He has driven innovation and change in the market with his bold strategies, and in 2023, he steered the company through difficult waters when Hippo put a pause on new services following losses throughout the industry in the P&C space.

Insurtech Insights caught up with him to find out more about this dynamic CEO’s story – and his journey into the insurance industry.

Tell us how you joined the insurance industry. Were you always interested in the space?

I grew up in an agency family, started working in insurance in high school, and have spent 30+ years working in the industry since graduating from Oregon State University. I worked at various companies before joining Hippo, including Mercury Insurance Group, Superior Access Insurance, and First Connect.

I am a Chartered Property & Casualty Underwriter and a Certified Insurance Counselor. I sit on the board of directors of First Connect Insurance, Players Health, Spinnaker Insurance Company, the National Alliance of Insurance Education and Research, and serve as an advisor to several other insurtech companies. I love this industry!

Hippo went public in 2021

You’ve chosen to concentrate your career within the P&C space. Why is that?

Property and Casualty insurance, particularly homeowners insurance, provides the opportunity to help people. Our customers entrust us to protect what is likely their most valuable financial and emotional asset. Our vision at Hippo is to protect the joy of homeownership. We want to prevent the little things from becoming big issues and support our customers when something goes wrong.

The home should be about the memories and milestones you celebrate with your family, not remembering when to get your HVAC serviced or replacing roof shingles after a storm. If we can reduce some of the stress of being a homeowner, we are truly helping our customers, and that is rewarding work.

The insurance market is particularly challenging right now, both from an investment and customer offerings perspective (with rising premiums etc) What, in your opinion, are the strategies CEOs should focus on to achieve growth and survival?

While the insurance industry is facing challenges, there is a growing light at the end of the tunnel. When the market turns, the insurtechs that committed to disciplined underwriting and streamlined operations will be well-positioned for success. The decisive actions companies like Hippo took this past year will begin to pay off in the second half of 2024 and 2025 as improvements have time to fully work their way through the book of business and more insurtechs realise their potential.

The biggest spotlights are being shone on Florida and California. Do you think there are imminent solutions to the problems both states are facing, from a P&C perspective?

Florida and California may get the most attention, but every market comes with unique challenges, and it’s important to remember that market conditions are cyclical. We have faced challenging insurance environments before, and this likely will not be the last time the industry needs to adapt.

In fact, two of the best examples of industry wide change took place in Florida, with the significantly improved catastrophe modeling that emerged after Hurricane Andrew in 1992, and California, with the establishment of the California Earthquake Authority following the 1994 Northridge Earthquake. The takeaway from those two examples is that we’ve been here before and will emerge from these challenges stronger and better prepared to serve our customers.

Hippo has undergone an interesting journey since we last spoke. Can you tell us how things are going, following the lifting of the nationwide pause late last year?

Last year, in response to weather-induced volatility, we paused the writing of new Hippo Homeowners policies nationwide. When one of the worst second quarters in our industry’s history threatened our profitability goal, we undertook significant cost-cutting measures. Those actions have had a lasting, positive impact on our business, which was evident in our Q1 2024 results. Our gross PCS loss ratio improved 20% YoY, our expenses were down 24% YoY, and our revenue increased 114% YoY.

The home should be about the memories and milestones you celebrate with your family, not remembering when to get your HVAC serviced or replacing roof shingles after a storm.

Richard McCathron

In short, we successfully reduced our CAT exposure and streamed our operations without sacrificing growth. We are on track to turn adjusted EBITDA positive by the end of this year and have proven the ability to efficiently grow our business.

What’s new on the horizon for Hippo?

We’re excited to go back on the offensive and grow our business in areas where we hold a competitive advantage and a high degree of confidence in future profitability. Embedded products, like our New Homes offering with our builder partners, are a great example. We meet the needs of both our customers by removing some of the friction at closing and our builder partners, who are looking to generate a predictable, ancillary revenue stream.

What inspires you in insurtech today?

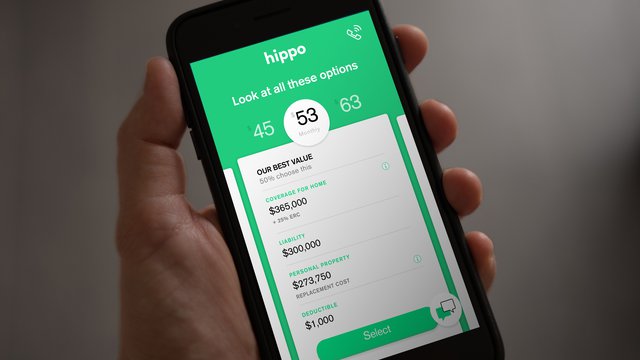

Contrary to popular belief, not all insurtechs set out to disrupt a successful, hundreds-year-old industry built on decades and decades of data. We have always been a long-term investment in technology that will enhance, not replace, traditional models.

And now, armed with the necessary data gained from a maturing book of business, insurtechs like Hippo are beginning to demonstrate the ability to self-fund growth and deliver a superior, industry-changing customer experience. It is an incredible time to be in insurtech – this is the moment I’ve been working toward since I joined Hippo 7+ years ago.

Join Hippo leaders at Insurtech Insights USA 2024 in New York on June 5th and 6th

Richard McCathron will be taking to the stage at Insurtech Insights USA 2024 at the Javits Centre in New York on June 5th and 6th. He will be taking part in: “Navigating the Insurance Industry’s Knowledge Gap: Bridging Skills and Technology in the Age of AI – Award Insurance Podcast recording“ and “Insurtech’s Turning Point: Overcoming a Challenging 2023 on the Path to Profitability“ with Bryan Falchuk.

Grace Hanson will be taking part in the panel: “Between Tradition and Innovation: How is the Broking Landscape Evolving?“ while Pete Piotrowski, Chief Claims Officer for Hippo, will also be taking to the stage in a live panel debate.

Interview by Joanna England