The early autumn storms have left the UK susceptible to flooding, causing substantial property damage, power disruptions, and fatalities.

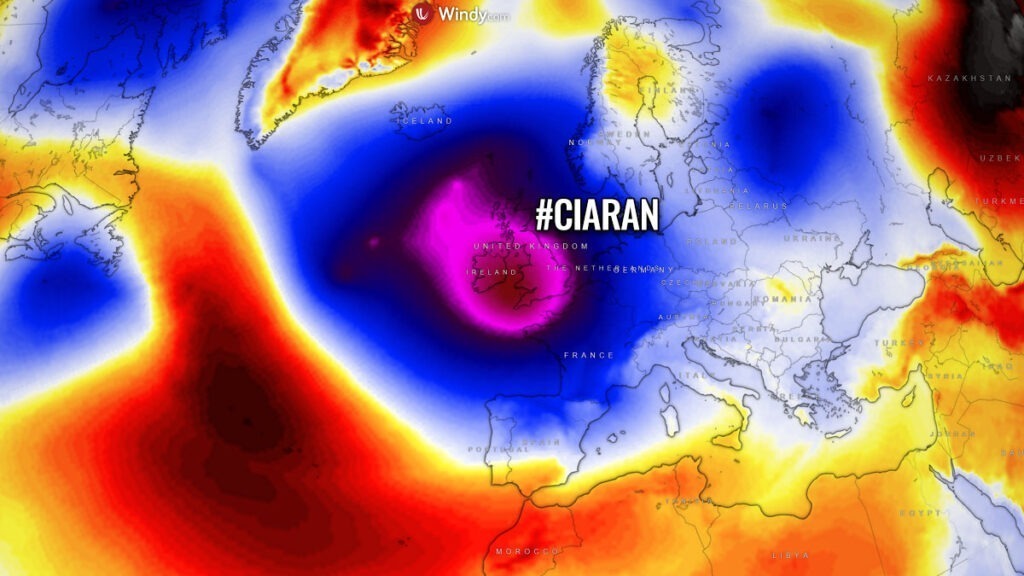

Mohammad Khan, General Insurance Leader at PwC UK, said the widespread damage inflicted on residential and commercial properties, contributing to the projected insurance losses within the specified range. The aftermath of Storm Babet raises concerns about potential exacerbation due to the more recent Storm Ciarán, which could further impact the already affected regions and extend its repercussions to the French insurance market.

In a recent statement, Dr. Eugenia Cacciatori, Senior Lecturer in Management at Bayes Business School, highlighted the need for a comprehensive integration of insurance within the UK’s resilience landscape. Dr. Cacciatori highlighted the urgency for insurance schemes to be more accessible and seamlessly integrated into broader resilience strategies to effectively address the escalating threat posed by weather-related disasters.

Drawing attention to successful models, she cited Switzerland as an example, where insurers actively participate in discussions related to construction and resilience. Dr. Cacciatori urged the adoption of such a mindset in the UK to mitigate the severe impacts of flooding and other natural disasters.

She said: “Integrating insurance in the wider resilience landscape is not easy and many countries are struggling with this problem. Some countries however offer useful models. Switzerland, for example, has insurers included in any conversation about construction and resilience, and this mindset must be adopted in the UK to alleviate the worst effects of flooding.”

Parametric insurance may provide swifter, more accurate services as companies scramble to address floods

According to Nyasha Kuwana, Commercial Director for FloodFlash, insurance companies have rallied and were fully prepared for the recent weather events. She says: “With storms of this scale and intensity very few property insurers will have avoided claims for wind and flood damages. The claims that we’ve seen so far are in line with our expectations for this severity of event though, but we are continuing to monitor our sensor network closely. The great news is that the industry comes into its own at times like these. The positive stories we are creating and hearing about from our peers are testament to that response.”

FloodFlash operates parametric cover, which means claims and payments are triggered once the network of sensors receives the appropriate data. Speaking specifically about Storm Babet, Kuwana explained: “Our sensors began taking flood readings on Friday morning and this continued throughout the weekend. Derby, Wakefield, and Yorkshire all showed significant activity from a commercial claims perspective.

“The benefit of installing the sensors on the property means that we can begin the claims process immediately upon receiving the data. In that sense we are unconcerned with “hotspots” as we don’t deploy resources locally but manage everything remotely. This means that we can inform each client that their claim is underway within moments of the flood reaching their trigger depth.”

The prognosis for further events over the winter months is uncertain, but companies are prepared to handle the disruptions. “Whilst we never want to make predictions – we hope for our clients that we see a return to the conditions we’ve seen throughout the year. That’s certainly what we’d have expected at the beginning of the year. If there are more floods to come, we’ll be ready,” Kuwana continued.

Managing and paying claims to repair damage has also seen significant improvements over the past few years as companies have embraced new products and services. Indeed, insurers are learning and gathering response data to improve their systems with every occurring event. “In our experience working with flood-stressed clients, something worsens with each event: the difficulty for the people and businesses that experience renewing their policies.”

However, what is becoming increasingly obvious, says Kuwana, is that traditional models of insurance are simply not geared up to handle crises as effectively as parametric offerings. She says, “It is becoming increasingly difficult for businesses to secure affordable flood insurance without punitive excesses and limits. That’s why the specialist market for parametric and excess flood insurance has grown so quickly in the last few years.”

She adds that the final costs to the insurance industry will only be known once full assessments have been carried out – but that predictions on the latest event can be based on the cost of previous storm events. “In terms of flood severity, we’d place it [Babet] in the same ballpark of recent storms Dennis and Ciara and slightly larger than Christoph.”

Author: Joanna England