Within a week of announcing its expansion into auto insurance, Lemonade (New York) announced its planned acquisition of Metromile (San Francisco), the data/tech-focused pay-per-mile pioneer and now insurance technology vendor with the recent launch of Metromile Enterprise. The companies made a definitive agreement whereby Lemonade will acquire Metromile in an all-stock transaction that implies a fully diluted equity value of approximately $500 million, or roughly $200 million net of cash. Following stockholder and regulatory approval, Metromile’s shareholders will receive Lemonade common shares at a ratio of 19:1, according to Lemonade’s announcement of the agreement.

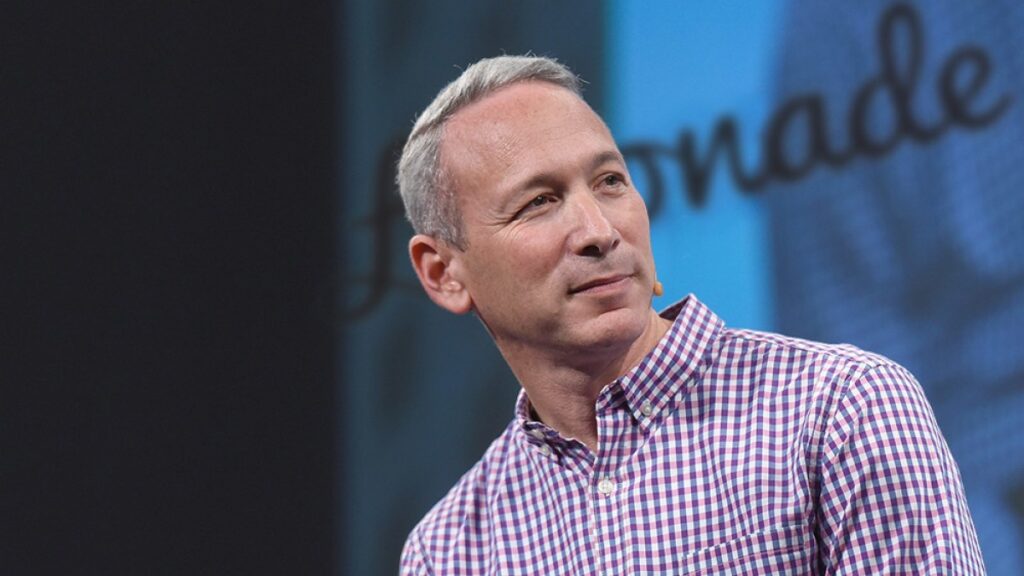

In that statement, Lemonade CEO Daniel Schreiber stressed Metromile’s complementarity to its new auto business, Lemonade Car. The new Lemonade auto product is powered by telematics and architected to learn from the data it generates, with precision pricing as its ultimate destination, and that’s where Metromile comes in, Schreiber says. “They have been down this road billions of times, and their proprietary data and machine learning algorithms can vault us over the most time and cost intensive parts of the journey. In a vast and competitive market like auto insurance, today’s deal is a huge unlock of value for our customers and shareholders.”

Metromile also comes with 49 state licenses, over $100 million of seasoned in-force premium, over $250 million of cash on its balance sheet, along with a team that has developed expertise in using big data and AI for car insurance. Metromile Enterprise is included in the acquisition agreement, according to a Lemonade source.

A Good Match

The acquisition will give Lemonade the opportunity to expand its offering and provide a well-rounded set of products to customers, according to Karlyn Carnahan, head of Celent’s North American Property Casualty practice. “Lemonade’s reliance and focus on data to drive their underwriting and processes meant that any acquisition target would also have to be a heavily data driven insurer to fit with their culture and business model.”

Metromile fits that bill, according to Carnahan, given that the company has a long history of the creative use of data in the underwriting process. “And of course, the additional value of new licenses, and new customers can’t be overlooked,” she adds. “But to truly generate value, Lemonade will need to find a way to use the Metromile data to drive insights and efficiencies across the Lemonade customers—and vice versa. They have an impressive set of data scientists between the two companies who are likely salivating over the data each company has available.”

Comprehensive Offering

Forrester senior analyst Jeffery Williams sees Lemonade’s acquisition of Lemonade as falling within a solution-focused trend addressing customer appetite for one-stop-shopping for financial products. “Companies that sell limited products and services will thrive, but companies that sell comprehensive packages will dominate markets and maximize their operating leverage,” Williams predicts.

Forrester’s survey data shows that the top three reasons customers buy additional products from their auto insurers are cheaper rates, easier multipolicy management, and trust in the provider. I”nsurers that provide comprehensive solutions can leverage deep customer relationships to reduce buying frictions and expand margins—in part through lower average customer acquisition costs,” Williams explains. “Lemonade understands this opportunity as it underpins its growth approach and its interest in Metromile.”

The Metromile acquisition also signals Lemonade’s maturing into a new perspective on growth, according to Williams. Upon launch, organic growth and product diversification was a logical focus, he says. The company developed and offered renters insurance and, shortly thereafter, pet insurance. Early this year, Lemonade began selling life insurance through Bestow’s API, using a partnership (embedded insurance) approach to spur growth.

“Now it’s purchasing Metromile to add to its multifaceted growth model, gaining scale in the business while meeting the needs of the customer,” Williams says. “Lemonade’s focus on Millennial customers is smart, and its strategy to provide comprehensive, affordable solutions beneath one umbrella will benefit the customer experience.”

Acquiring Metromile is a good move for Lemonade as it allows the company to expand its reach from writing insurance policies in one state to being licensed to do so with a telematics product in 49 states, according to Kaenan Hertz, Managing Partner, Insurtech Advisors LLC. “This is a leapfrog move that will allow them to rapidly grow,” Hertz comments. “Additionally, they gain an enterprise sales strategy that has been marketing Metromile’s claims handling technology on a SaaS basis.”

However, cautions Hertz, Metromile’s market cap is now $390M. “It’s down more than 50 percent from its IPO price of $956M,” he says. “Lemonade is paying a premium, which might not be too big of a problem except Metromile and Lemonade are still losing millions of dollars per quarter.”

Money Pit

In the first half of 2021, Hertz notes, Metromile and Lemonade’s combined net loss was $250M. “So, in the end, we have one money-losing insurtech buy another money-losing insurtech, only to have the combined insurtech be a bigger money pit,” he says.

Hertz notes that incumbent carriers have huge resources to resist disruption, but that consolidation within the insurtech realm will likely be a factor in long-term competition in the sector. Hertz speculates that the greater insurtech market opportunity might be with Root. “Hippo currently has a program in place to combine their home insurance product with Metromile’s car insurance,” he elaborates. “I suspect Hippo is looking for a new car insurance partner. Root is larger and more established, and the combination with Hippo might be even better for both companies.”