Technology

Home » Latest news » Technology

We regularly curate the latest insights and reports provided by and in collaboration with our partners and stakeholders to create the largest platform for knowledge-sharing and development within the world’s insurance industry.

Transforming The Insurance Industry With Big Data, Machine Learning, And AI

The future of insurance will be a hybrid model where consumers can choose a digital or traditional experience and gracefully move between these options with ease, convenience, and efficiency.

The ROI of Automation

When people think of automation, and in particular the ROI of automation, they typically think that the return part of that equation is driven primarily by savings realized by cutting costs or faster processing times.

5 Key Ways to Automate Insurance Claims Workflows

Automated workflows ensure insurers keep the ball rolling between critical steps in the claim cycle, bringing both better efficiency and compliance.

The three faces of insurance innovation

Lots of insurers are talking about innovation, but not every insurer means the same thing when they use the term.

How can insurance companies become truly autonomous?

At first glance, the similarities between the Mars landers, and the fraud detection and claims automation services of Daisy Intelligence may not appear obvious but there lies a strong parallel – a shared utilisation of truly autonomous systems.

Taking telematics data collection to the next level

Telematics technology is a “total game changer” for the future of the auto insurance industry.

Insurtech Startup bolttech Raises $180 Million, Valuing Firm at More Than $1B

Insurance tech startup bolttech on Thursday said it raised $180 million in a funding round, led by private investment firm Activant Capital Group, that valued it at more than $1 billion.

How to leverage next-gen apps and data to drive profitability across the insurance value chain

Thanks to digital engagement and emerging technologies like AI, IoT, and machine learning, insurers have more data than ever.

“The insurance industry is still in its infancy with regards to digitisation”: Interview with Getsafe’s CEO, Christian Wiens

There’s no doubt that COVID-19 has been a catalyst for digitisation. We’ve witnessed the rise of fintech, the explosion of edtech and the vast spread of ‘fit-tech’ to keep us moving during the quarantine. But what about the global insurance industry?

AutoClaims Direct partners with Attestiv

AutoClaims Direct, Inc., (ACD) an established auto claims technology and services company to the property and casualty industry, and Attestiv, Inc., a leading media authenticity platform today announced a joint collaboration to bring photo verification and fraud detection to ACD’s CLARITY technology platform.

What does the ‘Amazon’ of insurance look like?

Today we spoke with Apollo’s Jeff McCann and Berkley Canada’s Alexandra Spence about what the ‘Amazon’ insurance experience could look like – from embedded insurance to platform ecosystems, distribution is fundamentally changing.

How insurers are divesting to shift to a digital future

The COVID-19 pandemic is accelerating the transformational trends impacting the insurance sector and highlighting the need to take bolder actions in areas such as digital capability and effective engagement to address the customer’s needs post-pandemic. Over 90% of companies in the sector report that the changing technology and competitive landscape are directly influencing their divestment plans.

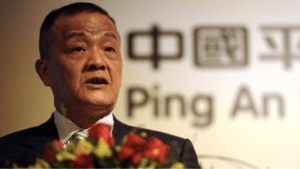

Ping An Chairman Marks 33rd Anniversary of Group with Message: My Thoughts on the New Digitalization

Peter Ma, Chairman and founder of Ping An Insurance, marked the 33rd anniversary of the company with a reflection on the impact of digitalization on human progress and productivity.

Insurance Company Accepting Crypto for Premium Payments

Universal Fire & Casualty Insurance Company (UFCIC) has become the first insurance company to accept cryptocurrency for premium payments.

Why insurtech should avoid incrementalism

It’s 2021 and fintech is more than mainstream. The neo-banks are snapping at the big banks’ heels, Robinhood traders are dominating the headlines, and more mortgages are being done online than not.

French insurtech Hoggo raises €11 million

Paris-based insurtech Hoggo has raised €11 million in a Series A funding round led by Partech with the participation of its existing investor GFC.

How to build truly flexible insurance products

In today’s webinar we discussed the possibilities of digital product development, and how a flexible mindset within teams can drive dynamic, flexible products.

The future clients want to see in auto claims processing

After an initial surge, the number of clients taking advantage of virtual claims processing has dipped. For insurers, now is a critical time to evaluate their processes and figure out how to properly provide a touchless experience, says a recent report.

Digitization, Automation, AI Define Role of Human Agents in Insurance Industry

The digitization of the insurance industry is inevitable but human interaction is still an essential part of the process. Paul Ford, CEO of insurance platform Traffk, explains how the companies that will succeed are those that use data and automation to develop better products and help their agents become advisors.

Greater Than’s AI revolutionize motor insurance underwriting

Greater Than (GREAT), the AI data analytics provider, is taking motor underwriting into a new era. The company’s AI unlocks future cost for accidents per driver, thus providing a time advantage of 12 to 18 months’ over traditional risk models. A time advantage that fundamentally changes how motor risk proactively will be mitigated, managed, and priced.

Is Insurance Missing Out on the Crypto Opportunity?

While the full potential of blockchain is yet to be revealed, its far-reaching applications, in combination with adjacent technologies, has the potential to transform every industry—including insurance.

Ping An Life is Driving Reform to become World-leading Insurer

Ping An Life’s reform is driven by a combination of digital empowerment and a “heartwarming” value system, said Peter Ma, Chairman of Ping An Insurance. Mr. Ma spoke at the 25th Ping An Life Insurance Summit in Chongqing.

How AI Plays Into the Future of Risk Management

Risk analysts have always relied on data to guide decisions toward strong growth potential and away from high-risk strategies. This used to be a fairly linear process, but now that up to 90% of our data is unstructured, information is not only difficult to organize into digestible formats but also produced in volumes that go beyond the capabilities of human analysts aided by conventional data systems.

How automated claims can revolutionise customer and insurer experience

In our latest webinar, we discussed how automation in the claims process can improve customer experience, optimise the efficiency of claims and make insurers’ lives easier.

Digital disruptors to revolutionise Insurtech market in 2021

Digitisation will disrupt the traditional life insurance sector in 2021 as Millennials and GenX embrace financial protection and ‘embedded insurance’ products, according to technology investment bank ICON Corporate Finance which recently secured £5m Series A funding for innovative InsurTech start-up Anorak.

6 Insurtech startups revolutionizing the corporate Insurance landscape in India

The ongoing global pandemic has brought the health insurance industry into the spotlight. Over 80% Indian population does not have any personal health insurance cover and the others are heavily dependent on their employers for insurance and other regular welfare benefits.

insurtech talk with Kamet’s Stéphane Guinet: How to get your insurtech noticed by VCs

This week Stéphane Guinet, founder and CEO at Kamet Ventures discussed the key attributes of startups that can rise above the rest and attract major funding.

Amodo received the Frost and Sullivan’s Technology Innovation Leadership award for 2021

Global market research and consulting company Frost and Sullivan rewarded Amodo with a European User-based Insurance Industry Excellence in Best Practices award.

Digital Engagement Pays Its Way by Opening Supply Chains

Digital experiences that will not only be efficient and resilient, but they will pay for themselves through improved customer and agent engagement and far greater profitability due to smarter risk selection and greater portfolio management.

Insurtech talk with Swiss Re’s Silvi Wompa Sinclair: How reinsurers can bring their underwriting into the 21st Century

This week we spoke with Silvi Wompa Sinclair, group head of portfolio underwriting at Swiss Re Institute, on modern approaches to data, cultural shifts in reinsurance and how incumbent reinsurers can forge effective partnerships with fresh players in the space.

Digital insurer Branch raises $50M VC round

Branch Insurance, the all-digital home and auto insurer that moved to Columbus last year, has raised $50 million in venture capital.

How to leverage data to thrive in spite of a hard market

In today’s webinar, we explored approaches to modernising underwriting, AI and machine learning solutions and how to embed data-driven solutions into the heart of insurance workflows.

Rethinking cyber insurance

Cyber insurance seems smart but risks increasing criminal behaviour and may be an unsustainable business model.

Insurers Invest In Digital For Better Customer Experience: Capgemini And Efma

Insurance Technology Innovations are changing the face of insurance business and making it more dynamic. With the advent of latest technologies, insurers are now not far behind in providing better services and solutions to their clients.

Insurance Technology Innovations

Insurance Technology Innovations are changing the face of insurance business and making it more dynamic. With the advent of latest technologies, insurers are now not far behind in providing better services and solutions to their clients.

Aon using IoT to cover Covid-19 vaccine supply chain is ‘game changer’ says GlobalData

Aon’s specialised cargo insurance product that uses the Internet of Things (IoT) to provide supply chain cover for transporting the Covid-19 vaccine globally is a “game changer” for this line of business, according to data and analytics firm GlobalData.

Is Technology Changing the Insurance Industry?

The obvious answer to this question is, of course, Yes! Technology is always changing industries—always innovating, building, adapting, evolving. In this regard, the insurance industry is no different than any other.

Insurtech talk with Andy Tomlinson, chief operating officer at Cuvva: How treating customers better can fix the insurance trust problem

This week, we spoke with Andy Tomlinson, COO of Cuvva, on how customers are losing out in the current motor insurance equation, and how the industry can adapt to more discerning customer expectations.

Picking up the pace of digital transformation with no-code

Digital transformation in insurance is a complex and challenging undertaking. But most problematic of all – the process is often extremely slow and siloed.

Deep-dive on Cyber-security Insurance: How to go from nice-to-have to business critical

With the threat of cyber attacks looming larger than ever in the minds of business leaders, we investigate the current state of cybersecurity insurance.

Insurtech talk with Janthana Kaenprakhamroy, CEO of Tapoly: Gig insurance solutions for the gig economy

This week we spoke with Janthana Kaenprakhamroy, CEO of Tapoly, about insuring the gig economy, founding an all-digital MGA and the future of platforms in insurance.

Risk-averse insurers need to embrace failure to find success: insurtech exec

Insurance companies, generally risk-averse, are not used to seeing failure — something they need to get used to when they work with insurtechs that are trying to create a better system for them, says one insurtech leader.

Ping An Reports Successfully Completing Initial Close of $200M Fintech and Healthtech Venture Fund

Ping An Insurance recently revealed that it has completed the initial close of Ping An Voyager Partners, LP, which is a growth stage venture fund. Approximately $200 million in commitments have now been made toward the planned $475 million target.

Digital communication helps insurers bridge the relationship gap

Traditional insurers have never faced as much competition for their customers’ attention as they do now.

How to counter the evolving threat of cybercrime

In our latest webinar we discuss the threat of ransomware and cyber-extortion, how to engage SMEs in cybersecurity insurance and integrating cybersecurity into insurance verticals.

Aon, Willis Towers Watson to Sell Group of WTW Assets to Gallagher for $3.57 Billion

Aon plc and Willis Towers Watson have agreed to sell Willis Re and a set of Willis Towers Watson corporate risk and broking and health and benefits services to Arthur J. Gallagher & Co.

SCOR partnership targets new digital health data underwriting solutions

Global reinsurer SCOR is partnering with digital life and health underwriting specialist HealthyHealth to help provide customers with instant underwriting decisions via new data-driven solutions.

New AXA XL CUO appointment for P&C, $2bn valuation for Ethos, Series C funding for Kin

Anish Jadav has been appointed Chief Underwriting Officer for AXA XL P&C in the UK, life insurtech Ethos Technologies Inc. has a more than $2bn (£1.4bn) valuation after a $200m funding round, and home insurtech Kin has raised $63.9m in Series C funding.

Machine Intelligence In Insurance: Insights For End-To-End Enterprise Transformation

COVID-19 has forced consumers and businesses to embrace virtual, contactless transaction modes to minimise infection risks. This trend has accelerated the digitalisation of processes, many of which leverage machine learning (ML) and artificial intelligence (AI).

New unicorn in town: Paris-based Shift Technology raises $220M at a valuation of $1B+

Paris-based Shift Technology is a startup that provides AI-based fraud detection for the insurance industry. In a recent development, the SaaS provider announced that it has raised $220M (approx €182.58M) in its Series D round of funding.

AXA Partners and Insurance2go deal bolsters growth plans

AXA Partners has entered a new deal with mobile phone and gadget insurance provider Insurance2go – this supports the company’s growth plans within its existing brands and markets.

SCOR Partners with Insurtech Snapsheet on Digital Claims Management Solutions

Global reinsurer SCOR has announced a new strategic partnership that will provide its clients with access to an end-to-end claims management platform, digital payments platform, motor virtual appraisal offering, and set of third-party integrations.

The Insurtech Revolution And How It Could Transform The Life Insurance Industry

In a counterintuitive twist, technology can go a long way toward humanizing the life insurance industry.

Kenyan Insurance Tech, Lami Raises $1.8M Seed Funding to Expand its Solution Across Africa

Africa has one of the lowest insurance penetrations in the world. A 2018 study by McKinsey revealed that penetration stands at about 3%. This is significantly lower than the global average of 7.23%.

Christiaan Erasmus, CEO at SLVRCLD: Improving lives with automated content claims

Christiaan Erasmus explains how SLVRCLD are improving lives with automated and digitised P&C claims processes. What trends within the industry are we currently seeing, and what will the future hold?

Ernie Bray, CEO at AutoClaims Direct: Why full automation is short-sighted

Ernie Bray is passionate about technology – he understands why there is so much potential behind AI, machine learning and video estimating. But, he cautions, there is a time and a place for tech. The touchless utopia some in the industry are wishing for has downsides, too.

Aon Launches D&O Exposure Modelling Service

Broker Aon announced today the launch of a shareholder class action exposure modelling service, responding to clients’ need for support to manage the challenging directors’ and officers’ (D&O) insurance market.

How a Digital Mindset in Pet Insurance has Paved the Way for Disruption

Digital disruption stems from initiatives in younger insurance markets, such as the fast-growing pet insurance sector, and we are now seeing traditional insurance sectors successfully adopting a digital mindset in areas such as claims management.

Integrate, Digitise, Transform: 3 Insurtech Trends for the Rest of 2021

Though the insurance industry can be slow to adopt new technologies, with the past year bringing new challenges to businesses, the rest of 2021 is insurtech’s time to shine.

Tencent-Backed Insurance Platform Waterdrop Targets US$360 Million US Listing

Waterdrop, the online insurance and medical crowdfunding platform backed by Tencent, has started marketing its initial public offering (IPO) of up to US$360 million on the New York Stock Exchange.

Want to share your knowledge?

With world’s largest forum for insurance professionals, Insurtech Insights provides an invaluable platform for networking, new insights and exposure for thought leaders. We are always looking for new partners, content creators, and contributors to create value and deliver exceptional support to Insurtech Insights.

To share your knowledge, simply fill out the form.