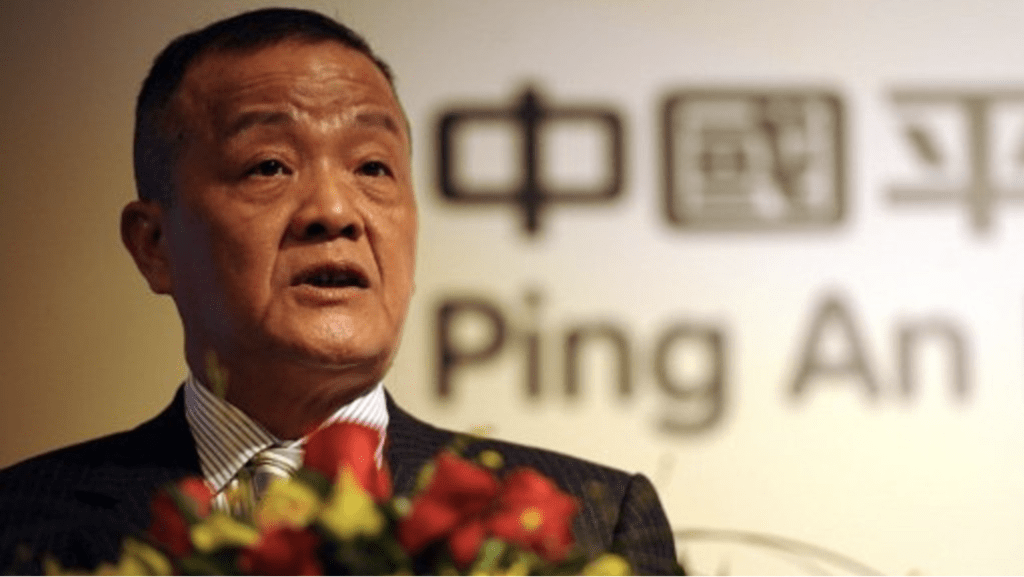

The “Chinization” of Ping An Life’s development

Mr. Ma said Ping An Life has had three distinct stages of growth. Ping An Life was a pioneer in China’s life insurance industry when it was founded in 1994. It drew on the Taiwanese insurance business model, which had taken Western models and adapted it for its local culture.

As international insurance companies entered the Chinese market, Ping An entered the second development stage of “internationalization”. It looked to global competitors and adopted their professional operational approaches, management theories and talent.

Now, Ping An Life is in the third stage, “Chinization”, creating an innovative made-in-China approach to developing life insurance. With rising living standards in China, customers have become more aware of insurance and want high quality options. “We must accelerate to seek transformation in response to the call of the times,” Mr. Ma said: “Our goal is to learn from outstanding international systems, processes and standards, while developing a life insurance model in line with the requirements of the new era in China. With technology empowerment, we will provide customers insurance products with heartwarming services.”

A digital revolution in insurance

Technology is the key to Ping An’s “heartwarming” insurance products and services. Over the past decade, Ping An Group has invested heavily in technology to compete globally. As of the first quarter of this year, Ping An had filed more than 32,000 applications for technology patents, leading in financial technology and digital medical technology, and in third place for artificial intelligence patents worldwide.

Free Webinar: Why Insurance Products Need to Be Flexible. Sign up here!

Ping An has been upgrading its life insurance business with technology, from operations to sales agent performance management to customer service. Ping An Life established a database with millions of entries of data via AI-powered AskBob, providing services for over 800,000 users, with a per capita usage frequency of over six times per day. The database has become a smart training platform for agents’ lifelong learning and continued education, helping them to strengthen overall capabilities. Ping An Life’s smart insurance tool provides customers with AI-enabled insurance demand analysis and insurance planning. In 2020, the smart insurance tool generated written premiums of over RMB15.0 billion from customer conversion for Ping An Life. Ping An is also optimizing its digital life insurance platform and plans to roll it out across China, helping all industry players increase productivity and revenue.

Going beyond settling claims to comprehensive health care

“Traditionally, insurers only settle claims after an accident happens, which only guarantees financial security. However, customers need not just an insurance policy but professional and thoughtful services in health protection, medical care, elderly care, and daily life and they expect our timely help,” Mr. Ma said.

China’s 14th Five-Year Plan, which began this year, emphasizes enhancing insurance capabilities and developing the elderly care insurance system, Mr. Ma said.

Ping An’s technology-driven health care ecosystem enables insurers to go beyond insurance to also meet customers’ health care needs. The ecosystem connects health care services to customers, so that every customer will be provided with one general practitioner and one care assistant to access Ping An’s health management, medical management, chronic disease management, critical illness management, and elderly care management services at any time.

Mr. Ma noted that when customers buy insurance, they are not just signing a contract: they also expect a commitment to protect their families. Ping An will continue to improve service quality and further its operation and management reforms to support the development of insurance industry as well as China’s economic development and social stability.

Via PR Newswire