Thought Leadership

Home » Latest news » Thought Leadership

We regularly curate the latest insights and reports provided by and in collaboration with our partners and stakeholders to create the largest platform for knowledge-sharing and development within the world’s insurance industry.

ShapeShift: On Emerging Field Of Decentralized Insurance

Analysis reviews innovative, decentralized applications that help offset the financial risk associated with decentralized finance.

Seeing Is Believing: The Use of Augmented Reality in Society and Insurance

While augmented reality (AR) has been around for a few decades, the technology to power its widespread use is still fairly recent.

Insurtech Worry+Peace Highlights Value of Negative Reviews

Insurtech Worry+Peace has highlighted the implications of “potential complacency” should the insurance industry fail to embrace negative reviews – it believes customers should not be afraid of leaving negative reviews as they can be a way of problem solving.

Innovate for Insurance Revenues and Profitable Growth

The insurance industry has proven its resilience. Through the disruptions of COVID-19 and massive claims from storms and other catastrophic events, valuations have gradually improved.

Industry Urged to Accelerate ‘Intelligent’ Tech Push

A new report from Accenture says Australian and global insurers should work towards building an “intelligent, data driven” operating model to elevate business performance.

AXA UK Makes Two Leadership Appointments

AXA UK Retail Insurance has appointed Marco Distefano as Managing Director for Motor and Home and Anna Fleming as Chief Operating Officer.

Porsche Says Carmakers See Tech as Key to Customer Acquisition

Steve Jobs trained consumers too well, says Kjell Gruner, the new president and chief executive officer of Porsche Cars North America Inc. And now car companies have a lot of catching up to do to match Apple Inc.’s standards for user interface.

Smart Choice Partners with Cover Whale

Insurtech broker Cover Whale has announced a new partnership with Smart Choice. Under the partnership, Cover Whale’s streamlined truck insurance platform will be open to Smart Choice agents in select states.

Not Just The Ad Industry: Big Data Is Making Insurance Greater Than Ever

Technology is redefining the very way our world works. From general knowledge to private data, we as a cohort have access to more information than any others through the course of human history.

What Makes a Truly Great Claims Experience for Brokers and Customers?

Insurance services are promises that only really get tested in the event of a claim, according to Mark Stephenson, head of business development and market relationships at Liberty Specialty Markets, which is why it makes sense to integrate claims across the entire business.

Digital Trends in The Insurance Industry

The Covid-19 pandemic has ushered in ample opportunities by accelerating the digital transition of tasks that were once considered mundane.

A Mobile-First Life Insurance Built For The Future

Singlife entered the local market in 2020, around the same time the World Health Organization declared the COVID-19 outbreak a global pandemic. Apart from its economic impact, people also feared the expensive medical bills that came with contracting the virus. Armed with advanced insurance technologies, Singlife Philippines quickly pivoted its launch plans and offered Cash for Dengue Costs with a FREE COVID-19 cover.

Video-Based Telematics? Car Subscription Services? The Future of Auto Insurance is Already Here

Increased use of video-based telematics in the commercial fleet space, as well as the evolution of car subscription services, are just two ways in which the Canadian insurance market could change over the next few years.

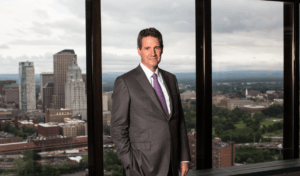

Hartford CEO Optimistic About COVID, Business Interruption Claims, Economy

The Hartford CEO Christopher Swift expressed confidence that the property/casualty insurer has weathered the worst of the COVID-19 pandemic and that related concerns about business interruption claims have become minimal.

Shift Towards Asset-Light Economy is Transformative, Says Flandro

The shift towards an asset-light global economy has been described as transformative by HX Analytics managing director David Flandro, in a Howden report that highlights the rise of intangibles and the subsequent challenges this brings to re/insurers.

The Insurance Protection Gap: What is it and how does it affect the insurance industry and our quality of life?

The insurance industry has been developing fast in the past few years. Companies have been focused on growth and increasing their Gross Written Premiums (GWP), but are facing increasing challenges such as tough competition, a low interest rate environment, growing customer expectations and regulatory scrutiny.

A New Normal for Consumers and Businesses – and a New Normal for Insurers

COVID-19 has placed insurers of all shapes and sizes before a host of unaccustomed challenges. But as vaccines are rolled out and we move beyond the acute phase of the pandemic, there are increasing opportunities on offer as well – where insurers can play a role in addressing the pain points that consumers and businesses face in the new normal.

3 Ways To Solve Inefficiencies In Your Claims Process

In our newly released webinar, The Principles of Claims Efficiency, FRISS and co-founder Christian van Leeuwen teamed up with Karen Mican, Chief Claims Officer at RSA Canada, and Ben Allen, co-founder and CTO at Laka, to answer some of your most pressing questions on claims efficiency.

Data Migration to Cloud Helps Underwriters: Insurers

The increased amount of data cloud providers can provide as more information moves to the cloud will help underwriters write cyber risk and their policyholders in turn, say insurers and a cloud provider.

Telemedicine Crushed It in 2020. Will the Service Be Just as Amazing in 2021?

The pandemic has changed a lot of things — online shopping, at-home entertainment, work arrangements, take out and food delivery — and telemedicine.

How Technology is Changing the Auto Insurance Landscape

AI, blockchain, and just an overall rise in technologies across the planet are changing the way traditional industries are doing business. The wide world of auto insurance is no exception, with disruptive technology from insurtech propelling the industry forward.

Insurance Risk Platform Archipelago Raises $34 Million

Insurance risk platform Archipelago has raised $34 million in funding led by Scale Venture Partners and earlier investors Canaan Partners, Ignition Partners, and Zigg Capital. Principals from Stone Point Capital, along with Prologis Ventures, also participated in the round.

How Digital is Transforming Commercial Insurance for Customers and Agents

Commercial underwriting is inherently complex, and it’s led many insurers to underinvest in technology.

German Insurance Unicorn Startup CEO on Profitability Focus

In 2020, annual funding for insurance startups hit an all-time high of $ 7.1 billion on 377 transactions. This equates to a 12% increase in funding and a 20% increase in transactions compared to 2019. according to CB Insights.

Carbon Limiting Tech Creates New Opportunities for Insurers

Climate change is one of the biggest challenges we face as a society. With climate-related catastrophe losses continuing to climb, insurers are in a unique position to recognize just how high the stakes of climate change truly are.

Willis Towers Watson Commits to Net Zero by 2050

Re/insurance broker Willis Towers Watson (WTW) has announced a set of measures aimed at reducing carbon emissions across its business operations, with a target to deliver net zero greenhouse gas emissions by 2050.

How AI Can Turn Insurance On Its Head by Helping Customers to Proactively Manage Their Risk

In recent years and particularly during the Covid-19 pandemic, we have started to see a rise in businesses using artificial intelligence (AI) to improve their service or products and ensure a seamless, transparent customer experience.

Munich-Based insureQ, a Digital Insurance Platform for SMEs & Freelancers, Raises €5 Million

Today Munich-based insurtech insureQ announces raising a €5 million seed round led by Nauta Capital, with existing investors Flash Ventures and GFC also participating.

What Does Insurance’s Digital Future Hold for Actuarial?

Insurance markets are competitive (and getting more competitive with new market entrants), and insurance products are complex (and getting more complex with changing customer expectations).

The Insurance Industry is Realizing We’ll Never Go Back After Digitalization

Touchless digital insurance, for years a mirage somewhere in the future for the insurance industry, is here to stay thanks to Covid-19. High-growth breakout successes of the past few years such as Lemonade, Hippo, Next, Root and–if I may be bold, my company Neptune–highlight how innovation in the use of data can change every aspect of the insurance supply chain.

11 Digital Trends in the Insurance Industry

Most all players in the insurance sector are digitising – some more seamlessly than others. This phygital (meeting of the physical and digital worlds) trend is becoming omnipotent, with a blend of automation and human expertise now the norm.

Insurance 2030: The future isn’t what it used to be

The pandemic has changed everything. Well, not everything… but it has changed many aspects of the lives of individuals and families and has had far-reaching effects on businesses in every industry.

Why Partnerships are the Future of insurance

As the world prepares for a post-COVID recovery, Insurtech Insights’ Kristoffer Lundberg and Bradley Collins lay out their vision for the future of the industry

Lloyd’s Lab Innovation Program Choses 11 InsurTech Startups for Next Cohort

Lloyd’s announced the next 11 InsurTech start-ups that are participating in the sixth cohort of its Lloyd’s Lab innovation accelerator program.

Lloyd’s European CEO Rottiers to Depart, Amélie Breitburd Succeeds

Lloyd’s of London has announced the departure of Sonja Rottiers from her role as European Chief Executive Officer, with Amélie Breitburd set to step into the position.

Forget COVID-19, It’s Time to Start Insuring The New Normal

If you’re reading this, you successfully made it through your first year of COVID-19. Like a dependable four-wheel drive, the insurance industry kept itself on the road over the past year’s many first-of-their-kind hazards: remote-working mandates, the evaporation of face-to-face channels, mass event cancellations and a slew of Business Interruption claims, to name a few.

2021 To Mark “Generational Transformation” for Re/Insurance: Conduit Re’s Carvey

Trevor Carvey, Chief Executive Officer (CEO) and Chief Underwriting Officer (CUO) of newly launched P&C reinsurer Conduit Re, has said that he expects 2021 to mark a “generational transformation” in the way the re/insurance industry operates.

Why Insurance Firms Need to Adopt Open Data

Johanna Von Geyr, partner and EMEA lead banking, financial services & insurance at ISG, explains why insurance firms need to adopt open data.

Chubb CEO Greenberg Reiterates Call for Litigation Reform

Chubb Chairman and CEO Evan Greenberg is reiterating a call for litigation reform nationally and at the state level to address what he said is a “systemic” worsening of the legal environment and its harmful impact on the insurance industry.

Insurance startup Clearcover raises $200 million from Eldridge, others at $1 billion valuation

Clearcover has raised $200 million in fresh capital as part of a late-stage financing round led by Eldridge, the investment firm helmed by Los Angeles Dodgers owner Todd Boehly, the digital car-insurance startup will announce on Tuesday.

How Insurance is Modernizing On-Demand Generation

Over the past ten years, the world has become increasingly on-demand in order to cater to the preferences of Gen-Zs and millennials. The on-demand generation refers to being able to order things easily and quickly as the need for them arises. Examples of on-demand services that are currently dominating the world including Uber (rides), Airbnb (housing), and Instacart (groceries).

Is Standardisation the Key to Building Customer Loyalty?

Coronavirus has turned a spotlight on the insurance industry’s failings, now insurers must be bold to rehabilitate reputations and regain trust

Munich Re’s 2020 Cyber Risk Report Sheds Light on Cyber Insurance Inadequacy

The COVID-19 pandemic exacerbated the threat and likelihood of cyber security breaches for organizations, Munich Re’s 2020 cyber risk report found. Despite the growing risk of cyber attacks, its insurance coverage products and services are still failing to catch up.

How Argo Group Innovates: Q&A with Ian Macartney

IIR talks with Ian Macartney about the specialty insurer/reinsurer has accelerated its transformation journey with grass roots innovation and an Enterprise Solution for digital transformation.

Accenture AI Expert on How First Principles Prevent Problems

As more organizations begin employing AI in production environments, it’s clear not everyone has completely thought through how AI will fundamentally change their business.

Think 24-Year-Olds Don’t Influence Insurance? Think Again

As GenZ becomes more influential as consumers, their expectations for services and interactions will include many AI-based offerings. Add the purchasing power of the Millennial generation with that of GenZ, and all businesses must evolve to meet these collective expectations for technology.

Thirty UK Insurtech Companies to Watch Out for in 2021

The insurtech sector has emerged as one of the most significant players in the UK’s fintech industry, continuously reaping investments, even amid a myriad of economic disruptions caused by the pandemic.

The Future of AI in Insurance

Artificial intelligence (AI) and machine learning have come a long way, both in terms of adoption across the broader technology landscape and the insurance industry specifically. That said, there is still much more territory to cover, helping integral employees like claims adjusters do their jobs better, faster and easier.

Lemonade & 12 More Insurtech Companies You Should Know In 2021

Insurance has always been a valuable option for those looking to protect themselves from potential threats, and the pandemic has even further reenforced the importance of preparing for the unexpected. However, some customers have been deterred from enrolling in insurance coverage with traditional companies, due to barriers like complicated coverage options and unclear eligibility requirements.

Tackling the Talent Crisis in Insurance

The coronavirus pandemic has highlighted how insurance can operate in a new way and excel, and it must now capitalise on new opportunities or risk losing out on a generation of talent

The Next Generation of Insurance: Personalization, Platforms and Data

By leveraging platforms, modernizing their data use and adapting their portfolios, insurers will be well-prepared for the world that awaits us post-COVID.

Reinsurance Management Tech Critical for Carriers: Sapiens’ Greenberg

Technologies to help manage and automate the reinsurance ceding are becoming increasingly critical for insurance carriers, according to Martin Greenberg, Reinsurance Product Manager for Sapiens, a global provider of software solutions for the insurance industry.

Trov Technology Enables A New Wave Of Consumer Brands To Offer Digital Renters Insurance

New UK brands include Lloyds Bank, Love To Rent, Moovshack, OpenBrix, Utilita and Movinghub, with many more to come in 2021

Embedded Insurance Helps Merchants Avoid The ‘Protection Gap’

Whether they know it or not, consumers have been the beneficiaries of embedded insurance, a trend that’s moving beyond simple eCommerce payments and has recently made its debut in the logistics sector.

3 Ways Technology Is Reshaping Insurance in 2021 and Beyond

As technology has reshaped the world in recent years, it’s also become an integral part of the financial industry. The emergence of financial technology companies, or fintech for short, has changed the way we spend money, take out loans, and track our budgets.

5 InsurTech Trends To Follow In 2021

The insurance industry isn’t exactly synonymous with “cutting edge,” but that’s changing thanks to modern technology. Insurtech is completely upending the way the insurance companies operate and how consumers access coverage.

Lemonade CEO: Why Regulators Need to Engineer Equity in Insurance Prices

CEO of Lemonade, Daniel Schreiber says: It takes a one-two punch to make insurance fair. I’ve previously argued that AI can vanquish bias in insurance, and so it can. But while machine learning can help ensure equality, it cannot ensure equity. It might even make it worse.

The Evolution Towards Continuous Underwriting

New generally available release includes features that provide major quality of distributor performance improvements for carriers looking to optimize and expand distribution channels.

How to Ensure Your Board’s Cyber Risk Readiness: Tips from AIG’s Rich Baich

This RIMS session weighs in on how all corporate boards can prepare themselves for any cyber risk that may occur.

Astorya, Search Engine for Insurance and Banking Tech, Reviews 10 Years of Insurtech in Europe

Astorya.io, which aims to serve as the search engine for Insurance and Banking technologies, has published a blog post, titled InsurTech Europe: 10 Years Of InsurTech In Europe Analyzed Through 800+ Startups (based on data from astorya.io).

Do you have news you would like to share with the World's Largest Insurtech Community?

Please feel free to send us an email

news@insurtechinsights.com