All News

Home » Latest news » All News

We regularly curate the latest insights and reports provided by and in collaboration with our partners and stakeholders to create the largest platform for knowledge-sharing and development within the world’s insurance industry.

SecureNow raises $6M in series B funding from Apis Insurtech, SelectQuote

SecureNow, an end-to-end insurtech platform currently serving 25,000 small businesses across 150 locations, has raised a total of US$ 6 million in its last funding round.

Zurich Insurance to sell Italian life and pensions back book to GamaLife

Zurich Insurance will release about $1.2 billion of capital by selling its Italian life and pensions back book to Portuguese insurer GamaLife, the Swiss company said on Monday.

Duck Creek and Adiona team up to revolutionise UK Motor Insurance with multi-faceted SaaS solution and scalable business model

Duck Creek Technologies announced today that it has partnered with a new UK insurtech motor insurer, Adiona, to offer insurance policies with premiums built on data / telematics, artificial intelligence and machine learning that provide fair and transparent pricing based on the driving habits of each insured customer.

Lloyd’s Forms ‘Product Launchpad’ to Develop Insurance Solutions for Emerging Risks

The “Lloyd’s Product Launchpad” is the brand new residence for the event of insurance coverage options to sort out rising dangers.

Lemonade’s Year in Review

Lemonade, the insurance firm that’s powered by AI and behavioural economics, notes that the end of the year 2021 is a time for “sitting back, taking stock, and reflecting on the past twelve months.”

Klinc now offers home insurance

Klinc, Zurich’s digital insurance brand, has introduced home insurance “designed for millennials.

Next Insurance launches mobile app

Next Insurance has been working on a mobile app since April of last year and today that app is available.

Insurtech Trends for 2022

The insurance sector is facing unprecedented change in a rapidly evolving environment. Energy transition, circular economy, urbanisation, digitisation: These trends have far-reaching consequences for the way we live and work.

3 digital home insurance opportunities in 2022

For years, technology has been transforming the insurance industry, and that trend will only accelerate in 2022.

Is ‘Google Insurance’ on the Horizon?

Insurers should expect big players in mainstream tech to influence the property/casualty industry during 2022.

5 predictions for the insurance industry in 2022

For many of us, ringing in the new year means setting resolutions for better health and well-being. Whether in business or our personal lives, we must consider the scenarios that may threaten or enable our success. The insurance industry is no different.

Investor B.P. Marsh sells stake in motor MGA to insurtech Humn

Specialist early-stage investor B.P. Marsh & Partners has announced the sale of a stake in UK based motor insurance managing general agent Walsingham Motor Insurance Limited for £4.6 million.

How digital transformation enables product innovation, richer customer experiences

For years, digital transformation has been the talk of the insurance industry. In the wake of the ongoing COVID-19 pandemic, many insurers made bold advances in automating core processes, adopting new technology and expanding their digital selling and collaboration capabilities.

Risk mitigation for cyber insurance: Digital tools, twins and ecosystems

Before cyber insurance can truly become a mainstay of the digital economy – as a widely available, widely affordable, consistently priced product – these problems need addressing.

2022 Predictions: Growing emphasis on risk governance in the insurance industry

It was great to see how so many companies showed incredible adaptability during COVID-19. While initially, we thought a lot of the insurance market would be at a loss as to what to do next, instead they were able to show resilience relatively quickly and technology was the enabler of that.

Insurtech Zensung launches ‘go green’ app

Singapore-based insurtech firm, Zensung today launched its application called Parrot on the app stores.

What insurtech industry trends to watch for in 2022

In case you missed it, insurtech — technology developed to improve and transform the insurance industry — is having a bit of a moment.

Swedish Insurtech Paydrive Partners With CMT to Enhance its Telematics Platform

Paydrive, the Nordic region’s leading insurtech in car insurance, is partnering with Cambridge Mobile Telematics (CMT), the global leader in smartphone telematics, to upgrade its unique pricing engine with industry-leading driving intelligence.

Tower partners with Allianz Partners for pet insurance

The pet insurance policy covers injury and illness, specialist treatments and optional dental care, and offers a multi-pet discount. Premiums start at $3 a week for cats and $4 a week for dogs.

Bâloise : From the rise of embedded insurance products to record-breaking Insurtech financing, 2021 was a remarkable year

From the rise of embedded insurance products to record-breaking InsurTech financing, 2021 was a remarkable year for the global insurance industry.

Insurer to add $90M in premiums via acquisition

Tampa-based HCI Group Inc. has agreed to buy United Insurance Holdings’ lines of business in three states.

Leading a “once in a generation” change in insurtech

The convergence of software and data is a major trend in insurance technology, and Zywave is proud to be a leader in this transformation.

Toyota wants to sell you auto insurance

So far it’s being sold in Arizona, Illinois, Indiana, Ohio and South Carolina. Along with Texas, it will soon be operating in Georgia, Missouri and Tennessee with more states added monthly, Toyota said Thursday.

Brit deploys machine learning to accelerate tornado claims

Brit has announced that it has expanded the use of a proprietary machine-learning algorithm to accelerate the identification of US tornado property damage.

WTW launches new Risk and Analytics model

Willis Towers Watson has launched a new Risk and Analytics model for the trade credit market which analyses clients’ trade receivables to predict potential losses over a range of statistical scenarios.

Sensely Announces Partnership with Krungthai-AXA Life Insurance

Virtual assistant pioneer Sensely announced a strategic partnership with Krungthai-AXA Life Insurance, a Thailand-based carrier providing health insurance to approximately 500,000 members.

Making the digital leap in underwriting

Underwriting has historically been one of the most data-intensive areas of insurance. But when it comes to looking at investments and results, data and information handling for underwriting at most carriers is still disjointed and disconnected

Aviva invests £50 million into sustainability focused venture capital funds

Aviva announced a commitment to invest £50 million into venture capital funds focused on emerging technology which supports a more sustainable future.

Data Companies Will Explode into the Insurance Market in 2022

In 2022, we will see the growing prominence of datasets as the facilitators of new realms of knowledge for P&C insurers, helping them predict and price risk more efficiently than ever before.

How AI Regulation Is Developing In The Insurance Industry

2021 has seen a material acceleration in regulatory interest and posturing regarding the use of AI — both within insurance and more broadly.

UK Brokerage Insurtech Eyes U.S. Expansion After $7.9M Capital Raise

A commercial insurance brokerage technology company that is up and running in the UK is targeting the U.S. after raising more than $7.9 million in a Series A funding round.

Insurers will innovate to improve customer experience and build trust, post-COVID

With the flow of COVID-related business interruption (BI) claims payments nearing its end, in 2022 insurers will focus on strengthening their brands and customer relationships following the BI crises in 2020 and 2021.

WTW designs ‘game changing’ climate-focused parametric solution

Broker Willis Towers Watson has actually revealed its participation in the style and positioning of the world’s very first parametric insurance deal efficient in enabling the Government of Belize’s ground-breaking financial obligation restructuring for marine preservation.

MetLife partners with YuLife

A new partnership between heritage insurance provider MetLife UK and insurtech startup YuLife marks the start of a new era of insurance for both companies

Milliman names Dermot Corry next CEO

Consulting and actuarial firm Milliman has named Dermot Corry as its new Chief Executive Officer, effective in the new year.

Allianz Embraces Insurtech Cytora’s AI Risk Processing Tool

Allianz will be using London-based insurtech Cytora’s risk processing tool that uses AI to better process risk data and improve the underwriting process

Where does the M&A market stand going into 2022? – Report

Increased deal activity and the use of M&A insurance has led to a record rise in the number of notifications, according to a new report by Howden M&A, an international M&A insurance broker. However, the COVID-19 outbreak did not result in a surge in the volume of claims or the number of coronavirus-related break events that had initially been anticipated.

McKinsey: Insurance 2030—The impact of AI on the future of insurance

The industry is on the verge of a seismic, tech-driven shift. A focus on four areas can position carriers to embrace this change.

Breeze CEO Colin Nabity on Bridging the Income Protection Gap

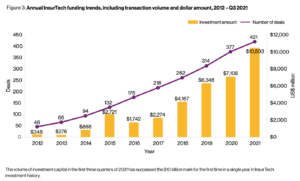

2021 has been a record year for insurtech funding. As of Q3 2021, more than US$10.5 billion had been raised by companies in the space year-to-date (YTD), surpassing 2020’s total of US$7.1 billion by nearly 48%, data from insurance advisory firm Willis Towers Watson show.

The Biggest Insurtech Funding Rounds of 2021 in APAC

2021 has been a record year for insurtech funding. As of Q3 2021, more than US$10.5 billion had been raised by companies in the space year-to-date (YTD), surpassing 2020’s total of US$7.1 billion by nearly 48%, data from insurance advisory firm Willis Towers Watson show.

Bought By Many acquires VetBox

Pet health and insurtech company, Bought By Many, has acquired VetBox, a UK pet health subscription and fulfilment business, in a major step in the extension of its offering beyond insurance.

Tesla expands its real-time data car insurance product to Illinois

Tesla has now expanded the availability of its real-time data car insurance product to car owners in Illinois.

Allianz to leverage AI-driven risk processing from insurtech Cytora

Allianz SE has announced an agreement with London-based insurtech Cytora that will see the former integrate AI-based digital risk processing solutions into its commercial insurance business.

Insurtech M&A dealmaking will rise to new heights in 2022

2021 ended up being a bumper year for M&A deals and also for M&A insurers.

Insurtech bolttech and Samsung expand partnership

bolttech and Samsung have expanded their device protection partnership to multiple European markets.

Why unlocking customer data is vital for the future of insurance

The emergence of next-generation technology solutions such as artificial intelligence, machine learning, predictive analytics, cloud and edge computing is causing a seismic shift in the insurance market – disrupting the outdated, typically protection policy-focused model.

4 Ways Blockchain Can Transform Insurance

Advancements in this breakthrough technology are spurring innovation across the insurance industry, including coverage for crops, flights and travel delays, shipping and live events.

Matic Insurance Launches New Partnership with HSBC Bank

Matic, a leading digital insurance agency, and HSBC USA announced today a long-term partnership to provide insurance products to HSBC clients. Under the partnership, Matic’s innovative insurance marketplace of over 40 A-rated carriers will be integrated into HSBC Wealth and Personal Banking offerings.

Swiss Re Reorganizes Group Operations; Names Ladva as Group CTO

Swiss Re announced the appointment of Pravina Ladva as group chief digital & technology officer and member of the group executive committee, effective Jan. 1, 2022. Group Chief Operating Officer Anette Bronder will leave the company, and group operations will be reorganized.

Performance gap between cyber underwriters will widen in 2022

The gap between the best-performing cyber insurers and the worst-performing will widen in 2022, according to the CEO of cyber risk analytics specialist, CyberCube.

Zurich Insurance to Acquire Conversational AI Company AlphaChat

Zurich Insurance Group agreed to acquire Estonia-based company AlphaChat, which provides conversational artificial intelligence (AI) technology for customer service automation, to further enhance the group’s digital capabilities.

Generali partners with Accenture, Vodafone Business on cyber solutions

Generali has joined forces with Accenture and Vodafone Business on the creation of cyber insurance services designed to help corporate and SMEs clients more effectively recognize, respond to and recover from cybersecurity threats and incidents.

The 5 insurance trends that we will see in 2022

There are some negative phenomena that are foreseen for the following year, which are part of the ravages that this pandemic has left.

Chubb Launches New Employment Practices Liability Insurance Policy

New EPLI coverage helps protect companies from the financial costs incurred from a range of employment-related lawsuits.

Generali CEO’s bold plan may just save his neck

Philippe Donnet has upped his game just in time. Generali’s (GASI.MI) chief executive on Wednesday announced a bold plan to grow earnings and return capital to investors. It should be enough for him to keep his job.

The venture capital view of insurtechs

Insurtechs continue to be a highly-funded sector and the pace will likely continue into 2022. Global insurtech funding has seen over $10 billion across 427 deals so far this year which is 48% greater than all the deals in 2020, according to a report from CB Insights.

Herald Raises $8 Million in Seed Funding to Build Digital Infrastructure for Commercial Insurance

Herald, a digital infrastructure that connects software developers to commercial insurance carriers through a single API, announced today that it has raised $8 million in new funding.

Thimble launches event liability coverage

Insurtech startup Thimble has announced the launch of its new Event Liability Insurance offering for business owners. The product will be available through Thimble’s app and website.

Kin expands US reach with carrier takeover

Kin, a leading direct-to-consumer homeowners insurance technology company, today announced it has completed the acquisition of an inactive insurance carrier that holds licenses in 43 states.

Insurtech Stere raises $2mn seed funding

Stere, a digital solution designed to tackle speed-to-market, capacity sourcing, and other challenges relevant to managing general agents and insurers, has closed its $2 million seed funding round.

Do you have news you would like to share with the World's Largest Insurtech Community?

Please feel free to send us an email

news@insurtechinsights.com