The news follows on from a turbulent year that has seen a rise in GWP, a partnership with Zurich Australia, legal disputes over insurance customer services and claims – and the recall of cyber trucks.

The new key discounts include:

- Multi-Car Discount: Automatically applied in all states when insuring multiple vehicles under the same Tesla Insurance policy.

- Defensive Driving Course Discount: Available in states such as Colorado, Illinois, Minnesota, Nevada, Oregon, Utah, and Virginia, typically for drivers over 55 who have completed an approved accident prevention course.

- Group Discount: Offered to Tesla employees across multiple states, requiring contact with Tesla Insurance to apply.

- Anti-Theft Device Discount: Available in Illinois and Minnesota for vehicles equipped with approved anti-theft devices.

- Autopilot Discount: Automatically applied in Nevada for Tesla vehicles with qualifying autonomous features. Non-Tesla vehicle owners can contact Tesla Insurance to determine if their vehicles qualify.

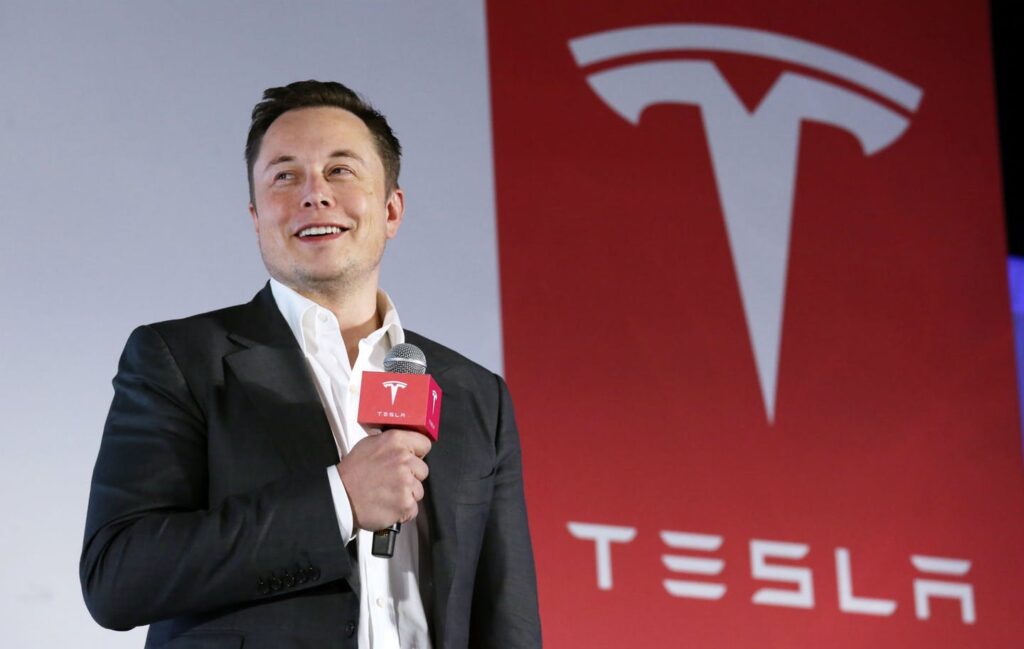

Tesla’s insurance division has seen significant growth, ending the fiscal year 2023 with nearly $500 million in written premiums, marking a remarkable 115% year-over-year increase. Premium volumes surged by 116% in 2023, with California, Ohio, and Arizona leading, totalling $387.2 million, up from $217.6 million in 2022. Tesla also writes substantial premiums in Texas, Virginia, and Maryland on its own paper.

In April, Tesla recalled 3,878 Cybertrucks to address a faulty accelerator pedal pad that could become loose and become trapped in the interior trim, according to a statement from the U.S. National Highway Traffic Safety Administration (NHTSA). The agency warned that a trapped accelerator pedal could lead to unintended vehicle acceleration, increasing the risk of a crash.

And last month, Zurich Australia has announced a new partnership with Tesla to become the preferred electric vehicle insurer for Tesla customers in Australia. Under this agreement, existing and new Tesla owners can access the “InsureMyTesla” EV offering, exclusively provided by Zurich using its “Edge” technology, directly within the Tesla app. The “InsureMyTesla” coverage includes all vehicle repairs, including glass, charging equipment, and batteries, using Tesla’s accredited repair network. The offering is available to all Tesla Model 3 and Model Y customers through the Tesla app.

Commenting at the time, Justin Delaney, CEO of Zurich Australia and New Zealand, said: “EV uptake in Australia is rapidly growing as consumers continue to recognise the importance of lowering their environmental impact. Ensuring these customers receive quality insurance protection is critical for supporting the national transition journey.

“Zurich and Tesla share a common pursuit to drive a more sustainable future, invest in cutting-edge technology, and provide leading products and services to a loyal customer base. With shared global strength paired with deep local expertise, this is a natural alignment that will benefit many Australians on our roads.”

Thom Drew, Tesla Country Director for Australia and New Zealand, added: “Zurich has a long-standing reputation for protecting its customers in Australia and across the globe. As the preferred provider for InsureMyTesla, Zurich offers Tesla customers affordable and convenient insurance, all accessible within the Tesla app. With InsureMyTesla, Tesla ownership becomes even more secure, giving more Australians the confidence to switch to electric vehicles.”