Artificial Intelligence

Home » Latest news » Artificial Intelligence

We regularly curate the latest insights and reports provided by and in collaboration with our partners and stakeholders to create the largest platform for knowledge-sharing and development within the world’s insurance industry.

5 Key Advances Driving AI 2.0

The move AI 2.0 is being driven by five areas of AI advancement, according to a new report from analyst firm Forrester.

Insurers Must Address Bias in AI

Recently, a group of U.S. senators wrote a letter urging the Equal Employment Opportunity Commission to address employers’ use of Artificial Intelligence (AI), machine learning, and other hiring technologies that might result in discrimination.

AI Startup that Uses AI and Partners with Re/insurers, Now Is Seeking Canadian IPO

Farmers Edge Inc., a firm that uses artificial intelligence to help growers boost crop yields, is seeking to raise about C$100 million ($79 million) in an initial public offering to strengthen its finances and repay debt.

AI-Based Video Identification Shaping the Insurance Industry in 2021

Onboarding legitimate customers are getting complicated with every passing day since fraudsters are coming up with better ways to terrorize different industries. Hence, KYC requirements are becoming stringent across the world. For onboarding, a secure clientele base, robust identity verification is essential for businesses.

Amazon Plans Cameras with AI in Its Delivery Vans to Improve Driver Safety

Amazon.com has revealed plans to install AI-powered video cameras in its branded delivery vans, in a move that the world’s largest e-commerce firm says would improve safety of both drivers and the communities in which they deliver.

Next Insurance Doubles Gross Written Premium with AI-Powered Coverage

The US-based small business insurtech reached a $200 million gross written premium run rate by the end of 2020, from $100 million last February, per PR Newswire.

Revolutionizing Customer’s Insurance Journey With AI

Customer experience and customer service are the holy grail of businesses. And yet, CX in insurance is often lagging behind. The customer-facing leg has been digitized, but the issuance operations and internal processing leg are still old-school.

What The NAIC’s Guiding Principles on AI Say

“AI will be life-changing for insurance companies and consumers alike, raising the question of how regulators can ensure that models and algorithms and machine learning don’t simply scale-up the bad practices of the past,” writes Andrew Mais, commissioner of the Connecticut Insurance Department.

How Insurers will use AI to Provide Cover

Covid-19 has caused consumer interest in protection products to rise significantly, while insurers have had to respond quickly, and rapidly gear up for home-working.

Cyber Insurance Startup At-Bay Raises $34M Series C

Cybersecurity insurance startup At-Bay has raised $34 million in its Series C round, the company announced Tuesday.

3 ways AI can transform auto insurance customer experience

It’s safe to say we have our physician, babysitter, personal trainer and dog walker on speed dial. But it’s unlikely that the average auto insurance customer knows the right number to call to reach their carrier in the chaotic moments following an accident.

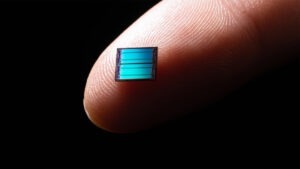

Which AI Techs are most Valuable in P&C?

Artificial intelligence technologies are everywhere. The great leap forward in AI over the past decade has come along with an explosion of new tech companies, AI deployment across almost every industry sector, and AI capabilities behind the scenes in billions of intelligent devices around the world. What does all of this mean for the personal lines insurance sector?

How AI Transforms Risk Engineering

“AI could contribute to the global economy by 2030, more than the current output of China and India combined.”

Destination AI: Augmented Automated Underwriting and Life Insurance

It’s almost inevitable. Spend your working life identifying, analysing, quantifying and ascribing monetary value to risk, and you’re likely to have a fairly strong aversion to it. Or more accurately, an aversion to undertaking new endeavours with inadequately understood consequences. The insurance industry is, on any number of levels, the very definition of risk-averse

How AI Can Tackle Claims Staffing Gap

A job description with “acquire AI superpowers” might appeal to millennials more than “study policy footnotes and calculate claim reserves.”

3 Ways for CIOs to Improve Their Positioning with AI

Artificial intelligence is changing the pace at which CIOs can achieve an enviable position on their leadership teams.

Oxford University AI Company Mind Foundry Closes $13.6 Million Series A

Mind Foundry, an Artificial Intelligence (AI) company that spun out of the University of Oxford’s Machine Learning Research Group (MLRG), today announced it has raised an additional $13.6 million in Series A funding.

How AI Powers Customer Contacts

Existing and prospective customers now expect prompt, appropriate answers via the channel of their choice, or they may look to your competitors. For insurance carriers,

Tractable’s AI Solution to Save Adjusters 360,000 Hours Annually

Property and casualty insurer MS&AD Insurance Group Holdings will adopt Tractable’s artificial intelligence (AI) solution across Japan in a bid to fast-track auto claims and

Arturo Delivers Insights Across Nearly 9 Million Australian Properties

Arturo, the leading provider of AI-powered residential and commercial property insights and predictive analytics, today announced the delivery of nearly 9M AI generated property characteristics

Unlocking AI’s Potential for Social Good

New developments in AI could spur a massive democratization of access to services and work opportunities, improving the lives of millions of people around the

3 Practical Uses for AI in Risk Management

Banks, insurance companies, asset managers and other industry players need to rethink how they approach financial risk management. Every year, financial crime becomes more sophisticated,

HawkSoft Partners With Innovative Proof Of Insurance And Certificial

Many interactions between businesses hinge on the ability for one party to provide a proof of insurance to the other. For example, delivering commercial shipments,

Aon Collaborates with Athenium Analytics to Identify High-Risk Claims through Predictive Analytics

Aon plc, a leading global professional services firm providing a broad range of risk, retirement and health solutions, has announced it is collaborating with Athenium

Want to share your knowledge?

With world’s largest forum for insurance professionals, Insurtech Insights provides an invaluable platform for networking, new insights and exposure for thought leaders. We are always looking for new partners, content creators, and contributors to create value and deliver exceptional support to Insurtech Insights.

To share your knowledge, simply fill out the form.