Leading actuary Chengchen Li stepped away from corporate comfort and a career that had seen her rise through the ranks in Manulife and John Hancock, to enter the adventurous and challenging entrepreneurial space.

She launched Penguin Benefits after deep consumer research and having personally navigating the complex maze of maternity and parental leave following the birth of her daughter.

Li discovered that new parents were potentially ‘missing out’ on vital benefits during a crucial time in their lives, because the already complicated layers of benefits (which have different benefits available in different US States, and through different employer or insurance offerings) had become even more challenging following digital transformation and remote working practices.

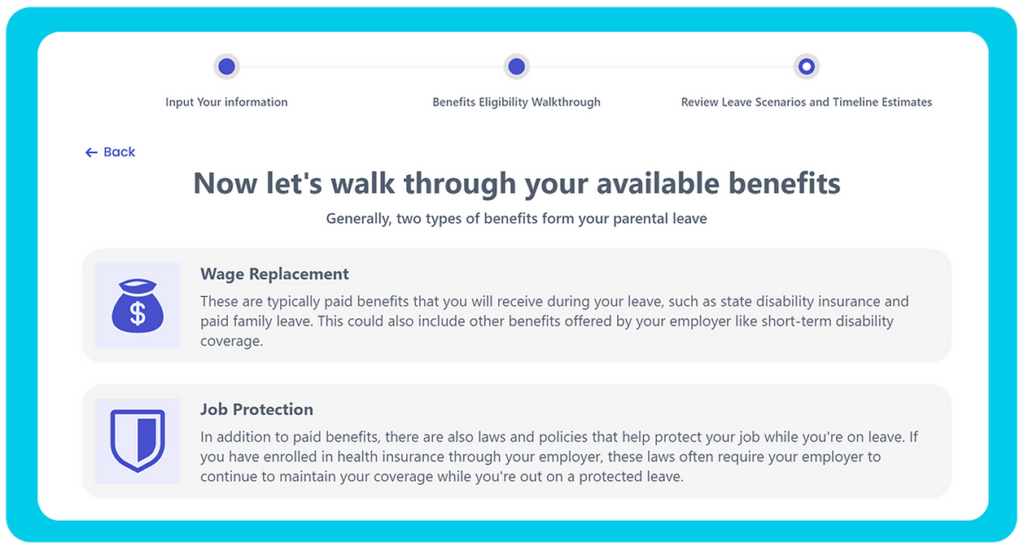

Initially designed as a consumer-focused tool for parents, Penguin Benefits’ platform enables employees to enter details such as their earnings and state of residence, guiding them through their benefits estimates and leave scenarios. It presents information through intuitive graphs and tables, helping users understand their potential benefits during leave.

Recognizing the need for a more comprehensive approach, the insurtech has now evolved to work closely with leave administrators. By collaborating with these key stakeholders, including insurance companies and third-party administrators (TPAs), Penguin Benefits ensures that employees receive accurate, integrated, and personalized benefit information.

Today, the startup serves 38 US States – and will soon be branching into all 50 . Insurtech Insights caught up with Chengchen Li to find out more.

Tell us about your background. How and why did you become an actuary?

I’ve always enjoyed using math and logical reasoning to create models and solve real-world problems. I studied actuarial science at the University of Toronto. After earning my degree, I became an actuary and spent nearly 10 years in the insurance industry, primarily focused on insurance product development.

The role provided me with valuable insights into the product development process and modeling methods for complex financial contracts and regulations. These skills have been incredibly useful in my current work at Penguin Benefits, where we model and illustrate benefits for working parents in an easy-to-understand way.

Can you share the story of your journey into entrepreneurship?

It wasn’t a sudden move for sure. It was gradual for me. I’ve always had an interest in solving real-world problems and pain points for end users. In a corporate role, you don’t really get to touch the end users much. Initially, I didn’t know how to turn this desire into action. Then, I moved to California with my husband, and with Stanford nearby, I decided to apply to Stanford Business School. That’s where I learned about design thinking, researching pain points, prototyping solutions, and iterating on those solutions. It was very eye-opening and I gained a deep understanding of innovation and entrepreneurship.

During a design thinking project at Stanford, I chose to research the insurance and benefit needs of new parents. Working with classmates, we discovered that many working parents face confusion when taking parental leave. They struggle with understanding the length of their leave and how much they will be paid. This resonated with me because, at the time, my daughter was only two years old. Navigating my own maternity leave was like piecing together a puzzle, given the mix of state benefits, group disability insurance, and employer-specific benefits. Realizing that this confusion was a common problem, I developed a strong interest in solving it.

Upon graduating from Stanford, I founded Penguin Benefits to build a tool that helps parents navigate their leave benefits. Our goal is to simplify and clarify the process, making it easier for parents to learn about and navigate the complexities of their parental leave benefits.

The skills I developed in insurance product development are directly applicable to what we do at Penguin. We focus on modeling benefits and presenting them in a way that is digestible for working parents. This involves the same logical reasoning and mathematical modeling techniques I used in my actuarial roles. Our goal is to empower working parents to better understand and access their parental leave benefits.

Your own experience as a parent seeking benefits was a lightbulb moment for your journey into entrepreneurship. What was it like navigating the process?

I was more familiar with the process and how to go about learning things. However, I wasn’t intimately familiar with every terminology related to leave and disability. The situation was complex, especially since my employer was in one state and I was in another. The HR team was more accustomed to supporting employees in a different state and less familiar with California regulations. So, the whole benefit package and how it was designed to work with California state laws weren’t as clear.

Fortunately, I had a very supportive manager, and the leave package offered by my employer was excellent. The challenge was navigating the logistics because of the different parties involved—the state, the insurance company, and the HR department. Each party only provided information related to the piece of the benefit they administered. I found myself bouncing between them, piecing together the information like a puzzle, and I was never entirely sure if I had it right. Even with my background, it was a daunting task to manage all the logistics.

Do you think the complexity of the current system causes many people to miss out on potential benefits?

Absolutely. I can share some real examples of how this happens. When we were developing our tool, we conducted extensive user interviews using a design thinking approach. We found that many people don’t even know the right questions to ask initially. Somemight think they can double-dip benefits, like using two benefits one after another, but sometimes these benefits overlap (run simultaneously), leading to confusion.

One common issue we encountered is that people don’t know where to start because they’re so confused. Many mothers we interviewed missed out on available benefits simply because they used them in the wrong order. For instance, there are medical benefits for recovering from childbirth and bonding benefits for time with the baby. Some mothers filed for bonding first, only to realise later they should have used the medical benefits during recovery. By the time they figured it out, it was too late to claim the medical benefits.

Another example involved both an employee and an employer who were working together to plan the employee’s leave. Despite their collaboration and planning, they both had incorrect expectations about the number of weeks of leave the employee was entitled to. It wasn’t until the employee actually went on leave that they discovered the discrepancy, causing stress for both parties. The employee had to adjust her return-to-work plan while already on leave, and the employer felt unprepared and unable to support her as intended. These real-life examples highlight the confusion and stress caused by the current system’s complexity.

What were the biggest challenges you encountered when you decided to launch your own solution?

I’m sure a lot of startup founders encounter all types of challenges, and those are expected. But what’s unique to this particular business is that it’s not just about building a product from scratch and making it better, smarter, and faster. Initially, I thought, as a working mother, why couldn’t the insurance company or my employer just explain everything clearly?

However, as I dug deeper, I realized the systematic challenges that prevented this clarity. The leave benefits system is incredibly complex, involving federal, state, local leave benefits, insurance benefits, and other employer-provided benefits..

The individual wants to navigate everything, but administrators or employers only handle pieces of the problem. They can’t speak on behalf of the state, and the state can’t speak on behalf of the insurance company. As I interviewed more stakeholders, I saw that employers, insurers, third-party administrators, and even the states are dedicated to educating employees about these benefits. Many of them put together tons of material, like flyers and example graphs, and host monthly presentations and workshops with live Q&A sessions afterward.

“Our team has really deep roots in the insurance industry, particularly around leave and disability. We have such a passion to solve this problem from multiple perspectives. And I think that’s what differentiates us as we continue to grow and iterate on the solutions to tackle it from all these different perspectives.”

Chengchen Li

Despite these efforts, employees can still be confused because there are so many individualised scenarios to navigate. Because if you explain it in a workshop to everybody, people still have lots of questions. It’s their first time looking at so many acronyms. I realised this is indeed a really complex concept and there are so many stakeholders involved, each with their own challenges. So there needed to be some patience in really understanding those different perspectives to solve this problem.

To create this, we needed an aggregated source of information that integrates the various benefits in one place and then explains it to the employee. Our team has really deep roots in the insurance industry, particularly around leave and disability. We have such a passion to solve this problem from multiple perspectives. And I think that’s what differentiates us as we continue to grow and iterate on the solutions to tackle it from all these different perspectives. It’s a pretty complex problem to tackle.

How does Penguin Benefits work? Does the company have a dashboard that employees can log into, enter their details, and then be walked through the benefits they’re entitled to?

Yes – exactly. Penguin Benefits is designed for the end consumer, the individual employee. The process begins with the employee visiting a portal we’ve built specifically for this purpose. They enter some basic information such as their earnings and the state they reside in. Then, we guide them through each leave benefit, checking their eligibility. We explain eligibility criteria and provide estimates for what their benefits might look like, using graphs and tables to illustrate the timelines and amounts.

Regarding the B2B2C model, we did iterate on this aspect. Initially, our tool was directly consumer-facing, aimed straight at the parents. But we quickly realised that to effectively help parents, we needed to engage with their employers and leave administrators. The employees often don’t have all the information they need, and it’s their employers and leave administrators who hold the crucial data and know the specific details of the benefits offered.

“Right now, there’s a significant opportunity to assist working parents, employers, and leave administrators as they navigate this complex landscape. When we first began, most states were either starting to implement PFML programs or were in the process of considering them.”

Chengchen Li

So, we now partner with leave administrators, which can be insurance companies or third-party administrators (TPAs). By collaborating with them, we access the most accurate information regarding people’s leave plans, allowing us to integrate this into our tool. This ensures that the end user receives a clear, personalised, and integrated view of their benefits. The approach helps us navigate the various stakeholders and refine our business model to best serve everyone involved.

What do you see as the current opportunity in the market?

Right now, there’s a significant opportunity to assist working parents, employers, and leave administrators as they navigate this complex landscape. When we first began, most states were either starting to implement PFML programs or were in the process of considering them. At that time, California was the primary state facing these challenges, and employees and employers in many other states hadn’t yet realised the issue was coming.

Today, with more states rolling out their own programs, the need for our tool has become much more evident. We’re seeing increased demand and traction for our services. We believe that the entire industry will eventually need a solution like Penguin Benefits. We’re well-positioned to address this need and our ultimate goal is to support all working families effectively.

Finally, what inspires you in the Insurtech industry today?

What inspires me is the openness of insurance companies, TPAs, and administrators to adopt new technology that enhances the customer experience. Nearly every insurance company has an innovation team and actively participates in InsureTech conferences to discover new solutions. The insurance industry is uniquely positioned to support people through major life events, often involving some form of insurance. We have the opportunity—and responsibility—to make a meaningful impact in these crucial moments, which is what truly motivates me.

Interview by Joanna England