All News

Home » Latest news » All News

We regularly curate the latest insights and reports provided by and in collaboration with our partners and stakeholders to create the largest platform for knowledge-sharing and development within the world’s insurance industry.

International women’s day series: An interview with Pravina Ladva, Group Chief Digital and Technology Officer at Swiss Re

In an effort to help drive change in the insruance industry and to provide inspiration to all future leaders, we have interviewed some of the most senior figures who are speaking at Insurtech Insights Europe 2022.

Life Insurtech Company Pendella Technologies Secures $5.2 Million

Pendella Technologies – a fast-growing technology company on a mission to take the bias out of life insurance – recently announced the completion of $5.2 million in Series Seed-2 funding.

International women’s day series: An interview with Tara Foley, CEO at AXA UK Retail

In an effort to help drive change in the insruance industry and to provide inspiration to all future leaders, we have interviewed some of the most senior figures who are speaking at Insurtech Insights Europe 2022.

Aviva and Zego announce deal to provide fleet insurance

Aviva and Zego have today announced a multi-year partnership to provide tailored fleet policies to trades and haulage businesses. The partnership will pair Zego’s behavioural insight, data and telematics capabilities with Aviva’s experience and expertise in fleet underwriting and claims.

Whatfix Partners with Duck Creek Technologies

Whatfix, the global leader in the digital adoption platforms (DAP) space, today announced a new partnership with Duck Creek Technologies, a leader in property and casualty (P&C) insurance software-as-a-service (SaaS) solutions.

CyberCube Urges Insurers and Reinsurers to Stress Test Threat of Russian Cyber Attacks

Insurers and reinsurers holding large books of East European business are being urged to stress test their portfolios against the threat of Russian and Ukrainian cyber attacks.

Why Digitisation Of Data Is A Priority For Commercial Insurance

It’s 3 am, you are thinking about your client meeting – is your data in order? If it is in your inbox, various word templates or on paper documents, it’s not a surprise that you are awake at this hour.

Coalition Launches Active Insurance, Reaches $650M Run Rate GWP

Coalition, the world’s first Active Insurance provider, reported today on its rapid growth and launched “Active Insurance,” a new tech-powered model for insurance and risk management designed to prevent digital risk before it strikes.

Data Driven Insurance Transformation

Insurers are re-shaping their roles and value propositions with customers in mind, transforming into data driven, value-based entities.

DeadHappy Raises $15m

DeadHappy, the UK’s fastest-growing life insurance provider, has raised over $15M in equity in its latest funding round, with existing VC’s Octopus and Headline reinvesting in this round alongside new shareholders Volution, Verso Capital and Channel 4 Ventures.

4 ways technology can help carriers acquire new customers

As property and casualty insurance carriers look to reduce growing loss ratios in 2022, many have shifted their focus away from growing their customer bases and toward increasing their profits. But for carrier marketers, the path to efficient customer acquisition isn’t as simple as merely cutting budgets.

For Gen Z and Millennial Women, Finances Are a Balancing Act

Over the past few years, the economy has reeled from inflation, labor shortages, global conflict, and, yes, the Covid-19 pandemic. Even before the uncertainty of today’s climate, women were grappling with unique setbacks: earning lower wages, shouldering the bulk of unpaid labor, and facing more student loan debt than men.

Socotra, Sureify Partner to Deliver Enhanced Digital Capabilities to the Life Insurance Industry

Strategic partnership will enable insurers to accelerate product development and provide policyholders an optimized customer experience

Lloyd’s taps new chief people officer

Lloyd’s has announced the appointment of Sara Gomez as chief people officer (CPO), effective immediately.

WTW hires data science leader

WTW has announced the appointment of Pardeep Bassi as global position leader in data science for the company’s insurance consulting and technology business. In the newly created role, Bassi will lead the advancement of the unit’s data science capability globally, building on WTW’s analytics and data science software, Emblem and Radar.

Plum Life raises $5.3 million

Plum Life Inc announced today it closed a $5.3 Million seed round led by ManchesterStory with additional participation from MTech Capital, Sonostar Ventures and other investors.

Top insurtech funding rounds, Feb. 2022

There were 34 funding rounds in the insurtech sector between Feb. 1 and Feb. 28, 2022, according to a review by Digital Insurance. What follows is a selection of the funding rounds, focusing on those in the P&C and life insurance sectors that are part of the venture-capital financing model.

HSBC, Marsh extend partnership

HSBC has announced that it has signed a new, five-year broker agreement with Marsh. The agreement builds on a relationship that began in 2010.

Pendella Technologies Raises $5.2M in Seed-2 Funding Led By Top Insurtech Investors

Pendella Technologies, a fast-growing technology company on a mission to take the bias out of life insurance, announced the completion of $5.2 million in Series Seed-2 funding.

Hub International and Bold Penguin to Acquire Insureon

Hub will acquire the Insureon digital insurance agency and brand while Bold Penguin will acquire the Insureon technology platform.

Liberty Mutual closes State Auto acquisition

The closing makes Liberty Mutual the second-largest carrier serving the independent agent channel.

Kin Announces $82M First Close in Series D Financing

Kin Insurance, the direct-to-consumer home insurance company built for every new normal, today announced the $82 million first close of its Series D round, with additional commitments for a second close totaling $18 million.

Nayya Raises $55 Million, Doubling its Valuation, to Transform the Way Americans Select and Utilize Benefits

Nayya will further its mission of providing consumers with a personalized benefits experience that meets the realities of today’s health and financial landscape. Helping Americans gain understanding and control in the wake of rapid inflation, surprise medical bills, and growing debt is more critical than ever.

Aon Acquires Tyche Platform to Expand Insurance Consulting Capabilities for Clients

Aon plc (NYSE: AON), a leading global professional services firm, today announced it has acquired actuarial software platform Tyche from technology and software firm RPC Tyche.

Amazon Links Alexa to Telehealth Provider Teladoc

Amazon Alexa can now connect users to doctors through their Echo smart speakers thanks to a new partnership with telemedicine giant Teladoc Health. Telling the voice assistant, “Alexa, I want to talk to a doctor,” will prompt a call back on the device from a Teladoc doctor for any non-emergency consultation.

MAPFRE launches new global call for InsurTech start-ups

MAPFRE has launched a new scale-up program for insurtechs that offers up to €100,000 of financing per project, focusing on health and wellness, climate risks, and cybersecurity for SMEs.

CyberCube Partners With Duck Creek Technologies

Cyber risk analytics specialist CyberCube announced today that it has partnered with Duck Creek Technologies (Nasdaq: DCT), a leading provider of software as a service (SaaS) insurance core systems, to streamline the underwriting of cyber insurance policies.

‘Open Insurance’ in Financial Ecosystems Is Growing. What Else Is on the Horizon in 2022?

Now is an excellent time for people in the insurance industry to start studying what trends may become prominent during 2022.

Socotra chosen to power Aioi Nissay Dowa’s MOTER commercial fleet insurance program

Aioi Nissay Dowa is launching MOTER as an insurtech MGA in the U.S. and partnering with Socotra to rapidly develop its telematics-driven, usage-based insurance product.

Swiss Re’s iptiQ to enter bancassurance deal with digital bank WiZink

Swiss Re’s digital B2B2C insurer iptiQ and the digital bank WiZink announced a bancassurance partnership focussing on the Spanish and Portuguese markets.

OCTO Telematics and Ford Motor Company Partner for Accurate Data Management of Connected Cars in Europe

OCTO Telematics today announced a new agreement with Ford Motor Company to extend its data streaming partnership into Europe.

Where the Insurtech Heat Is Rising

Two years into the global pandemic, it seems nearly impossible to remember what life was like before COVID. In that short time, life as we know it has changed dramatically and we are redefining what is considered “normal.”

InsurTech Sprout.ai turns to new CEO

An insurance technology company reimagining the insurance claims process has appointed former Tractable executive Roi Amir as CEO.

Cowbell Cyber Partners with Trend Micro to Offer Improved Access to Cyber Insurance

Cowbell and Trend Micro now provide MSP partners and customers with actionable, real-time insights to reduce risk exposures.

Life insurance epigenetics insurtech Foxo plans to go public via SPAC

Foxo Technologies Inc., whose artificial intelligence and genetics technology is used to underwrite life insurance, is going public through a deal with a blank-check company, according to people familiar with the matter.

What’s Driving Insurers to Prioritize ESG Investments? Hint: Climate Change Isn’t the Only Factor

A recent survey of 280 decision makers at U.S.-based life/annuity and P&C insurers shows increased attention and commitment to aligning investments with Environmental, Social and Governance (ESG) goals.

CEO shares update on Ageas UK’s strategic transformation

February has been a landmark month for Ageas UK. In the last fortnight alone, the insurer has announced the sale of the renewal rights of its commercial business to AXA UK&I, a brand new partnership with EIS and its full-year 2021 financial results.

Digitization Makes Insurance Coverage More Accessible to Small Businesses

Small businesses that find it difficult to find affordable insurance with traditional carriers may find new options with digital-first carriers that operate with different assumptions and new processes.

Stable Insurance Raises $3.3M for Rideshare/Carshare Protection

The round, co-led by MLTPLY and Brooklyn Bridge Ventures, provides fit-for-purpose coverage and tools to help policyholders run their businesses more effectively.

Nirvana Insurance launches, raises $22 million

Nirvana Insurance, a technology-driven platform that modernizes commercial fleet insurance using vast amounts of data from sensors on trucks, today announced the public launch of its services to make our roads safer and aid the imperiled truck industry.

Trōv Technology Assets Acquired by Travelers

Trōv, one of the earliest and most widely recognized insurtechs, today announced that its technology has been acquired by The Travelers Companies, Inc. (NYSE: TRV), a leading provider of property casualty insurance for auto, home and business. Most members of Trōv’s team have also joined the company. Terms of the transaction were not disclosed.

Zurich unit hires new chief claims officer

Zurich Life & Investments has expanded its operations team by appointing Suzi Leung as its new chief claims officer (CCO), effective immediately.

Descartes Partners with Reask to Advance Parametric Windstorm Insurance

Uniting Descartes’ technology-driven product expertise with wind risk data from Reask will enable expansion of parametric cyclone insurance into new locations.

Inside $1bn insurtech unicorn Zego: “We have no plans to slow down”

The insurer has redeployed finance employees to work on acquisitions or product development, CFO says

Prudential Automates Expense Management to Cut Costs

The insurer has redeployed finance employees to work on acquisitions or product development, CFO says

Nationwide, Labrador Systems partner on assistive robot pilot

Nationwide and Labrador Systems, an early-stage robotics company, are partnering on an assistive robot pilot program to support people aging in place, individuals with short and long-term health challenges, and their caregivers.

5 trends influencing how customers relate to their insurers

In the two years since the World Health Organization declared COVID-19 a global pandemic, we have seen major shifts in how people expect to work, play, shop, and take on risks. It’s becoming clear that many of these new expectations are here to stay.

Pension Risk Transfer Growth Sets UK Life Sector Apart

UK life insurance stands out as the only life sector in Europe with an improving outlook, which is largely due to the likelihood of increasing business from pension schemes looking to transfer their risk to insurers, Fitch Ratings says.

Insurtech HealthySure raises $1.2 M in Pre-Series A took IPV

Insurtech startup HealthySure has raised $1.2 Million (9crore approx.) in a Pre-Series A round led by Inflection Point Ventures (IPV). The round also saw participation from We Founder Circle, Dexter Angels, Campus Fund, HEM Angels and other private investors.

Why Tesla and GM want to be big in a new kind of car insurance business

For consumers who have found that costlier insurance is just one of the expenses that make electric cars trickier to love, this is the year when relief may be coming.

Strategies for insurers to grow AI responsibly

Artificial intelligence is changing how the insurance industry operates and use cases for AI are skyrocketing. Today, AI is being used to provide customer service, assess risk profiles, to determine pricing, detect fraud and more. As technologies evolve and the industry’s use of AI becomes more mature, the opportunities for using AI in the future appear virtually limitless.

Axa launches EV fleet product

AXA Commercial has announced the official launch of its electric vehicle proposition for motor fleet customers, offering a greener fleet option to businesses.

Swiss Re acquires liability reinsurance captive

Swiss Re has acquired the entire share capital of Champlain Reinsurance Company (CRC), a Swiss-based run-off reinsurance captive of Alcan Holdings Switzerland.

Fenris Announces New Partnership with Socotra to Improve Customer Buying Journey

Fenris Digital (Fenris), an insurance data sourcing innovator providing a suite of API-delivered, SOC 2 compliant products, is pleased to announce a new partnership with Socotra, the first truly modern insurance core platform.

ennabl Raises $4M To Transform Insurance Brokerage

Connecting information across data silos to accelerate insurance brokers and agents into the digital age.

AIG ‘very pleased’ with core reinsurance placements at Jan 1: CEO Zaffino

The Chairman and Chief Executive Officer (CEO) of global insurer AIG, Peter Zaffino, said today that the carrier is “very pleased” with the outcome of its core reinsurance placements at the January 1st, 2022 renewals, despite limited retrocessional and other capacity issues.

5 Trending Captive-Insurance Considerations for 2022

Business owners and leaders must take these trends into account when developing a robust risk-management strategy.

Former CEO of Allianz UK Appointed as CEO of Hiscox UK

Specialist global insurer, Hiscox, has announced the appointment of Jon Dye as its new UK CEO, effective September 2022, subject to regulatory approval.

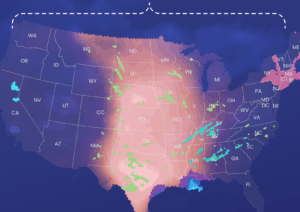

CoreLogic Climate Change Catastrophe Report Estimates 1 in 10 U.S. Residential Properties Impacted by Natural Disasters in 2021

CoreLogic, a leading global property information, analytics and data-enabled solutions provider, today released its 2021 CoreLogic Climate Change. Catastrophe Report, revealing over 14.5 million single- and multifamily homes were impacted by the largest natural catastrophe events of 2021, with an estimated $56.92 billion in property damage.

Prepared Mind: The insurtech landscape and five predictions for the future

When Arthur Patterson and Jim Swartz co-founded Accel, a core principle of their approach to investing was a thesis-based method called a “Prepared Mind”. Referencing the Louis Pasteur quote “chance only favours the prepared mind”, this method remains integral to how we approach, learn about and invest in new opportunities today.

Do you have news you would like to share with the World's Largest Insurtech Community?

Please feel free to send us an email

news@insurtechinsights.com