Funding News

Home » Latest news » Funding News

We regularly curate the latest insights and reports provided by and in collaboration with our partners and stakeholders to create the largest platform for knowledge-sharing and development within the world’s insurance industry.

Singapore-based insurtech bolttech secures Series B investment

bolttech, one of the world’s fastest growing international insurtech companies, today announced Tokio Marine, alongside other shareholders, will lead bolttech’s Series B funding round.

Blockchain-powered reinsurer Re raises $14 million seed round

Re, a blockchain-powered reinsurance company, has raised $14 million in seed-round funding to build a decentralised system for investors which will allow them to gain exposure to “a massive and uncorrelated asset class” that is insurance premiums.

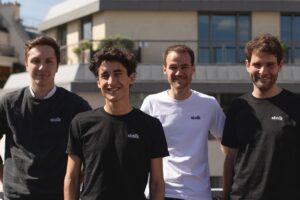

French insurtech startup Olino scores €2.2 million to bolster its embedded insurance product for European SMEs

Paris-based insurtech company Riskee is changing its name to Olino and announcing the close of a €2.2 million funding round to accelerate its growth.

Evident Raises $14 Million to Reduce Third Party Insurance-Related Risk for Enterprises

Our investors have been instrumental to our growth and continued innovations,” Thomas continued. “We are excited and humbled to work with such great partners and look forward to continued growth.”

Health insurtech startup Peachy raises £1.5m

Insurtech startup Peachy has raised £1.5m in a funding round in support of its app-based platform that provides quick access to private health services.

AIG unit Corebridge raises $1.68 billion in year’s largest IPO

AIG Inc’s life insurance and retirement division Corebridge Financial Inc raised $1.68 billion on Wednesday in the biggest initial public offering (IPO) so far this year, braving market volatility and ending a seven-month lull in major listings.

Insurtech CoverTree Acquires $10M In Funding, Introduces Digital Manufactured Home Insurance – Crowdfund

Detroit-based InsurTech CoverTree has raised $10m in a seed funding round and launched a home insurance offering.

PolicyMe Raises $18M to Scale Its Product Suite and B2B2C Distribution

Insurance industry leaders RGAX, Securian Financial and Siriuspoint join existing investors HCS Capital and Westdale Properties and a Tier 1 Canadian bank to round out the $18M Series A funding for PolicyMe.

SMB-focused Pie Insurance raises $315M Series D

Pie Insurance in Denver, Colorado, raised a $315 million Series D round of funding.

Insly Raises €1.1m in Bridge Funding

We all know buying insurance is hardly a gratifying experience, especially when there are several policy options available in the market.

Planck Raises $71M to Date to Expand its First-to-Market Cognitive Business Analytics Platform

Planck Raises $71M to Date to Expand its First-to-Market Cognitive Business Analytics Platform.

Insurtech Patra gets $146M from FTV

Patra, an insuretech startup, has raised $146 million from fintech-focused growth equity firm FTV Capital.

Digital Insurer Carrot Eyes Unicorn Club as It Raises US $250M; Boosts Its Valuation to Over $850M

South Korean digital insurance carrier Carrot General Insurance (“Carrot” or the “Company”) today announced it has secured a fresh funding of 300 billion Korean won.

Lloyd’s of London sets aside $1.3 bln for Ukraine claims, posts H1 loss

Lloyd’s of London (SOLYD.UL) has set aside 1.1 billion pounds ($1.26 billion) to pay claims related to the war in Ukraine, the commercial insurance market said on Thursday, as it recorded a first-half pre-tax loss of 1.8 billion pounds.

Insurtech startup MetaMorphoSys raises $3 million in funding led by Capital2B

Business-to-business (B2B) SaaS insurance startup MetaMorphoSys has raised $3 million in funding led by Info Edge-backed technology fund Capital2B. Angel investors such as Pavitar Singh and Dhruv Dhanraj Bahl participated in the funding.

Ottonova raises 34 million euros

Digital private health insurer Ottonova has closed its Series F financing with an equity raise of €34 million. The current round is led by private equity investor Cadence Growth Capital (CGC). In addition, existing investors and a Munich-based family office are participating.

State Farm invests $1.2 billion in ADT

Home-security firm ADT Inc (ADT.N) has secured an investment of $1.2 billion from State Farm as part of a partnership that it hopes will encourage the insurer’s many customers to buy its smoke detection and anti-intrusion products.

Insurtech startup Fairmatic raises $42 million to innovate commercial auto insurance

The company, co-founded and headed by Israeli Jonathan Matus, has developed AI-powered risk and pricing models that have been trained with nearly 200 billion miles of driving data and tested over five years of operations.

iCover Raises $5 Million in Pre-Series A Funding

The company will use the funds to expand technical staff, sales and marketing, and R&D for its AI underwriting framework and private Blockchain network.

Insurtech Ledgebrook raises $4.2M to provide a best-in-class quoting experience to wholesale brokers

Ledgebrook, an insurtech MGA startup focusing on middle market E&S, has closed a $4.2M seed round led by Brand Foundry Ventures alongside American Family Ventures.

Sequoia India-backed Digit Insurance files for $440 million IPO

Indian insurer Digit has filed for an initial public offering, looking to raise about $440 million even as many of its local peers have deferred plans to list publicly in the South Asia nation.

Modern Life Launches to Public with $15M Funding Led by Thrive Capital

Modern Life (New York), a tech-enabled life insurance brokerage for advisors, announced that it has exited stealth with $15M in seed funding. Thrive Capital (New York) led the funding with participation by founders of Hippo, Plaid, Reddit, Flatiron Health, Newfront, At Bay, Vouch, Cedar, and Lattice.

Buying Cyber Insurance Gets Trickier as Attacks Proliferate, Costs Rise

For many businesses, obtaining or renewing cyber insurance has become expensive and arduous.

Coalition appoints first-ever CFO, names two more new hires

Cyber insurance and security provider, Coalition, has appointed Jim Young as its first Chief Financial Officer (CFO) after raising $250m in a Series F funding round.

Pie Insurance partners with Talage, Bold Penguin, Tarmika

Pie Insurance has parnered with Talage, Bold Penguin and Tarmika as part of the insurtech’s growth strategy.

Function of Risk Management in Insurance

As nations recover from the pandemic and prepare for the next decade of prosperity, insurance companies must reconsider the strategic role of risk.

Insurtech start-up raises $4 million seed

Business insurance platform Mulberri has announced that it has raised a $4 million series seed led by a consortium that includes Hanover Technology Management, MS&AD Ventures, and Altamont Capital Partners.

Axio lands $23M to help companies quantify cyber risk

Axio, a platform for cybersecurity risk evaluation, today announced the closure of a $23 million Series B round led by Temasek’s ISTARI, with participation from investors NFP Ventures, IA Capital Group and former BP CEO Bob Dudley.

Kenyan insurtech Lami raises $3.7M seed extension led by Harlem Capital

Right from the launch of its first product in 2020, Kenyan insurtech Lami Technologies set out to increase insurance penetration in Kenya and the rest of Africa.

Top insurtech funding rounds, July 2022

There were about 33 funding rounds in the insurtech sector between July 1 and July 31, 2022, according to a review by Digital Insurance.

Swiss Blockchain-Insurtech Jarowa Raises CHF 12.4 Million Series A for Europe Expansion

JAROWA has successfully closed its Series A funding round, led by Eos Venture Partners, a strategic venture capital fund focused on InsurTech. The proceeds will be used to further expand JAROWA’s offering throughout Europe.

Insurtech Mulberri raises $4mn Series Seed

Mulberri, a pioneering insurtech and business insurance platform for modern PEOs and brokers, has announced that it has raised a $4 million Series Seed led by a consortium that includes Hanover Technology Management, MS&AD Ventures, and Altamont Capital Partners (via insurance enterprises in its portfolio).

Wallife closes €12m series a round led by united ventures to increase protection from digital risks

Wallife, the Italian insurtech startup that protects individuals from new risks originating from technological and scientific progress in the areas of genetics, biometrics and biohacking, today announced the close of a €12 million investment round led by United Ventures, the Italian venture capital firm specialising in digital technology investments.

Program Data Insurtech Noldor Raises $10M

Funding round for AI-based data platform led by a venture studio headed by New York-based global investment and technology development firm DE Shaw

Thai Life Insurance raises $1 billion via IPO

Thai life Insurance is the first Thai insurance company and one of the largest companies in Thailand. Digital transformation and online distribution channel are currently at the top of the agenda for upcoming investments.

Cinven Raises $1.5 Billion for Dedicated Insurance, Financial Services Fund

Cinven private equity firm has raised more than 37 billion euros since its inception in 1977. Headquartered in London, it now operates internationally across nine locations.

Wefox grabs $400M at $4.5B valuation to buck the insurtech downturn trend

European insurance tech startup Wefox has raised $400 million in a series D round of funding, giving the German company a post-money valuation of $4.5 billion. This represents a 50% increase on last year’s $3 billion valuation at its series C round.

Coalition Closes $250 Million in Series F Funding, Valuing The Cyber Insurance Provider At $5 Billion

Coalition, the world’s first Active Insurance company designed to prevent digital risk before it strikes, today announced it has raised an additional $250 million to accelerate its rapid growth, power international expansion, and broaden the services Coalition offers to help organizations manage digital risk.

Ranger raises $5.25 million

Since departing his role as Casper CEO in 2021, Philip Krim has spent the majority of his time investing and incubating companies via Montauk Ventures. The latest is an insurance company called Ranger, which aims to elevate the agents in the insurance industry, rather than replace them.

YuLife Raises $120M Series C Round, Led By Dai-ichi Life, to Accelerate Global Expansion

Tech-driven insurance company YuLife will use its new capital to fundamentally change how people and businesses around the world derive value from financial products.

French insurtech startup Orus locks in €5 million to reinvent professional insurances for SMEs

In just one year since its launch, Paris-based insurtech startup Orus has raised €5 million. The company is aiming to reinvent professional insurance for small businesses, providing a tailored service to underserved players.

Business insurance startup Upcover raises $2.7 million Seed round

Insurtech startup Upcover has raised $2.7 million in a Seed funding alongside $2 million in debt as it looks to transform the small business insurance sector.

Insurtech startup Konsileo raises £4.7m funding

Insurtech company Konsileo has raised £4.7m in a Series A funding round, with £3.2m provided by previous investors Committed Capital.

French insurtech Stoïk wins Andreessen Horowitz’s backing in €11m Series A

Paris-based cybersecurity insurtech Stoïk has raised €11m in a Series A round led by US investment giant Andreessen Horowitz (a16z) to roll out its hybrid insurance and cybersecurity product in European SME markets.

Home insurer Openly secures $75m funding round

Homeowners insurance provider Openly, has closed a $75m Series C investment as part of its mission to empower independent insurance agents, according to the company.

Laka Gets Series A extension led by Porsche Ventures

Laka, winner of the ‘Best Cycle Insurance Provider’ Award four years in a row has secured additional funding from Porsche Ventures, the venture capital unit of Porsche AG.

Insurtech Startup Wefox Seeks Funding at Over $5 Billion Value

Wefox, the German digital insurer, is in advanced discussions to raise fresh funding at a valuation of $5 billion to $6 billion, people with knowledge of the matter said.

UK InsurTech Startup Instanda Raises $45M

Instanda, provider of a “no-code core insurance platform,” Monday (June 20) announced it raised $45 million in a Series B funding round that was led by Toscafund and included existing investor Dale Ventures.

Munich Re backs Amber Group digital asset cover by Arch & OneDegree

Global digital asset platform Amber Group has secured insurance coverage for its wallet infrastructure from Arch Syndicate 2012 at Lloyd’s and insurtech firm OneDegree, which is supported by a multi-year reinsurance partnership with Munich Re.

Corvus Insurance Appoints Paul Gaspar as New Chief Data Officer

Corvus Insurance, the market-leading specialty insurance MGA offering Smart Commercial Insurance products powered by AI-driven risk data, today announced the appointment of Paul Gaspar as Chief Data Officer, effective immediately.

Bangalore-based Pazcare, an employee benefits and insurtech platform, raises $8.2M

Pazcare, a Bangalore-based employee benefits and insurtech platform, announced today it has raised $8.2 million led by Jafco Asia, bringing its valuation to $48 million. The funding also included participation from returning investors 3One4 Capital and BEENEXT.

Middesk raises $57M to automate business verification and underwriting

Middesk, a platform designed to automate business verification and underwriting decisions, today announced that it raised $57 million in a Series B round.

Branch snags $147M at a $1.05B valuation, showing that thorny insurtech market not impervious to growth

Branch, a startup offering bundled home and auto insurance, has raised $147 million in Series C funding at a postmoney valuation of $1.05 billion.

Overalls raises $4.6 million

Overalls closed a $4.6 million funding round led by RPM Ventures , bringing its total funding to $8.6 million.

Dalma claws on €15 million to unveil superapp for pet parents in France and beyond

The French startup wants to disrupt the traditional pet insurance experience with personalised coverage, fast reimbursement, unlimited live vet chats and support, and charity-driven benefits.

Lumera acquires Ai-London

Strategic acquisition will be instrumental for expansion to the UK and Ireland markets, while investing in Ai-London’s vision to create the world’s first AI-powered PAS and adding award-winning digital engagement to Lumera’s policy administration environment.

Acrisure secures $725m in new funding

Acrisure, a Fintech specialist that operates a top-10 global insurance broker, has closed a $725 million in Series B-2 Preferred Equity funding at a $23 billion valuation, representing a 31% increase from its last preferred equity raise in March 2021.

Air Doctor raises $20 million

Medical care and travel startup Air Doctor has secured $20M in funding for scaling the company globally. This second round of investment capitalizes on the worldwide influx in travelers after the Covid-19 pandemic and will enable the company to enter its next phase of growth.

Lassie pockets €11M for pet insurance app

Any pet owner will be able to confirm it – our pets become part of our family and their health is just as important as the owners. Increasingly, people are becoming pet parents and are prepared to invest in all aspects of their pet’s care – from how they are fed, to insurance, to toys and beyond. It’s meant that a new area of innovation has sprung up – PetTech.

Neptune Mutual raises $5.3 million

Founded in 2021, Neptune Mutual is a marketplace for parametric coverage protection of digital assets against hacks and exploits.

Do you have news you would like to share with the World's Largest Insurtech Community?

Please feel free to send us an email

news@insurtechinsights.com