Carriers that recognize and make use of the innovation capabilities that cloud services offer will outpace their competitors in the race to build expansive ecosystems. With enhanced agility and reach, they will seize many of the lucrative opportunities likely to spawned by ecosystems in the next few years.

Some far-sighted insurers are already using cloud services to quicken innovation and strengthen their digital ecosystems. They’re employing powerful cloud-based technologies to roll out an array of new ecosystem offerings.

Accenture’s research shows that insurers that combine cloud-based ecosystems with analytics systems, for example, can cut the time it takes to develop business solutions by up to 70 percent. They can, for instance, use advanced risk modelling and pricing analytics to target new marketing and sales opportunities. Such ecosystem innovations allow insurers to capitalize on business opportunities much faster. They also help carriers improve the efficiency of operations such as customer management and claims handling.

Technology leaders see the cloud as an innovation catalyst.

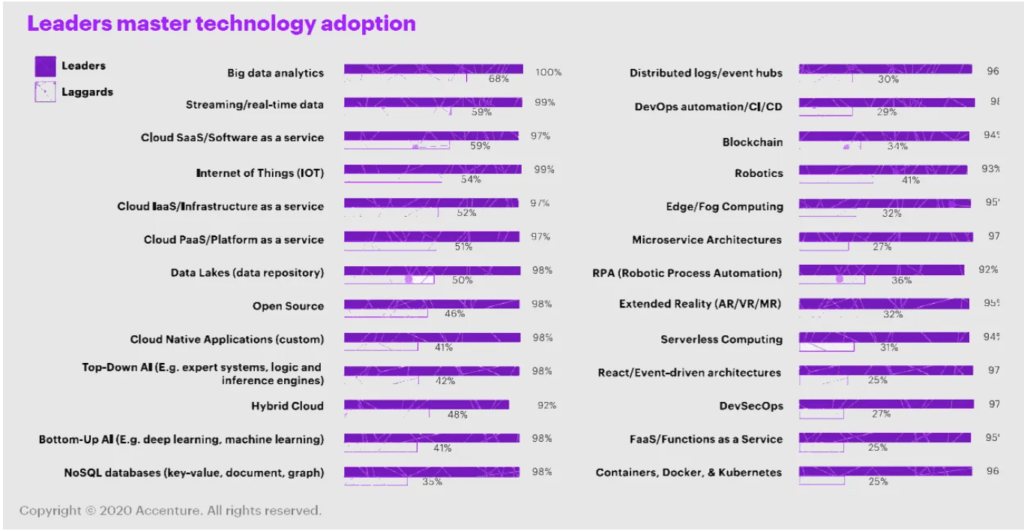

Accenture found that organizations with a track record of being alert to the potential of new technology have been quick to spot the innovation capabilities that cloud computing offers. They see cloud services as an innovation catalyst. Around 95 percent of these “technology leaders” have adopted sophisticated cloud technologies. These include serverless computing, functions-as-a-service (FaaS) and event-driven architectures.

Technology leaders are way ahead of more cautious adopters. Only 30 percent of “technology laggards” recognize the cloud as an engine for innovation. Most still see the cloud as a cost-effective data center.

The COVID-19 pandemic thrust the innovation capabilities that cloud computing offers into the spotlight. Insurers such as AIA in Hong Kong, Poland’s PZU, and San Cristóbal of Argentina, moved quickly, using their cloud platforms to develop and launch innovative customer care services. They swiftly rolled out these critical services across their ecosystems.

Several insurers have also looked to cloud services to transform their business processes.

Mitsui Sumitomo Insurance in Japan has developed a cloud-based sales support system that fuses human expertise with artificial intelligence (AI). The MS1 Brain platform helps the company’s agents better understand the needs of customers and points them to the most suitable products and services.

In Spain, Mutua Madrilen͂a has enhanced its customer service by developing an intelligent cloud-based solution to help its support staff. The EME Virtual Assistant responds to many different combinations of queries on nearly a thousand topics via text or voice messages.

VIG in Poland is using cloud-based technologies to overhaul its claims processes and improve the customer experience. Its AI-augmented claims solution uses advanced data analytics to automatically process claims from the first notification of loss through to smart claims segmentation, routing, assessment, settlement, and finally to adjusting claims reserves.

By capitalizing on the speed and flexibility of cloud services, insurers can quickly build appealing customer services that enhance their ecosystems. Ideally, these services should deliver immersive and interactive experiences. This will strengthen relations with customers. The smart application of cloud services also enables carriers to stretch beyond their traditional distribution channels to reach a host of new customers.

By using cloud platforms to deliver services at speed and to promote innovation across their organizations, progressive insurers are emulating big digital technology companies. They’re providing their customers with more enticing and rewarding services while also pushing into new business sectors.

Consumers are hungry for ecosystem services.

Already, some smart insurers have started using their cloud services to bolster and broaden their ecosystems. AXA, for example, extended its reach into the mobility sector through its partnership with Uber. Similarly, AG Insurance in Belgium entered the smart-home business by using its ecosystem to launch its “Phil at Home” facility. The cloud-based offering protects elderly people who are alone by providing them with a suite of monitoring and support services. In China, Alibaba firm the Ant Group (formerly Ant Financial Services) is using the reach of the retail group’s cloud-based ecosystem to provide credit to consumers who didn’t have access to financial services. Ant customers can also use the group’s ecosystem to submit motor vehicle accident claims and supporting digital photographs.

Consumers are hungry for ecosystem services. More than half the consumers we surveyed showed interest in ecosystem-based healthcare or wellness services. A similar proportion were enthusiastic about home-care offerings that bundle insurance with, for example, building maintenance and utility services. Many are also keen on using personal finance services that they can access via ecosystems.

But consumers are choosey about what they pay for. Only a third of consumers, for example, want to pay for wellness or home-care offerings. Even fewer are happy to part with money to get help with their finances.

Smart ecosystem strategies that use cloud services to drive innovation will enable insurers to deliver services and experiences that better reach, delight and retain customers. Carriers will be able to speed up new business growth while also protecting their traditional markets from increasing competition.

Source: Accenture

Share on linkedin

Share on twitter

Share on facebook