Root, Inc., the parent company of Root Insurance Company, announced that it publicly filed a registration statement on Form S-1 with the U.S. Securities and Exchange Commission relating to the proposed public offering of its common stock.

Here are the S-1 highlights:

The company’s DWP grew from $106.4 million in 2018 to $451.1 million in 2019. For the six months ended June 30, 2020, DWP was $306.5 million. Revenue was $43.3 million and $290.2 million in 2018 and 2019, respectively, and net losses were $69.1 million and $282.4 million, respectively. For the six months ended June 30, 2020, revenue was $245.4 million and net loss was $144.5 million.

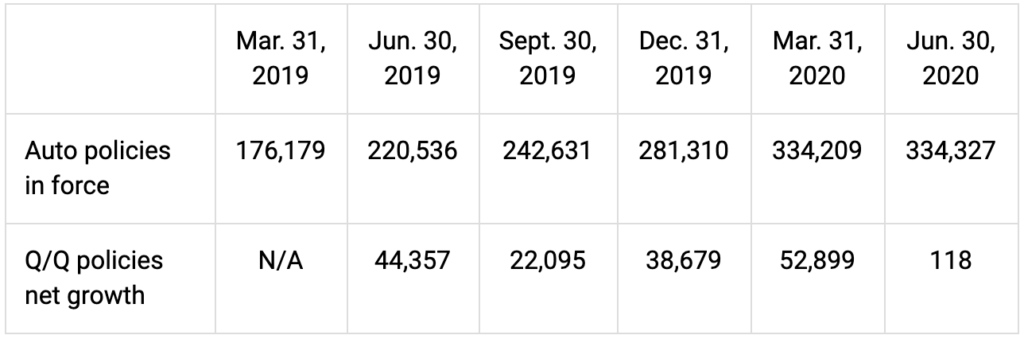

Auto policies in force for the six months ended June 30, 2020 stood at 334,327.

Approximately 40.1% of the company’s gross written premium for the six months ended June 30, 2020 originated from customers in Texas (21%), Kentucky (10.3%) and Georgia (9.7%). Other states making up the top ten list are Arizona (5.9%), Pennsylvania (5.6%), Ohio (5%), Missouri (4.9%), Utah (3.9%), Maryland (3.7%), and Louisiana (3.4%).

Approximately 40.1% of the company’s gross written premium for the six months ended June 30, 2020 originated from customers in Texas (21%), Kentucky (10.3%) and Georgia (9.7%). Other states making up the top ten list are Arizona (5.9%), Pennsylvania (5.6%), Ohio (5%), Missouri (4.9%), Utah (3.9%), Maryland (3.7%), and Louisiana (3.4%).

As of June 30, 2020, 47% of Root’s portfolio was comprised of renewal premiums, “compared to an industry standard of approximately 80%.” Sales and marketing costs for Root’s B2C and B2B units increased $69.3 million, or 172.0%, from $40.3 million for the year ended December 31, 2018 to $109.6 million in 2019. The increase was primarily due to the company’s continuing efforts to increase its customer base and marketing to the seven additional states it expanded into during 2019. Personnel Costs allocated to sales and marketing grew between the periods as Root scaled up its sales and marketing function between the periods. Sales and marketing as a percentage of revenue decreased from 93.1% of revenue in 2018 to 37.8% of revenue in 2019. Root distributes largely through the mobile channel, with over 75% of customers acquired through either their mobile app or mobile web platform. Over the period from August 2018 to August 2020 the company’s average customer acquisition cost was $332. The company claims that the data science behind its UBI scoring tells them that the riskiest 10-15% of drivers are up to two times more likely to get in an accident than their average targeted customer. Root acts upon this observation in two ways. First, it does not quote this high-risk segment of potential customers. Second, because they are not burdened by the elevated risk and potential losses of this narrow segment, the company can offer the most competitive prices for their targeted customers. Despite avoiding this risky segment, the company couldn’t avoid costly claims. Loss and LAE increased $277.9 million, or 638.9%, from $43.5 million for the year ended December 31, 2018 to $321.4 million in 2019. The increase was primarily due to increased claims between the periods which corresponds to growth in premium volume and customer base. The company also wasn’t able to avoid rate increases which impact retention. As of June 30, 2020, Root’s term one and term two policy retention rates were 84% and 75%, respectively. Retention rates include customers that retain through the first day of the subsequent term and exclude policies that do not make it through the underwriting period and company-initiated rescissions. Adjusting for these customers reduces one and two term policy retention by 33% and 10%, respectively. Root shares one challenge around fairness: “While we believe our telematics-based pricing model to be more fair to consumers, it may yield results that customers find unfair. For instance, we may quote certain drivers higher premiums than our competitors, if our model determines that the driver is higher risk even though their higher-risk driving has not resulted in a claim. Such perception of unfairness could negatively impact our brand and reputation.” Root shares one challenge around the collection of telematics data: “We are selective in the volume of data we collect, both in terms of the number of variables and how frequently we record. Data collection has battery life implications and we view it as critical to user experience that we do not apply undue pressure on battery life.” The company states that while there are competing companies that collect data, synthesize behavioral scores, and price risk, it believes it is the only one performing all three functions. Root shares the advantage of its smartphone-based telematics model: “Many competing telematics programs use OBD2 devices, often referred to as “dongles”, which plug into a vehicle’s on-board diagnostics, or OBD, port and which we believe are inferior to mobile-based solutions. OBD2 devices capture wheel rotation on a per-second basis and are therefore effective in measuring speed and hard braking, but are otherwise limited in their ability to capture other forms of behavioral data such as distracted driving. Further, deploying OBD2 devices as part of a telematics program involves considerable expense and is a source of customer friction as the device needs to be physically delivered to the customer, properly installed and maintained or replaced over time.” With customer permission, Root continues to monitor driving behavior after the initial underwriting period. The data is used as part of the company’s “systematic data science pipeline used to train and retrain our models, continuously improving their predictive power over time.” This provides the capability to re-score and re-price at renewal based on behavioral changes, which the company is scaling across its renewal portfolio. Users are already complaining about battery issues so it will be interesting to see how many will opt-in for continuous tracking. Root shares the timeline of their UBI scroing:

- Root UBI 1.0. Built in 2016 and leveraging 100,000 trips and over 2 million miles but without explicit claims integration. With GPS-only input data, Root UBI 1.0 had four times the predictive power than did our original third-party solution and represented our first step towards internal pricing models rather than relying on publicly available and approved rate sheets, a pricing strategy referred to as “me too pricing” that is common among new entrants across insurance products.

- Root UBI 2.0. Built in 2018 and leveraging 50 million trips, 700 million miles and 3,000 claims. This capability improved upon motion input, such as hard braking, by leveraging accelerometers and gyroscopes.

- Root UBI 3.14. Built in 2020, our latest generation delivers almost ten times the predictive power versus our original third-party solution, leveraging over 10 billion miles driven and hundreds of thousands of associated claims.

“We launched our insurance in 2016 with UBI scoring performed by a regulator-approved third-party telematics provider while we simultaneously built our own proprietary telematics solution. The third-party base case of predictive power underperformed our expectations but provided a reference point from which we measure our own scoring solution that now extends to the third generation of our UBI score, Root UBI 3.14.” The third-party telematics provider was Octo Telematics. The company gets into detail about how it analyzes data: “Hard braking very often flags a near miss, an accident that almost happened. We have observed over time that drivers who report claims have typically applied hard braking at a greater frequency than drivers with a limited or no claims history. This suggests that a current or prospective customer who, relative to the broader pool of drivers, applies hard braking frequently is more likely to get into an accident and make a claim in the future. However, hard braking can be more frequent in an urban setting. We are able to adjust for context, ensuring our customers are not penalized for driving as safely as they can in a given environment. We can infer the difference between a Sunday drive and a commute, adjusting accordingly. Certain driving performance is expected if, for instance, a driver is experiencing the route for the first time. We use an internally developed claims infrastructure to capture comprehensive structured data, contributing to our data advantage when combined with telematics experience and iterated over time.” In April 2020, Root entered into a Stock Purchase Agreement to purchase Catlin Indemnity for consideration equal to Catlin’s aggregate amount of statutory capital, surplus, and investment income at the time of closing, plus approximately $8.2 million. The acquisition, subject to approval, will expand Root’s ability to sell personal auto insurance in 48 states and the District of Columbia. The company will look to expand into the international market, both as a consumer-facing insurer in certain markets and through enterprise software in other markets, enabling select insurance companies with mobile telematics data collection and scoring capabilities. Source: Coverager

Share on linkedin

LinkedIn

Share on twitter

Twitter

Share on facebook

Facebook