The prevailing view is that customers should be enabled to interact in their channel of choice and that companies should provide this experience in a personalized and seamless manner. Digital technologies are the key to enabling this vision. Even when customers prefer agent interaction, the agent is still empowered by digital resources (recommendation engines, illustration tools, video chat, etc).

This current perspective appears to be bearing fruit, while also opening the door to more unique distribution approaches.

Digital Distribution Pays Off

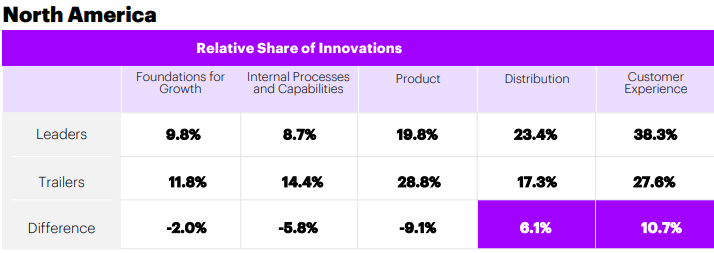

We recently published a report on the payback of digital innovation in insurance. Within this report, we measured key performance indicators (KPIs) to determine the difference between leaders and trailers for different innovation categories in North America.

Innovations related to distribution have significantly higher KPI performance for leaders when compared to trailers. The difference in customer experience is even higher, which makes sense. There is a direct connection between a good customer experience and a seamless distribution channel.

The report also highlights that investment implies this same focus on distribution: 38% of total insurtech funding goes to companies focused on the distribution (up from 25% in 2010).

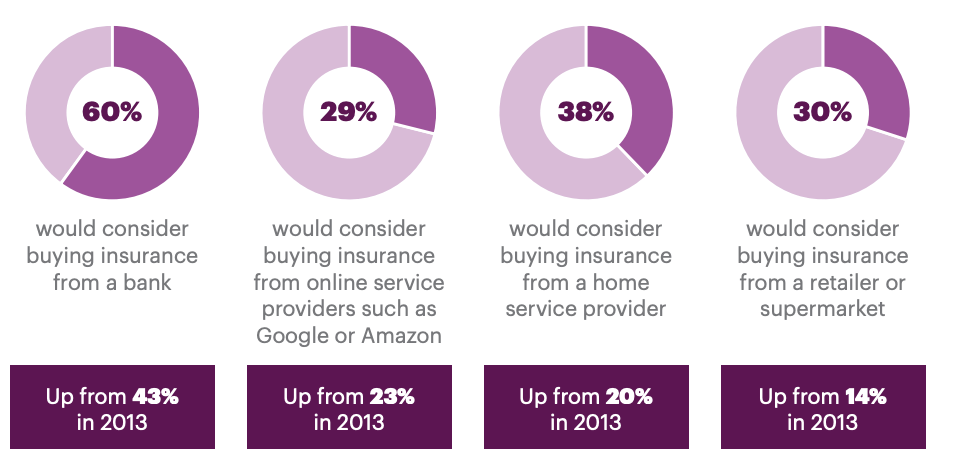

But what about customer sentiment? Back in 2017, we published a consumer study around insurance distribution. Even without taking age demographics into account, it’s clear that consumers are more open to buying insurance through non-insurance companies.

COVID-19’s Impact on Insurance Distribution

The pandemic has accelerated trends around digital distribution, forcing even the most ardent supporters of traditional distribution models to adopt new methods and tools in order to survive.

This is largely good news because it will improve the customer experience of the traditional model and give rise to new models which could offer radically better customer experiences and with potentially better economics. However, if incumbent insurers don’t proactively innovate, they may find that others do . . . with or without them.

I suspect that many insurers would acknowledge this perspective, although with different views on the pace and size of the opportunity as well as the downside risks of not being proactive. I also suspect that some would dismiss this view as hyperbole because they believe the current distribution model is difficult to displace due to regulatory requirements and overall complexity. That may be true for a subset of offerings and segments, but it will prove to be less true for a large portion of the existing market.

You don’t need to stretch your imagination too far to see how new distribution channels can quickly evolve.

Where New Distribution Channels Can Emerge

Consider two of the most fundamental principles of customer experience: personalization and ease. The industry is making huge investments implementing these principles in the form of simplified product language, digitized and streamlined forms, pre-population of data and the leverage of data for tailored experiences and offerings.

But what if we take these principles a step further to truly make the customer experience as easy and personalized as possible? In some cases, like auto insurance, you wouldn’t even need to ask the customer to contact an insurer at all. Instead, insurance would be an embedded part of the transportation solution that the customer purchases. GM’s recent announcement to provide Onstar Insurance Services is a move in this direction, which essentially uses the automobile as a platform for insurance distribution.

If automobiles can be a platform for distribution, what about other platforms, like homes? With the proliferation of smart devices and an increasing number of connected homes, this could be a future frontier.

What about social media and messaging platforms? These already have a huge advantage in terms of engagement and interaction frequency (two challenges that are pervasive for insurers). Social media users spend on average of 2 hours and 24 minutes per day multi networking across an average of 8 social networks and messaging apps.

As payments and business applications become increasingly integrated to these platforms, why couldn’t some types of insurance products be distributed through these channels? Of course, the regulatory situation is different in parts of the world where this is already happening (e.g. China/WeChat), but if you consider the size of the user base and the potential for ease and personalization, then it’s only a matter of time before we see similar things in the U.S.

Overall, investments to improve and digitally power distribution channels are critical but don’t ignore what many companies currently consider “alternate” channels, as these are likely to displace or become integrated with current methods over time. Consider new models of distribution, paired with focused customer segmentation and a compelling value proposition. Whether branded or promoted as “white label,” new distribution models will be required to reach and engage customers in the future.

Source: Accenture

Share this article:

Share on linkedin

Share on facebook

Share on twitter