The two-day event, which took place at the InterContinental London – The O2 on March 20-21st, played host to 400+ speakers who gave presentations, fireside chats and took part in panel debates across the two-day conference.

According to stats from Brella, the official event app, more than 20,000 meetings also took take place.

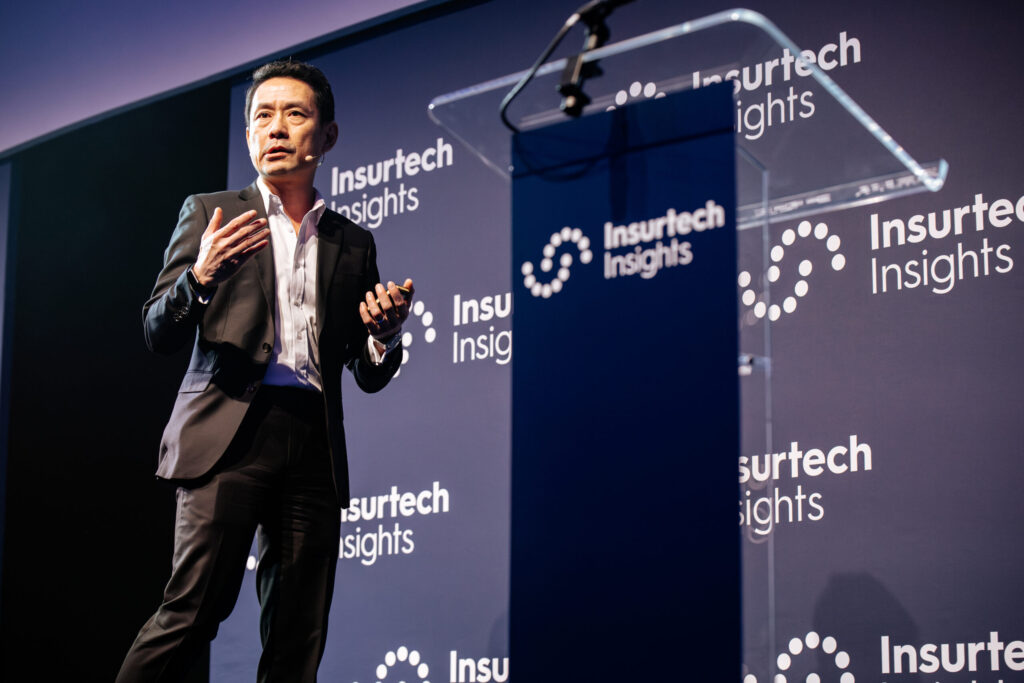

The event opened with a keynote address by Ericson Chan, Group Chief Information & Digital Officer at Zurich Insurance. He delivered the speech, entitled: The neXt for Insurance, in the Age of Hyperinnovation, to a standing room only audience on the conference main stage.

Speaking about the change AI will drive in the insurance industry over the coming months, he said: “It’s a real pleasure to share the Zurich journey with a room filled with 6,000 fellow insuretech enthusiasts. This is both a fascinating and fast moving industry so it’s crucial we share insights and most importantly learnings across our sector. This will be a huge catalyst for progress, which in turn enables us to provide the best service for all of our customers.

This was followed just an hour later by Zurich’s Group Head of AI, Dr. Christian Westermann, who took to the Blue stage to explore the latest opportunities for the insurance industry in a session entitled: Unlocking the Power of (Gen.) AI: How The Insurance Industry Can Stay Ahead of the Curve

Known for his charismatic approach, Westerman is a technology enthusiast and physicist who worked on technologies for space missions for the ESA and NASA during the 90s. His expertise includes building satellite-based instruments, signal detection, and exploring the origins of our solar system through physics, data, and modelling.

Commenting on the AI revolution – and why the industry must stay abreast of change. He said: “Ai is for the greater good of the industry and our customers. This journey is filled with trial and error, what’s important is that we all learn from this. We don’t all want to make the same mistakes, it will slow us down.”

An evolving world

Ash Jokhoo, CIO for Direct Line Group, took part in a leading panel session, entitled: Reaching Customers Where They Are: Entering the Digital End-to-End Claims Era. He was joined by David Thronton, Head of UK for InRule, and Tjerrie Smit, Chief Analytics Officer for NN Group.

In a recent interview with Insurtech Insights, Jokhoo expressed his passion for technological innovation, saying: “The fact that the industry is reinventing itself and re-imagining the art is what is inspiring me because competition breeds performance and performance is better for customers.

During the panel ‘The Secrets to Effective Capital Raising in 2024 and Beyond’, Romaney O’Malley, bolttech’s Group CFO, highlighted the importance of a clear communication about where your business model fits in the broad insurtech landscape. She said: “bolttech found success bringing together in equal parts deep insurance expertise to navigate the complex and regulated space of insurance, and harnessing cutting-edge technological capabilities.”

Exploring innovation

David Ovenden, AXA Commerial’s Chief Underwriting Officer, took part in a live on stage discussion with John Cummins of Axiome Partners, entitled: Making Computable Contracts happen. He said: “Insurtech Insights is an event that always attracts a diverse and engaged audience and today was no exception. It was encouraging to see so much interest in the emerging area of modular computable contracting, with strong attendance at the session and some interesting audience questions.

“Reimagining the contract is important for the whole insurance sector so this was a powerful opportunity to help people understand that computable contracting isn’t just a tech issue, it has the potential to completely revolutionise how we work as an industry.”

Connecting the industry

Insurtech Queen and Founder of Alchemy, Sabine Vanderlinden will be live on stage tomorrow (day two of the conference) in two sessions entitled How AI Is the Answer to Underwriting Emerging Risks and Is Parametric Insurance the Silver Bullet for the Insurance Industry.

She said: “Insurtech insights is the premier insurance technology conference of the year. It’s an important stop for anyone in the industry to experience. I’m excited to be moderating two panels, one of which will be connecting underwriting and AI and emerging risk. The second panel discussing parametrics in a data driven world”.

Sparring with Chatgpt

Lightening the technical mood after lunch, insurance leader Lisa Wardlaw refereed a sparring session between AI’s ChatGPT and Artur Niemczewski, Insurance NED’s CEO. The event made its debut during 2023’s conference, shortly after ChatGPT was launched.

Wardlaw said: “Our world is changing; the economy is shifting. There’s a new landscape where traditional roles and patterns don’t apply. This new economy is often not served well by existing products.”

This year, following a year of swift learning, the odds were stacked against Niemezewski winning the Q&A session, as he did last year. But, he rallied well and resulted in proving that humans still have the edge over AI when it comes to insurance genius.

Speaking about the success of the conference, Insurtech Insights Global Content Manager, Emil Hannesbo, said: “It’s been a fantastic experience. The calibre of speakers we’ve seen is a sign that Insurtech Insights is moving from strength to strength.”

Insurtech Insights CEO, Kristoffer Lundberg added: “It’s such a privilege to bring together so many industry leaders in one place. The atmosphere has been incredible – and the record numbers of meetings that are happening is proof that we are doing our job in supporting this great industry.”