Against this backdrop there is the continued effort by many governments and companies worldwide towards the shared vision to reach Net Zero by 2050, fighting climate change to avert the most detrimental consequences. Most players in the automotive industry have already set ambitious targets to phase out combustion engines (ICEs) by the end of the decade in favour of electric vehicles (EVs), and autonomous vehicles (AVs) are bound to take up within the next 15 years. In fact, technological advancements, such as Advanced Driver Assistance Systems (ADAS), are already having a significant impact on driving safety today. Understanding and quantifying the current and future impact of new technologies will be crucial for insurers to remain competitive in a fast-evolving environment.

Motor has been a low-risk and high-volume mainstay segment of Property & Casualty insurance for many decades. Competition among insurers is thus rightly fierce and any novelty impacting their portfolios’ performance metrics, even lightly, becomes something worth exploring and, eventually, a must-have. Swiss Re has recently published a paper titled “Driver today, passenger next“, in which automotive and mobility experts explore the various dimensions of their holistic view of motor risk.

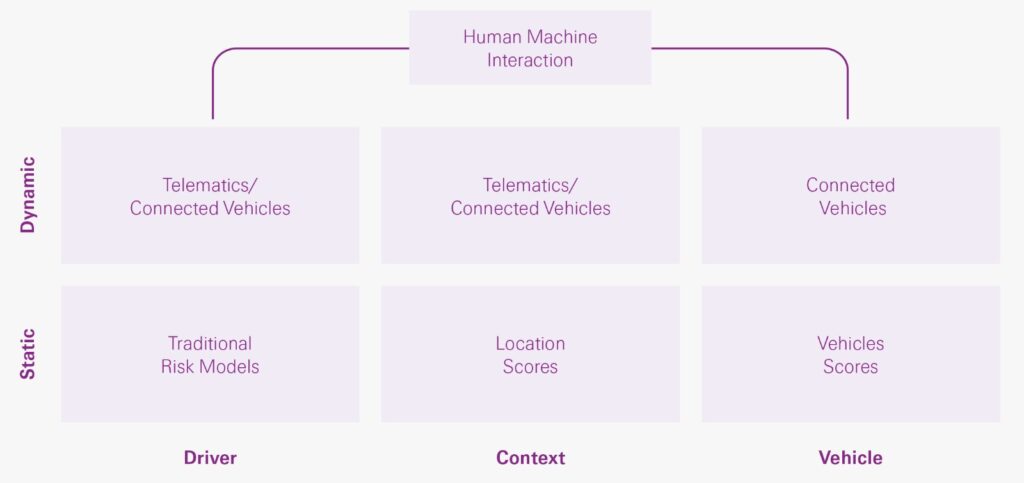

Motor risk is the risk associated with a certain driver using a specific vehicle in a given context. An insurer has to be able to estimate these risk factors when underwriting a policy and, to achieve that, it has to resort to variables that describe them as closely as possible (e.g., proxies):

- Driver risk: represented by a set of variables describing the driving behaviour of the person behind the steering wheel

- Vehicle risk: represented by a set of variables describing the capability of a vehicle in mitigating the risk of accidents

- Contextual risk: represented by a set of variables describing the characteristics of the surroundings that can impact the risk incurring in accidents (e.g., road conditions, weather,

location)

The nature of the data used for such estimations is either static or dynamic, or a combination of both:

- When we talk about static data, we typically refer to time-independent characteristics of either the driver, the context and/or the vehicle; thus, offering a snapshot of a given variable. One scenario is that these characteristics do not change during a given time frame, from the policy inception date to the policy expiry date. The second option is that they are recorded at a very low frequency – usually every time a policy is generated or renewed- and/or generally consist of information that does not change over time or over large time intervals (post code, profession, driving licence validation dates).

- In contrast, dynamic data, by definition, changes frequently, e.g., more than 10 times per second for accelerometer data. These are used for the identification of acceleration-based events like hard braking, excessive speeding, phone usage and screen interaction, and can be collected through dedicated devices, such as a mobile app or a hardware box – or come directly from the vehicle itself.

The latter is becoming an increasingly attractive option due to the higher quality, enhanced granularity and frequency of the available data, which could potentially lead to more accurate risk estimations.

The aforementioned paper explains how traditional insurance models can be enhanced using static and dynamic data to inform about driver and context risk. It also showcases the importance of new vehicle technologies in improving motor safety and thus significantly impacting insurance claims.

The path to the future is a risk assessment that can holistically account for all the risk dimensions, dynamically and simultaneously, and that will become particularly relevant as we move towards increasingly automated mobility.

Download the whitepaper to gain more insights.

Source: Swiss Re