State Farm has reported that the company’s annual claims paid to help customers recover from hail damages increased more than $1 billion from 2021 to 2022.

According to the insurance giant’s official statement, the reasons for the sharp increase is two-fold, namely: an increase in hail claims and inflation.

The number of hail claims increased by nearly 45,000 from 2021. However, inflation and supply chain issues occurring across the country is also responsible for the overall increase. To put it in more relative terms, the average claim increased by nearly $2,000 last year. That is the largest year-over-year increase to date.

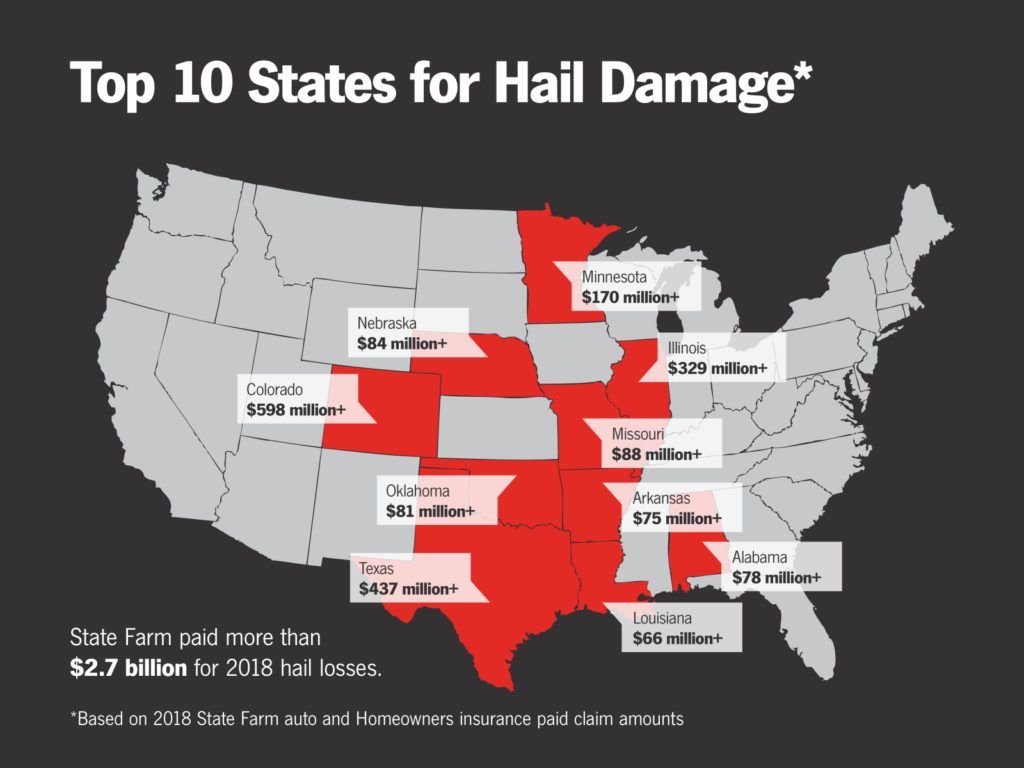

Top 10 States for Hail Claims in 2022

| State | 2022 Hail Costs |

| 1. Minnesota | $799M |

| 2. Texas | $510M |

| 3. Arkansas | $231M |

| 4. Illinois | $225M |

| 5. Nebraska | $212M |

| 6. Wisconsin | $194M |

| 7. Iowa | $131M |

| 8. Colorado | $129M |

| 9. Oklahoma | $126M |

| 10. South Dakota | $79M |

Advice from State Farm suggests customers should consider taking the following actions to maintain their protection and also assist in making claims processing easier.

What can homeowners do to prepare?

“The best thing to do right now, before spring storm season, is to call your State Farm agent and conduct an annual review of your coverage,” said Gina Wilken, State Farm Public Affairs Specialist. “Because of inflation and supply chain issues, some homeowners are seeing a deficit in replacement costs versus levels covered in the insurance policy. After a catastrophe is not the time for homeowners to find out they are not covered to meet their needs.”

Even if you aren’t in a top 10 state, preparation is key.

After talking with your State Farm agent, update your home inventory, and take photos or videos of everything in your home. This not only speeds up the claims process but can trigger your memory when filing a claim. If a storm is on the way, review your emergency plan with all members of the house, have an emergency bag with essentials, pull your vehicles into a covered space or garage, close your blinds and curtains, and stay away from windows.

After the storm, recovery can begin.

Once the storm passes and it is safe to do so, begin to look for damage around your home and take photos. Look for shingles in your yard, water stains on your highest ceiling, and damages to downspouts and gutters and document with photos. Begin to make temporary repairs to roofs with tarps or boarding up broken windows and keep receipts to file for reimbursement. Start to file your claim with your agent or 1800SFCLAIM, at statefarm.com, or on the State Farm mobile app.

Beware of door-to-door contractors.

Unfortunately, after a catastrophe there is an influx of storm chasing contractors who begin knocking on doors nearly immediately after the storm passes. Use caution in hiring a contractor and be wary of the out of state door-to-door contractors. Local contractors with deep community roots are the best to use because if something goes wrong with the work, you know where to find them and get it fixed. Ask neighbors for referrals and get multiple estimates in writing. Look over the estimates for quantity of materials, labor charges, starting and completion dates. Never sign your insurance check over to a contractor.

Source: State Farm