All News

Home » Latest news » All News

We regularly curate the latest insights and reports provided by and in collaboration with our partners and stakeholders to create the largest platform for knowledge-sharing and development within the world’s insurance industry.

How to build truly flexible insurance products

In today’s webinar we discussed the possibilities of digital product development, and how a flexible mindset within teams can drive dynamic, flexible products.

7 Major Cyber Insurers Form Company to Coordinate Cyber Analysis, Risk Mitigation

With cyberattacks and insurance claims on the rise, leading cyber insurers AIG, AXIS, Beazley, Chubb, The Hartford, Liberty Mutual Insurance and Travelers have formed a company to pool their data and expertise and join forces to bring containment efforts together of cyber risks in all areas to improve the insurance industry.

How is digitization altering insurance claim settlement?

Over the past few years, changing business landscape, new digital-first entrants, and evolving customer expectations have transformed the way companies deliver services and handle the moment of truth, yes, including insurers.

Nayms Secures an Additional $6m for Future NAYM Token

Having secured its $2.1m seed funding round in January this year, Nayms brings in a new cohort of investors who have subscribed to a future listing of the project’s native token, NAYM.

Combined Aon/WTW would be world’s largest outsourced investment firm

Reports from Bloomberg highlight how the proposed $30 billion merger of insurance brokerage giants Aon and Willis Towers Watson (WTW) would create the world’s largest outsourced investment management firm.

Honeycomb Launches in North America with $3M Funding

The company seeks to disrupt the $22B market multi-family property market by delivering a simple, efficient, and transparent experience for buildings and communities.

Why brokers are the key to breaking down cyber insurance barriers

In the last week alone, multiple high-profile cyber incidents have made the headlines of news sites across the world, impacting everything from high-profile insurance companies to healthcare providers.

The future clients want to see in auto claims processing

After an initial surge, the number of clients taking advantage of virtual claims processing has dipped. For insurers, now is a critical time to evaluate their processes and figure out how to properly provide a touchless experience, says a recent report.

Generali to buy rival Axa Malaysia insurers in ‘transforming’ strategic move

Assicurazioni Generali has agreed to buy rival Axa’s insurance assets in Malaysia for a consideration of RM 1,290m (€262m) in a key strategic push into the region.

Resolution Life hires Swiss Re’s Nardeep Sangha as CEO, New Markets

Resolution Life, a long-term manager of legacy life insurance portfolios, has appointed Nardeep Sangha as Chief Executive Officer (CEO) of New Markets.

AXA Partners with Hong Kong Broadband Network to Offer Homeowners Insurance

Hong Kong Broadband Network Ltd. (HKBN) is now offering customers an “All-in-One Home Kit,” complete with fiber broadband service and home insurance from AXA Hong Kong and Macau (AXA).

Zego launches Trans and Non-Binary workplace policy

Commercial motor insurance provider Zego has introduced a robust workplace policy to support Trans and Non-Binary employees, outlining the company’s clear position and commitment to supporting Trans and Non-Binary employees.

Digitization, Automation, AI Define Role of Human Agents in Insurance Industry

The digitization of the insurance industry is inevitable but human interaction is still an essential part of the process. Paul Ford, CEO of insurance platform Traffk, explains how the companies that will succeed are those that use data and automation to develop better products and help their agents become advisors.

How are insurers communicating digital strategy?

IT strategies establish a vision for the future and can be motivational if communicated properly.

Greater Than’s AI revolutionize motor insurance underwriting

Greater Than (GREAT), the AI data analytics provider, is taking motor underwriting into a new era. The company’s AI unlocks future cost for accidents per driver, thus providing a time advantage of 12 to 18 months’ over traditional risk models. A time advantage that fundamentally changes how motor risk proactively will be mitigated, managed, and priced.

Caura raises $4.2 million

Caura, the vehicle management platform founded by former Apple exec Dr Sai Lakshmi, has secured $4.2 million in funding to develop its application and integrate with in-car infotainment systems.

Tractable hits unicorn status and takes on property damage appraisal

The US-based AI-enabled insurtech raised a $60 million Series D funding round, valuing it at $1 billion, per TechCrunch. Tractable’s AI solution uses computer vision technology to evaluate photos of vehicle damage rather than relying on human appraisals, which both increases the accuracy of damage estimates and streamlines the customer claims journey.

AI and the Amazon Effect on Commercial Insurance

A successful AI-powered digital distribution strategy integrates tried-and-true customer relationship-building strategies with new data-driven digital experiences.

Leading InsurTech RenewBuy raises US$ 45 million

RenewBuy, one of India’s leading InsurTech companies, has raised US$ 45 million, in a series C funding round. This funding round has been led by an investment from Apis Growth Fund II, a private equity fund managed by Apis Partners LLP, a UK-based asset manager that supports growth stage financial services and financial technology businesses. RenewBuy’s existing investors, Lok Capital and IIFL Wealth also participated in the fundraise.

Urban Jungle launches Building and Contents insurance to target homeowners

Insurtech startup Urban Jungle, famous for its £5 per month renters insurance, has today announced the launch of its new Building and Contents insurance product – targeted at younger homeowners, who it says have been ‘ignored’ by the big insurance companies.

Digitisation in Financial Services and Insurance: Key things to remember while preparing digital strategy

An outcome of 2020 is the emergence of a digital economy – one where digital avenues and alternatives are just as effective as traditional engagements were in 2019.

Aon-WTW Merger Would Help Boost Industry’s Innovation. Aon CEO Makes the Case

The enhanced ability to innovate is a principal motivator for Aon’s proposed acquisition of Aon and Willis Towers Watson. It’s a message that Aon CEO Greg Case has been emphasizing since the $30 billion deal was announced in March 2020.

Is Insurance Missing Out on the Crypto Opportunity?

While the full potential of blockchain is yet to be revealed, its far-reaching applications, in combination with adjacent technologies, has the potential to transform every industry—including insurance.

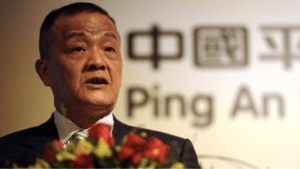

Ping An Life is Driving Reform to become World-leading Insurer

Ping An Life’s reform is driven by a combination of digital empowerment and a “heartwarming” value system, said Peter Ma, Chairman of Ping An Insurance. Mr. Ma spoke at the 25th Ping An Life Insurance Summit in Chongqing.

Next-generation insurance company Hellas Direct raises EUR 32m

Hellas Direct, an innovative, technology-driven insurance company operating in Greece and Cyprus, announced that it has raised a further EUR 32m in funding in its latest financing round, bringing the total raised to date to EUR 56m.

U.S. sues to stop $30 billion global insurance merger of Aon and Willis Towers Watson

The U.S. Justice Department filed a lawsuit on Wednesday aimed at stopping insurance broker Aon’s $30 billion acquisition of Willis Towers Watson because it would reduce competition and could lead to higher prices.

Cambridge Mobile Telematics Acquires TrueMotion

Cambridge Mobile Telematics (CMT), the global leader in mobile telematics and analytics, has acquired TrueMotion, the second largest mobile telematics provider.

InsurTech startup Vital raises $3mn in pre-series A round

Vital, a next-generation InsurTech platform, has raised $3mn in total with a pre-series A round led by India’s renowned venture capital company BLinC Invest. Venture Catalyst, Survam Partners and several other angel investors also participated in the pre-series A round.

McKinsey warns life insurance is blind to power of AI

McKinsey has warned the life insurance industry does not realise the full impact artificial intelligence (AI) will have on the sector.

Lori Dickerson Fouché Joins Hippo’s Board of Directors

Hippo Enterprises Inc. (“Hippo”), the home insurance group that created a new standard of care and protection for homeowners, today announced that Lori Dickerson Fouché has been appointed to the company’s board of directors.

Tractable raises $60M at a $1B valuation to make damage appraisals using AI

As the insurance industry adjusts to life in the 21st century (heh), an AI startup that has built computer vision tools to enable remote damage appraisals is announcing a significant round of growth funding.

Aioi Nissay Dowa Insurance and Flock join forces to reinvent commercial motor insurance

Today, Flock has announced a partnership Aioi Nissay Dowa Insurance UK to develop two connected motor fleet insurance products now available to fleets across the UK.

Insurtech AI startup Akur8 closes $30M Series B

Automating insurance claims is a big business, and the world of AI is coming at it ‘full pelt’. The latest is Akur8, an insurtech automating insurance platform whose ‘Transparent AI’ product is trying to eat into the incumbent large business of Willis Towers watson, among others.

Tokio Marine HCC promotes Jay Ritchie to CEO, Stop Loss Group

Tokio Marine HCC, a member of Tokio Marine Group, has appointed Jay Ritchie as Chief Executive Officer of its Stop Loss Group after it was announced that Daniel Strusz will be retiring at the end of October.

Honey Insurance launches with $15.5M AUD, the largest seed round ever for an Australian tech startup

When Richard Joffe moved his family to Australia in 2019, he said applying for home insurance “was like traveling back in time 30 years.”

CLARA Analytics Names Heather H. Wilson as Chief Executive Officer

CLARA Analytics (“CLARA”), the leading provider of artificial intelligence (AI) technology in the commercial insurance industry, today announced that Heather H. Wilson has been named as Chief Executive Officer.

How AI Plays Into the Future of Risk Management

Risk analysts have always relied on data to guide decisions toward strong growth potential and away from high-risk strategies. This used to be a fairly linear process, but now that up to 90% of our data is unstructured, information is not only difficult to organize into digestible formats but also produced in volumes that go beyond the capabilities of human analysts aided by conventional data systems.

How automated claims can revolutionise customer and insurer experience

In our latest webinar, we discussed how automation in the claims process can improve customer experience, optimise the efficiency of claims and make insurers’ lives easier.

handdii Raises $3M to Help Insurance Companies Digitize and Simplify the Property Claims Experience

As the insurance industry continues to seek the best way to digitize and simplify the property claims experience, claim management platform handdii is announcing a $3 million Seed round led by Brick & Mortar Ventures, with participation from Nine Four Ventures and Australia-based Scale Investors and Fifty-Second Celebration.

Zurich expands medical stop-loss presence

Zurich North America has announced the expansion of its medical stop-loss insurance presence in the middle-market space through a relationship with Pennsylvania-based managing general underwriter IOA Re.

Health insurer Bright Health files for $1.5B IPO, sets initial terms

Bright Health Group today announced the launch of its initial public offering of 60,000,000 shares of its common stock pursuant to a registration statement filed with the Securities and Exchange Commission.

Budweiser Gets into Insurance

Piloting in Canada, Budweiser to explore lifestyle-based insurance plans, marking a creative business extension for the brand.

Data analytics ‘the Holy Grail’ for insurers

Most insurance organisations look the same at their core. They’re supported by the same foundations, they share the same core processes, they produce similar products, and they share the same goal of transferring risk while supporting a profitable industry.

Digital disruptors to revolutionise Insurtech market in 2021

Digitisation will disrupt the traditional life insurance sector in 2021 as Millennials and GenX embrace financial protection and ‘embedded insurance’ products, according to technology investment bank ICON Corporate Finance which recently secured £5m Series A funding for innovative InsurTech start-up Anorak.

6 Insurtech startups revolutionizing the corporate Insurance landscape in India

The ongoing global pandemic has brought the health insurance industry into the spotlight. Over 80% Indian population does not have any personal health insurance cover and the others are heavily dependent on their employers for insurance and other regular welfare benefits.

AI-driven customer experience: Smart move for life insurers

Life insurers that invest in artificial intelligence (AI) can improve the customer experience by making it more personalized and data-driven. With AI, carriers can profitably attract and retain customers with new “pay-as-you-live” products and services that reward consumers’ healthy habits.

insurtech talk with Kamet’s Stéphane Guinet: How to get your insurtech noticed by VCs

This week Stéphane Guinet, founder and CEO at Kamet Ventures discussed the key attributes of startups that can rise above the rest and attract major funding.

Insurtech Startup iLife Raises $4 Million

Playa Vista-based iLife Technologies Inc., a software platform that gives insurance agents and brokers the ability to quickly create their own digital insurance agencies, has received $4 million in seed funding.

Farmers Insurance partners with Zesty.ai

P&C and life insurer Farmers Insurance announced it has integrated Zesty.ai ‘s wildfire risk scoring model (Z-FIRE™) into its homeowners insurance underwriting processes – selectively expanding opportunities for coverage for residences located in certain wildfire-risk areas.

Aon’s $30 billion Willis bid set for EU okay in late June, early July – sources

Insurance broker Aon’s $30 billion bid for Willis Towers Watson, the biggest ever in the sector, is expected to get the EU antitrust green light later this month or in early July, people familiar with the matter said.

SOMPO Invests Additional $45M in One Concern, a Global Resilience AI Startup

SOMPO Holdings, one of Japan’s largest insurers, is investing an additional $45 million in One Concern, Inc., an AI startup focused on building the global resilience market. The money is part of an expanded partnership between the two companies.

League and Humana Partner to Digitally Transform Healthcare Experience

The collaboration will enable a personalized, simplified and connected “digital front door” for Humana Employer Group and Specialty members.

Insurtech funding rounds in 2021 break pandemic gloom – GlobalData

This year, insurtech funding rounds are breaking the pandemic gloom by helping to insert these businesses ”successfully into the insurance value chain”, according to data and analytics company GlobalData.

AXA in €300mn settlement offer to 15,000 restaurant clients over COVID claims

AXA France has today announced a settlement offer of €300 million, gross of tax and before reinsurance, to 15,000 restaurant owners who hold non-damage business interruption (BI) policies.

Vitality announces new partnership with Samsung

Vitality has today announced it has partnered with Samsung UK to integrate Samsung Health into the Vitality Programme, providing members with more ways to track their activity and improve their health.

USAA acquires insurtech Noblr to launch new UBI product

USAA is acquiring the insurtech Noblr and will use the company’s usage-based insurance platform for a new offering.

Qlaims names new CEO

Insurtech Qlaims has announced a new CEO – but it isn’t saying goodbye to her predecessor.

Amodo received the Frost and Sullivan’s Technology Innovation Leadership award for 2021

Global market research and consulting company Frost and Sullivan rewarded Amodo with a European User-based Insurance Industry Excellence in Best Practices award.

Digital Engagement Pays Its Way by Opening Supply Chains

Digital experiences that will not only be efficient and resilient, but they will pay for themselves through improved customer and agent engagement and far greater profitability due to smarter risk selection and greater portfolio management.

Chubb launches ‘Pay As You Roam’ travel insurance

Chubb, the world’s largest publicly traded property and casualty insurer, has announced the development of its “Pay As You Roam” (PAYR) travel insurance proposition.

Do you have news you would like to share with the World's Largest Insurtech Community?

Please feel free to send us an email

news@insurtechinsights.com