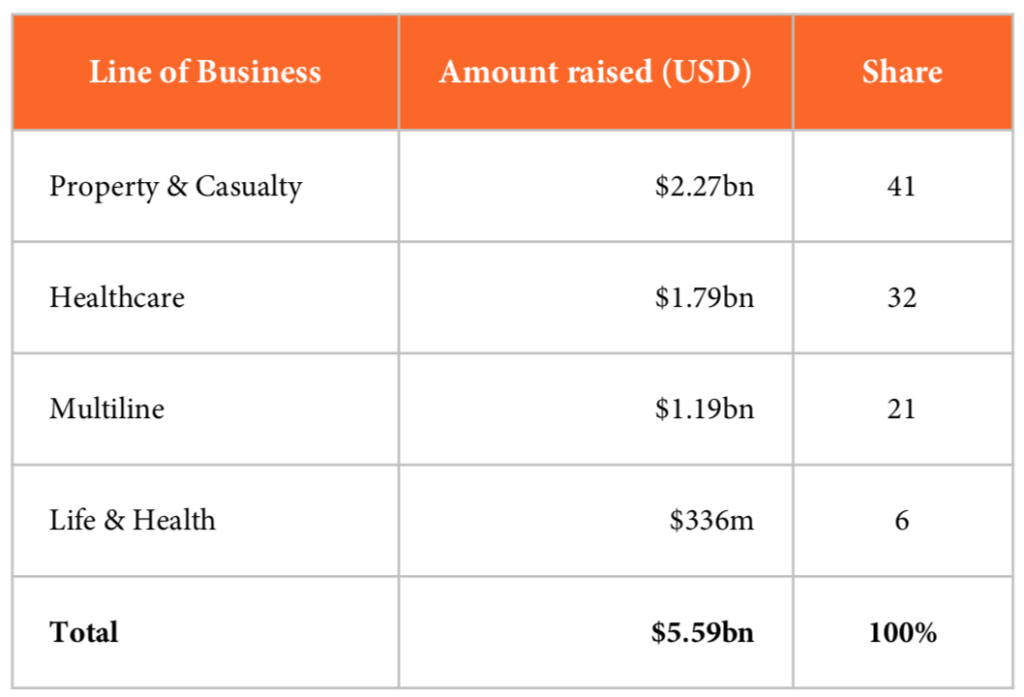

Given the pace of the market development, it makes little sense to provide a fully updated and detailed state-of-insurtech – it does makes sense, however, to understand the underlying nature of the insurtech landscape to examine how insurtechs are entering and affecting the insurance industry. This understanding will provide insurers with a future outlook and enable the development of adequate strategic responses – this will also help insurers to identify if and where insurtechs can fit into insurers’ value chain. More than 75% of total dollar investments are invested in insurtechs offering products and services within distribution, and a total of 79% of all investments are in single-line insurtechs. Table 1: 2019 total insurtech investmentsSource: Coverager 2019 insurtech investments in review These two numbers, 75% of investments in products and services within distribution and 79% of all investments in single-line insurtechs, combined with insurtechs’ focus in the insurance value chain (see below) clearly show that insurtechs are focusing on specific areas of the total insurance value chain and not in creating new, full-fledged insurers. The insurtechs seems to be zooming in on the areas that have the greatest business and growth potential and leaving out the less lucrative parts of the entire insurance value chain, which makes perfectly good business sense. You would only enter into industry areas with high inertia and potential for fast improvements.

Table 1: 2019 total insurtech investmentsSource: Coverager 2019 insurtech investments in review These two numbers, 75% of investments in products and services within distribution and 79% of all investments in single-line insurtechs, combined with insurtechs’ focus in the insurance value chain (see below) clearly show that insurtechs are focusing on specific areas of the total insurance value chain and not in creating new, full-fledged insurers. The insurtechs seems to be zooming in on the areas that have the greatest business and growth potential and leaving out the less lucrative parts of the entire insurance value chain, which makes perfectly good business sense. You would only enter into industry areas with high inertia and potential for fast improvements.

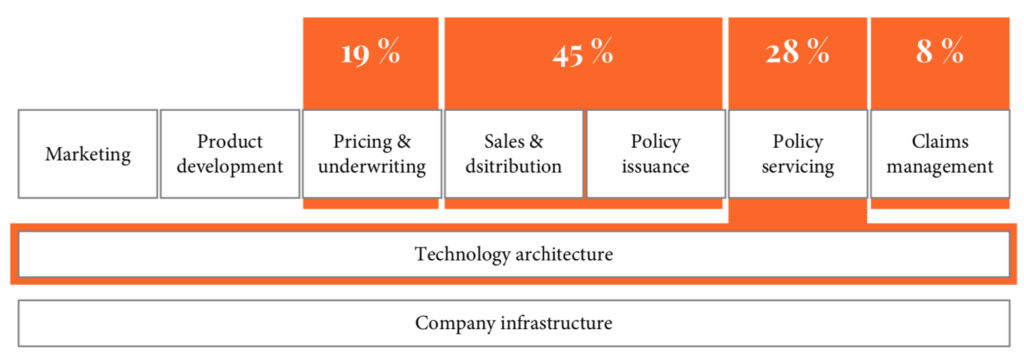

Figure 1: Insurtech focus in the insurance value chain (Quarterly Insurtech Briefing January 2020)

Following the numbers from Figure 1, it appears that the structural issues impeding insurers to realize transformations at scale and speed are not addressed in particular by the insurtechs in the market. Successful transformation of incumbent insurers requires more than a digital front end or various, isolated digital innovations – granted, it may add to the overall value provided to the customers or partners, but the underlying structural and process challenges still exist in the incumbents and still need to be redesigned for the insurer to reach the future virtual and digital state. As shown later, some insurers are already partnering with insurtechs and benefiting from improved, isolated processes within distribution, sales, policy servicing and claims management, but very few – if any – have created a cohesive end-to-end experience for the customers and partners. Partnering with an insurtech for a specific element of the value chain still leaves it with the incumbent insurer to realign, adjust and connect surrounding processes in an effort to create a complete customer-oriented solution. Besides ensuring technical and operational integration, the incumbent should also carefully understand the cultural and organizational changes required when aligning and redesigning core processes. In other words, and put provocatively, insurtechs are acting as digitally advanced middlemen or brokers – their disruption primarily lies within customer experience and service, while some leverage Internet of Things to refine pricing and improve service offering (health, home, car, travel). Most insurtechs greatly rely on the backbone of the insurer – an important point to make and for incumbent insurers considering partnerships with insurtech to be aware about.

Successfully integrating with insurtechs

As mentioned, it does make good sense for incumbent insurers to look towards insurtechs for partnerships, as a partnership can fast-track the digital development process. Apart from being aware of the organizational changes required to make the partnership work, it is beneficial to create a gap analysis to evaluate existing competencies against competencies required to deliver on the insurer’s overall strategic direction and targets. While looking at the elements in the value chain, and apart from identifying the gaps, noting down current pain points can detail the requirements for an insurtech partnership further. A starting exercise can be mapping the insurer against the “three-speed” insurer model to have a point of departure in defining the gaps and requirements for an insurtech partnership, followed by identification of current pain points throughout the value chain.

The three speeds of insurers

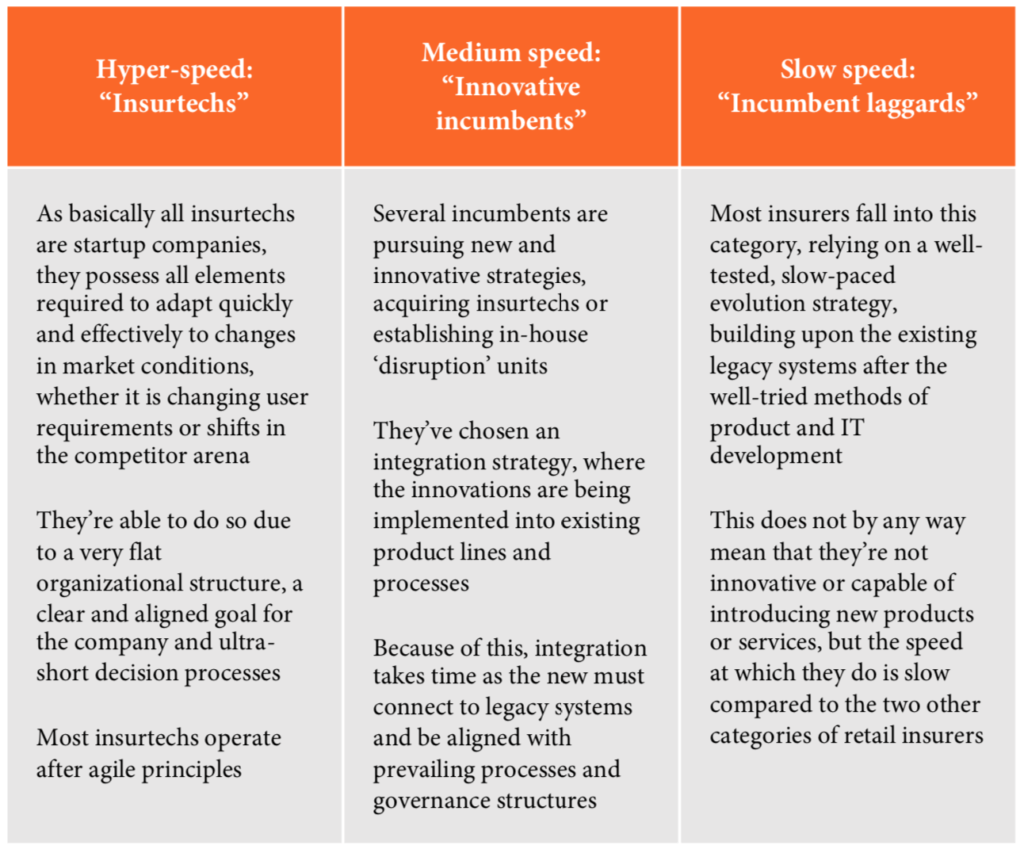

Insurers can broadly be divided into three different categories, reflecting their current digital strategy and ability to react fast to changes in the market from both users and competitors/partners.  Table 2: Insurers in the industry can be broadly divided into three different ‘speeds’You can fill out Table 3 below to get an idea of how fast your insurer is capable of reacting to market changes. Both internal factors as well as external factors are evaluated, as external factors play an important role in an insurer’s commercial success and viability. Process change refers to the ease of changing internal processes within the insurer, such as claims services, approval processes, etc. An important part of innovation in insurance is to offer a seamless and very fast experience for the users, which requires incumbent insurers to change their existing processes – this will not be a significant issue for insurtechs due to their startup nature and very quick decision processes. Innovative incumbents acknowledge this need and change their internal procedures to accommodate this – but they are still far from the nimbleness and flexibility of the insurtechs because the innovative incumbents require the innovations to integrate with existing systems and processes. The rationale behind product changes (agility) is similar to the process change described above but needs to be treated separately, as some products and services can be integrated at arm’s length and thus require less integration and internal adjustments to work. Organizational agility is the insurer’s ability to react on changes, internal as well as external, and is generally an indication of how fast the organization can get projects approved and begin implementing them. It’s also an indicator for how fast the projects can be implanted once approved.

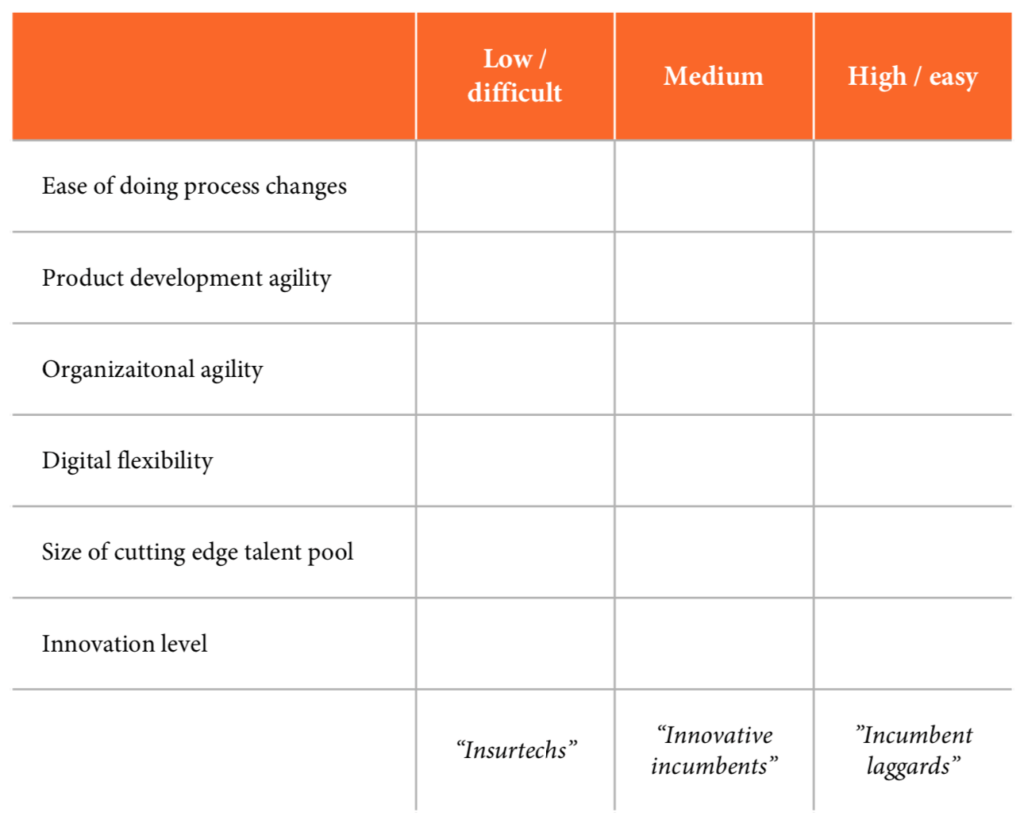

Table 2: Insurers in the industry can be broadly divided into three different ‘speeds’You can fill out Table 3 below to get an idea of how fast your insurer is capable of reacting to market changes. Both internal factors as well as external factors are evaluated, as external factors play an important role in an insurer’s commercial success and viability. Process change refers to the ease of changing internal processes within the insurer, such as claims services, approval processes, etc. An important part of innovation in insurance is to offer a seamless and very fast experience for the users, which requires incumbent insurers to change their existing processes – this will not be a significant issue for insurtechs due to their startup nature and very quick decision processes. Innovative incumbents acknowledge this need and change their internal procedures to accommodate this – but they are still far from the nimbleness and flexibility of the insurtechs because the innovative incumbents require the innovations to integrate with existing systems and processes. The rationale behind product changes (agility) is similar to the process change described above but needs to be treated separately, as some products and services can be integrated at arm’s length and thus require less integration and internal adjustments to work. Organizational agility is the insurer’s ability to react on changes, internal as well as external, and is generally an indication of how fast the organization can get projects approved and begin implementing them. It’s also an indicator for how fast the projects can be implanted once approved.  Table 3: A simple framework to assess the insurer’s current level of development and transformation speed The organizational agility depends on the formal hierarchical structure and numbers of approval nodes each change request must pass before finally being approved and ready to implement. Insurtechs have a flat structure with very few formal approval nodes, which means they’re able to approve and begin implementation of changes almost immediately, where laggards are at the opposite end of the spectrum, being slowed down by a large number of approval nodes and long- lasting approval processes. The innovative insurers are placed in between, again because they’ve realized the need for agility and adjusted internal structures and processes to accommodate this somewhat. The level of an insurer’s digital flexibility is based on how open and flexible the IT systems are, especially the customer facing systems. The laggards are basing their development almost purely on legacy IT systems, which most often are inflexible monolithic structures, making it a long process to carry out changes, let alone introduce products and functionalities. Innovative insurers have typically been through one or more digital transformation projects, making them far nimbler than laggards in terms of IT connectivity and development, but they still lag behind the insurtechs, who have full control of each and every bit in their digital control room. It takes cutting-edge talent to drive innovation through, regardless of company and industry, and here again the insurtechs are in front, as they wouldn’t have been insurtechs if highly competent people hadn’t gotten together to create the insurer. Innovative incumbents are partly innovative and forward-reaching because they’ve managed to hire the right key talent to develop their new digital universe, but even the best talent is bogged down by the existing organizational structures and processes. Even laggards with exceptional talent will find it difficult to perform due to the organizational structures and systems. Given this, it’s unlikely that they’re able to attract the right talent and in the right numbers as the right talent is focused on deliveries, which is too complex in laggard insurance companies. The presence of talent, and the insurer’s willingness to invest, is key to determine the insurer’s level of innovation. Laggards don’t possess the talent and cannot have an innovation strategy due to their choice on building evolutionary on existing IT systems, where innovative incumbents very much have an innovation strategy, as this is the basis for their future development. The delivery on the innovation strategy is still not as fast as with the insurtechs for the same reasons.

Table 3: A simple framework to assess the insurer’s current level of development and transformation speed The organizational agility depends on the formal hierarchical structure and numbers of approval nodes each change request must pass before finally being approved and ready to implement. Insurtechs have a flat structure with very few formal approval nodes, which means they’re able to approve and begin implementation of changes almost immediately, where laggards are at the opposite end of the spectrum, being slowed down by a large number of approval nodes and long- lasting approval processes. The innovative insurers are placed in between, again because they’ve realized the need for agility and adjusted internal structures and processes to accommodate this somewhat. The level of an insurer’s digital flexibility is based on how open and flexible the IT systems are, especially the customer facing systems. The laggards are basing their development almost purely on legacy IT systems, which most often are inflexible monolithic structures, making it a long process to carry out changes, let alone introduce products and functionalities. Innovative insurers have typically been through one or more digital transformation projects, making them far nimbler than laggards in terms of IT connectivity and development, but they still lag behind the insurtechs, who have full control of each and every bit in their digital control room. It takes cutting-edge talent to drive innovation through, regardless of company and industry, and here again the insurtechs are in front, as they wouldn’t have been insurtechs if highly competent people hadn’t gotten together to create the insurer. Innovative incumbents are partly innovative and forward-reaching because they’ve managed to hire the right key talent to develop their new digital universe, but even the best talent is bogged down by the existing organizational structures and processes. Even laggards with exceptional talent will find it difficult to perform due to the organizational structures and systems. Given this, it’s unlikely that they’re able to attract the right talent and in the right numbers as the right talent is focused on deliveries, which is too complex in laggard insurance companies. The presence of talent, and the insurer’s willingness to invest, is key to determine the insurer’s level of innovation. Laggards don’t possess the talent and cannot have an innovation strategy due to their choice on building evolutionary on existing IT systems, where innovative incumbents very much have an innovation strategy, as this is the basis for their future development. The delivery on the innovation strategy is still not as fast as with the insurtechs for the same reasons.

Mapping current pain points

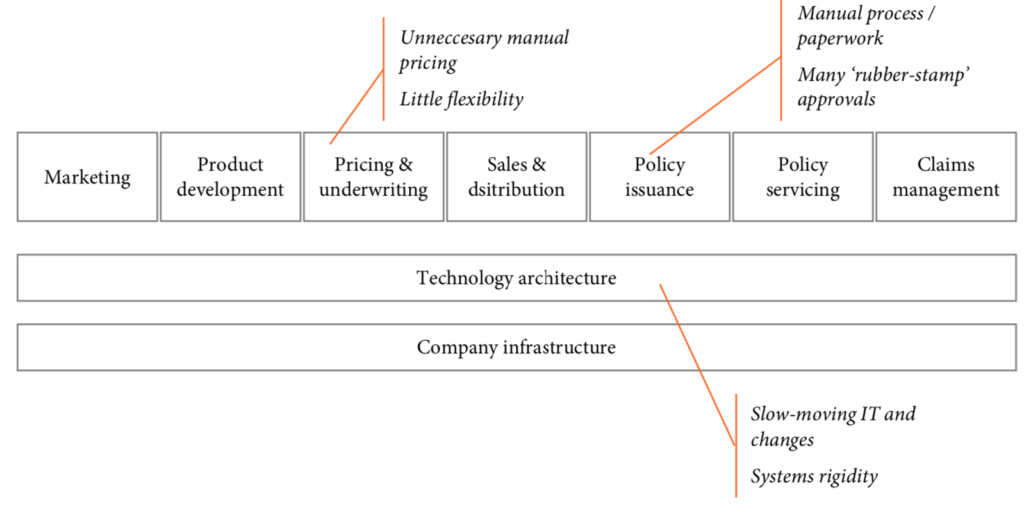

A quick analysis of the insurer’s current speed and flexibility, combined with the identification of current pain points, sets the basis for understanding what kind of insurtech would add the most value in a partnership. Pain points are generally specific processes or procedures that cause customers – or the organization – difficulties in getting their job done, whether it is buying a policy from the insurer, filing a claim or encountering bureaucratic red tape stopping marketing or sales processes required to keep – or establish – a competitive market position. A fast and easy way to identify the pain points throughout the organization is to use the value chain and for each element to write down what is causing delays, inflexibility, challenges or downright customer issues.  Figure 2: Examples of mapping pain points to the elements in the insurance value chain It is often a good idea to identify the pain points with colleagues to get a more accurate and unbiased view of the pains throughout the organization – done alone, the exercise can be biased toward specific areas that may not be representative for the organization. These two small company analyses — the speed of the insurer and current pain points — provide a great starting point for understanding how insurtechs can help in the transformation of the insurer to a virtual and digital insurer. The next step is to search the marketplace for insurtech companies that offer products and services that match the insurer’s planned transformation journey.

Figure 2: Examples of mapping pain points to the elements in the insurance value chain It is often a good idea to identify the pain points with colleagues to get a more accurate and unbiased view of the pains throughout the organization – done alone, the exercise can be biased toward specific areas that may not be representative for the organization. These two small company analyses — the speed of the insurer and current pain points — provide a great starting point for understanding how insurtechs can help in the transformation of the insurer to a virtual and digital insurer. The next step is to search the marketplace for insurtech companies that offer products and services that match the insurer’s planned transformation journey.

Benefits of partnering with insurtechs

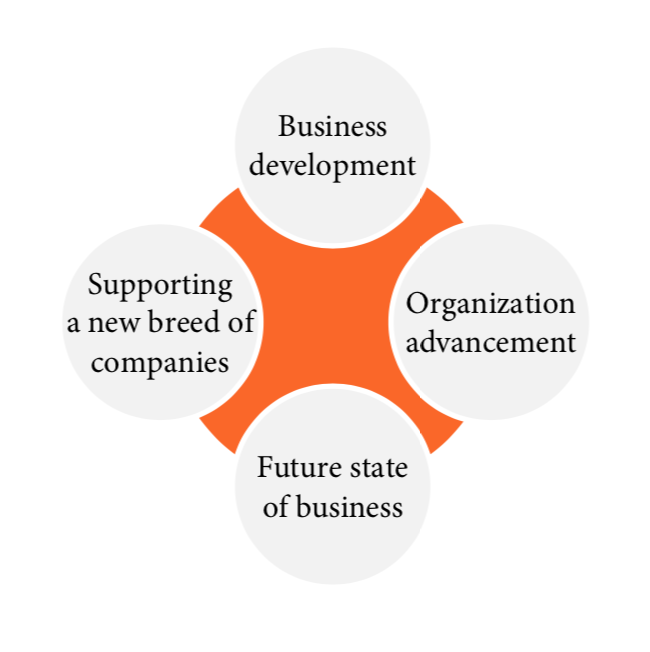

It should already now be clear that partnering with insurtechs can make very good sense for the insurer to speed up and improve the digital transformation of the incumbent. There are at least four distinct advantages for insurers partnering with insurtechs.  Figure 3: Four major benefits for insurers by partnering with insurtechs

Figure 3: Four major benefits for insurers by partnering with insurtechs

Business development

An obvious advantage of partnering with a tech- savvy professional is the opportunities it creates for new ways of selling existing products and introducing new products to the market. However, as previously discussed, many insurtechs are building products and services that focus on optimizing existing business processes, including operational efficiency and claims costs savings (direct as well as indirect through reduction of operational expenses). Business development can therefore be both in terms of increasing revenue through new sales channels or new products and in terms of improving business processes and hence reduce operating and claims costs.

Organizational advancement

It’s important again to underline that successful integration of an insurtech partner requires significant adjustments of the insurer’s organization to fully cater to new processes and products that are introduced through the partnership. This is, of course, especially true when the insurtech’s product is focused on internal process development, where the full participation of the organization is required. When done correctly, these organizational advancements will lead to a changed organization with a broader understanding and acceptance of new and more efficient ways of working.

Creating a future state of business

The organizational changes pave the way for creating a more advanced organization, capable of dealing with complex partnerships going forward. This will not only benefit potential future insurtechs but also improve the way the incumbent insurers are handling their partnerships – the learnings from the insurtech partnership enable the insurer to revisit existing agreements with fresh eyes and new ideas on how to optimize for the future. The insurtech partnership helps direct the attention on a future state, and a successful integration will instill a “can-do” attitude in the organization. Working with insurtechs creates a source of continuous learning and organization development, enabling the insurer to stay competitive.

Supporting a new breed of companies

Apart from direct business and organizational benefits, partnering with insurtechs sends a strong message from the insurer to the market, a message of being at the forefront of the industry, which increases the insurer’s ability to attract talent, partners and customers. Furthermore, the insurtech partnership actively supports the development of the next generation of insurers and partners, thereby supporting the development of the industry long into the future – the insurer leaves its mark on the industry.

Will all insurtechs do?

There are several areas the incumbent insurer should be aware of before venturing into a partnership with an insurtech. The insurtech must be a real new technology service/product provider, and partnering with it should demonstrate a clear business leap for the insurer, as opposed to an incremental change. Incremental changes and improvements are required and should be part of any company’s improvement programs, but to reap the full benefits, the insurtech must offer a truly innovative leap for the insurer. Partnering with the insurtech should match the company’s current strategic direction – or actively be part of a new strategic direction set by the management. It makes little sense to spend time, money and organizational effort to partner with an insurtech if the partnership will not take the incumbent insurer a great step toward the set strategic targets. Following the discussion on organizational learning and culture, it’s an extreme benefit if there’s a people/culture match even before the partnership is agreed upon.

How to integrate: four basic ways

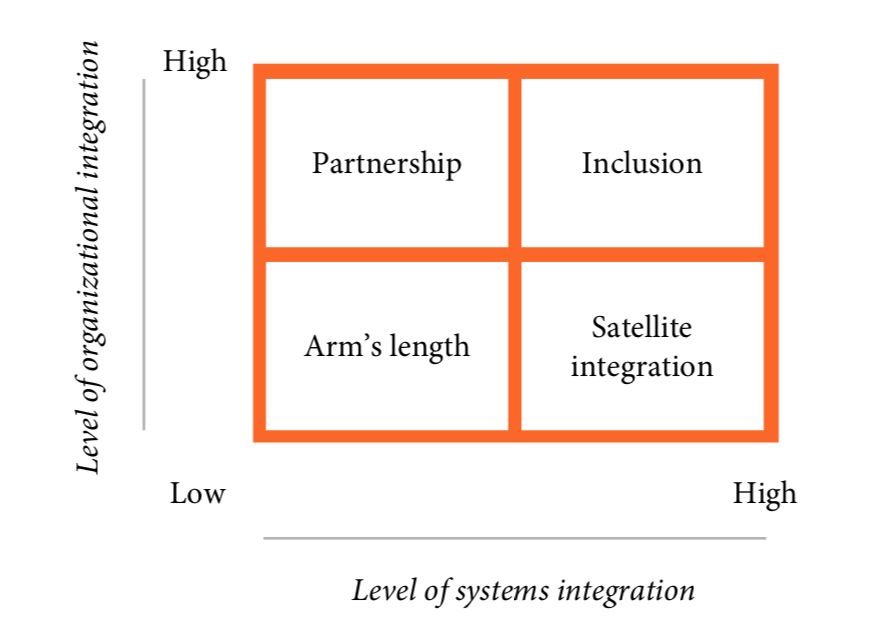

It’s imperative to understand that this is two very different worlds: an agile and very modern small-business environment and the more bureaucratic and institutionalized environment of the incumbent insurer. At some point, these must match to make the partnership a success, and positive vibes between the partners beforehand will ease this process. There are different ways of considering structuring the partnership between the insurer and the insurtech, all of which have different advantages and disadvantages to consider – and to be aware of when the partnership hits the insurer’s organization.  Figure 4: Four different ways insurers can integrate or partner with insurtechs

Figure 4: Four different ways insurers can integrate or partner with insurtechs

Arm’s length

Partnering with an insurtech and managing the relationship at arm’s length makes it little more than an external distribution partner or an outsourced claims management function. It is very easy for the insurer to administer, as there will be minimal disturbance and interruption of the daily operations, processes and organization. The arm’s length will have very limited transformation effect on the insurer.

Satellite integration

A high level of systems integration with little organizational integration is typical for insurtechs that connects to the insurer via APIs or using the insurer’s microservices for a specific set of transactions. In this scenario, there will be little organizational red tape, but some IT challenges can be expected as the IT unit must work and integrate with the insurtech.

Partnership

Insurtech partnerships with little systems integration and high levels of organizational integration typically rely on the technology from the insurtech and require a high level of cooperation and coordination between the insurtech and the insurer – advanced use of artificial intelligence for underwriting or fraud detection could be examples of this, where the insurer in many cases only needs to export simple data sets for the insurtech’s solution to work with. This can have quite a few organizational challenges as the incumbent organization can get the “not invented here” syndrome and feel the insurtech is coming and interfering with the daily work.

Inclusion

Integrating the insurtech into the insurer will most likely be the partnership model with the biggest return on investment, but at the same time this model poses the greatest challenges, as both systems and organizations must be included and aligned with each other. It’s safe to say the most significant risk is a clash of cultures between a well-established, well-regulated, experienced incumbent insurer and a newly founded, agile, dynamic and “free-of-rules” insurtech.

Performance indicators – the cornerstone of success

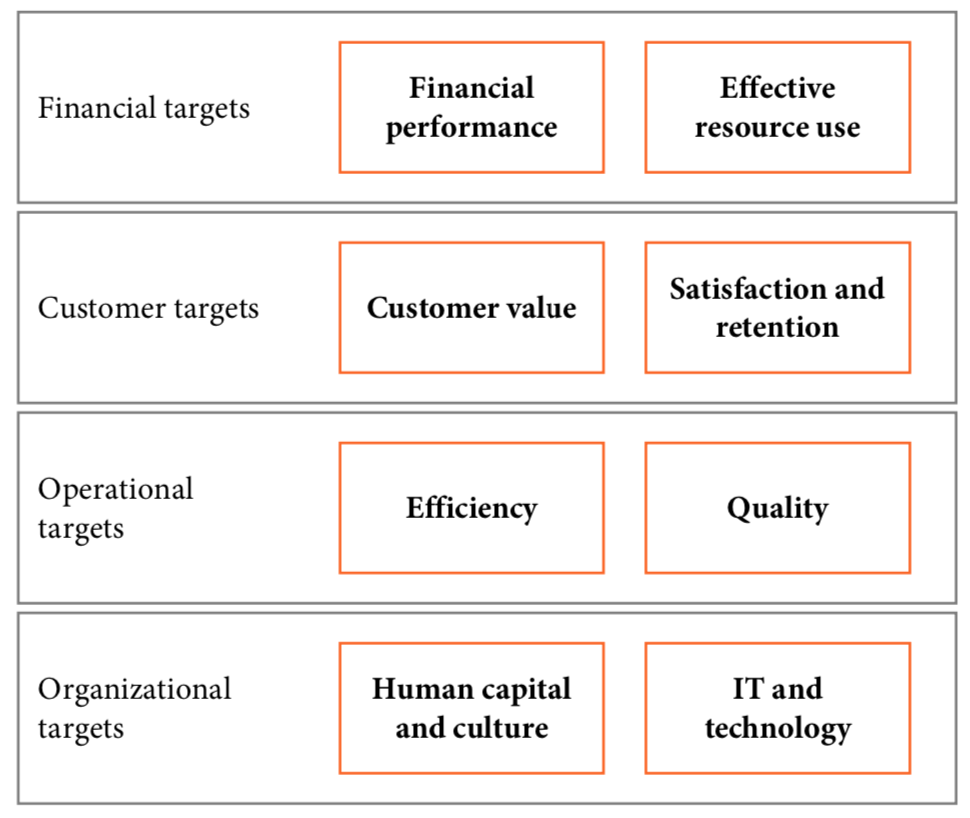

The organizational and cultural strain caused by introducing external parties to the organization – or simply caused by digital change initiatives – can be somewhat reduced by creating a set of clearly articulated targets and goals for the company, the units, the teams and the individuals. To be successful, the targets and goals must be connected, so the teams and units will be depending on each other to achieve them. This will initially force collaboration that, over time, if managed, will reduce the cultural tensions – working toward the same target is a strong motivator. A fast way of setting up a framework for target and goal setting is to use the principles from the balanced scorecard, illustrated below.  Figure 5: The balanced scorecard high-level structure Source: Balanced Scorecard Institute One of the major strengths of the balanced scorecard is that targets are set for the organization as a whole and then cascaded down to the business units, teams and individuals. This provides an overview of how each goal and target is supporting the organization in achieving the end targets. Given the insurer already has a set of financial performance targets, the balanced scorecard is used to set underlying goals for the units working with the digital transformation and insurtech partnerships, all aiming at supporting the insurer in reaching the overall targets. This approach can further be used to create business cases for investments and calculate return on investments, because of the specificity of the targets and goals required to create a successful balanced scorecard. When setting the goals in the scorecard, it can be defined how investments help move the performance indicators toward the goals and therefore illustrate the value of the investment.

Figure 5: The balanced scorecard high-level structure Source: Balanced Scorecard Institute One of the major strengths of the balanced scorecard is that targets are set for the organization as a whole and then cascaded down to the business units, teams and individuals. This provides an overview of how each goal and target is supporting the organization in achieving the end targets. Given the insurer already has a set of financial performance targets, the balanced scorecard is used to set underlying goals for the units working with the digital transformation and insurtech partnerships, all aiming at supporting the insurer in reaching the overall targets. This approach can further be used to create business cases for investments and calculate return on investments, because of the specificity of the targets and goals required to create a successful balanced scorecard. When setting the goals in the scorecard, it can be defined how investments help move the performance indicators toward the goals and therefore illustrate the value of the investment.

Final thoughts

Insurtechs are not the only answer to transforming incumbent insurers into virtual and digital insurers, but they may be able to play a very important role for the insurer in achieving the virtual vision. When embarking on a continuous transformation journey, it is vital for insurers to keep the overall picture of the organization, its interdependencies, culture and modus operandi in mind. For insurers to become agile, virtually and digitally competent organizations, they must ensure proper adjustment and development of the underlying key systems, which include organizational structure, management processes and culture. Merely partnering with insurtechs or other companies does not make these challenges disappear, though – and conquering these challenges are key for future and sustainable success. Source: Frederik Bisbjerg, Insurance Thought Leadership

Share on linkedin

LinkedIn

Share on twitter

Twitter

Share on facebook

Facebook