Thought Leadership

Home » Latest news » Thought Leadership

We regularly curate the latest insights and reports provided by and in collaboration with our partners and stakeholders to create the largest platform for knowledge-sharing and development within the world’s insurance industry.

Juggling Act: Modernising Core Platforms for P&C Insurers

One of the most crucial issues facing insurers is how to modernise their core platforms, which in most cases are unfit for the digital age.

How Insurers will use AI to Provide Cover

Covid-19 has caused consumer interest in protection products to rise significantly, while insurers have had to respond quickly, and rapidly gear up for home-working.

The Role of Platform Protection Insurance in the Sharing Economy

The rise of the sharing economy has dramatically reshaped marketing thought and practice. The projected revenue from sharing accommodations and transportation alone will surpass $335 billion in 2025. The recent initial public offerings of Uber and Lyft exemplify this remarkable growth.

2021: The Great Reset in Insurance

A shift toward greater corporate and social responsibility and empathy in general is underway, and 2021 will bring a great global reset.

Innovating Our Way Out of a Crisis

Any requirement, process, delay or regulatory cost that does not serve insurer solvency or consumer protection should be on the table for retirement.

Sustainable Insurers need to Build Strong Ecosystems

Sustainability ecosystems enable insurers to call on the resources and skills of a network of partners committed to building a sustainable future.

How has the Pandemic Impacted Commercial Insurance Digital Strategy?

The unexpected, unprecedented events of 2020 have turned the world upside down. Like every business sector, commercial lines insurance has had to adapt and adjust throughout the year.

Why War Exclusions Need to Evolve for Cyber Insurance to be Effective

Insurance can act as a key tool in addressing pervasive cybersecurity vulnerabilities, but, according to one report, “Cyber insurance is not yet mature enough to fulfill its potential, partly due to uncertainty about what kinds of cyber risks are, or can be, insured.”

Insurers Urged to Provide Flexible Auto Insurance Options to UK Students

Insurtech company Cuvva is urging the insurance industry to make their coverage options more flexible for UK students travelling back home for Christmas.

Framework for Better Comparative Ratings

For insurers that wish to compare their quotes with competitors, existing platforms and tools are insufficient.

Swiss Re’s Kleiterp Urges Re/Insurers to Share Tech Insights

Fred Kleiterp, Regional CEO for the EMEA region at Swiss Re Corporate Solutions, has expressed optimism about the prospects for the global re/insurance industry if it is able to “work together and share technology to innovate.”

3 ways AI can transform auto insurance customer experience

It’s safe to say we have our physician, babysitter, personal trainer and dog walker on speed dial. But it’s unlikely that the average auto insurance customer knows the right number to call to reach their carrier in the chaotic moments following an accident.

How Insurers Can Achieve Greatness

If insurers can summon the will to protect the public by providing disposable face masks, then insurers will achieve greatness.

Is this the Future of Motor Insurance Claims in the Gulf?

Braxtone Group unveils new motor claims recovery platform after graduating from regulatory sandbox of Bahrain Central Bank.

Who Is Liable When a Driverless Car Crashes?

How should insurers think about the liability for AVs? Using history as a guide, it’s possible to make reasonable guesses at some of the answers.

Generali CIO on How Insurers can Make their Digital Transformation Work

In insurance, as in so much of life, timing really is everything. This has only become clearer during the COVID-19 pandemic which saw those companies which had already embraced remote working and digital communication channels reap the rewards of this investment when lockdown hit.

Tesla, GM, Amazon: Industry Intruders that Insurers Need to Keep an Eye On

It’s not just tech behemoths who are invading the turf of insurers these days and giving the industry a run for its money.

InsurTech is Helping to Drive the Digital Evolution of the UK Motor Retail Industry

If the last nine months have made anything clear, it is that the pandemic has fundamentally changed both buying and driving habits for UK motorists. The latest Tempcover research has revealed that online-only used car sales had increased fifteen-fold during the pandemic among 2,000 survey respondents.

Smart Contracts in Insurance

Smart contracts will likely be used first for simpler insurance processes like underwriting and payouts, then scale as technology and the law allow.

Re/Insurers Misjudged Pandemic Response: Swiss Re’s Mumenthaler

According to Swiss Re CEO Christian Mumenthaler, the re/insurance industry vastly underestimated the cost of a global pandemic due to its failure to account for the extent of government lockdown measures.

10 Steps to Achieving Insurance Data Literacy

Peter Jackson, Legal & General: When I was asked to write an article on big insurers and their digital transformations, I had to hit the pause button right from the outset to make the clear, if underappreciated, distinction between digital literacy and data literacy.

A New Industry Model for Insurtech

Insurance companies should pay close attention to insurtechs—not because they’re coming to attack, but because they’re coming to collaborate. For established insurers, insurtechs can be digital enablers that drive the adoption of digital technologies along the value chain.

How to Rework Insurance Data Models

Efforts to rework existing data models come down to the very same question that is asked for reworking most existing systems: retrofit what exists or start over with a clean slate?

Car Insurance Must Evolve for Autonomous Vehicles

Connected vehicles, especially fully autonomous vehicles, are going to profoundly change the nature of car insurance – particularly the ways in which insurers assess risk and set premiums

Using Payments to Improve the CX

Simply having an online payment option does not mean your organization is automatically providing a positive user experience

Which AI Techs are most Valuable in P&C?

Artificial intelligence technologies are everywhere. The great leap forward in AI over the past decade has come along with an explosion of new tech companies, AI deployment across almost every industry sector, and AI capabilities behind the scenes in billions of intelligent devices around the world. What does all of this mean for the personal lines insurance sector?

OnStar: Next Step for OEM Partnerships

Insurers hope to create a new way to collect driving data that’s easier for the driver than installing a device or downloading an app

How Insurance Companies can Adapt to Increased Remote Work

The need for employee engagement cannot be overstated. More engaged employees, according to a Stanford University/Ctrip survey, are more satisfied with their jobs. It also boosts productivity

How AI Transforms Risk Engineering

“AI could contribute to the global economy by 2030, more than the current output of China and India combined.”

ESG: Doing Well by Doing Good

Insurance is at the forefront of the environmental, social and governance movement, which may usher in a Second Age of Enlightenment

If your Innovations are Unknown, you May be Underrated

Amid the economic turmoil of 2020, we’ve heard a lot about pricing adjustments on existing insurance products and about product innovations aimed at addressing new areas of risk

Health Insurance Providers Must Prioritise Digital Services for Super-Efficient Post-Covid-19 World

The Covid-19 pandemic continues to have an impact on every industrial sector as businesses and societies worldwide grapple with an ever-evolving situation. While some industries will be looking to embark on a recovery in the short-term, the Covid-19 impact on the healthcare sector will be long-lasting.

Insurance has Evolved from a Product that is Sold to One that is Bought

Over time, insurance has evolved from a product that is sold to a product that is bought, according to Christian Bieck, global leader of the insurance practice for the IBM Institute for Business Value, a research organization that provides thought leadership based on primary data and real-life case studies

Why Insurance Needs Tesla’s Autopilot Too

Digitization is the industrial revolution of the 21st century. What does this mean for a data-driven industry like insurance? The answer is simple: Turn everything on its head and reinvent yourself under high pressure- the future of insurance is digital

What Does 2020 Tell Us About InsurTech Opportunities in 2021?

With the pace of change InsurTech has driven—and which COVID-19 has accelerated—the competitive pressure for insurers to change has grown proportionately more intense

What Does Successful Claims Innovation Look Like?

As insurance technology advances, carriers must focus on customer pain points and allow them to drive efforts to find solutions

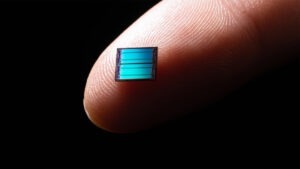

5G: Revolution or Exaggeration?

The race to fifth-generation (5G) wireless technology is on, with governments around the globe scrambling to support it. If they don’t, many industry experts believe, they risk losing out on the futuristic opportunities that 5G could make possible, from self-driving cars to smart cities that can point vehicles to the clearest roads. These advances also promise significant economic incentives: A 2019 study from IHS Markit predicts that by 2035, 5G will create 22 million jobs and generate $3.5 trillion in economic activity globally

How COVID Alters Consumer Demands

Digital transformations that would have taken three to five years are now happening in under six months

Telematics can Help Control Rising Insurance Costs

The most effective way fleets can control their insurance costs in a hard market is to leverage telematics to drive out risky driving behaviors

4 Initiatives That Unlock IoT’s Value

Technology promises to free agents to spend more time with clients and prospects, broadening and deepening relationships

Transforming claims: Keep the Customer Satisfied

Keeping customers informed requires systems that can clarify the different stages of the claims process, determine what’s needed and calculate what will happen next – and can deliver that information in a way that the customer can understand

The New Innovator’s Dilemma in Insurance

Here are the challenges insurance incumbents face in securing the tools needed to better keep up with our changing world.

Innovation Comes to Risk Engineering

“From now on, nothing in risk engineering will ever be constant BUT change. If you can’t get used to constant change, you’d better leave.”

How Lloyd’s Underwriters Are Viewing Today’s U.S. Property Insurance Environment

While the COVID-19 pandemic has slowed business activity around the globe, for underwriters in the Lloyd’s market who were in the process of increasing property insurance rates when the pandemic hit, the timing may be auspicious.

Re-engineering Claims Payments

A recent survey found that 42% of consumers would be more likely to stay with an insurer that pays approved claims within minutes.

Life Insurance Next for Lemonade: Auto on the Horizon

Lemonade plans to start selling term life insurance in the next 90 days, adding to its current rental, homeowners and pet insurance offerings, the company said in an earnings report released late Tuesday.

Insurtech Revolution is Disrupting the Market

As the tech giants and startups enter the insurance market, are we witnessing the beginning of the decline of the traditional insurance giants?

Are Pay-Per-Mile Policies Here to Stay?

Without a daily commute for the foreseeable future, consumer interest in pay-per-mile coverage is on the rise.

Big Insurtech Opportunities for Carriers Entrenched in the Cloud

Insurers that have successfully shifted to the cloud are set to capitalize on a surge in insurtech alliances triggered by the COVID-19 pandemic.

How AI Can Tackle Claims Staffing Gap

A job description with “acquire AI superpowers” might appeal to millennials more than “study policy footnotes and calculate claim reserves.”

NPS Scores Provide 3 Keys to Growth

Automation, analytics and the right ecosystem of partners can drive up customer satisfaction and let carriers grow in these chaotic times.

Could Traditional Services Firms Out-Compete Amazon?

When I was a schoolboy, I would make a little extra pocket money by buying Creme Eggs in bulk from the local cash & carry and then sell them at a 100% profit margin in the school playground. Fast forward 30 years and it’s my daughter’s turn, albeit she is now designing, sewing and selling Covid face masks (and has launched on Instagram too). Whilst her profit margins aren’t as good as the ones I made on Creme Eggs, her online presence means she has the reach and potential to earn a lot more pocket money than I did.

Powerful Cloud Services will Drive Ecosystem Innovation

Carriers that recognize and make use of the innovation capabilities that cloud services offer will outpace their competitors in the race to build expansive ecosystems. With enhanced agility and reach, they will seize many of the lucrative opportunities likely to spawned by ecosystems in the next few years.

Man vs. machine? How Automated Machine Learning will Evolve Actuaries

Gort. The Terminator. Wall-E. HAL 9000 …and AutoML? Popular images of artificial intelligence can terrify, inspire, and amuse us – but the real thing, AutoML (automated machine learning or AML), often just confounds us.

The Unique Threat of Tech Companies in Insurance

For years, the established insurance industry has viewed insurtech start-ups as disruptors. And rightly so—they are nimble, responsive to customer needs and built on modern technology.

Uber Eats, Grubhub and Other Delivery Drivers Need Insurance Coverage, So Why Won’t Regulators Mandate It?

As businesses have had to adjust how they transact with patrons in an effort to curb the spread of the novel virus, on-demand delivery drivers

Technology Takes a Front Seat in Claims Handling

The COVID-19 outbreak has changed, among other things, the way we work, travel, and socialise; in the world of insurance, one aspect that has been

To Build or Buy Insurance Tech? Brokers Have Their Say

Do we build or do we buy? It’s the question that all insurance brokers must ask themselves when working out their digital strategy. There are

How AI Powers Customer Contacts

Existing and prospective customers now expect prompt, appropriate answers via the channel of their choice, or they may look to your competitors. For insurance carriers,

Transforming the Claims Space

Paying claims needs to be the default, with AI and analytics ensuring that adjusters spend their time more valuably and have more interesting work. Fundamentally,

Do you have news you would like to share with the World's Largest Insurtech Community?

Please feel free to send us an email

news@insurtechinsights.com