All News

Home » Latest news » All News

We regularly curate the latest insights and reports provided by and in collaboration with our partners and stakeholders to create the largest platform for knowledge-sharing and development within the world’s insurance industry.

AXA names new board chair – CEO to stay

AXA shareholders approved all resolutions submitted to them by the board of directors at the company’s annual shareholders’ meeting Thursday.

Elon Musk trumpets Tesla’s foray into car insurance — after Warren Buffett warned any automaker would struggle in that business

Elon Musk trumpeted Tesla’s early inroads into automotive insurance last week. Warren Buffett, whose Berkshire Hathaway conglomerate owns Geico, has cast serious doubt on whether Tesla and other automakers can break into the industry and turn a profit.

Record $19.8B insurtech funding in 2021, Forrester

Hippo’s Expansion to the Empire State Further Diversifies its Portfolio, Reaching 88% of Americans in 38 States.

Hippo Launches Proactive Home Protection in New York State

Hippo’s Expansion to the Empire State Further Diversifies its Portfolio, Reaching 88% of Americans in 38 States.

Resilience Continues to Attract Leading Insurance Talent: Names Sarah Thompson SVP of Underwriting

Resilience, which provides cyber insurance and security solutions to mid-market enterprises, continues to build its experienced insurance team with the addition of Sarah Thompson as SVP of Underwriting.

Insurers perceive telematics app data as incomplete, LexisNexis

MassMutual Ventures (MMV, Boston) has announced that its Asia-Pacific (APAC) and Europe team has launched a new fund of $300 million to invest in early and growth-stage companies in digital health, financial technology, enterprise SaaS, and cybersecurity.

MassMutual Ventures Launches $300M Fund for Europe, APAC

MassMutual Ventures (MMV, Boston) has announced that its Asia-Pacific (APAC) and Europe team has launched a new fund of $300 million to invest in early and growth-stage companies in digital health, financial technology, enterprise SaaS, and cybersecurity.

Zurich picks 12 startups to work with on future of insurance

Zurich Insurance Group (Zurich) has selected 12 startups to collaborate on novel ways to serve customers, create more frequent meaningful touchpoints with them, and challenge the boundaries of insurance.

The Future Trends of Usage Based Insurance and Telematics

It’s not hard to understand and forecast why usage based insurance (UBI) — otherwise known as behaviour-based insurance or pay-as-you-drive (PAYD) — is becoming popular among North American drivers and rest of the world.

So, How Insurable Is Flood Risk?

Nowhere is the insurance gap more pressing than in the case of flood insurance.

Amanda Blanc to co-chair Treasury’s climate transition plan taskforce

HM Treasury formally launched the taskforce today to develop the “gold standard” for UK firms’ climate transition plans.

Tesla Insurance turns ‘nightmare’ claims experience into ‘dream’: Musk

Tesla is “trying to turn a nightmare into a dream with Tesla Insurance,” chief executive Elon Musk said Wednesday.

Trends that Will Change the Insurance Industry

Harsh market conditions, innovative entrants, and demanding clients are a few forces driving transformation in the insurance industry, but every challenge presents an opportunity.

Is it time for insurers to reimagine digital payments?

What makes a true digital payment experience in insurance? Although the past few years have been characterized by rapid digital payment options, the real game-changer has been the focus of market leaders to embrace the transformation of the actual payment experience – both for premium and claim payments.

Tractable and Mitchell Partner to Enable Straight-Through Claims Processing

Tractable to make AI-enabled straight-through processing available to North American insurers, backed by Mitchell’s open platform and comprehensive repair data.

Aon sets up IP-based funding for self-ordering tech firm

Aon has set up a $35 million intellectual property (IP) based funding arrangement for GRUBBRR, a provider of self-ordering technologies, creating an IP-collateralized debt structure that enabled the firm to raise additional funds through debt.

SafetyWing Raises $35 Million To Scale Its Health Insurance Cover For Remote Workers

SafetyWing, a startup that’s providing health insurance coverage to remote workers, has secured $35 million in a Series B round.

Marsh unveils cybersecurity marketplace services

Marsh has announced the launch of new cybersecurity marketplace services aimed at simplifying the procurement process for US clients seeking to protect their organisations from cyber threats.

AXA XL unveils enhanced Risk Scanning property risk assessment tool in North America

To help companies see the ‘big risk picture’ and pinpoint potential property exposures across their business locations, AXA XL Risk Consulting is rolling out its Risk Scanning risk assessment service in the US and Canada.

Travelers CEO Schnitzer: Loss Costs ‘Challenging as Ever to Predict’

In the words of its CEO, there’s a “fair amount to pay attention to” from the first-quarter earnings call of Travelers, as the P/C insurer grew net written premiums 11% to a record $8.4 billion.

Tesla launches insurance based on real-time driver data in three more states

Tesla Insurance is now available in three new states – Oregon, Virginia, and Colorado. With these additions, Tesla Insurance is now live in a total of 8 states.

Tokio Marine launches CVC fund

Tokio Marine, a Tokyo-headquartered insurance corporation, said Tuesday it has launched its $42 million corporate venture capital (CVC) fund, dubbed Tokio Marine Future Fund, to invest in early-stage startups around the world.

Insurtech Innovators Blink Parametric And baoba Enter Partnership

Blink Parametric, a CPP Group Company, enters partnership with baoba, a global travel insurtech with offices in the US, Canada and Hungary. baoba serves as a B2B marketplace for travel sector organisations looking to add innovative solutions for their customer base including online travel agents (OTAs), travel insurance companies and airlines.

Kin secures $175m of Florida hurricane reinsurance with debut cat bond

Direct-to-consumer and fast-growing insurtech Kin Insurance coverage has now priced its debut Hestia Re Ltd. (Collection 2022-1) disaster bond issuance at a dimension of $175 million, with the coupon traders will obtain finalised on the top-end of preliminary steering.

Italian insurtech nabs €5.5 million to boost video and photograph-based claim management

Insoore plans to develop AI projects in damage detection, engage new talent and expand globally.

Swiss Re secures significant alternative capital via an innovative hybrid transaction

Swiss Re has successfully closed an innovative multi-year stop-loss transaction, with financing ultimately provided by J.P. Morgan and various institutional investors.

How automation can focus insurer resources

Insurers have made significant investments in improving their data assets over time. Large-scale IT projects are replacing legacy systems, data lakes and warehouses are being built and new policy and claims administration systems have been installed. All with the promise of improved data quality and greater data availability.

Kin bolsters surplus by $20m to meet Demotech requirements

We’ve learned that direct-to-consumer and fast-growing insurtech Kin bolstered the surplus capital of its main carrier operating in Florida by $20 million in order to meet Demotech’s requirements for its rating affirmation recently.

Aviva, Lloyds join British FloodRe insurance scheme to build flood resilience

Five insurers including Aviva (AV.L) and Lloyds Banking Group (LLOY.L) have joined a programme set up by Britain’s FloodRe to give homeowners extra funds to build up resilience to floods, FloodRe said on Thursday.

Lockton launches Insights & Innovation Lab

The expanded capability will focus on formulating market insights, evaluating new solutions through advanced analytics, and curating the market to find the best fit solutions for clients.

Unique synergies are creating added values for car insurance: Amodo & kasko2go

The innovative data science company kasko2go is joining forces with Amodo, an award-winning Insurtech company. The combination of their solutions offers insurers unique and groundbreaking technology and helps both companies reach new customer groups around the world. As a result of the partnership, both companies will be able to broaden their offerings and strengthen their mutual global presence.

EvolutionIQ secures $21M to streamline insurance claims processing with AI

Processing claims at scale presents a challenge for insurers, particularly where the claims entail factors like complex underlying health conditions.

Munich Re to buy Clareto

Munich Re Life US, part of the global reinsurer, has signalled its intent to buy medical record firm Clareto.

Roamly Launches Global Travel Insurance Product

Roamly’s global travel insurance offers coverage designed to protect consumers from financial losses should a trip be delayed, interrupted, or canceled.

Tokio Marine Kiln launches new IP product for SMEs

Tokio Marine Kiln has released its new Intellectual Property Abatement Insurance for US-based SMEs, where the product will be available as an add-on to TMK’s Intellectual Property (IP) Infringement Defence Policy and features limits of up to $3 million.

Travelers, Nationwide on distracted driving

The COVID-19 pandemic has likely led to more distracted driving. April marks Distracted Driving Awareness Month and insurers have released data and studies that reveal what behaviors are leading to unsafe roadways.

AIG Appoints New Chief Risk Officer

Insurance conglomerate American International Group Inc. has named Tom Bolt its chief risk officer.

Swiss Re promotes Claudia Cordioli to Group Finance Director

Reinsurance giant Swiss Re has appointed Claudia Cordioli as the new Group Finance Director, reporting to Group CFO John Dacey.

Surance.io Closes US$ 4Million Series A Round

Surance.io has recently completed a round of financing from Tech Mahindra that acquired 25% equity of the start-up with an option to invest in additional 20%. The initial investment is at the amount of US$ 4 million which will support the global expansion of the strong player in the InsurTech industry.

How India’s first insurtech unicorn Digit Insurance consistently outperforms industry growth rate

Digit Insurance sold its first policy in late-2017. In 2021, it became not only the first unicorn of the year but also the first insurtech startup to achieve the coveted billion-dollar valuation. Founder Kamesh Goyal charts his and the company’s growth journey.

Newfront raises $200m at $2.2bn valuation to modernise insurance

For any life insurer, future success means resonating with demographically diverse generations of new consumers where they live—and that’s increasingly in a digital world.

Digital Life Insurance for a Digital World

For any life insurer, future success means resonating with demographically diverse generations of new consumers where they live—and that’s increasingly in a digital world.

Tech is improving underwriting—but not in the way you’d think

In this blog series, we’ve looked at the latest entry in the only longitudinal survey of underwriters in North America. The study, which is run in partnership with Accenture and The Institutes, provides vital context for tracking the trajectory of underwriting, which is the heart of any insurance carrier’s business.

Insurtech start-up raises $15 million in Series B round

Digital life insurance platform Covr Financial Technologies has announced the completion of a Series B funding round.

An Eye on AI: How the Human Element Plays a Role in Today’s Tech

Artificial intelligence is becoming an increasingly important tool for commercial insurers, but ethical concerns remain.

How embedded insurance is transforming the industry

Since the onset of the pandemic, many businesses across all industries stayed afloat by fundamentally understanding the way people shop and purchase and transforming their processes to meet that need.

How new technology is disrupting the insurance industry

Challenger firms are helping to change the industry, but incumbents will take the rewards, says John Chambers.

United Kingdom and Connecticut Sign Agreement to Launch New Insurtech Corridor

The UK Government today announced a formal agreement with Connecticut Insurance & Financial Services (CT IFS), the MetroHartford Alliance, the Connecticut Department of Economic & Community Development, the Connecticut Insurance Department and Insurtech UK to launch a new InsurTech Corridor.

Generali in United Nations insurance collaboration

Italian giant Generali has partnered with the United Nations Development Programme (UNDP) to help boost access to insurance and risk finance solutions in developing countries.

OneDegree announces multi-year partnership with Munich Re to launch “OneInfinity” digital asset insurance

OneDegree Hong Kong Limited (“OneDegree”) announced today that it has entered into a three-year strategic partnership with Munich Re to launch OneInfinity, a digital asset insurance product, making OneDegree the first licensed insurer in Asia to collaborate with a global leading reinsurer in offering digital asset insurance.

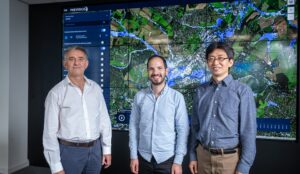

Previsico seals Watertight partnership to boost flood resilience and mitigate insurers’ losses

Previsico, the live flood alert InsurTech, today announces its partnership with Watertight International, the market leader in property flood resilience solutions, to enhance its service to insurers and major corporates as it continues to scale in the UK and worldwide in the flood risk mitigation space.

Betterview Announces Partnership with Canopy Weather

Canopy’s specific focus on hail damage insights will enable Betterview to provide even more accurate information to insurer customers evaluating risks.

Marsh unveils property analytics tool

Insurance broker and risk advisor Marsh has announced the launch of a new property analytics product. The new product aims to help clients around the world manage their property risks by transforming a slow, manual process into a digital experience with real-time, actionable insights.

Insuring the Metaverse: New Worlds Meet Old Policies

Covington & Burling LLP attorneys suggest how the insurance industry might respond to the unique risks that are sure to arise from commerce in the metaverse.

Data driven insurance companies will be frontrunners of their industry

It is no big secret that insurance companies sit on potential goldmines of data. But extracting value from that data is easier said than done, with many data transformation projects across the world failing to reap their full benefits. Pieter Stel, an associate partner at Valcon, outlines how insurers can successfully adopt a data driven model.

Redkik partners with Howden Insurance Brokers and Chubb

Redkik, a global software company with the mission to simplify and improve the cargo insurance industry with technology, today announced a strategic partnership with Howden Insurance Brokers AB, a leading provider of insurance brokerage and risk consulting.

Allianz & Swiss Re place first legally bound Cat XoL reinsurance DLT-contract, enabled by B3i

Allianz and Swiss Re have successfully placed the world’s first legally binding reinsurance contract on distributed ledger technology (DLT), enabled by B3i’s live production network.

LeO Partners with Vertafore

LeO will integrate with Vertafore and third-party sources, letting distributors use text and voice querying to identify business opportunities.

Sigo Seguros Raises $5.4 Million in Seed Funding

InsurTech closes new round of funding aiming to bring auto insurance to the underserved Hispanic market.

5 trends influencing how consumers relate to insurers

It’s been just over two years since the World Health Organization declared COVID-19 a global pandemic. As a result, we’ve seen major shifts in how people expect to work, play, shop and take on risks. It’s become clear that many of these new expectations are here to stay with varying degrees of impact on all industries.

Do you have news you would like to share with the World's Largest Insurtech Community?

Please feel free to send us an email

news@insurtechinsights.com