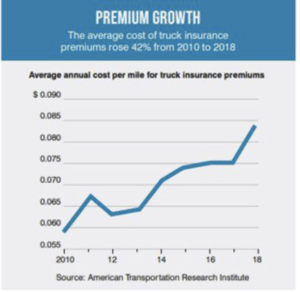

While the social and economic impacts of the pandemic have been front and center this year, insurance has remained a top concern among fleet leaders in 2020. In its annual report, the American Transportation Research Institute (ATRI) listed insurance cost and availability as the fifth most pressing issue facing trucking. In fact, ATRI’s annual Operational Costs of Trucking analysis found that insurance costs per mile have increased 18.3% over the last five years. This figure is even more dramatic among smaller fleets, which report per-mile insurance costs more than three times those of larger fleets.

Widespread concern is no surprise as rising insurance costs—coupled with sky-high verdicts—have also been cited as the reason many fleets have gone out of business. According to Donald Broughton, principal and managing partner at Broughton Capital, at least 795 trucking companies failed in 2019, with 24,000 trucks removed from the nation’s capacity. That’s more than double the number of failures recorded during 2018 and this trend is likely to continue over the next few years.

While many factors that contributed to rising rates are beyond the fleet’s control, there are ways to improve your company’s risk profile—and technology can help.

Understanding your risk profile

In the transportation industry, it’s common to hear executives ask, “Why are my insurance rates going up when our fleet has favorable loss experience?” Unfortunately for many hardworking fleets, loss experience is not the only factor used to determine rates. Due to the heightened costs of potential lawsuits, insurers are forced to be ultra-selective in issuing rates to fleet partners, which means even the safest fleets must constantly work to improve their risk profile.

Before developing a strategy to address insurance rates, it’s important for fleet managers to understand what motivates their insurance partners, how decisions are made when it comes to pricing and the factors considered when pricing particular risk. While many of these may be out of your control, pinpointing factors your fleet can influence through improved performance is the cornerstone of an effective insurance strategy.

Since the loss performance of the entire book of business is a major factor for how an insurer approaches pricing, it’s also worthwhile to recommend to your insurer like-minded carriers that share similar safety and risk attributes. Such fleets may positively impact pricing across the portfolio.

Technology’s place at the negotiation table

The best way to reduce the frequency and severity of crashes is to invest in safety technologies, such as a video-based safety program. By providing insight into pre-accident, post-accident and “everything in between” events, these tools offer quantifiable analytics that can inform discussions between fleets and insurance partners. As the years progress, the gap in insurance renewal rate increases widens between fleets that are early to adopt new technologies and those that are more passive.

However, it’s not enough to solely adopt the latest safety technology. Insurance partners will want to see a comprehensive strategy for how your fleet is using these tools to mitigate risk and improve safety outcomes. On top of this, fleet managers should be prepared to regularly share analytics related to fleet driving performance and examples of where technology helped to efficiently resolve claims. By offering data-driven updates on safety performances throughout the year, fleets can solicit feedback from insurance partners, show consistent improvement and prepare for annual rate renewals.

Of course, these technologies can also improve the safety outcomes that inform a fleet’s risk profile. After 12 months with video-based safety, one specialized flatbed carrier out of Oregon saw a 88% improvement in the carrier’s SmartDrive Safety Score, a 10% improvement in preventable crash rate per million miles driven and 11 driver exonerations. In total, these improvements resulted in an unprecedented 122% reduction in insurance loss ratios, the percentage of total premium used to pay for fleet claims.

Billy Dover, a senior risk manager at Leavitt’s Freight Service, shared that before adopting video-based safety, his fleet was “paying out on claims where we knew we should have been exonerated. During the July 2018 to June 2019 time period, Leavitt’s [insurance] loss ratio came in at 13% compared to the previous 4-year average of 135%—this is phenomenal.”

Preparing for an insurance renewal

Unfortunately, too many fleets leave money on the table when it comes to insurance renewals. There are several steps you can take to prepare for a renewal, but don’t take your eyes off the frequency and severity of your incidents. To mitigate past, current and future losses around claims, it’s important to maintain a proactive approach to incidents. You might even drive value by finding dead dollars in claims that you didn’t even realize were sitting in your files.

If you’re only thinking about an insurance renewal 90 days in advance, you’re going to get market-level results. The main difference between achieving average and better-than-average results is approaching your insurance strategy like a business. The best risk managers stay actively engaged throughout the year by consistently monitoring fleet analytics, coaching drivers to develop safety skills and constantly adopting new, cutting-edge methods to improve their safety outcomes.

Source: Business Insider

Share this article:

Share on facebook

Share on twitter

Share on linkedin