Technology

Home » Latest news » Technology

We regularly curate the latest insights and reports provided by and in collaboration with our partners and stakeholders to create the largest platform for knowledge-sharing and development within the world’s insurance industry.

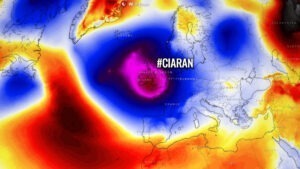

Parametric Offerings Yield Better Service as Estimated Losses From Storm Babet Could hit US$800 Million

As Storm Ciaran continues to batter the UK, PwC UK has forecasted insurance losses stemming from Storm Babet, estimating the range to be between US$550-$800 Million.

Global Cyber Insurance Prices Decline for the First Time Since 2018: Marsh’s Q3 Report

Cyber insurance pricing has witnessed a 2% global decrease in the third quarter of 2023, marking the initial average downturn since the latter half of 2018, as reported by insurance broker and risk advisor Marsh, a subsidiary of Marsh McLennan.

CSAA Enters New Partnership with WTW to Leverage Radar Software Suite

WTW has announced a strategic collaboration with CSAA Insurance Group, leveraging WTW’s cutting-edge Radar software.

LEADERSHIP SPOTLIGHT: Socotra’s CBO Ekine Akuiyibo, Talks AI, Insurance Penetration, and Emerging Markets

Insurtech Insights sits down with Socotra’s Chief Business Officer, Ekine Akuiybo to find out why technology will address California and Florida’s current problems, and how AI fits into the whole equation

Unhackable Insurance: Matt Zagwoski of Beazley Talks Cyber Tech Vulnerabilities

The Consolidated Appropriations Act of 2023, introduced earlier this month impacts all insurers in the US offering the latest data collecting devices.

Guidewire and EvolutionIQ Forge Strategic Partnership to Transform Claims Processes

Guidewire has announced a new collaboration with EvolutionIQ as a new Solution partner on Guidewire PartnerConnect.

Upfort Secures US$8 Million in Series A Funding for Cybersecurity and Insurance Solutions

Upfort, a San Francisco-based cybersecurity and insurance provider, has successfully raised $8 million in a Series A funding round.

AI-Driven DGTAL Launches Intelligent Document Processing Tool, GRABBER

Insurtech firm DGTAL has introduced GRABBER, a cutting-edge Intelligent Document Processing tool, as part of its Software-as-a-Service (SaaS) platform specialising in AI-driven audit solutions for insurance portfolios.

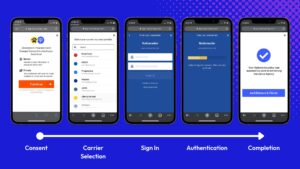

Canopy Connect Raises US$6.5 Million in Series A Led by Nevcaut Ventures

Canopy Connect, the leading platform for collecting, verifying, and monitoring insurance information has announced the closing of a US$6.5 million Series A funding round.

Protos Labs Secures US$2.1 Million in Successful Seed Funding Round

Singapore-based cyber risk management firm, Protos Labs, has triumphantly concluded its seed funding round, raising US $2.1 million (SGD $3 million).

Messagepoint and Unqork Partner to Transform Customer Experiences for Life Insurers

Leading cloud-based customer communications management (CCM) solutions provider, Messagepoint, and prominent codeless platform, Unqork, have forged a partnership to empower life insurers in the pursuit of modernising customer experiences effortlessly, without the need for coding.

Previsico Secures Additional Funding to Drive European Growth and Facilitate US Expansion

ClimateTech firm Previsico, renowned for its live flood alert solutions, has successfully concluded its latest funding round, marking a substantial increase in valuation compared to the previous round in August 2021.

AXA XL Launches Immersive VR Driven Training Solution

AXA XL Risk Consulting has launched AXA Immersive Solutions, a groundbreaking training solution that harnesses the power of Virtual Reality (VR) and Digital Twin technologies.

Arity Partners with Google Cloud to Provide Auto Insurance Customers with Driving Behaviour Data

Arity, a prominent mobility and data analytics company, has officially launched its Arity IQSM network and attributes dataset on Google Cloud’s data exchange platform, Analytics Hub – a platform that empowers auto insurers with enhanced pricing accuracy.

How Telematics is Revolutionising Risk Management for Fleet Managers

James Cowen, Chief Commercial Officer (CCO) at HUMN.ai, discusses how telematics is revolutionising risk management for fleet managers

Prove Secures US$40 Million in Funding for Expansion of Digital Identity Solutions

Prove, a leading provider of digital identity solutions, has successfully concluded a funding round, raising $40 million. The funding round was led by MassMutual Ventures and Capital One Ventures.

Clearwater Report says 90% of Insurers Struggle with Outdated Operating Models

A recent report by Clearwater Analytics, a leading provider of SaaS-based investment management, accounting, reporting, and analytics solutions, claims that up to 90% of insurers are at a disadvantage due to their current operating models, deemed inadequate to meet future business needs.

Lloyd’s Sounds the Alarm: Global Economy Faces US$3.5 Trillion Cyber Attack Risk Over Five Years

Lloyd’s has unveiled a startling assessment of the global economy’s vulnerability to a potential cyber attack, estimating a staggering $3.5 trillion in losses over a five-year period.

Lockton Re Breaks New Ground in Reinsurance Efficiency through Supercede Partnership

Lockton Re has entered into a long-term partnership with Supercede, a leading reinsurance technology provider, to refine its reinsurance data processing.

Hiscox Finds Cyber Attacks Surge on Businesses for Fourth Consecutive Year

A recent investigation by Hiscox has uncovered a disturbing pattern of escalating cyber attacks on businesses, marking the fourth consecutive year of growth in such incidents.

Lloyd’s Introduces Data Tool Revealing US$5 Trillion Impact of Extreme Weather Events

Lloyd’s has launched a groundbreaking systemic risk scenario, unveiling the potential worldwide economic consequences of extreme weather events leading to food and water shocks.

Ukraine Unveils Marsh McLennan-Supported War Risk Data Platform for Comprehensive Analysis

Ukraine has officially launched a data platform, developed with the support of Marsh McLennan, providing a robust tool for insurers, investors, and governments to assess war risks within the country.

China’s Insurance Market Leaps 10 Indexed Places in a Decade, Says New Study from Swiss Re on Digital Adoption

A new report from Swiss Re has found that China has leapt an incredible 10 places, according to the insurance giant’s index on digital adoption – documented in a new report from the Swiss Re Institute.

Aon Revolutionises Reinsurance Claims Processing Through Digitalization with Appian

In a groundbreaking move, global re/insurance broker Aon has undertaken a significant transformation in its reinsurance claims processing, leveraging the advanced capabilities of the Appian Platform

Kita Teams Up with Puro.earth to Introduce Exclusive Biochar Carbon Insurance

Kita, a leading carbon insurance specialist and Lloyd’s of London coverholder, has joined forces with Puro.earth, an ICROA-backed carbon standard.

Insurtech Start-Up Breach Insurance Launches Crypto Shield Pro

Breach Insurance, a Boston-based global insurance underwriter that provides insurance technology and regulated insurance products for the cryptocurrency market, has announced the launch of Crypto Shield Pro – an innovative crypto custody insurance policy for institutional clients of crypto custody solutions.

Majesco Ranked #1 Leader in Quadrant Knowledge Solutions

Majesco has announced that it ranked as the #1 leader in Quadrant Knowledge Solutions “SPARK Matrix: P&C Core Insurance Platform, 2023” and SPARK Matrix: Life Insurance Policy Administration System, 2023” reports.

SkyWatch and Droneinsurance.com Partner to Set New Benchmark in Digital Drone Insurance

SkyWatch, a leader in digital insurance has announced the strategic acquisition of Droneinsurance.com’s assets.

Akur8 Announces Platinum Sponsorship of 2023 Casualty Actuarial Society (CAS) Annual Meeting

Akur8, the next generation insurance pricing solution powered by transparent machine learning, is excited to announce its Platinum sponsorship of the 2023 CAS Annual Meeting for the third year in a row.

AI-Driven Insurtech Reserv Raises $20 Million is Series A Led By Altai Ventures and Bain Capital Ventures

Reserv, a frontrunner in AI-powered insurance claims processing, has successfully concluded its Series A funding round, securing $20 million to enhance its generative AI tools for claims data analysis.

Why Integrative Ecosystems are the Winners of Tomorrow

Laura Kauther, Commercial Director at ELEMENT, discusses why ‘insurers’ will still thrive when the word ‘insurance’ is not relevant anymore.

LEADERSHIP SPOTLIGHT: Teo Blidarus, CEO and Co-Founder, FintechOS, on Simplifying Fintech for All

With a passion for technology and 25 years in the fintech space, Teo Blidarus, CEO and Co-Founder of FintechOS, is on a mission to make financial innovation available to all companies globally. Insurtech Insights caught up with him to find out more.

Blue Marble Partners with Nestlé to Launch Weather Insurance Platform in Indonesia

Parametric insurtech Blue Marble and global conglomerate Nestlé, have partnered to deliver weather insurance to coffee farmers in Indonesia.

CoverGo Secures Patent for its Drag-and-Drop Product Builder

CoverGo, a leader in the global Software as a Service (SaaS) no-code insurance core platform for health, property and casualty (P&C), and life, has secured a patent for its cutting-edge drag-and-drop product builder.

Skyrisks Ltd. Officially Launches, Secures Investment and Capacity from Convex Group

London-based Managing General Agent (MGA), Skyrisks Ltd., specialising in the advanced air mobility (AAM) sector, has marked its official launch, buoyed by a substantial investment and capacity support from Convex Group, a prominent specialty re/insurer.

Resistant AI Collaborates with Instabase to Strengthen Document Fraud Detection for Customers

Resistant AI, specialists in financial crime prevention harnessing the power of AI and machine learning, have announced a strategic partnership with Instabase, a leading unstructured data automation platform.

AXA Uses Advanced AI to Identify RAAC-Affected Customers

In a swift response to potential concerns related to reinforced autoclaved aerated concrete (RAAC), AXA Commercial has harnessed the power of an advanced AI tool, significantly expediting its ability to identify affected customers.

Cancer Detection HealthTech GRAIL Earns a Spot on Fortune’s Prestigious ‘Change the World’ List

HealthTech GRAIL has secured a coveted spot on Fortune’s 2023 Change the World List. This marks the ninth year of the prestigious list, which highlights companies making positive contributions to society through activities integral to their core business.

MGA, Measured Analytics, Launches New Cyber Solution for SMEs

Measured Analytics and Insurance, a prominent cyber insurance Managing General Agency (MGA) based in the US, has introduced CyberGuard 2023, a state-of-the-art AI-driven cyber insurance product designed to fortify the cybersecurity defenses of Small and Midsize Enterprises (SMEs).

At-Bay Appoints Kristie Felton as New Head of Insurance

At-Bay has announced the recent appointment of Kristie Felton as the insurtech’s new Head of Insurance.

INSHUR Partners with Uber to Launch Insurance Products for On-Demand Livery Drivers in Arizona

On-demand insurance platform INSHUR has launched its insurance offering for on-demand livery drivers in Arizona, its second state in the US following its success in New York.

QBE Announces Finalists and Winners in AcceliCITY Resilience Challenge

QBE North America, the global insurance leader helping customers solve unique risks, in partnership with Leading Cities, has unveiled the 10 finalists for the 2023 QBE AcceliCITY Resilience Challenge main track, along with the victors of the property tech track.

USAA Expands Partnership with Resideo to Enhance Home Protection

USAA, a leading financial services provider, has announced an expansion of its collaboration with Resideo Technologies, based in Scottsdale, Arizona, to bolster its commitment to safeguarding homes and optimising efficiency.

Aon Introduces FI Protect 360 Insurance Solution for Financial Institutions

Aon plc has launched its cutting-edge insurance solution, FI Protect 360, in collaboration with esteemed London market insurers.

Chubb and SentinelOne Join Forces to Elevate Cyber Risk Management

Chubb has entered into a strategic partnership with SentinelOne, a frontrunner in the cybersecurity industry. The collaboration aims to revolutionise cyber risk management practices for businesses across the US.

Peppercorn AI Partners with Aurum Solutions to Drive Scalability

Peppercorn, the conversational AI platform designed for the insurance sector, has partnered with Aurum Solutions, specialists in next-generation reconciliation software, to streamline their reconciliation processes.

Bold Penguin Joins Forces with NEXT Insurance to Broaden Product Selections on Terminal

Bold Penguin has forged a strategic partnership with NEXT Insurance, a leading technology-driven insurer specialising in small businesses, with the aim of enriching the range of coverage options available on the Bold Penguin Terminal.

MGA Redline Underwriting Attains Lloyd’s Coverholder Status

Redline Underwriting, a Managing General Agent (MGA), has achieved official recognition as a Lloyd’s coverholder, marking a milestone in its ongoing expansion efforts.

Hexature Announces Acquisition of Insurtech Startup, Vive

Hexure, a leading provider of sales and regulatory automation solutions catering to the life and annuity sector, has officially completed the acquisition of Vive, an innovative startup specialising in quote and e-submission solutions for the life insurance industry.

RLI Boosts Claim Operations with Implementation of Guidewire ClaimCenter on Guidewire Cloud

Guidewire has announced that specialty P&C insurer RLI, a US-based specialty property and casualty (P&C) insurer, implemented Guidewire ClaimCenter on Guidewire Cloud to power its claim operations and enhance the claim experience for agents and policyholders.

Allianz Announces Extended Partnership with Car Subscription Company Fleetpool

Allianz Versicherungs-AG has announced it is expanding its partnership with Fleetpool – one of the largest providers of car subscription models in the B2C and B2B2E sectors in Germany – in a targeted manner to usher in more ESG mobility offerings and support net zero regulations in Germany.

Mulberri Launches Certificate of Insurance Platform for PEOs and Workers’ Compensation Master Carriers

In a groundbreaking move, Mulberri, an innovative AI-driven embedded insurance startup, has unveiled its cutting-edge Certificate of Insurance (COI) platform.

Markel and Cytora Partnership Spurs Remarkable 113% Productivity Surge for Underwriting Team

Markel, a prominent specialty insurer, and cutting-edge insurtech firm Cytora have unveiled the extraordinary outcomes of their collaborative effort, which have led to an astounding 113% increase in productivity (Gross Written Premium per Full-Time Equivalent) for Markel’s underwriting team.

Authentic Secures $5.5 Million in Seed Funding to Unveil Innovative Captive Insurance Platform

Authentic, the turnkey insurance platform catering to vertical Software-as-a-Service (SaaS) enterprises, has successfully raised US$5.5 million in seed funding.

NYC, DC, LA Identified as US Cities Most Iikely to see Unrest in the Next Year, Reveals Verisk

New York City, Washington DC, and Los Angeles are among the major US cities that have the highest chance of experiencing outbreaks of damaging civil unrest in the next 12 months, according to a new predictive data model released by Verisk’s global risk intelligence unit, Verisk Maplecroft.

How Verisk’s SRCC Solution is Insuring Against the Unthinkable

New technologies are enabling businesses to predict a whole new spectrum of risks related to political instability, rioting, strikes, terrorism, warfare and more. Insurtech insights talks to Torbjorn Soltvedt, Principal Analyst at Verisk Maplecroft, to find out how.

NEXT Insurance Launches Coverage Builder for Enhanced Agent Experience

NEXT Insurance, the prominent digital small business insurer, has unveiled a game-changing feature that empowers agents to finely customise coverage quotes, thus better serving the unique requirements of their small business clientele.

Planck Launches First GenAI-Enhanced Underwriting Workbench Solution

Planck has unveiled an innovative underwriting tool named Planck PLUS – a new platform that incorporates advanced Generative AI (GenAI) functionalities, marking a significant milestone in the evolution of underwriting processes.

Hollard Accelerates Claims Processing Through Guidewire Platform

Hollard has successfully expedited its operations with the adoption of the cloud-based Guidewire ClaimCenter. The insurer’s transition to this innovative platform has yielded promising results.

EMPOWERING INSURANCE: Sri Ramaswamy, CEO and Founder of Charlee.AI

From showroom sales to CEO, Sri Ramaswamy, Founder of Charlee.AI, talks to Insurtech Insights about her climb to the top and her passion for insurtech

Want to share your knowledge?

With world’s largest forum for insurance professionals, Insurtech Insights provides an invaluable platform for networking, new insights and exposure for thought leaders. We are always looking for new partners, content creators, and contributors to create value and deliver exceptional support to Insurtech Insights.

To share your knowledge, simply fill out the form.