Via Jeff Mitch, Managing Director – Strategy, Insurance, Accenture

What initiatives did insurers do in 2020?

To do this analysis, we looked at 25 US insurers (12 Life and 13 P&C). We then analyzed hundreds of press releases from March 2020 through February 2021 and combined that data with information from investor calls and quarterly reports. The goal was to narrow our focus specifically to COVID-19 related initiatives, which could be things that insurers did directly because of the pandemic or things that were accelerated because of it.

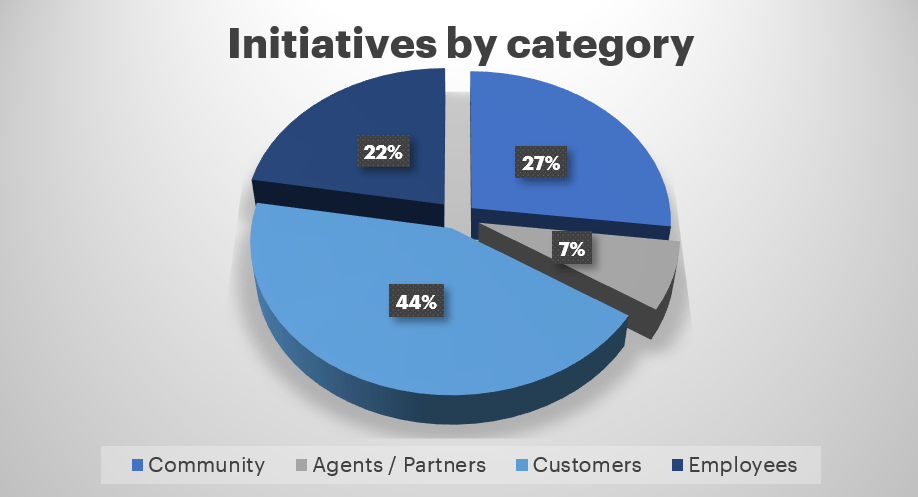

From there, we categorized the initiatives based on who they impacted the most: community, agents/partners, customers, or employees.

Here are the summary highlights:

- Community: Insurance is a major part of people’s lives. As such, insurers have an important role to play in communities—and an obligation to be a positive force. The pandemic was a chance for insurance companies to support their communities more broadly. Many insurers moved quickly to establish charity funds and donate personal protective equipment (PPE), respirators and other equipment.

- Agents/Partners: The pandemic disrupted typical interaction models for many agents by forcing a pivot to digital channels, while also driving people and companies towards new insurance products. Younger generations started thinking more seriously about life insurance, while companies learned the need for more robust business interruption insurance. With a wave of new customer needs and near-term financial pressures during the initial months of the pandemic, insurers had to better support their agents and distribution partners. Some launched partner platforms for more seamless integration, while others launched on-the-go quote tools, established data-driven insight centers and offered training.

- Customers: In the short-term, insurance companies quickly expanded their contact centers to support a flood of stressed and overwhelmed customers. Many P&C insurers introduced contactless claims and offered premium reductions for auto customers due to less driving. Life insurers offered fee waivers or extended grace periods. As the year progressed, insurers introduced new digital tools, experiences and products to tap into emerging opportunities and allow customers to interact with them in a more convenient and safe way.

- Employees: Insurers stepped up to support remote working when many weren’t equipped for it. Most companies also offered wellness programs, mental health days and work flexibility. While some insurance companies pledged to keep their workforce, others unfortunately made cuts. In the long-term, we saw insurers reimagining their internal processes to improve efficiency, while also offering upskilling programs to their workforce.

Even in this short summary, you can see that the insurance industry took a wide range of actions in response to COVID-19. Broadly, there were a mix of new initiatives launched and existing initiatives that were either stopped or modified.

Similarities and differences in how insurers responded to pandemic

All insurers took several actions to pivot in response to COVID-19, but the nature and scope of those actions varied. For example, most insurers launched cost initiatives, but some cut their workforce while others focused on technology to lower operating costs.

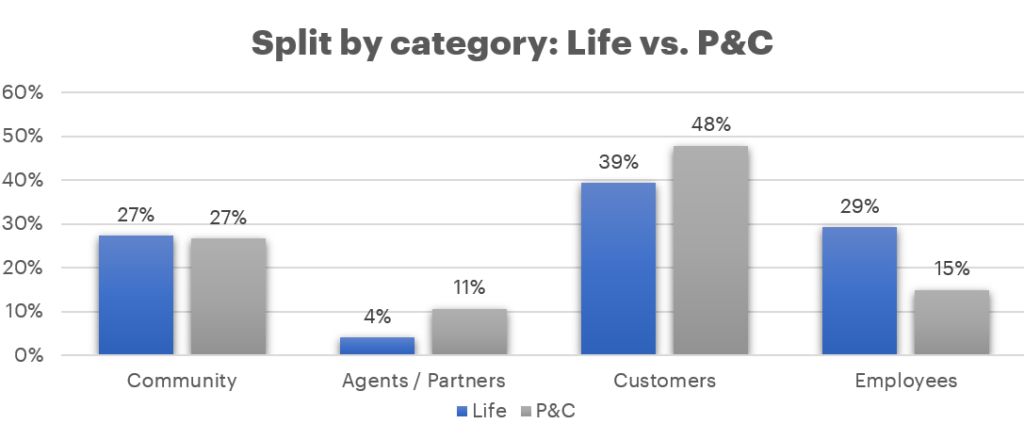

The reality is similar when comparing P&C and Life insurers. While there were some consistencies in where they focused their COVID-19 response, the actions they took were different based on the specific needs of each segment. P&C insurers announced payback plans, policy credits and digital claims initiatives, while Life insurers announced new digital products and heavily supported their agent network.

Looking at our categories gives a similar perspective. Both P&C and Life insurers announced a similar number of initiatives for the community. But Life insurers announced more internal initiatives focused on employees, while P&C insurers focused more of their initiatives on agents/partners and customers.

Another difference among insurers is scope. Most insurers announced a series of actions that, when taken together, represent a comprehensive response. Others took a more programmatic and structured approach, like Progressive. In direct response to COVID-19, Progressive created a Resolve, Return and Reimagine construct to help its employees and customers. This comprehensive program stood out among its peers because of its far-reaching scope. The construct is designed to respond quickly in the short-term through Progressive’s Apron Relief program for both customers and agents, but it’s also looking into the future by creating teams specifically to understand what the “new normal” will look like post-pandemic.

To quickly round out our research, we also looked at the COVID-19 initiatives in APAC and Europe. We found their responses to be largely consistent with the responses in the US.

Via Accenture