The start-up is among four purely online insurers that started operations last year as part of a push by the Hong Kong Insurance Authority to promote the use of more technology by the insurance sector to reduce costs and enhance services. Such companies can only use the internet and apps to sell their products and cannot hire agents.

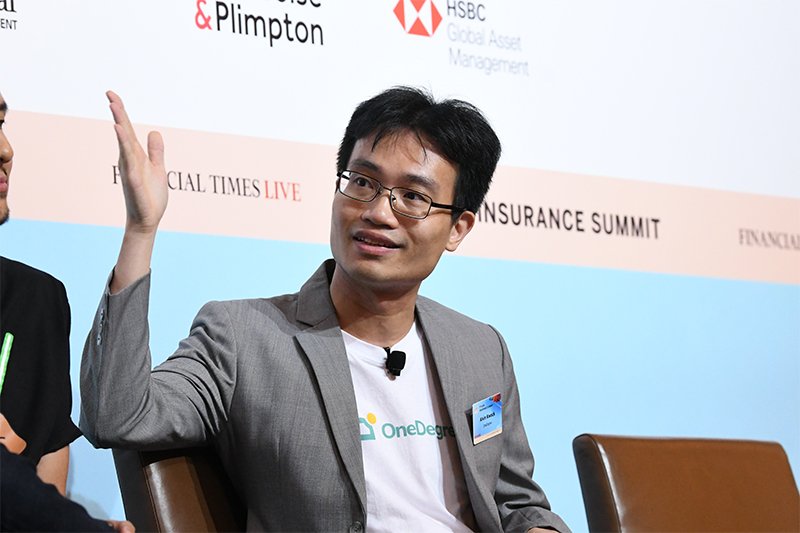

“The success of our fundraising exercise indicates investors are still confident about digital insurance start-ups in Hong Kong,” said Alvin Kwock Yin-lun, OneDegree’s co-founder and a former JPMorgan banker.

Webinar: How to create the Netflix Insurance experience. Sign up here!

The company is, in fact, just the latest Hong Kong start-up to announce its fundraising plans over the past seven days, which suggests that the city’s firms remain attractive to investors despite Beijing’s regulatory crackdown, which has since July created a lot of volatility in the stock markets in Hong Kong and mainland China.

For instance, DayDayCook, a Hong Kong-based recipe hub founded by Norma Chu, an online influencer and former HSBC banker, said on Thursday last week that it would list in the United States through a merger with a New York-listed special purpose acquisition company (SPAC). A day later, Hong Kong logistics company GoGoX filed to go public in the city.

“China’s regulatory crackdown may have led to a sell-off in Hong Kong and mainland stocks recently, but investors still believe in the long-term development of the country,” said Robert Lee, vice-chairman of industry body Hong Kong Securities Association. “In addition, the latest tightening has led companies rethink going public in the US, with more planning to list in Hong Kong instead,” he added.

Hong Kong logistics company Lalamove was considering shifting its planned US$1 billion initial public offering to Hong Kong from the US, according to a Bloomberg report last month, against the backdrop of Beijing’s crackdown.

Kwock said OneDegree would keep an open mind about going public, and that it would like to develop its business on a larger scale first. The proceeds from its latest funding round will be used for developing new products and markets, and doubling its headcount in the next one year to more than 300 people.

The online pet insurer has now conducted four fundraising rounds since its establishment in 2016, bringing its total funds raised till date to more than US$70 million.

It attracted new investors such as Sun Hung Kai Strategic Capital and AEF Greater Bay Area Fund, while existing investor BitRock Capital also increased its investment.

The company currently has 90,000 customers and is known for its core pet insurance products. OneDegree also sells products through partners in Shenzhen, Singapore and Taipei, and is building partnerships in Europe as well.

“China has 100 million dogs and cats, while Hong Kong has over 600,000 pets. The pandemic has led more people to raise dogs and cats after being forced to work from home. The demand for pet insurance is huge,” Kwock said.

He added that OneDegree will develop other personal medical insurance and general insurance products. “We aim to develop OneDegree to be among the top three general insurance companies in Hong Kong by 2025,” he said.

Source: South China Morning Post