Lemonade has experienced significant ups and downs, from a record high during the pandemic to trading 75% below its opening price. Despite challenges in the insurance industry due to inflation and increased loss ratios, Lemonade reported a 170% surge in gross profit to US$22 million in the third quarter, with a 33% decrease in net loss to US$62 million.

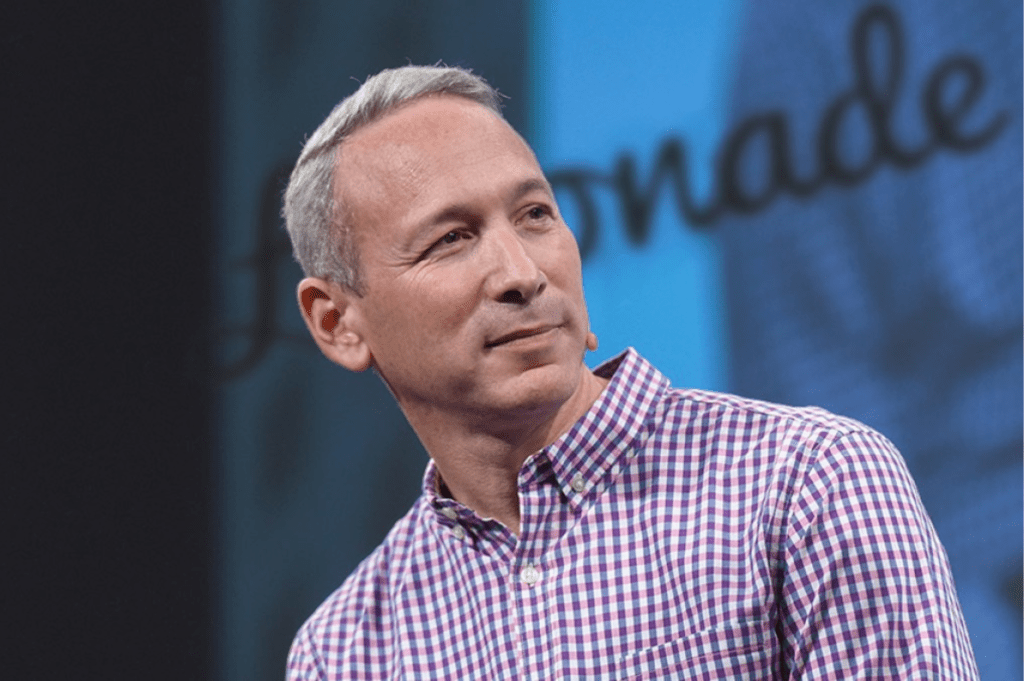

Schreiber joined Yahoo Finance to discuss the company’s recent performance, exponential growth, and its approach to handling insurance rates and premiums amid volatility and global economic headwinds.

He said: “One of the things we just shared last week is we’re passing our two millionth customer any day now. When you compare our millionth customer to our second millionth customer, you see that we have grown at a 35% faster rate and even though customers have doubled in number, a gross earned profit has more than trebled in numbers, so we’re seeing premiums for every customer growing much faster than the rest of the industry and that’s really driving a lot of the efficiencies.”

Schreiber acknowledged the industry-wide impact of inflation, particularly in home and car insurance, leading to some major players withdrawing from key markets. However, Lemonade’s business is trending positively, with rates slowly climbing.

“The whole industry has suffered greatly from heightened inflation. The economy has suffered from inflation but homes have suffered disproportionately and cars even more so… That loss ratio for insurers across the industry has been very, very high… and you’ve seen some of the largest names in the nation withdrawing from some of its largest markets – California, Florida and others. This is a time of real stress throughout the insurance space. But we are seeing everything, at least within our own business, trending in the right direction.”

He also expressed confidence in accelerating growth, pointing to rate adjustments and regulatory approvals for increased premiums in certain states, saying, “The quarter was very strong. We saw 55% growth in Revenue – 170% growth in gross profit, and other metrics like losses and loss ratio and operating expenses [are] all down. We’ve also said that we think next year will be better yet and that in 2025 we will achieve cash flow positivity.”

Schreiber continued: “This is really a story about the… whole thesis coming together and the technology doing what it has always promised – namely, lowering expense ratios lowering loss ratios driving efficiency while delighting customers.”

Lemonade, with its innovative technology-driven approach, has doubled its gross earned premium over the last 24 months without a proportional increase in expenses. Schreiber sees scalability as crucial for achieving profitability and spoke about the importance of scale in technology-driven businesses like theirs.

Addressing geopolitical concerns, particularly the conflict in Israel, Schreiber highlighted the resilience of Lemonade’s organisation, with 75% of its staff located outside of Israel and the majority of work being handled by artificial intelligence systems.

He said: “The conflict in Israel is terribly distressing any which way you look at it and the massacres on October 7th loom large. Close friends of mine lost loved ones or have loved ones now as hostages in Gaza. It’s hard to remove the atrocities from one’s mind. But the ray of sunshine if you like, is lemonade, because the business has been incredibly resilient. The results that we discuss in the continued projections are not withstanding that 75% of our staff or outside of Israel…”

Schreiber added: We have a very resilient organisation with massive contingency plans for geopolitical unrest so the one area that I am not concerned about is Lemonade – [I have] many concerns at a geopolitical level, but not at a company level.”

Author: Joanna England